FSD comes to China, 70 automakers can't withstand the impact

![]() 09/09 2024

09/09 2024

![]() 631

631

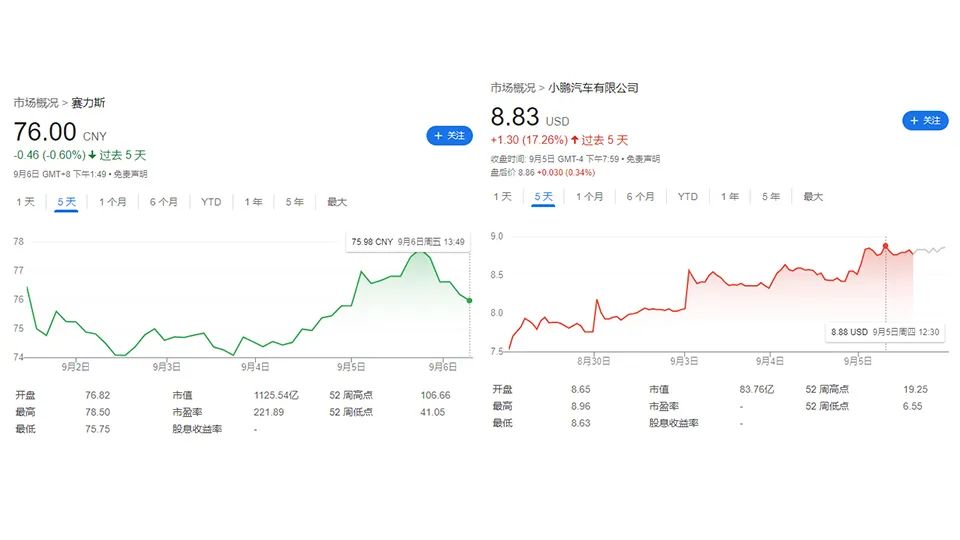

Although FSD has not officially entered China, it has already caused a substantial impact, such as fluctuations in the stock prices of many companies.

Huawei's most successful technology partner in the Chinese market, SF Motors, saw its share price decline from around 10:30 AM on September 6. XPeng's share price also saw significant fluctuations, with a decline starting around 12:30 PM on September 5. Notably, despite the popularity of XPeng's MONA M03 model, which led to the company treating its employees to afternoon tea and hosting a flying car launch event, there were even rumors that Wang Fengying, the company's executive, celebrated by drinking her first glass of wine.

However, while the new car models were selling well and becoming popular, the share prices stopped rising and began to decline. Investors cooled down and reconsidered their investment confidence. The decline in share prices at specific time points, with many similar cases occurring, suggests a strong connection to Tesla.

Musk is fond of discussing the first principle, which refers to the inevitable key issues that one must confront eventually. By addressing the first principle, many problems can be resolved effortlessly. Now, as Tesla's FSD is about to enter the Chinese market, it poses a first-principle challenge that other automakers have yet to encounter.

For consumers, the questions revolve around safety, whether FSD will only work in specific cities (like Shanghai) or regions, whether it can outperform Huawei, and whether the price of 64,000 yuan will drop.

For investors, the concern is whether XPeng can compete with Chinese smart driving companies like Huawei, potentially breaking its golden reputation, and whether to increase investment or withdraw.

For the automotive industry, the situation is different from when Tesla first entered the Chinese market with its new energy and intelligent vehicles. Back then, Tesla acted as a catalyst, stimulating consumer awareness and accelerating the overall industry's development. Now, while it still promotes growth, the competition is fiercer, with the next big showdown looming. Among the over 100 automotive brands selling cars in China, including BYD, Huawei, NIO, XPeng, and Li Auto, who will be able to withstand the pressure?

