Another “Iron Lady” Helps Wei Jianjun “Rebuild Great Wall Motor”

![]() 09/08 2024

09/08 2024

![]() 556

556

Can Wei Jianjun breathe a sigh of relief now?

On the evening of September 4, Xpeng Motors President Wang Fengying, who had not appeared in public for a long time, appeared at the Xpeng MONA M03 celebration. During the event, He Xiaopeng offered her a drink. Wang Fengying was quite emotional and raised her glass to toast everyone present, saying that this was the first drink of her life.

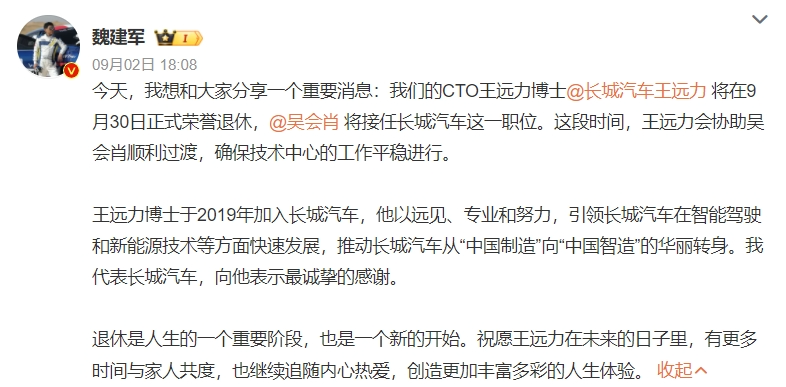

Two years after “Iron Lady” Wang Fengying left Great Wall Motor, on September 2, Wei Jianjun, Chairman of Great Wall Motor, officially announced a new “Iron Lady” on his personal Weibo account. Wei Jianjun posted that CTO Wang Yuanli of Great Wall Motor would retire on September 30, and Wu Huixiao would take over the position. According to “Qu Jie Shang Ye”, this is the first time that a woman has held the position of CTO at Great Wall Motor and is also the first female CTO among known Chinese automakers.

Source: Weibo Screenshot

Before Wu Huixiao served as Vice President of Intelligentization at Great Wall Motor, she has been deeply involved in the field of intelligentization for many years. Her team has achieved remarkable accomplishments in smart cockpits, intelligent driving, and other areas, playing a crucial role in Great Wall Motor's intelligentization strategy. Moving forward, it is worth anticipating the advancements Great Wall Motor will make in new energy and intelligentization.

2024 is considered the beginning of the "electric vehicle elimination race" in the industry, and Great Wall Motor's transition to electric vehicles has been challenging. Can the newly appointed CTO "Iron Lady" Wu Huixiao help Great Wall Motor break through?

Great Wall Motor has been in the news lately.

