Weekly Stock Review | NVIDIA's Market Share in China Plummets to Zero, Yet AI Chip Market Potential Soars to $50 Billion

![]() 10/20 2025

10/20 2025

![]() 462

462

Delving into Weekly Auto Stocks, We Uncover a Mosaic of Auto Market Trends.

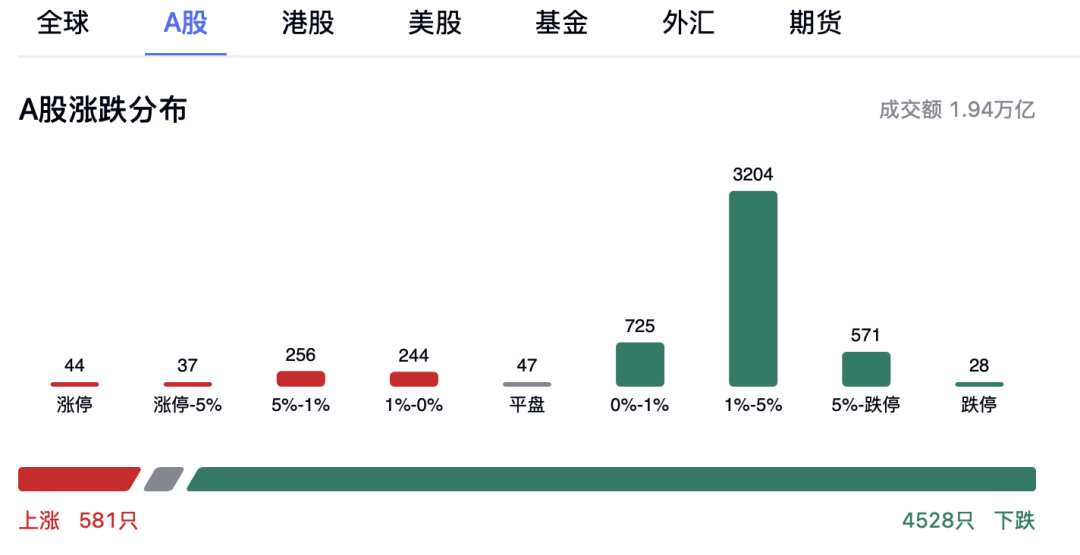

On October 17, the A-share market commenced trading on a lower note and continued its downward trajectory, with the decline accelerating in the afternoon session.

By the market's close, the Shanghai Composite Index had slipped below the 3,900-point mark, while the ChiNext Index had tumbled by more than 3%. Daily trading volume fell short of the 2 trillion yuan threshold, with 4,783 stocks closing in negative territory, led by a downturn in technology stocks, particularly electronics. Indeed, during the recent period of downward volatility in the A-share market, technology stocks have been at the forefront of the decline, whereas traditional sectors have provided a stabilizing force. Over the past five days, the electronics sector has witnessed a decline exceeding 7%.

Industry experts opine that, in the near term, consumer electronics and semiconductors are likely to face valuation headwinds. However, from a long-term perspective, technology sectors such as computing infrastructure and domestic substitution are poised to remain pivotal themes.

In stark contrast, the recent robust rebound in the U.S. stock market has offered investors a crash course in 'revived market sentiment,' with the surge in the chip manufacturing sector resembling a windfall.

In its latest report, investment bank Wedbush highlighted that its Asian research findings paint an extremely optimistic picture of the market outlook towards the 'Artificial Intelligence (AI) Revolution,' with demand for NVIDIA's chips accelerating at a rapid pace. This trend is anticipated to persist until 2026.

'In essence, we are witnessing a significant uptick in demand for NVIDIA chips. We estimate that the ratio of enterprise demand to supply for NVIDIA's next-generation GPUs is nearing 10:1—an astonishing figure that underscores the fact that this AI revolution is still in its infancy,' the report noted.

Analysts are of the view that this demand trend bodes exceptionally well for core chip manufacturers such as TSMC, AMD, and Intel. As the AI capital expenditure supercycle continues to unfold, these key chip suppliers are expected to experience sustained growth, with NVIDIA remaining the primary beneficiary.

'We see this as another bullish indicator for U.S. tech stocks. As the third-quarter earnings season approaches, we anticipate that tech company performance will align with, or even surpass, market enthusiasm for AI, driving further gains in tech stocks before the year-end. In our view, this tech bull market will extend at least until 2026,' analysts stated.