The good news is that over 20 automakers can withstand the challenge

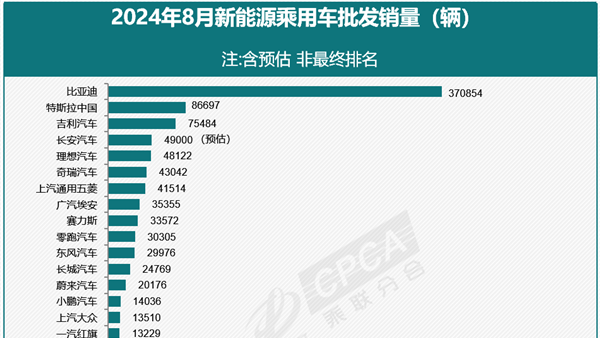

While different institutions may report varying numbers, the consensus is that there are over 100 passenger vehicle brands currently on sale and generating sales in the Chinese automotive market. Leading automotive media outlets that have in-depth partnerships with automotive brands also agree, estimating the number to be around 105.

More than half of these brands sell fewer than 5,000 vehicles per month, a threshold commonly used to evaluate profitability in the traditional fuel vehicle era. In terms of technical capabilities to withstand the impact of Tesla's FSD, at least 20 automakers possess the potential to compete effectively.

'The competition from FSD may not necessarily require Huawei's intervention,' said Lin Bin, a relevant leader in the smart driving solutions development department of an automaker. Since the latter half of 2023, the frequency of contact between automakers and smart driving solution providers has significantly increased. In fact, automakers are well-informed about industry developments. Since 2023, several leading automakers have taken actions to intensify competition in smart driving, both to gain sales advantages through the implementation of new technologies and to prepare for a technological arms race with Tesla.

As Tesla's FSD prepares to enter the Chinese market, identifying automakers that can compete effectively in the upcoming battle is not difficult. Those with urban NOA capabilities, intelligent parking systems, and affordable pricing will pose a challenge to Tesla, as FSD also focuses on these areas.

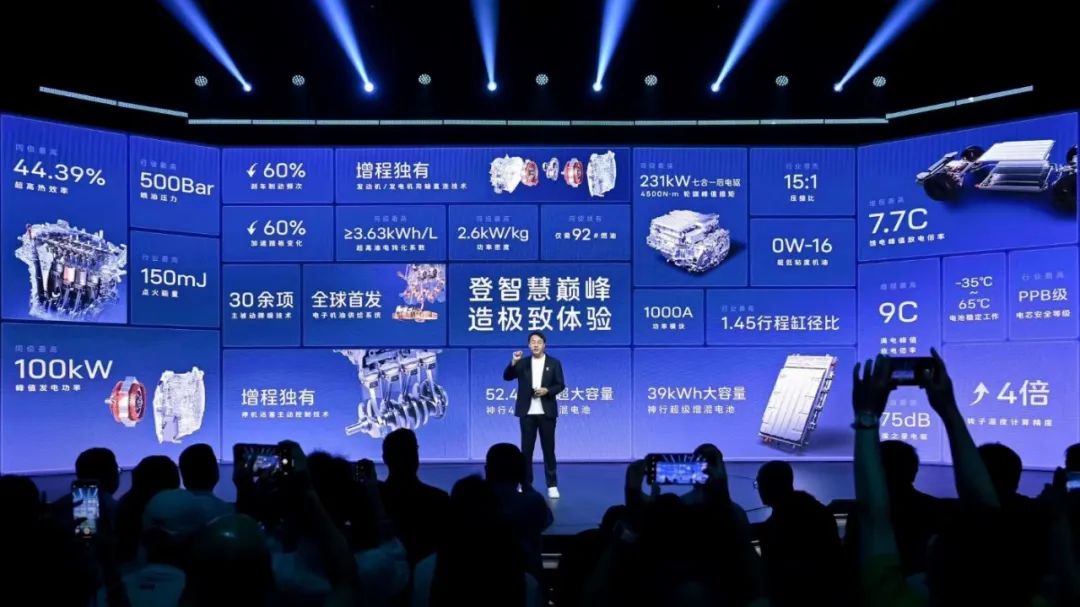

In 2022, the keywords in Chinese smart driving were OCC and highway navigation pilot. In 2023, they shifted to mapless driving and urban NOA. For 2024, the focus is on end-to-end solutions and large models. This includes Huawei's GOD network and Lixiang Auto's current large model combined with VLM. More and more automakers are turning to mapless, pure vision-based urban NOA, which has become memorable to consumers.

