Yutian Guanjia IPO: A Real Estate Family Crosses Over to New Energy, IPO Projects Reveal Underlying Technical Mysteries

![]() 09/06 2024

09/06 2024

![]() 488

488

Author

Baker Street Detective

During the recent summer vacation, stories in the automotive industry continued to emerge, once again bringing suppliers to the forefront. Shanghai Yutian Guanjia Technology Co., Ltd. (hereinafter referred to as "Yutian Guanjia") is an automotive motion components manufacturer that is queuing up for an IPO, with automotive sunroofs as its main product.

According to Yutian Guanjia, the company possesses integrated capabilities in the design, research, and production of automotive sunroofs. It primarily serves well-known domestic and international automakers established in China, as well as some overseas vehicle manufacturers, providing professional and systematic solutions for all types of automotive sunroofs and other automotive motion components. The company's main customers currently include well-known domestic automakers such as Changan Automobile, FAW Group, Geely Automobile, GAC Group, SAIC Volkswagen, and Great Wall Motor.

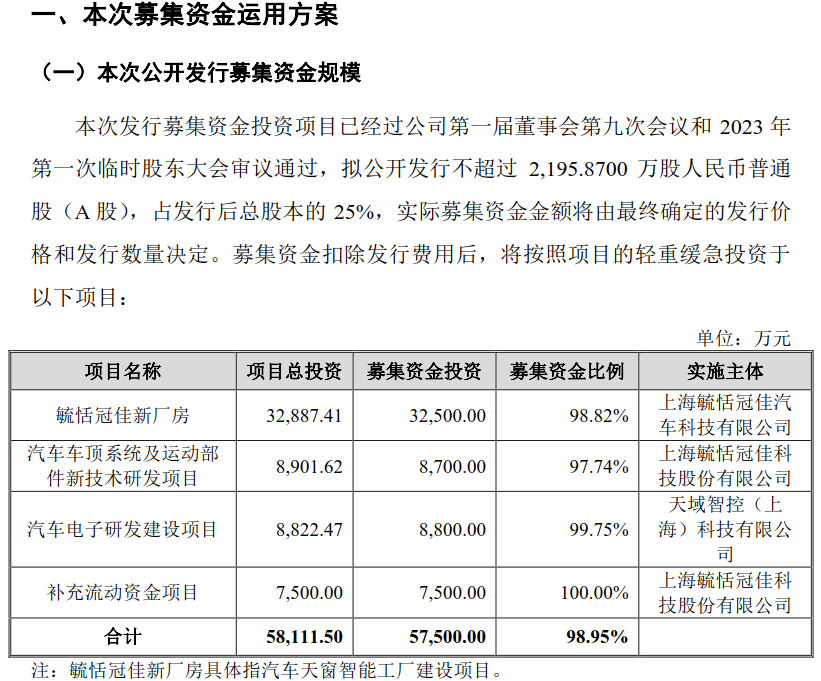

According to Yutian Guanjia's prospectus, the company plans to publicly issue no more than 21,958,700 shares of common stock (A shares) for a total of RMB 575 million, with funds allocated as follows: RMB 325 million for the "Yutian Guanjia New Factory" project; RMB 87 million for the "New Technology Research and Development Project for Automotive Roof Systems and Motion Components"; RMB 88 million for the "Automotive Electronics Research and Development Construction Project"; and RMB 75 million for "Supplementing Working Capital".

During the IPO queueing period, the company's technological advancement, whether the main technologies involved in the "Automotive Electronics Research and Development Construction IPO Project" originated from Xiong Xuefeng and Zhao Liangliang, partners of Shanghai Zhongliancheng, and patent disputes surrounding the invention patent for "Rolling Shutter Device for Vehicles" were among the key inquiry points for the exchange.