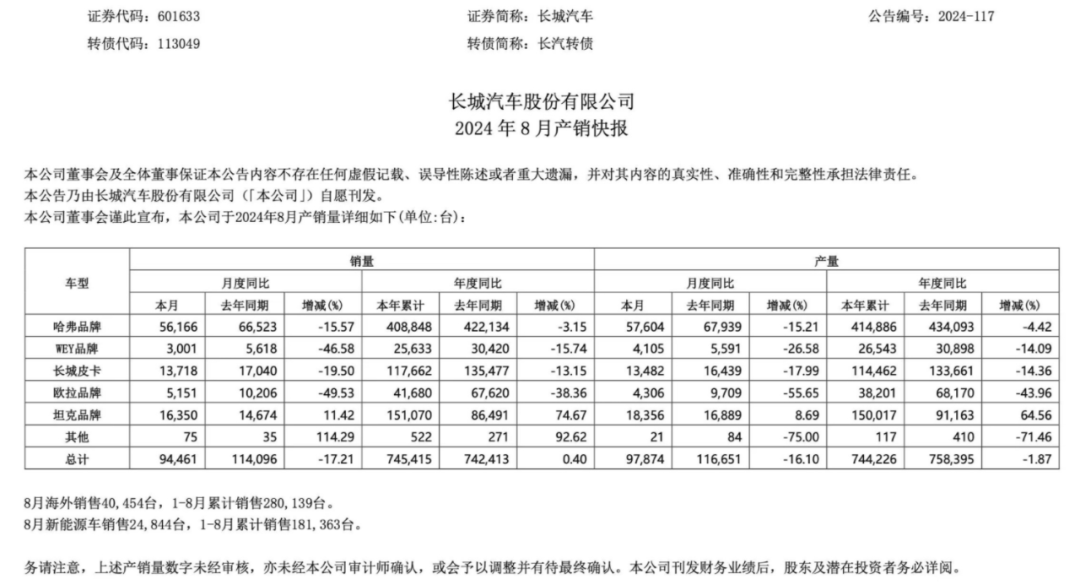

On the evening of September 1, Great Wall Motor announced that it sold 94,500 vehicles in August, a year-on-year decrease of 17.21%, with 24,800 new energy vehicles sold, also a year-on-year decrease of 5.5%. As of the end of August, Great Wall Motor had sold a cumulative total of 745,400 vehicles this year, a slight year-on-year increase of 0.4%, with 181,400 new energy vehicles sold, a year-on-year increase of 22.17%.

Source: Great Wall Motor Announcement Screenshot

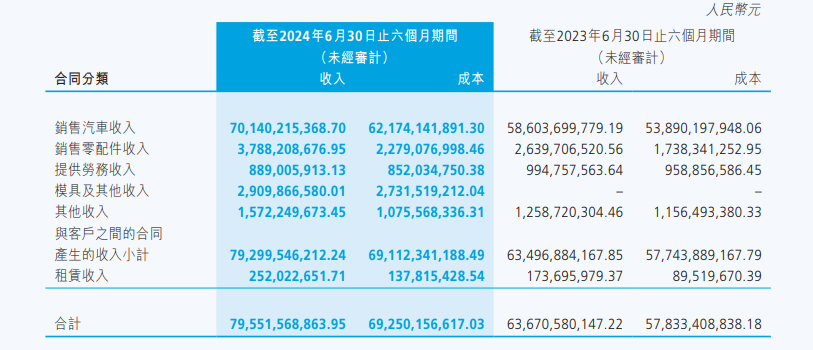

Just two days before disclosing August sales figures, on August 29, Great Wall Motor released its financial report for the first half of 2024. The report showed that Great Wall Motor's operating revenue for January-June 2024 was 91.43 billion yuan, a year-on-year increase of 30.7%, marking the fourth consecutive year of growth.

In terms of revenue, the overall performance was outstanding. In the first half of the year, Great Wall Motor achieved a revenue of 91.43 billion yuan, a year-on-year increase of 30.67%. Among them, the gross margin reached 20.73%, and the net profit attributable to the parent company reached 7.079 billion yuan, with a year-on-year increase of over 400%.

Judging from the data, Great Wall Motor's profitability has improved significantly.

Great Wall Motor's overall gross margin in the first half of the year exceeded 20%, an increase of over 3% compared to the same period last year. In terms of the gross margin from automobile sales alone, the 11.43% gross margin this year is also about 3% higher than that of last year.

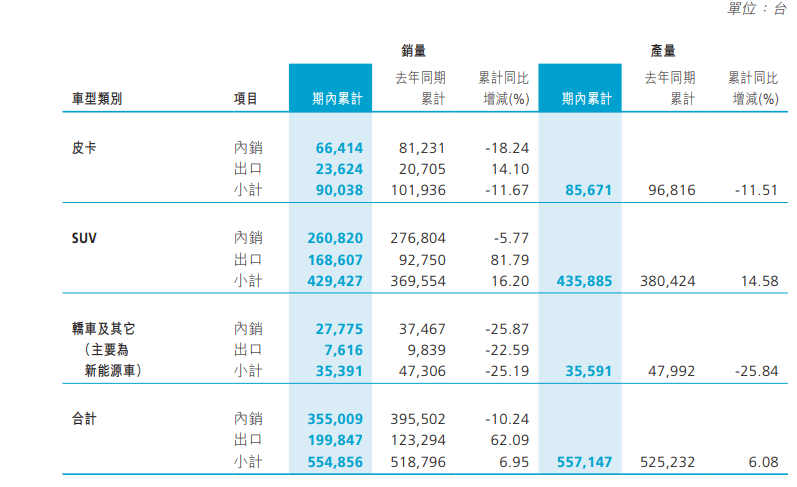

This is partially due to a 6.95% year-on-year increase in the overall sales volume of vehicles in the first half of the year at Great Wall Motor. On the other hand, with the launch of new products, the average selling price of automobiles was approximately 126,300 yuan, an increase from 113,000 yuan in the same period last year.