However, behind this trend lies a dynamic where Tesla innovates, and Chinese automakers compete to apply these innovations. The opening remarks at almost every technical communication meeting typically begin with, 'Tesla did X, and we're doing X too.'

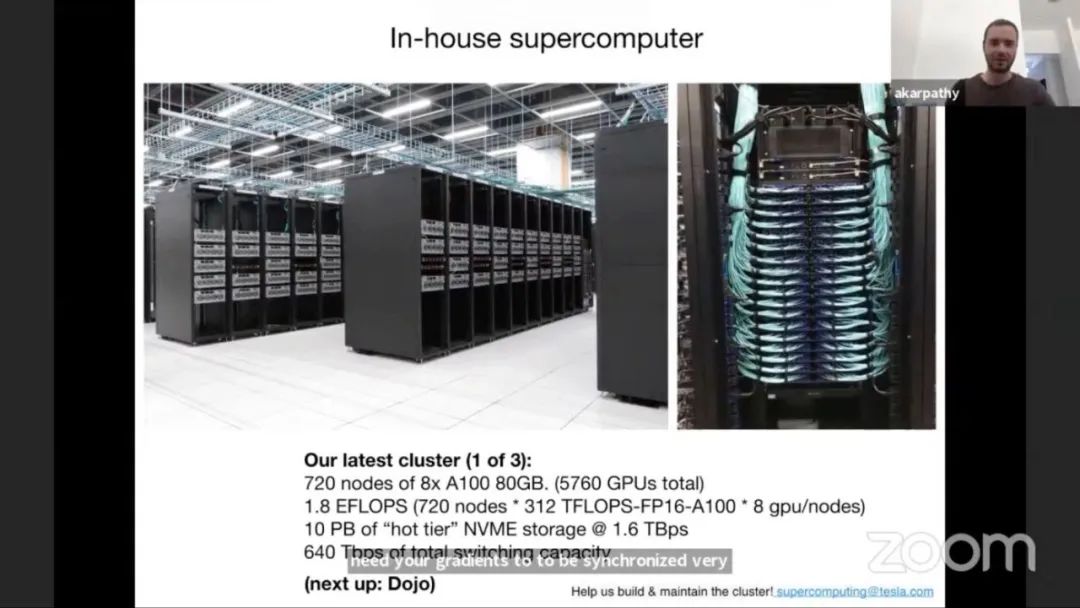

In May 2023, Musk officially announced the upcoming release of FSD V12, which would utilize end-to-end AI technology. Starting in the fourth quarter of 2023, leading domestic OEMs began to adopt end-to-end solutions en masse. Similar trends can be observed in the adoption of BEV, Transformer, and Occupancy technologies. The reason why most automakers focused on smart driving have invested heavily in Silicon Valley and established North American headquarters is rooted in this underlying logic. This also directly reflects the rapid follow-up and judgment of Chinese automakers, eroding Tesla's early mover advantage.

Coupled with the rapid pace of competition among Chinese automakers, a more relaxed environment for technology implementation, and the significant data growth stemming from China's large population, these factors enable them to catch up with or even surpass the growth rate of Tesla's FSD. Consequently, Musk announced plans to develop over 10,000 Dojo supercomputers in an attempt to maintain and expand its leading edge.