It is understandable that the exchange would focus on Yutian Guanjia's patents, as technological advancement determines a company's competitive advantage within the industry. Therefore, the company's R&D expenses are also within the exchange's scope of inquiry. In addition, Yutian Guanjia's shareholders and key members, cash dividends, valuation adjustment mechanisms, and other matters are also subject to inquiry.

01

The Technical Mysteries Behind the "Automotive Electronics Research and Development Construction IPO Project"

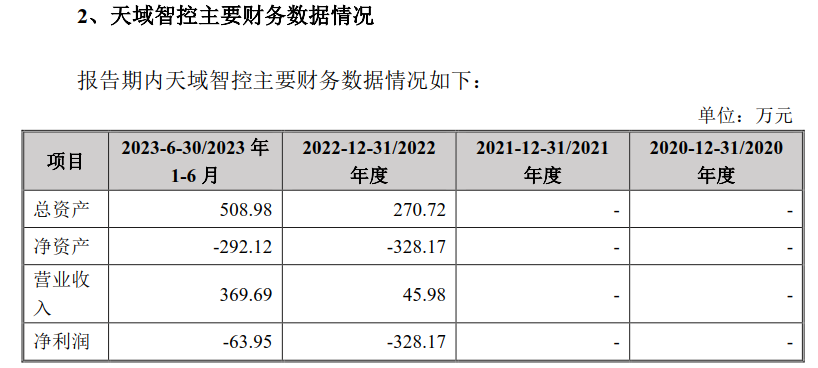

According to the second round of inquiry, Yutian Guanjia's RMB 88 million Automotive Electronics Research and Development Construction Project is implemented by Tianyu Zhikong (Shanghai) Technology Co., Ltd. (hereinafter referred to as Tianyu Zhikong).

Regarding Tianyu Zhikong, the exchange requested Yutian Guanjia to clarify whether the main technologies involved in the "Automotive Electronics Research and Development Construction IPO Project" originated from Xiong Xuefeng and Zhao Liangliang, partners of Shanghai Zhongliancheng, whether Xiong Xuefeng, Zhao Liangliang, and the main technical team have officially joined Tianyu Zhikong, whether relevant technologies have been patented, and the progress of Tianyu Zhikong's ongoing research projects, including completed projects, ongoing projects, R&D investments, and research outcomes.

Public information indicates that Tianyu Zhikong was jointly established by Yutian Guanjia and Shanghai Zhongliancheng in March 2022 and is a controlled subsidiary of Yutian Guanjia, with Yutian Guanjia holding a 71% stake and Shanghai Zhongliancheng Management Consulting Partnership (Limited Partnership) holding a 29% stake.

Shanghai Zhongliancheng was established on January 24, 2022, with a capital contribution of RMB 290,000. As of February 27, 2024, the general partner and managing partner was Xiong Xuefeng, who subscribed for RMB 275,000 (fully paid), accounting for a 94.8276% subscription ratio. The limited partner was Zhao Liangliang, who subscribed for RMB 15,000 (fully paid), accounting for a 5.1724% subscription ratio. Apart from Xiong Xuefeng and Zhao Liangliang, Shanghai Zhongliancheng has no other personnel and engages in no other business.

Chronologically, Xiong Xuefeng and Zhao Liangliang established Shanghai Zhongliancheng Management Consulting Partnership (Limited Partnership) approximately two months prior to jointly founding Tianyu Zhikong with Yutian Guanjia.

Yutian Guanjia stated that Tianyu Zhikong, with Xiong Xuefeng and Zhao Liangliang as its technical core, primarily engages in motor and electronic control research and development, production, and other businesses, including smart in-vehicle devices and electric power components. During the reporting period, Tianyu Zhikong's operating funds primarily came from shareholder investments and loans from Yutian Guanjia. As of the end of June 2023, Tianyu Zhikong had not yet repaid a loan balance of RMB 6.7396 million to Yutian Guanjia.