Source: Great Wall Motor Semi-Annual Report Screenshot

However, judging from the specific net profit figures, Great Wall Motor's doubled net profit cannot be attributed solely to vehicle sales.

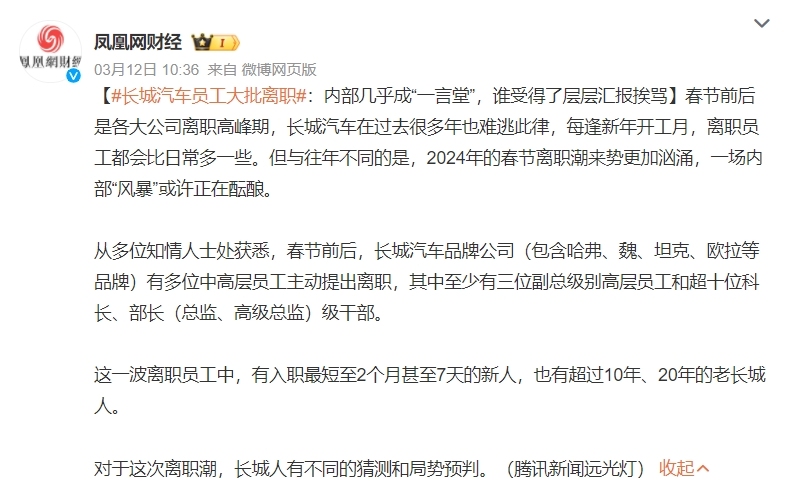

In terms of cost control, Great Wall Motor experienced a decrease in administrative expenses, which include employee salaries. However, the year-on-year decrease in this expense may also reflect a reduction in the number of Great Wall Motor employees.

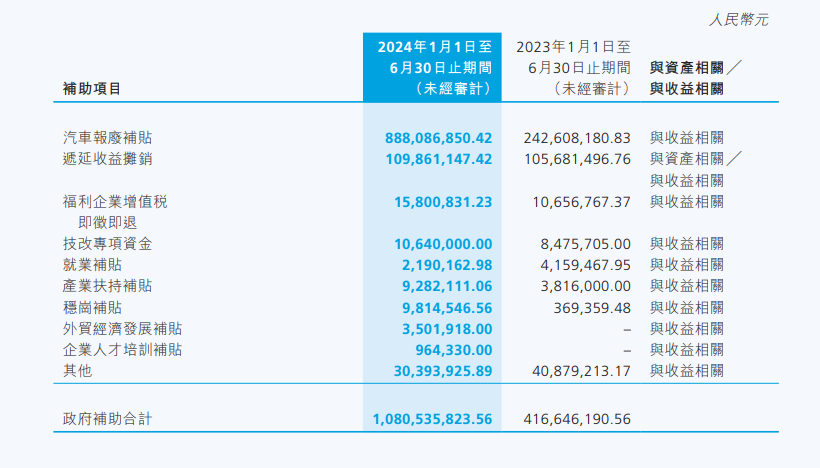

In fact, in March of this year, media reported that a large number of employees had left Great Wall Motor, and correspondingly, the government employment subsidies received by Great Wall Motor in the first half of the year also decreased.

Source: Weibo Screenshot

Although employment subsidies decreased, Great Wall Motor received a total of 1.08 billion yuan in government subsidies in the first half of the year, a year-on-year increase of 161%. Among these, vehicle scrapping subsidies amounted to 888 million yuan, more than triple the amount received in the same period last year. According to “Qu Jie Shang Ye”, vehicle scrapping subsidies are intended to encourage car owners to replace their vehicles, especially from gasoline-powered to electric-powered vehicles. The increase in this subsidy amount may also reflect an increase in the number of Great Wall Motor consumers encouraged by policy.