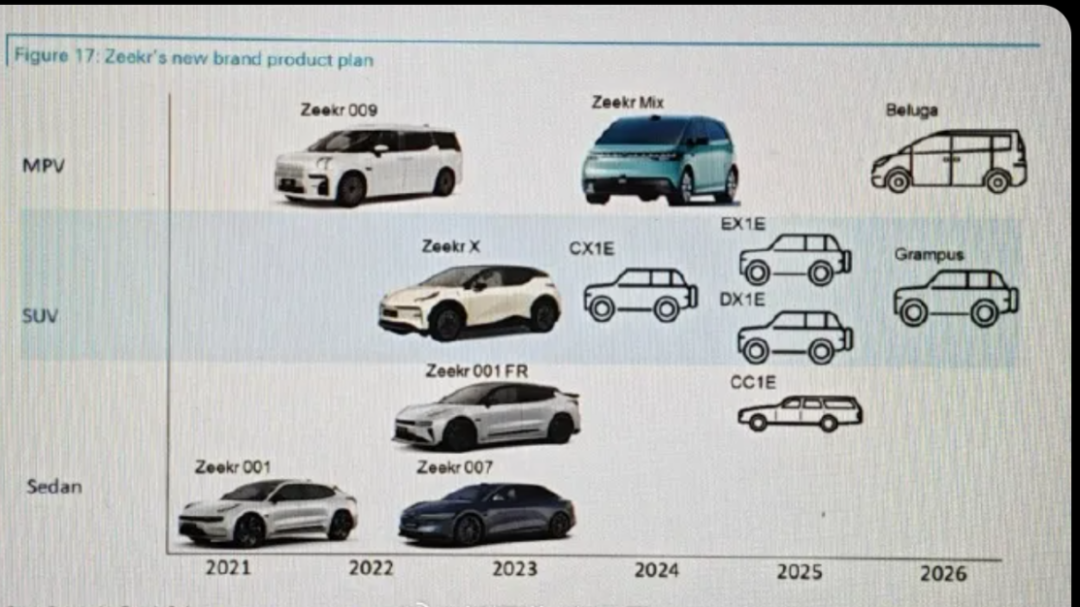

The list of automakers that can initially compete with Tesla includes those under Huawei's HarmonyOS Intelligent Driving Ecosystem, such as NIO, XPeng, and Lixiang Auto, as well as Changan Automobile, which has invested in Huawei through its AVATR brand. Other notable competitors include Great Wall Motors, whose Chairman Wei Jianjun has conducted three live broadcasts recently, and Geely Auto, behind the forceful promotion of its ZEEKR brand in the 2025 model year.

In fact, since July this year, Chinese automakers have been secretly intensifying their competition in smart driving. At the Chengdu Auto Show this year, BYD introduced its high-end smart driving capabilities into vehicles priced below 200,000 yuan with the launch of its new Song L EV. According to our sources, this is just the beginning, as BYD is planning to gradually equip more vehicles with smart driving capabilities in a similar manner to how it rolled out its fifth-generation DM technology.

Additionally, there will be many surprising names on this list. For example, traditional automakers like Mercedes-Benz, BMW, Toyota, Honda, and Volkswagen, which have traditionally been less vocal in China, are now deeply committed to the market. Mercedes-Benz has increased its investment in China by 14 billion yuan, not only localizing the production of the GLE but also partnering with Momenta on intelligent driving, with the potential for urban NOA to be introduced in 2025.

BMW has already planned upgrades for its highway ramp entry and exit functions in its refreshed models this year. Toyota and Honda are both embracing Huawei, with their cockpits fully equipped with Huawei technology. Toyota is also partnering with Momenta, and if things go according to plan, its new plug-in hybrid SUV could be equipped with urban NOA by the fourth quarter of this year. Volkswagen, on the other hand, is using DJI for the transition phase but has confirmed that it will adopt XPeng's complete vehicle solution in the future, with Audi and SAIC Motor following suit. If XPeng can compete with Tesla, so can Volkswagen.

Counting this list means that from a technical and equipment perspective alone, Tesla will face competition from 20 automakers. Looking at the hidden themes of the 2024 Chengdu Auto Show, Chery uses semi-urban NOA functionality (which does not allow free-roaming but provides city memory assistance, similar to XPeng's valet parking mode, after learning commonly used routes). More and more Chinese brands are adopting similar concepts.