Yutian Guanjia believes that Xiong Xuefeng, Zhao Liangliang, and the main technical team possess the technical capabilities to advance the "Automotive Electronics Research and Development Construction Project." Mr. Xiong Xuefeng has 16 years of experience in automotive electronics R&D and has worked at renowned automotive electronics companies such as Shanghai Pan Asia Technical Automotive Center and NIO.

Mr. Zhao Liangliang has 8 years of experience in automotive electronics software development and has worked at renowned companies such as Contemporary Amperex Technology Co., Limited (CATL), Trico Group, and Hailida Automotive Technology. He excels in software process setup and underlying application development.

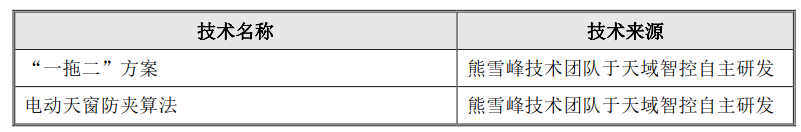

Other core members of the technical team come from new energy vehicle companies and automotive electronics companies such as XPeng Motors and Huayu Vision, with over 8 years of experience in automotive electronics R&D, software development, and project management. Tianyu Zhikong has developed significant technical reserves based on its actual business operations, including the "One-to-Two" solution, which is of primary concern to the exchange.

In the second round of inquiry, the exchange requested Yutian Guanjia to clarify whether Tianyu Zhikong's "One-to-Two" solution and other industry-standard technologies or processes possess technical advantages and the specific application scenarios and fields of downstream customers. Yutian Guanjia believes that Tianyu Zhikong's current core technologies possess technical advantages, effectively reducing the production costs of sunroof controllers. They also have strong anti-pinch algorithm advantages, which have been applied to models such as Chery T1E and T26.

Returning to the exchange's key focus on the "Automotive Electronics Research and Development Construction Project," Yutian Guanjia stated that the research and development direction of the project is based on Tianyu Zhikong's existing technologies. It emphasized that as of February 27, 2024, Shanghai Zhongliancheng had no pending or acquired intellectual property rights. Xiong Xuefeng, Zhao Liangliang, and the main technical team have officially joined Tianyu Zhikong. All future patents applied for by Tianyu Zhikong will belong to Yutian Guanjia, eliminating the risk of technological independence.

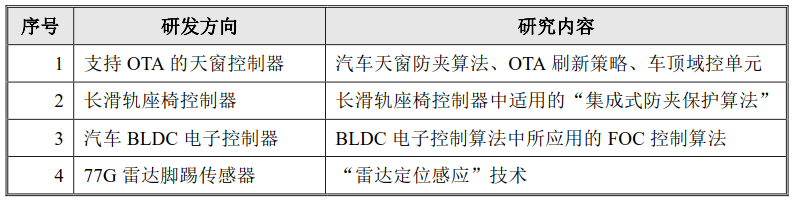

The "Automotive Electronics Research and Development Construction Project" has a total investment of RMB 88,224,700 and is based on the existing technologies of Xiong Xuefeng's technical team and their accumulated experience in automotive electronics R&D. It aims to conduct in-depth research and development in areas such as OTA-supported sunroof controllers, long-slide seat controllers, automotive BLDC electronic controllers, and 77G radar foot sensors, extending towards the five major domain controllers, sensors, and smart actuators of complete vehicles.

In its response to the second round of inquiry, the company stated that the research and development of the Automotive Electronics Research and Development Construction Project relies on the experience accumulated by Xiong Xuefeng's technical team in automotive electronics R&D and extends from Tianyu Zhikong's existing technologies, making it relatively feasible. The company possesses the technical capabilities to complete the aforementioned R&D.

However, Yutian Guanjia also emphasized in its response to the second round of inquiry that Tianyu Zhikong possesses a robust R&D organization system, and systematic R&D work is not entirely dependent on individual researchers. This seemingly contradicts its earlier statement that the research and development of the Automotive Electronics Research and Development Construction Project relies on the experience accumulated by Xiong Xuefeng's technical team in automotive electronics R&D.

