Why Are European Automakers Unanimously Opposed to the Dutch Government's Sanctions?

![]() 10/20 2025

10/20 2025

![]() 696

696

DJI Zhuoyu, striking out on its own, has finally found a new safe haven. In the context of the global supply chain, no nation can afford to go it alone.

Recently, the Dutch sanctions imposed on Nexperia have sparked unease among European automotive CEOs, even before the involved parties had fully engaged in discussions. They are continuously exerting pressure on the Netherlands, further complicating the situation.

According to reports, Volkswagen Group CEO Oliver Blume personally traveled to The Hague, Netherlands, and directly appealed to Dutch Prime Minister Mark Rutte, stating, "If we can't resolve this issue, our factories will face a complete shutdown."

Meanwhile, the CEOs of BMW and Mercedes-Benz, though not making personal visits to the Netherlands like Blume, have been in constant communication with Dutch authorities, urging them to promptly initiate talks with China to resolve the dispute.

Sigrid de Vries, Director-General of the European Automobile Manufacturers Association, remarked, "We find ourselves in this concerning situation unexpectedly. We truly need swift and pragmatic solutions from all relevant countries."

It can be said that in this trade dispute suddenly initiated by the Netherlands, a significant rift has emerged within Europe, starkly contrasting with their previous stance on new energy vehicle tariff policies. All these reasons stem from the presence of Wingtech Technology, a Chinese company, behind Nexperia.

Nexperia's Alleged Betrayal of Wingtech

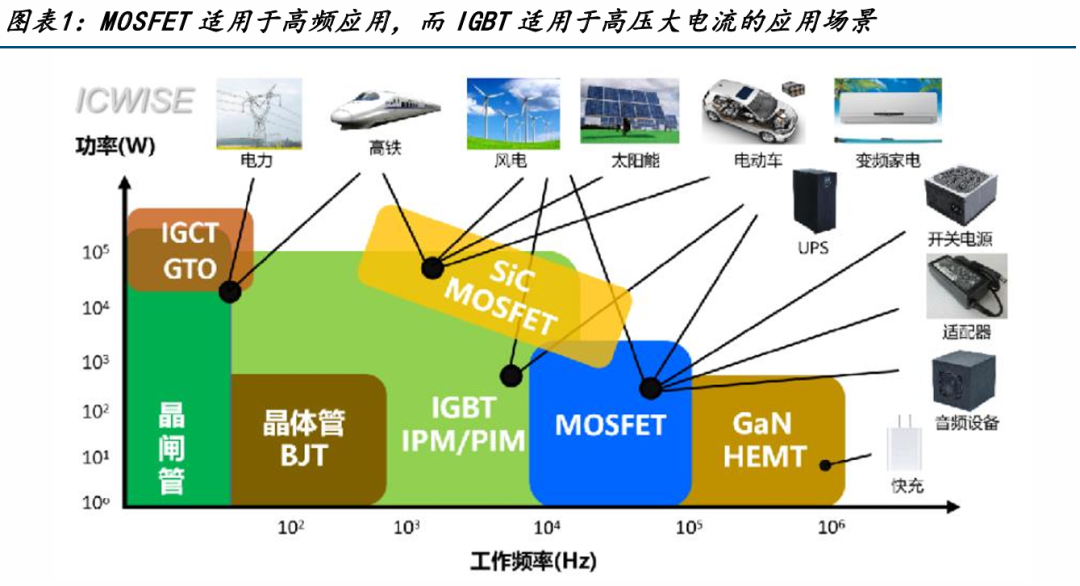

When it comes to automotive chips, consumers often first think of high-value chips, such as those used in in-vehicle infotainment systems and advanced driver-assistance systems, overlooking the importance of other chips.

According to incomplete statistics, a single car requires over 3,000 chips. Besides the well-known chips for infotainment and driver-assistance systems, there are numerous other chips that, while not as technologically advanced or costly to manufacture, play an irreplaceable role in the automotive supply chain.