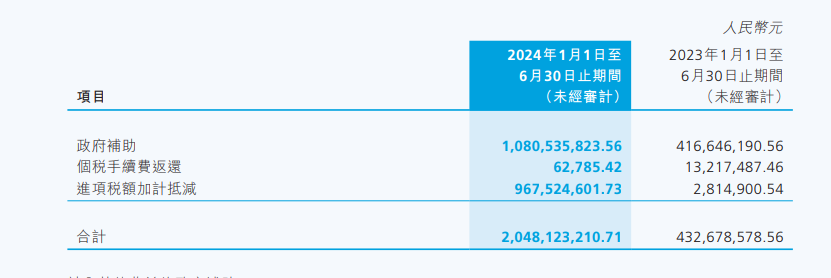

In addition, Great Wall Motor's input tax credits were credited with an additional deduction of 967 million yuan in the first half of the year, compared to just over 2 million yuan in the same period last year.

The substantial increase in government subsidies and tax incentives, which are classified as “other income,” significantly boosted Great Wall Motor's overall profitability. Although these two items are generated by business operations, they are both non-active incomes based on policy and cannot be considered long-term sustainable operating income.

Source: Great Wall Motor Semi-Annual Report Screenshot

However, despite far exceeding expectations in terms of profitability, Great Wall Motor's sales growth was not significant. In the first half of the year, Great Wall Motor sold a cumulative total of 554,900 vehicles, a year-on-year increase of 6.95%.

Among Great Wall Motor's major brands, only WEY and Tank experienced year-on-year growth of 43.54% and 97.66%, respectively, in the first half of the year. Haval, previously Great Wall Motor's best-selling brand, sold 297,000 vehicles in the first half of the year, a mere 0.17% year-on-year increase. Excluding overseas sales, Haval's domestic sales declined year-on-year. Pickups and Ora also performed poorly.

Source: Great Wall Motor Semi-Annual Report Screenshot

In terms of sales regions, Great Wall Motor sold 355,000 vehicles domestically in the first half of the year, a year-on-year decrease of 10%. According to Great Wall Motor's sales data, from January to August this year, Haval, Great Wall Pickups, WEY, and Ora experienced declines of 3.15%, 13.15%, 15.74%, and 38.36%, respectively. Great Wall Motor is facing severe challenges in the domestic market.

In contrast, the overseas market contributed significantly to Great Wall Motor's sales. In the first half of the year, Great Wall Motor sold 199,800 vehicles overseas, a year-on-year increase of 62%.

Overall, Great Wall Motor did achieve revenue and profit growth in the first half of the year. However, in terms of domestic sales performance, Great Wall Motor has not yet truly reversed the sluggishness of 2023.

With the fiercely competitive new energy vehicle market in 2024, as a traditional automaker undergoing transformation, Great Wall Motor faces an uphill battle to emerge victorious. Wei Jianjun, who has returned to the forefront, may not be able to relax just yet.

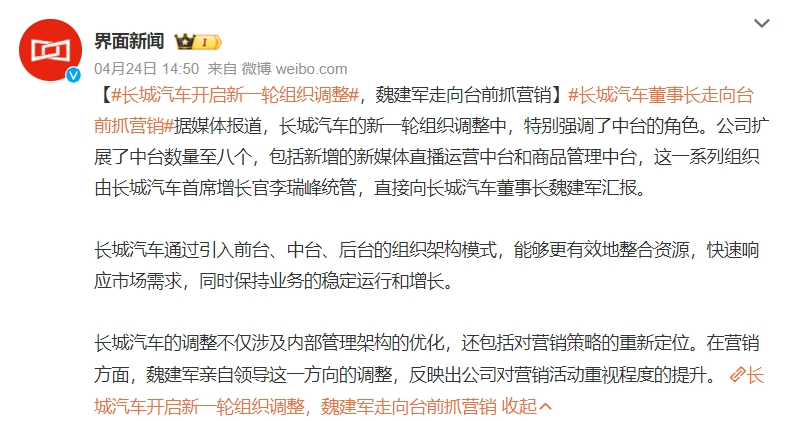

In April of this year, media reported that Great Wall Motor had repositioned its marketing strategy. "In terms of marketing, Wei Jianjun personally led the adjustment of this direction, reflecting the company's increased emphasis on marketing activities," the report stated.

Source: Weibo Screenshot

Wei Jianjun, Chairman of Great Wall Motor, has repeatedly emphasized in public statements that facing intense market competition, Great Wall Motor will pay more attention to marketing and brand building.

Since the beginning of this year, Wei Jianjun has frequently appeared on social media. On April 15, the 60-year-old Wei Jianjun launched his first live stream, testing full-scenario NOA and promoting Great Wall Motor's intelligent driving capabilities. At the end of the live stream, he mentioned that Great Wall Motor needed to make better use of internet and media resources to improve its traditional approach of "doing without saying."