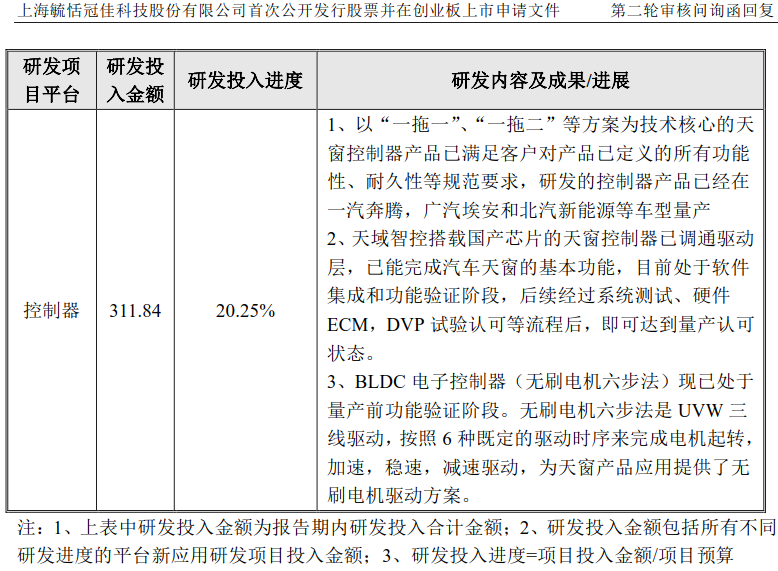

Finally, Yutian Guanjia stated that Tianyu Zhikong's main technologies have not yet been patented and will be patented for protection at an appropriate time once the technologies mature further. According to Yutian Guanjia's disclosure, during the reporting period, the R&D investment progress for new application R&D projects categorized by Tianyu Zhikong's main self-developed platforms was 20.25%.

When discussing R&D progress, it is inevitable to mention a company's stable and sustained investment in R&D expenses.

In response to Yutian Guanjia's R&D expenses, the exchange requested the company to clarify whether it can control all R&D outcomes, whether there are any R&D projects exclusively for specific customers with exclusivity agreements signed or can only be used for specific customer products. If so, the company was asked to specify the accounting categories for these expenses and whether they comply with the Accounting Standards for Business Enterprises. The exchange also inquired about whether Yutian Guanjia's lack of mold development capabilities is consistent with industry characteristics and whether this would constrain business expansion.

Yutian Guanjia stated that the company currently has over 20 self-developed platforms and has complete control over newly applied patents during the reporting period. As of October 11, 2023, the company held a total of 371 patents, including 13 invention patents, 331 utility model patents, and 27 design patents.

Yutian Guanjia emphasized that there are no R&D projects exclusively for specific customers. Self-developed platform R&D projects are independent R&D activities, and there are no exclusivity agreements with specific customers regarding these projects, nor are there any R&D projects that can only be used for specific customer products. However, it also stated that apart from four patents jointly applied for with Guangzhou Honda Automobile Co., Ltd. and Guangzhou Honda Research & Development Co., Ltd. in 2019, the company has complete control over 367 patents. As of February 27, 2024, Yutian Guanjia had not signed any exclusivity agreements for self-acquired patents.

02

Shanghai Yusu, the Continuously Losing Controlling Shareholder Behind Yutian Guanjia

In the second round of inquiry, after inquiring about Yutian Guanjia's IPO projects and related patents, the exchange also questioned the company's shareholders and key members.

According to Yutian Guanjia's prospectus, the company's actual controllers are Wu Jun, Wu Hongyang, and Wu Yuyang, with the latter two being Wu Jun's daughters. Together, they control 82.70% of the company's shares through direct and indirect means. Wu Jun's younger brother, Wu Peng, holds 3.83% of Yutian Guanjia's total shares. Wu Jun's spouse, Li Xiaoming, indirectly holds 2.95% of Yutian Guanjia's shares through a 5% stake in controlling shareholder Shanghai Yusu Industrial Co., Ltd. (hereinafter referred to as "Shanghai Yusu"). The two are deemed acting in concert with the actual controllers.