However, the analysis cannot be limited to smart driving alone, as car buyers also consider price and battery-electric performance.

Extended-range electric vehicles are also formidable competitors for Tesla

Practical considerations include the fact that while pure electric vehicles have continued to grow rapidly for several years, their growth rate has significantly slowed. In its place, plug-in hybrids, particularly extended-range electric vehicles, have emerged as a rising force.

With the new energy vehicle penetration rate stabilizing above 50%, the latest data shows that pure electric vehicles account for about 30% of the market, while broadly defined plug-in hybrids (including extended-range electric vehicles) make up 23.1%, and gasoline vehicles account for 46.8%. Since the launch of BYD's DM-i technology three years ago, the market share of plug-in hybrids has increased by 10%. If trends continue, they may even catch up with pure electric vehicles by 2025.

Therefore, for consumers, the imminent entry of Tesla's FSD into China presents two significant scenarios. The first is for those considering purchasing a smart electric vehicle, who may ponder whether to wait for Tesla or evaluate the progress of other automakers. The second scenario involves those who are not interested in smart electric vehicles but may worry that their new purchase could quickly become obsolete as many automakers struggle to withstand this new round of competition.

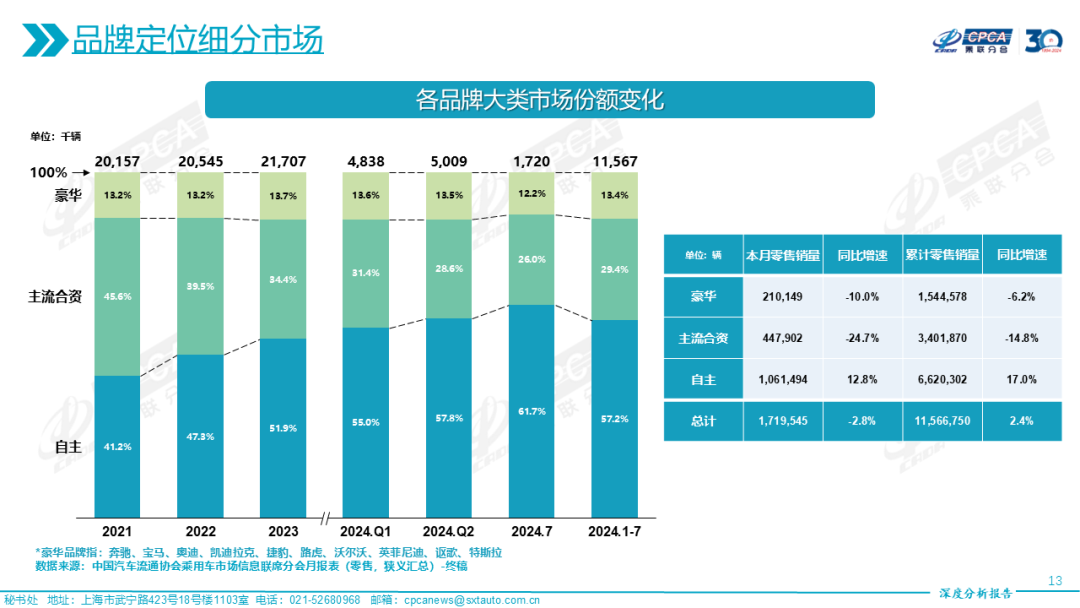

The latest data from the China Passenger Car Association reveals two key changes. Firstly, the market share of mainstream joint venture brands has shrunk to 29.4% from January to July 2024, down from 45.6% three years ago. Luxury brands hold a 13.4% share, with average transaction prices declining, while domestic brands have risen to 57.2%. Secondly, the new energy vehicle penetration rate reached a new high of 53.14% in August.

