Where does the confidence of Chinese manufacturers come from in dominating the overseas low-cost smartphone market?

![]() 09/06 2024

09/06 2024

![]() 618

618

I'm not sure when it started, but the prices of smartphones around me have been getting more and more expensive.

A decade ago, the domestic smartphone market was still in a state of chaos for entry-level devices. At that time, internet manufacturers/brands like Redmi, Honor, Coolpad, LeTV, and 360 were locked in fierce competition, striving to capture market share with low-cost hundred-yuan smartphones. Four years ago, as the domestic smartphone market gradually saturated, manufacturers who had already established themselves ventured into the high-end market, and mid-to-high-end smartphones priced above 4,000 yuan began to emerge continuously.

Today, a decade later, entry-level smartphones on the market have become increasingly scarce. Leaving aside niche smartphone manufacturers that have disappeared into history, Redmi, the traditional dominator of the low-cost smartphone market, has not specifically updated its entry-level product line for some time. The traditional Redmi digital series has also stagnation for a considerable period on the Redmi 13C, even giving the impression that new models are unlikely to arrive soon.

However, this situation looks slightly different overseas.

(Image source: Counterpoint Research)

Recently, market research firm Counterpoint Research released a blog post reporting that driven by emerging markets, global sales of affordable smartphones exceeded 100 million units in Q2 2024, up over 10% year-on-year, accounting for 37% of global smartphone sales. In comparison, global smartphone sales as a whole grew by 6% year-on-year during the same period, both achieving the highest year-on-year growth since Q2 2021.

Interestingly, this growth rate was achieved despite a nearly 50% reduction in the number of entry-level smartphone models on the market, indicating that overall sales have become more concentrated, with the top 10 models alone accounting for nearly a quarter of the market share.

As for which models are included in the top 10...just keep reading with me, and you'll find out.

Redmi Reigns Supreme, OPPO Takes Three Spots

In a mature consumer electronics market, the trend of the strong getting stronger is quite typical.

In the PC market, for example, the world's top six brands have remained largely unchanged over the past decade, with Lenovo, HP, and Dell consistently occupying the top three spots. The remaining three positions are contested among Apple, ASUS, and Acer. It can be said that as long as there are no significant changes in the external environment or technology, this market will continue to develop steadily.

In fact, the current entry-level market is also evolving in line with this market trend.

(Image source: Counterpoint Research)