Shanghai Yusu is Yutian Guanjia's controlling shareholder, holding 38,850,000 shares of Yutian Guanjia. Wu Jun, Li Xiaoming, and their two daughters, Wu Hongyang and Wu Yuyang, collectively hold 100% of Shanghai Yusu's shares. According to Tianyancha, the company's national standard industry is wholesale of mineral products, building materials, and chemicals. Currently, apart from Shanghai Yusu, all other enterprises of which Wu Jun, the actual controller of Yutian Guanjia, serves as a legal representative are related to Yutian Guanjia.

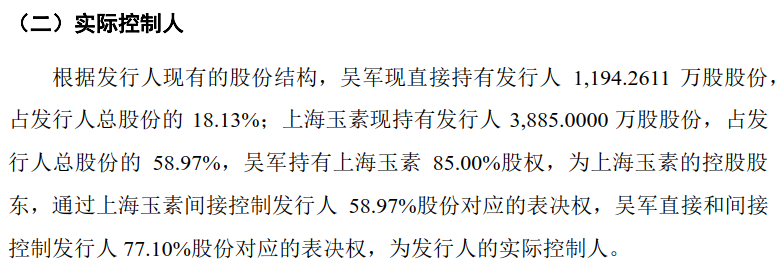

From a shareholding structure perspective, Yutian Guanjia is a controlled subsidiary of Shanghai Yusu. Focusing on Yutian Guanjia's shareholding structure, according to the company's prospectus, Wu Jun directly holds 11,942,611 shares of Yutian Guanjia, accounting for 18.13% of the total shares. Since Wu Jun holds an 85% stake in Shanghai Yusu and is its controlling shareholder, he indirectly controls 58.97% of the voting rights corresponding to Yutian Guanjia's shares through Shanghai Yusu. In total, Wu Jun directly and indirectly controls 77.10% of the voting rights corresponding to Yutian Guanjia's shares, making him the actual controller of the company. In the risk warning section of Section 3 of the prospectus, Yutian Guanjia notes the risk of improper control by the controlling shareholder and actual controller.

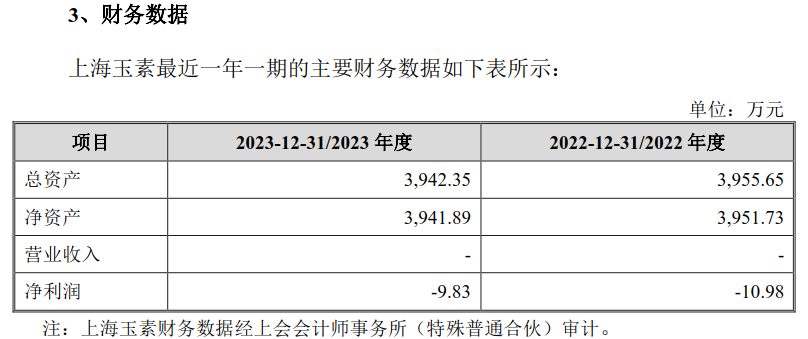

Regarding Shanghai Yusu's key financial data for the most recent year and quarter, Yutian Guanjia's prospectus discloses that Shanghai Yusu had a net asset value of RMB 39,517,300 and a net profit of -RMB 109,800 in 2022. In 2023, its net asset value was RMB 39,418,900, with a net profit of -RMB 98,300.

Apart from Shanghai Yusu, Wu Jun also serves as a shareholder in several real estate companies, including Anshan Yutian Housing Development Co., Ltd. and Anshan Hongyu Heating Co., Ltd. Companies that have been deregistered include Anshan Junli Real Estate Development Co., Ltd. and Shanghai Brown Automotive Sunroof Co., Ltd., mentioned in the inquiry letter.

