Tesla's FSD entering China, but car owners are not happy?

![]() 09/09 2024

09/09 2024

![]() 496

496

Tesla's FSD may enter China in as little as 4 months.

On September 5th, Tesla officially announced plans to officially introduce FSD in Europe and China in the first quarter of 2025, pending regulatory approval. This means that domestic users may be able to use Tesla's FSD function as early as January next year, although it is expected to be initially available only in select cities, not nationwide. Questions arise: which version of FSD will Tesla introduce in China first? How will it perform on Chinese roads? Will the price of FSD increase or decrease?

FSD entry into China may skip the latest version, focusing on local adaptation?

First, let's address the first question: Tesla's FSD version for the Chinese market is likely to skip the upcoming V13 version, set to be released in October, and instead opt for V12.6. Why is this?

Based on the timeline of Tesla's FSD entry into China news this year, Tesla CEO Elon Musk visited China in late April specifically to discuss FSD's entry, during which he disclosed that FSD would enter China, Europe, and other countries in either version V12.5 or V12.6. More recently, in mid-July, Musk reiterated during the second-quarter earnings call that FSD would be available in China and Europe after the release of version 12.6.

This suggests that, with the exception of Tesla's home market of the United States, other countries and regions, including China, will receive an older version of FSD. Let's delve into the reasons behind this.

The primary reasons for the delay in Tesla's FSD entering China, Europe, and other countries lie in two key issues. Firstly, each region has different regulatory restrictions, particularly in China, where stringent requirements for autonomous driving technology testing exist, and overseas companies must also comply with data localization principles for commercial operations. Secondly, from a technical perspective, China's complex and diverse traffic environment and driving behaviors necessitate targeted measures for extensive testing and deep localization of Tesla's FSD, which is not as straightforward as a global OTA update. This logic is similar to iOS system updates, where adaptation pushes tailored to local user habits are implemented.

Expanding on the second reason, Tesla's decision to use an older version of FSD for its Chinese debut can be seen as a strategy to accumulate driving data early on, training algorithms better suited to China's traffic environment and facilitating deep localization. Tesla's FSD differs from the multi-sensor fusion approach adopted by some domestic automakers, relying instead on end-to-end autonomous driving software algorithms and neural network models that replace tens of thousands of lines of code written by programmers. Rather than relying on high-precision radar sensors, Tesla's hardware layer utilizes only cameras for a pure vision-based solution. To maintain FSD's iterative capabilities, a considerable amount of real-world driving footage is necessary for training.

As Tesla's second-largest market globally, China currently has over 1.7 million Tesla vehicles on the road. This vast amount of real-world data is crucial for enhancing Tesla's FSD capabilities. With FSD's entry into China now counting down, indicating that Tesla has completed regulatory preparations, how will FSD perform on Chinese roads?

Will it recognize green lights, slow down to avoid obstacles, but stall at roundabouts and electric bicycles?

While version V12.6 has not yet been released, the current V12.5.3 version supports smart summoning in parking lots or lanes, attention monitoring under sunglasses, automatic exiting, parking, and reversing, earlier and more natural lane changing decisions, end-to-end highway driving, active obstacle avoidance, active lane changes, active green light passage, visual speed limit monitoring, reduced prompts for manual intervention, and compatibility with early HW3.0 models.

In terms of user experience, this intelligent driving solution covers most commuting scenarios in urban and expressway environments. It makes decisions based on perceptual judgments in advance for lane changes, turns, obstacle avoidance, braking, and parking, exhibiting a logical performance akin to a "driver" continuously learning driving techniques and rules.

With the addition of Baidu Maps providing extensive road network and traffic data to FSD, further enhancing its execution precision, it is anticipated that the V12.6 version, once released, will better adapt to China's traffic environment.

However, such intelligent driving experiences are no longer novel in China, and Tesla's FSD is no longer the only automaker adopting a pure vision-based solution. For example, Huawei's ADS3.0 advanced intelligent driving system has been mass-produced and is capable of end-to-end navigation from mapped to unmapped areas, with the ability to change destinations freely, recognize traffic signals, including at roundabouts, make autonomous following and braking decisions, and perform autonomous parking and exiting. Furthermore, since last year, companies like GAC Group (with its unmapped, pure vision-based GARCIA solution) have also ditched high-precision maps and LiDAR, enabling perception of not only vehicles, pedestrians, and cyclists but also irregular obstacles like small animals, trolleys, electric bicycles, and camping tents.