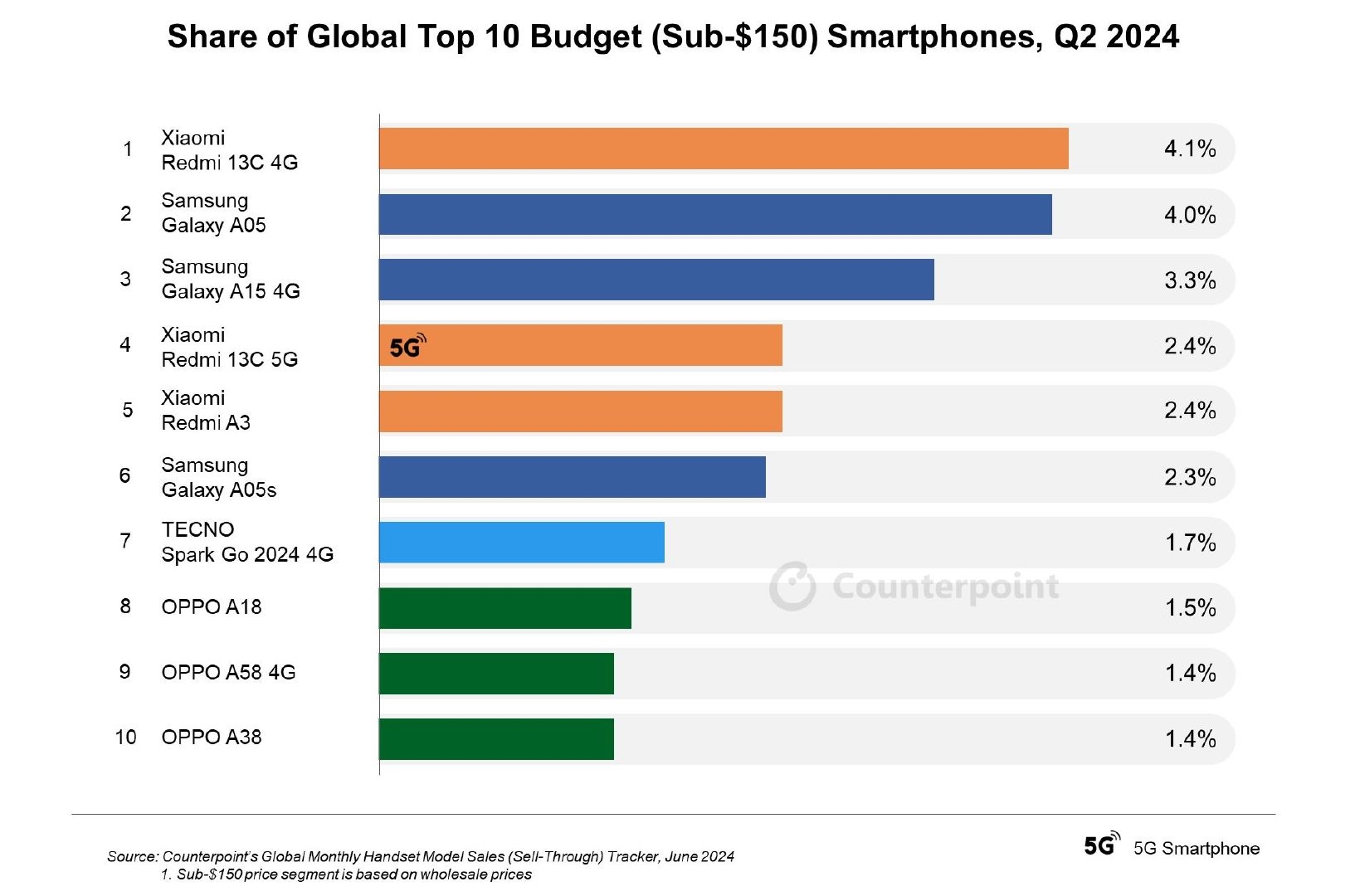

According to the "Q2 2024 Top 10 Best-Selling Entry-Level Smartphones" list provided by Counterpoint Research, Xiaomi, Samsung, and OPPO each occupy three spots, while the remaining spot is taken by Transsion.

No surprises here; they are all leading manufacturers in the industry.

As the fastest-growing TOP5 vendor in the global smartphone market, Xiaomi's sub-brand Redmi has delivered impressive performance in the entry-level smartphone market.

Specifically, the Redmi 13C 4G version captured 4.1% of the market share, making it the best-selling entry-level smartphone globally that quarter, truly deserving of the title of big winner.

(Image source: Redmi)

Released in November last year, this product offers a MediaTek Helio G85 processor, a 6.74-inch 90Hz LCD waterdrop display, and other configurations at a price of 108.44 euros (equivalent to approximately 850 Chinese yuan), making it a rare entry-level smartphone tailored for overseas markets at this price point.

Moreover, the Redmi 13C 5G version, released in December of the same year, successfully secured the fourth spot on the list with a 2.4% market share.

(Image source: Redmi)

Essentially an overseas version of the domestic Redmi 13C, this product is equipped with a MediaTek Dimensity 6100+ processor and is priced at around 143 euros (equivalent to approximately 1122 Chinese yuan), making it the only 5G model on the list. It truly embodies the idea of "letting everyone enjoy the joy of technology."

While Redmi is currently on a roll, to maintain its global leadership, it will need to contend with fierce competition from domestic giants like OPPO, vivo, and Honor, which are actively expanding their overseas markets. This is not just a battle of technology and innovation but also a game of brand influence and market strategy.

OPPO, which has continuously expanded its overseas markets in recent years, also delivered impressive results on this list, with three products ranking among the best-sellers and capturing 4.3% of the market share.