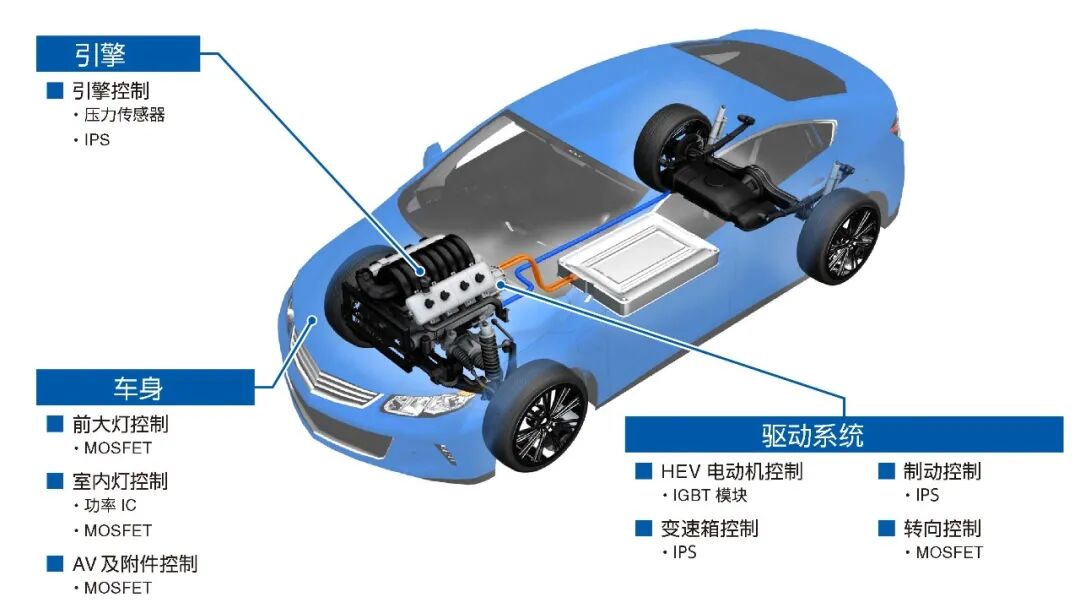

Nexperia's core business, power semiconductors, is crucial in the automotive industry. Simply put, power semiconductors are devices that control electrical switches. Particularly for new energy vehicles, this component is the heart of the main drive motor controller.

Of course, the application of power semiconductors extends beyond new energy vehicles. Even gasoline-powered cars require a substantial number of power semiconductors. For instance, in the Electronic Stability Program (ESP), power semiconductors are responsible for driving the pump motor to provide braking pressure. Similarly, in the electronic power steering system, they act as motor drive switches to drive the steering motor. Essentially, power semiconductors are present wherever electrical control switches are needed.

Among power semiconductors, silicon nitride is the most sought-after, often mentioned by automakers in recent years, as it can achieve high power and lower heat generation. However, this expensive material is not suitable for all applications, and a significant number of traditional semiconductor materials are still used in cars.

According to statistics, the value of power semiconductors in new energy vehicles is approximately $450, while in traditional gasoline-powered cars, it is less than $100.

However, these components, costing less than $100, play an indispensable role in the electrification and intelligence of automobiles.

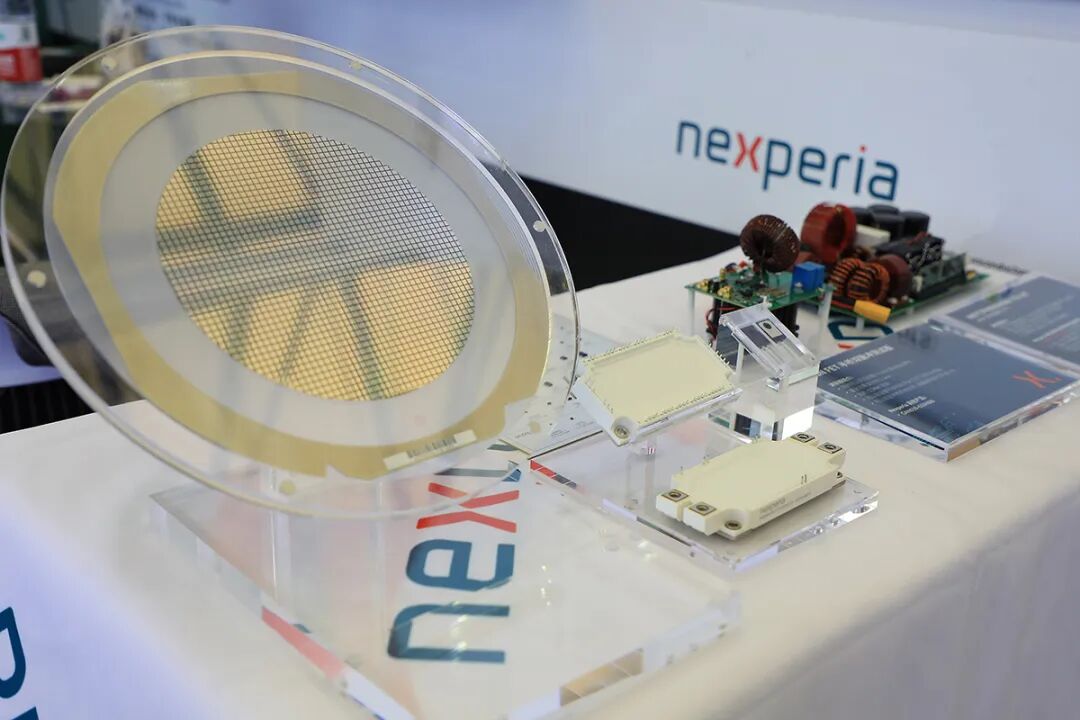

Nexperia is precisely the world's largest supplier of power semiconductors, ranking first in market share for small-signal power semiconductors and second in automotive-grade power semiconductors. It is a core supplier for multiple Tier 1 companies.