Upon entering China, Tesla's FSD may face two significant challenges: roundabouts and electric bicycles. Roundabouts have been an area of continuous improvement for Tesla's FSD, and even the latest V12.5 version struggles with lane recognition and being cut off by other vehicles at unsignaled roundabouts with heavy traffic. In China, cities like Chongqing and Shenzhen have complex road networks with numerous roundabouts and diverse driving behaviors. Will the upgraded V12.6 version of Tesla's FSD still stall or make autonomous decisions throughout? A question mark remains.

In addition to different traffic environments from the United States, Chinese urban roads present an obstacle that Tesla's FSD has never encountered before: electric bicycles weaving between motorized and non-motorized lanes. The diverse driving behaviors of electric bicycles pose a challenge not only to the perception capabilities of intelligent driving systems but also to their overall decision-making logic. When confronted with a suddenly appearing electric bicycle on the road, will FSD make an emergency lane change or maintain observation and make a judgment? Clearly, the latter approach aligns more closely with human driving habits, indicating that even in China, Tesla's FSD may not be significantly ahead of the curve.

FSD price is bound to drop, with subscriptions potentially offering better value

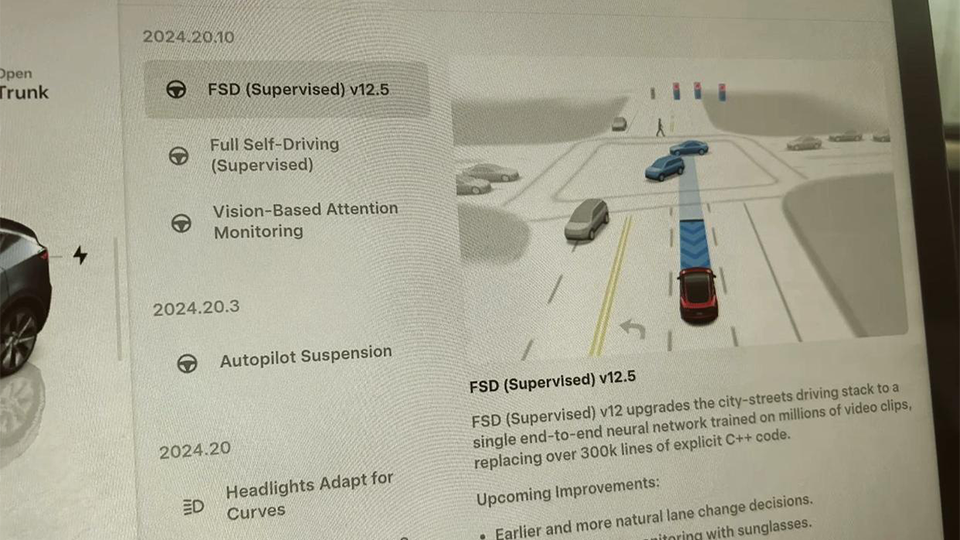

Finally, let's analyze the pricing of Tesla's FSD upon its entry into China. From two perspectives, the price of FSD is bound to adjust upon entering China, likely lower than the current buyout price of 64,000 yuan.

Firstly, let's consider Tesla's pricing strategy in the North American market. In April this year, considering the low installation rate of FSD, Tesla proactively reduced the buyout price from 2,000 USD to 8,000 USD, equivalent to approximately 57,000 yuan based on the exchange rate at the time, a decrease of approximately 27,400 yuan. Simultaneously, the subscription price was also lowered from 199 USD to 99 USD, a reduction of approximately 701 yuan.

Compared to Tesla's intelligent driving price plans in China, the current buyout price for the Full Self-Driving Capability is 64,000 yuan, while the Enhanced Autopilot costs 32,000 yuan. Subscriptions are available for Enhanced Autopilot at 699 yuan per month, but not for Full Self-Driving Capability. Given that China is Tesla's second-largest market globally, a price reduction is inevitable for Tesla to increase FSD installations and revenue in China.

Secondly, as a commercial product, Tesla is unlikely to take risks with FSD pricing. The domestic intelligent driving environment and competition are far more intense than overseas, and the user base is significant. Moreover, most domestic automakers do not charge for advanced intelligent driving systems. Therefore, to attract more users, Tesla must offer competitive pricing. As a result, subscriptions may offer better value than outright buyouts in the future.