On August 21, Wei Jianjun also personally attended the launch event for Great Wall Motor's new Blue Mountain model under the WEY brand. This marked Wei Jianjun's return to the stage at a Great Wall Motor launch event after six years.

During the event, after greeting everyone, Wei Jianjun first spoke about the hardships behind WEY, emphasizing that the car embodied Great Wall Motor's latest technology. He traced the origins of the WEY brand name and discussed its glories and setbacks, speaking for over ten minutes, prompting netizens to comment with sarcasm, "Are you having an internal meeting here?"

Source: Launch Event Live Stream Screenshot

Meanwhile, Chen Siying, former CEO of WEY, categorized unprofitable new forces into the "capitalist faction" at the WEY Blue Mountain launch event, sarcastically referring to them as only capable of offering refrigerators, sofas, and large TVs in their configurations, akin to a "lightning five-hit combo."

Earlier, at the launch event for the new Haval H6 in June, Li Ruifeng, CGO of Great Wall Motor, boldly stated, "If someone is cheating at the card table, we must issue a warning, stand up, bang on the table, and even overturn it," giving the entire event a strong sense of confrontation.

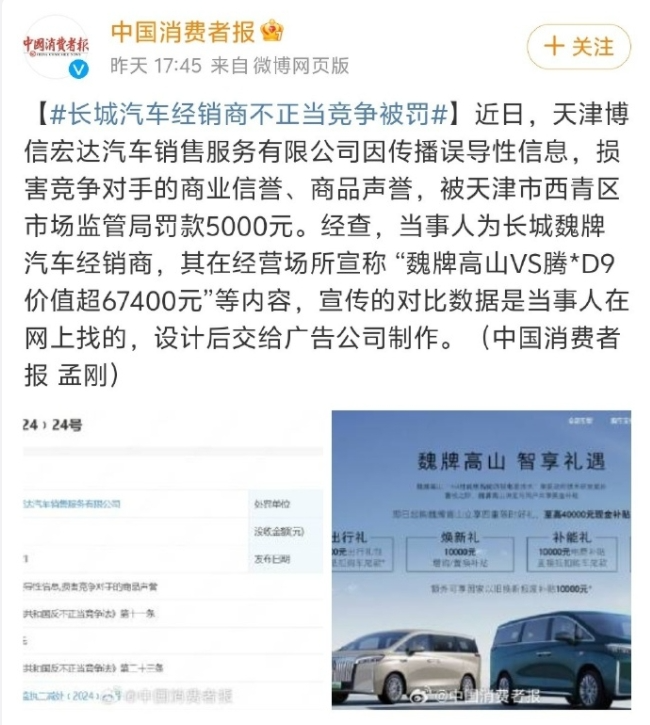

Awkwardly, the following day after the event, China Consumer News reported that Great Wall Motor dealer Tianjin Boxinhongda had engaged in misleading practices by claiming that the WEY Gaoshan model was "worth over 67,400 yuan more than the Tengzhi D9" at its premises, damaging the business reputation and commodity reputation of its competitors. Ultimately, the dealer was fined 5,000 yuan by the market supervision bureau for unfair competition.

Source: Weibo Screenshot

In reality, "sarcastically" targeting competitors does not elevate one's own brand value but only makes consumers perceive the brand as "caring too much" and "petty." Moreover, the popularity of "small three electrics" in electric vehicles indicates consumer acceptance, so such sarcasm is essentially slapping consumers in the face.

It's not just about launch events. As a traditional automaker undergoing transformation, Great Wall Motor seems to be struggling with the concept of "traffic" or online attention.

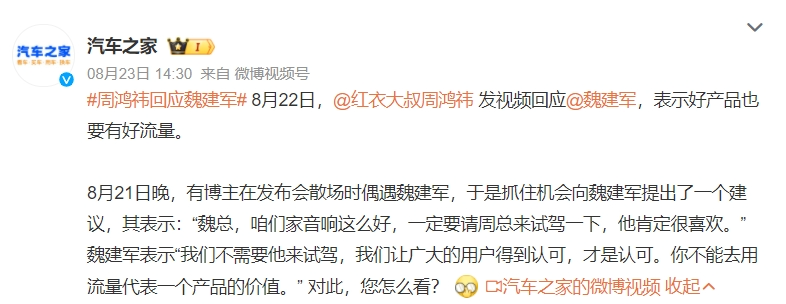

For instance, when someone suggested that Great Wall Motor invite newly-rising "car influencer" Zhou Hongyi for a test drive, Wei Jianjun responded that he "didn't need him to test drive" and that "traffic cannot represent the value of a product." Zhou Hongyi's response was quite to the point – "good products also need good traffic."