(Image source: OPPO)

Interestingly, while these three products share similar appearances and core configurations, they differ significantly in their peripheral specifications. The standout OPPO A38 boasts a 50MP main camera, a 90Hz LCD screen, and even supports 33W SuperVOOC fast charging.

Apart from these three similar products, OPPO has also introduced models like the OPPO Reno 12F 4G and OPPO A80 for overseas low-to-mid-end markets in recent years, hoping to steadily enhance its brand appeal in overseas markets.

Samsung Excels, Transsion Surprises

In terms of market share, Samsung remains the undisputed leader.

Although it has been relegated to the "Others" category in the domestic market, Samsung's brand appeal remains top-notch globally, which can be considered its foundation. Even in the entry-level smartphone market, Samsung maintains a significant presence with its extensive product lineup.

Last year, Samsung introduced two entry-level series, the Galaxy A05 and A15. Both the Galaxy A05 and Galaxy A15 4G use MediaTek 4G processors, while the equally popular Galaxy A05s even employs the six-year-old Qualcomm Snapdragon 680 processor.

It's remarkable that a new device with the Snapdragon 680 can still make it onto the best-seller list, demonstrating a certain synchronicity between domestic and international markets.

It's worth mentioning that the Samsung Galaxy A15 5G, which shares similar specifications with the Redmi 13C 5G and also uses a Dimensity 6100 processor, did not appear on this list due to its pricing. However, it ranked fourth among the world's best-selling smartphones in Q2 of this year, accounting for 2.0% of sales.

(Image source: Samsung)

It is reported that Samsung's internally tested Galaxy A16 is expected to be available only in a 5G version. According to Counterpoint Research, nearly a quarter of entry-level smartphones on the market have already embraced 5G networks, indicating that the full transition to the 5G era is imminent.

As for the brand that surprised me the most, it has to be Transsion.

As a relatively unknown player in the domestic market, Transsion's achievements today are entirely attributed to its overseas markets. Its comprehensive overseas layout and brand influence are among the best among Chinese smartphone brands. This year, it even ranked fifth globally in terms of sales share, with a 9% market share.

Many of these sales are undoubtedly driven by entry-level smartphones, as Transsion remains the king of the sub-$100 smartphone market in many developing countries.

(Image source: Transsion)

The Transsion Spark Go 2024 4G, which made it onto this list, is one of the standout products among these. Although its specifications are similar to those of other 4G entry-level smartphones, its low price of just 6,899 Indian rupees makes it a top choice for budget-conscious consumers.

Of course, Transsion is no longer limited to low-end and feature phones. It has launched high-end smartphones like the Phantom V Fold and V Flip in India. While it may take some time for Transsion to compete with Xiaomi, it certainly has the potential to emerge as a dark horse in the future.

Yes, Entry-Level Smartphones Still Matter

In a sense, entry-level smartphones and mainstream smartphones can be seen as two highly isolated systems.

Features that mainstream smartphone users have come to expect, such as 5G connectivity, high refresh rate screens, computational photography, and fast charging, are still relatively rare in the entry-level market. Looking at these best-selling models, one might even say that they have few standout features.

However, the entry-level smartphone market is indeed growing, and at a faster pace than the overall market.

In my opinion, there are two main reasons for this phenomenon. Firstly, as the research firm noted, demand for entry-level smartphones is continuing to grow in emerging markets such as India and Africa, where consumers' demand for cost-effective devices is driving overall sales growth.

Secondly, the dual effects of economic pressure and technological democratization are at play. Amidst global economic uncertainty, many consumers are opting for more affordable smartphones. As high refresh rate screens, large batteries, and 5G connectivity gradually become more accessible, entry-level smartphones are now meeting the usage standards of these consumers, leading to inevitable consumer downtrading.

While pursuing high-end flagship smartphones, we should not overlook the fact that a significant portion of the world's population still needs entry-level devices.

Students need smartphones that fit within their budgets but still meet their social and entertainment needs. People working away from home need devices that can last all day and won't break the bank if lost or damaged. Seniors, too, require phones that keep them connected with their families, even if they forget to charge them.

The ability to meet these user needs may very well be the foundation of a smartphone manufacturer's success.

Source: Leitech