Despite the ongoing U.S.-China trade frictions and geopolitical tensions, the fundamental demand for NVIDIA's gold-standard AI chips, which are driving the revolution, remains undiminished. Analysts believe that tech stocks are poised for a strong performance before the year-end, potentially rising by more than 10% in the remaining months as the next phase of the AI revolution unfolds and the upcoming tech earnings season further attracts investors.

Notably, during a recent interview event hosted by U.S.-based Castle Securities, NVIDIA CEO Jensen Huang stated that due to U.S. export controls, NVIDIA's market share in China has plummeted from 95% to 0%.

'Currently, NVIDIA has completely exited the Chinese market,' Huang remarked.

Huang contended that the policies implemented by the United States have resulted in the loss of one of the world's largest markets. The Associated Press recently reported that NVIDIA's performance in the quarter would have been even stronger if not for the U.S. government's export ban on China.

According to NVIDIA's Q2 FY2025 earnings report released in August this year, the company generated $46.743 billion in revenue, with $2.769 billion coming from the Chinese market. This represents a decline of nearly $900 million compared to the $3.667 billion in revenue from the Chinese market in Q2 FY2024.

U.S. export controls have also caused NVIDIA's revenue share from mainland China to decline for three consecutive years.

On April 9 of this year, amidst the U.S.-China tariff war, the U.S. government notified NVIDIA that exporting H20 chips to China (including Hong Kong and Macau) would require an export license. This effectively restricted NVIDIA's exports of H20 chips to China (as detailed in the report 'U.S. Government Restricts NVIDIA's Sale of H20 Chips to China').

On July 15 of this year, NVIDIA's official website briefly announced that the company was submitting an application to the U.S. government to resume sales of H20 chips to China. The U.S. government had assured NVIDIA that licenses would be granted, and NVIDIA hoped to commence shipping as soon as possible (as detailed in the report 'NVIDIA Announces Resumption of H20 Chip Sales to China').

However, to date, H20 chips have not entered the Chinese market through compliant channels.

During the company's Q2 FY2025 earnings call in August, NVIDIA CFO Colette Kress stated that no H20 chips were sold to the Chinese market during the quarter. If geopolitical conditions had been more favorable, NVIDIA's H20 chip shipment revenue for the quarter could have ranged between $2 billion and $5 billion.

According to sources, conservative estimates suggest that NVIDIA shipped approximately 600,000 to 800,000 H20 series chips in the Chinese market in 2024. Meanwhile, a mainstream domestic AI chip manufacturer shipped around 300,000 to 400,000 units. In other words, NVIDIA's market share in China in 2024 far exceeded 60%.

According to a 2024 year-end report by international market research firm Omdia, the world's largest buyers of NVIDIA's Hopper series chips (including H100, H200, and the H20 model exclusively for the Chinese market) in 2024 were Microsoft (485,000 units), ByteDance (230,000 units), Tencent (230,000 units), Meta (224,000 units), Amazon (196,000 units), xAI (196,000 units), and Google (169,000 units).

During the earnings call, Huang stated that he anticipates a $50 billion market opportunity in China. If the company has competitive products to meet market demand, he expects 50% annual growth in the coming years.

He emphasized that while the United States certainly aims to win the AI competition and policymakers want to make the right decisions for victory, actions that harm China often backfire on the United States, sometimes even more severely.

Overall, the current adjustment in the A-share technology sector is essentially a reflection of the interplay between valuation digestion and market sentiment fluctuations, while the strength of U.S. stocks confirms the long-term prosperity of the global AI industry chain. Although geopolitical tensions and export controls pose short-term challenges for companies like NVIDIA, the explosive demand for AI computing power and the accelerated trend of domestic substitution remain unaltered.

Huang's remark about the '$50 billion market opportunity' unveils the core contradiction—while technological blockades may delay short-term growth, they cannot reverse the inherent demand in the Chinese market. In the future, the breakthrough capabilities of domestic chip manufacturers, the progress of computing infrastructure deployment, and the marginal changes in U.S.-China technological competition will emerge as key variables influencing the differentiation of tech stocks.

For investors, it is crucial to remain vigilant about short-term valuation pressures but focus more on two major directions: first, the performance realization of the U.S. stock AI industry chain (such as core suppliers like NVIDIA and TSMC); second, domestic substitution targets in the A-share market with potential for technological breakthroughs (such as semiconductor equipment and computing infrastructure).

As Wedbush stated, the AI revolution is still in its early stages, and the tech stock supercycle is likely to continue evolving amidst volatility.

Note: Some images are sourced from the internet. If there is any infringement, please contact us for removal.

-END-