In today's era of information explosion, it's no longer a time when "good wine needs no bush." Nowadays, even sellers of alcoholic beverages block the entrance to the alley, making it impossible for those deep inside to be noticed.

Source: Weibo Screenshot

Regardless of whether Wei Jianjun returns to the forefront, Great Wall Motor seems to be lagging behind in adapting to new ways of generating online traffic.

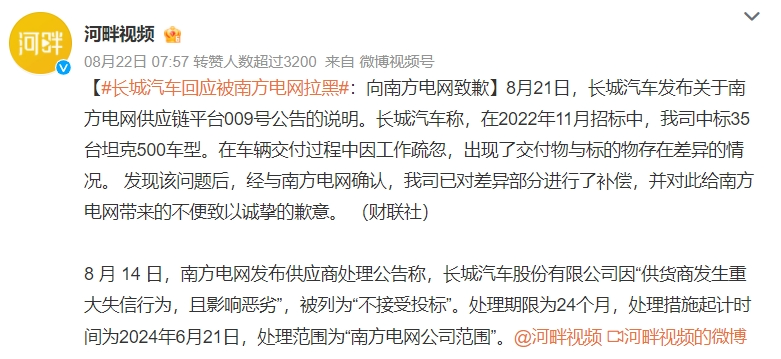

Furthermore, in the internet age, "good news travels slowly, but bad news travels fast," and it spreads even faster. Previously, rumors circulated that Great Wall Motor had been "blacklisted" by China Southern Power Grid. On August 21, Great Wall Motor issued a statement explaining that it had won a bid for 35 Tank 500 models from China Southern Power Grid at the end of 2022 but that "due to work negligence, there were differences between the delivered goods and the bid items," a phrase that was interpreted by some as "unilaterally reducing configurations without prior consultation."

Source: Weibo Screenshot

While this incident may seem minor, it involves the popular Tank series of Great Wall Motor, which could lead consumers to believe, "If they dare to deceive China Southern Power Grid, deceiving me will be even easier.""

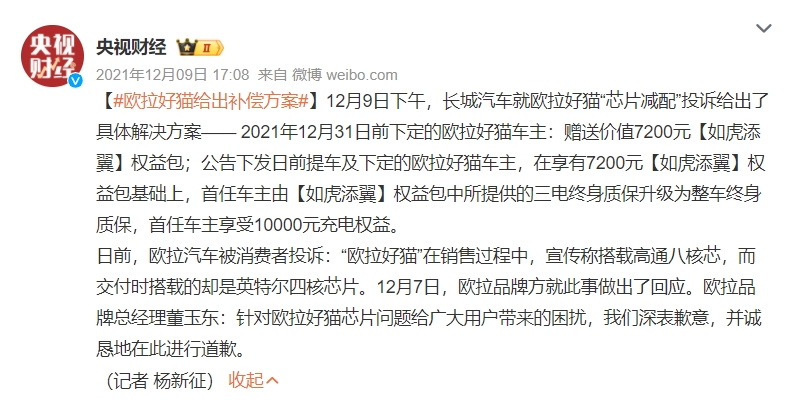

According to "Qu Jie Shang Ye," as early as 2021, Great Wall Motor's Ora Goodcat was subject to consumer complaints due to "chip downgrades" and "mismatched products." During sales, Ora advertised that the Goodcat would be equipped with an eight-core Qualcomm chip, but it was delivered with a four-core Intel chip instead.

Source: Weibo Screenshot

"Focus on quality, not cost reduction." In the current chaotic automotive industry, ensuring product and business quality is more crucial than playing with traffic. As Wei Jianjun said, "I must be a defender of order and justice, not harming national interests or consumer interests. If we deviate from our original intentions, what's the point of doing this?"""In June 2021, Great Wall Motor announced its 2025 strategy, with Wei Jianjun setting a sales target of 4 million vehicles for 2025, 80% of which would be new energy vehicles, with operating revenue exceeding 600 billion yuan by then. For Wei Jianjun, this is a battle of transformation. For Great Wall Motor, winning this new energy transformation battle is also urgent.