Nexperia originally started as Philips' semiconductor division. Over eighty years of development, it gradually evolved into an industry giant. Later, with the independence of Philips' semiconductor division, it became part of NXP Semiconductors and was subsequently spun off as an independent company, now known as Nexperia.

In 2019, Wingtech Technology, a globally renowned original design manufacturer of mobile phones, embarked on an industrial transformation, targeting the semiconductor business. It acquired Nexperia for 3.3 billion euros (approximately 33 billion yuan), with a market value of over 4 billion yuan, similar to Geely's acquisition of Volvo.

Since the acquisition in 2019, Nexperia has been operating globally as an independent company until September 30 of this year, when the Dutch government imposed a temporary ban on Nexperia due to "governance deficiencies." Subsequently, Nexperia's board of directors passed a resolution to "adjust director voting rights," swiftly removing Wingtech and transferring the shares to a so-called third party for custody.

This move was triggered by a series of chain reactions after Wingtech Technology was placed on the U.S. Department of Commerce's 'Entity List' in December 2024. The U.S. even claimed that Nexperia could only be exempted if the Chinese CEO was replaced.

Obviously, the Netherlands followed the U.S.'s advice, leading to the outbreak of the power seizure incident involving Wingtech Technology.

Fragile Supply Chain

Of course, everything stems from the naive notion of the Dutch government, believing that controlling the stake could achieve control over Nexperia. However, it clearly misjudged the close interconnection of the global supply chain.

Although Wingtech Technology has maintained Nexperia's independent operation since the acquisition, under globalization, 70% of Nexperia's production lines are built in China, while its Dutch headquarters focuses more on design and research and development.

After the Netherlands' administrative intervention in Nexperia, China also took countermeasures, suspending 70% of Nexperia's production line licenses in China and restricting exports.

This policy quickly took effect, with Nexperia issuing supply disruption warnings to over 20 automakers, including BMW, Volkswagen, and Ford. The originally planned delivery schedule from late October to early November was completely disrupted.

According to a warning issued by the European Automobile Manufacturers Association (ACEA), if supply cannot be restored by the end of the month, European automobiles will face a risk of short-term shutdown. Volkswagen's procurement director stated that chip inventories would only last three weeks, and the Wolfsburg plant in Germany was on the verge of shutdown. Mercedes-Benz and BMW also faced similar issues.

Meanwhile, Ford Motor Company in the United States encountered the same dilemma and is expected to reduce production due to component shortages starting in November. Ford angrily declared that it would hold the Dutch government accountable and seek compensation.

Perhaps many people do not understand why the mere disruption of Nexperia's supply could cause such a significant impact on the automotive industry. This reflects the scarcity and fragility of the automotive industry.

Firstly, unlike consumer semiconductors, automotive-grade semiconductors have higher production processes and stricter testing and packaging procedures, making it difficult to quickly ramp up production in the short term. On the other hand, a long-standing practice of producing based on sales has led to a tacit understanding among suppliers not to arbitrarily increase production capacity.

Particularly for companies like Nexperia, which possess full-chain capacity from chip design to wafer manufacturing and packaging testing, they are even more difficult to replace in the short term.

More importantly, while China suspended Nexperia's production, it further strengthened control over rare earths, with 85% of rare earth supplies for semiconductors coming from China.

This move prevented Nexperia from continuing production with limited capacity in the Netherlands and forced it to issue supply disruption warnings to downstream supply chain partners.

This move also compelled the European and American automotive industries to make a choice, pressuring Nexperia and the Dutch government.

After Wingtech Technology's acquisition of Nexperia, Nexperia's scale in the automotive semiconductor industry has continuously grown, with its European market share increasing to 40% and revenue growing to $2 billion.

It can be said that in the automotive industry chain, most investments have focused on competing for cutting-edge process chips, neglecting cost-sensitive and technologically mature industries like the power semiconductors produced by Nexperia. After this incident, the automotive industry will develop a new awareness of the supply security of basic chips.

At the same time, it reflects that the domestic automotive manufacturing industry not only plays an irreplaceable role in well-known areas like power batteries but also has a significant influence on cost-sensitive components like power semiconductors, which may cost only a dollar.

Perhaps after this incident, the automotive chip industry will undergo transformations. However, in the short term, the advantages brought by globalization remain irreplaceable, and the automotive supply chain continues to move forward in a fragile state.

Note: Some images are sourced from the internet. If there is any infringement, please contact us for deletion.

-END-