In its response, Yutian Guanjia stated that Shanghai Brown was established on June 3, 2004, with a registered business duration of ten years. On May 8, 2021, the Songjiang District Market Supervision and Administration Bureau of Shanghai issued a "Notice of Approval for Deregistration Registration," granting approval for the deregistration of Shanghai Brown.

Before deregistration, Shanghai Brown's shareholders were Wu Jun and Wang Zhongyue, with Wu Jun subscribing for RMB 400,000 and holding an 80% stake, and Wang Zhongyue subscribing for RMB 100,000 and holding a 20% stake. Wu Jun served as the executive director and legal representative, while Wang Zhongyue served as the supervisor.

Regarding the company's deregistration, Yutian Guanjia responded that according to the "Administrative Penalty Decision" (Hujianguan Songchu Zi [2019] No. 272018003476) issued by the Songjiang District Market Supervision and Administration Bureau of Shanghai on January 14, 2019, and confirmed with Wu Jun, the shareholder and executive director of Shanghai Brown at the time, Shanghai Brown's business license was revoked due to "voluntary cessation of business for more than six consecutive months after opening," without involving any significant violations of laws or regulations.

According to Yutian Guanjia's response, although Shanghai Brown's ten-year business duration expired on June 2, 2014, the company ceased operations before the expiration due to differences in business philosophies between shareholders Wu Jun and Wang Zhongyue. As Wang Zhongyue was unwilling to cooperate, the liquidation, dissolution, and deregistration procedures could not be completed. Therefore, despite the expiration of Shanghai Brown's ten-year duration stipulated in its articles of association on June 2, 2014, and its ineligibility for continued existence and operation, the inability to complete the liquidation, dissolution, and deregistration procedures resulted in Shanghai Brown remaining in existence and ultimately having its business license revoked by market supervision and administration authorities due to the aforementioned issues.

Yutian Guanjia believes that due to the non-cooperation and even the inability to contact another shareholder Wang Zhongyue in the later stage, and also because of the punishment of revocation of business license, Wu Jun had no choice but to apply to the court for compulsory liquidation to cancel Shanghai Brown. As the executive director and legal representative of Shanghai Brown at that time, Wu Jun applied to the competent tax authority for tax cancellation and actively promoted liquidation, dissolution and cancellation after the shutdown of Shanghai Brown, and had fulfilled his duties diligently. Later, Shanghai Brown's business license was revoked in 2019 due to the non-cooperation of another shareholder Wang Zhongyue, which led to the inability to complete the liquidation, dissolution and cancellation of the company. Wu Jun bears no personal responsibility for this.

In addition, among the current directors, supervisors and senior executives of Yutian Guanjia, Director and Deputy General Manager Piao Chenghong has other foreign investments or enterprises serving as key positions with their business licenses revoked, ordered to close or go into liquidation. Piao Chenghong served as manager of Gansu Hanlan Economic and Trade Co., Ltd., which was revoked its business license on December 9, 1997 and has not yet been cancelled.

According to Article 146 of the Company Law, although the business license of Gansu Hanlan Economic and Trade Co., Ltd. has been revoked, it has been nearly 27 years since then, far exceeding the three-year period stipulated in the Company Law, and Piao Chenghong did not serve as the legal representative of the company. Therefore, the aforementioned situation does not affect his position at Yutian Guanjia.

In addition to the aforementioned situation, there are no other foreign investments or enterprises serving as key positions among the current directors, supervisors, and senior executives of Yutian Guanjia whose business licenses have been revoked, ordered to close or go into liquidation during their investment or key positions.

© THE END

All materials are from official public information and prospectuses

This article is only for sharing and learning, and does not constitute any investment advice.

This article is originally created by Baker Street Detective Officer. Please do not reproduce without permission.