Source: Weibo Screenshot

As of the end of August this year, Great Wall Motor had sold a cumulative total of 745,400 vehicles, a slight year-on-year increase of 0.4%, including 181,400 new energy vehicles sold. There is still a significant gap between these figures and the 2025 targets.

Looking back to 2016, Great Wall Motor solidified its position as the second-largest domestic automaker with sales of 1.0745 million vehicles. At that time, NIO, Xpeng, and Li Auto were not even ranked, and the combined sales of Geely and BYD were still unable to surpass Great Wall Motor.

How come Great Wall Motor has struggled in the transition to new energy vehicles?

In 2018, Great Wall Motor launched its first new energy vehicle brand, Ora (ORA), with the "Ora iQ" priced at 89,800 yuan, selling over 3,000 units that year. This transition occurred at a neither early nor late stage in 2018, and with proper positioning and leveraging Great Wall's existing brand and traffic, it wouldn't have performed poorly.

However, Great Wall Motor chose a niche path: targeting female consumers and initially focusing on the A0-segment market, which accounts for less than 3% of the overall automotive market sales.

Moreover, Great Wall's innovation tailored to women's needs was unimpressive, such as "Gentleman Mode" and "Goddess Mode" to adjust in-car lighting, temperature, and mood lighting. In contrast, Xiaomi's SU7, released this year, won over many female drivers with its sunscreen function alone.

Image source: Canstockphoto

In contrast, BYD and Geely, which also underwent transitions around the same time, found more mainstream paths. BYD built its product matrix starting with hybrids, emphasizing multiple products and cost-effectiveness, while Geely's Zeekr 001 became a performance leader among similarly priced models.

Furthermore, Great Wall Motor's marketing shortcomings lie in confusing product naming and low product selling points perception. Its excessive focus on niche category innovation, with multiple brands operating independently, can also distract from internal efficiency and combat effectiveness. As Wei Jianjun once Self mockery said, "Great Wall Motor's products are actually very capable, but the current problem is that we're not very good at selling cars."

In the past two years, both TANK and WEY have made progress, with TANK in particular becoming a major growth driver for mid-to-high-end models, selling 116,000 units in the first half of the year, a year-on-year increase of 98.94%. However, the SUV segment is seeing more challengers, such as the FANGCHENGBAO BAO5 and JETOUR Traveler.

Image source: Canstockphoto

2024 is widely regarded as the start of the electric vehicle elimination race, and Wei Jianjun's return to the forefront reflects Great Wall Motor's commitment to a complete transformation.

Wei Jianjun's personal return to the forefront can stabilize morale internally and gain more influence externally. It also shows consumers the brand's conviction. While consumers may not buy solely based on conviction, when Wei Jianjun says, "WEY is a brand that I've staked my name on," it instills more confidence in the brand.

Furthermore, whether through Wei Jianjun's participation in NOA livestreams or his presence at new vehicle launches, he has been demonstrating Great Wall Motor's commitment to intelligent transformation. Wu Huixiao's recent appointment as CTO, succeeding Wang Yuanli, also signals Great Wall's strategic direction in a sense.

Reflecting this commitment, Great Wall Motor's R&D expenditure in the first half of this year reached 4.184 billion yuan, a year-on-year increase of 19.24%. With Wei Jianjun now overseeing Wu Huixiao, who leads Great Wall Motor's intelligent transformation, it is evident that intelligence has become a top priority for the company.

Image source: Weibo screenshot

Apart from Great Wall Motor, other established automakers are also increasing their R&D investments. In the first half of this year, BYD's R&D expenditure reached 20.177 billion yuan, a year-on-year increase of 41.64%, while Geely's total R&D expenditure was 7 billion yuan, up 17.9% year-on-year.

The automotive industry's competition will remain intense over the next three years. To avoid elimination, Great Wall Motor must continue to prioritize R&D innovation and listen closely to consumers and the market. However, the company also faces the question of whether Wei Jianjun, now over 60, can still sensitively capture the needs of younger consumers, and who will take over the baton for Great Wall Motor's future?