This suggests that the pure electric vehicle market, where Tesla operates, is already under significant pressure. In the Chinese automotive market in 2024, more and more automakers are diversifying their portfolios. This includes ZEEKR, which has announced plans to introduce plug-in hybrid (likely extended-range) vehicles in 2025, and Chery's high-end brand Starway, which has launched the Star Age ET plug-in hybrid and has seen good sales. Even Chery's new iCAR brand, originally focused on pure electric vehicles, has been spotted testing an extended-range version of its compact off-road SUV.

Moreover, it's not just Chinese brands that are pursuing this strategy. Luxury brands like Mercedes-Benz, BMW, and Volvo are also on the same track. The global head of research and development at Mercedes-Benz revealed in an interview with us at the 2024 Beijing Auto Show that the number of new vehicles combining internal combustion engines with electric motors will gradually increase, with the Mercedes-Benz E 350el, equipped with the fourth-generation plug-in hybrid system, set to enter the market soon. BMW is following a similar path, gradually adjusting its lineup to include a combination of pure electric, plug-in hybrid, and gasoline-powered vehicles, with plug-in hybrids regaining importance. Additionally, Volvo recently announced adjustments to its electrification plans, allowing for a portion of its sales to come from plug-in hybrids, revising its original plan to go fully electric by 2030.

Moreover, even the slowest-paced American Big Three have begun to slow down their pure electric vehicle transformation plans, adding more engines to new energy vehicles to survive the global economic downturn. At the end of August, Ford Motor Company announced that due to customers' increasing emphasis on cost-effectiveness and driving range, it would re-evaluate its electric vehicle plans and focus more on hybrid models with longer combined driving ranges and affordable models in the future.

In the second quarter of 2024, Ford sold 26,000 electric vehicles, generating revenue of $1.1 billion, but with an EBIT loss of $1.1 billion, resulting in an average loss of $42,300 (approximately RMB 306,000) per electric vehicle.

Relying solely on FSD raises significant doubts about whether it can compete against numerous Chinese newcomers with similar capabilities but larger and cheaper vehicles, as well as against established brands like Mercedes-Benz and BMW and more plug-in hybrids.

Moreover, the price of FSD in China, set at RMB 64,000, is already astronomical in the consumer market. Among today's mainstream automakers, Huawei's fully equipped three-lidar-equipped intelligent driving system is priced at RMB 10,000 for a limited time on AITO models. After a promotional price of RMB 6,000 for HarmonyOS Intelligent Driving, the current one-time buyout price is RMB 30,000, but for much of 2023-2024, the lowest price for ADS 2.0 was as low as RMB 8,000. Additionally, Huawei's Kunlun Intelligent Driving has recently further reduced the price of its entry-level basic version by RMB 5,000.

Other examples include Lixiang Auto including the feature in the vehicle price, Xiaopeng Motors offering it for free, and the visible decline in prices for high-end intelligent driving systems. The current pricing of Tesla's FSD is sufficient to purchase an entire BYD Seagull vehicle.

Closing Thoughts

Rumors of Tesla's entry into China began circulating in the second half of 2023, followed by Elon Musk's visit to China to meet with regulators. Subsequently, even Tesla's FSD beta features appeared in live streams. Unlike previous instances, the news in early September 2024 is no longer mere rumor but an official announcement, with the only variable being the pending approval from regulatory authorities.

Today, there are at least 20 companies with similar intelligent driving technology reserves and applications. More than 10 automakers can rival Tesla in terms of powertrain technology. Additionally, this discussion also includes Xiaomi as a wildcard. Lei Jun is not a traditional follower; while Huawei currently leads the way, he is undoubtedly seeking to surpass it. Therefore, it remains highly uncertain whether FSD faces a blue ocean or a red ocean.

One certainty, however, is that this competition is exclusively for the elite. As a consequence, the remaining 70+ automakers must quickly find their niche to survive, as they are unlikely to have many opportunities to participate in this race, which is far fewer than in the era of gasoline-powered vehicles.