"Encircling and Suppressing", Model Y

![]() 09/09 2024

09/09 2024

![]() 519

519

Introduction

Taking a piece of meat is a victory.

Recently, there are two things in China's automotive industry that impress me deeply.

The first is the ongoing Chengdu Auto Show. Although it's somewhat dull overall, when we look at specific segments, we see that with the emergence of vehicles like the ZEEKR 7X, AVITAR 07, and ZEEKR R7, coupled with the unfortunate absence of the LeDao L60 (which was highly anticipated), the mid-sized SUV market for new energy vehicles has undoubtedly gained significant momentum.

Their common enemy is the dominant Model Y.

On the other hand, Tesla recently announced its sales figures for August, and despite the intense competition, it managed to set a new high for the year, selling 86,697 new vehicles, representing a 17% month-on-month increase. Among these, Tesla's retail sales in China reached 63,000 units, a 37% month-on-month increase. Breaking it down further, Model Y sold 45,000 units in China, continuing to reign as the best-selling model in the domestic passenger vehicle market.

Connecting these two events, we arrive at the topic we want to discuss next: Can this renewed encircling and suppressing effort really succeed?

In fact, China's automotive industry has long been flooded with so-called "Model Y killers" in the form of new energy mid-sized SUVs. However, the results have shown that these efforts are often more bluster than bite, failing to put any real pressure or impact on Model Y.

The situation is ruthless and brutal.

Setting aside August, let's take a look at Model Y's retail sales in China for the first seven months of the year: 29,912 units, 22,537 units, 47,917 units, 26,356 units, 39,985 units, 41,110 units, and 36,299 units, respectively. While there are some fluctuations, the sales remain relatively stable, with a peak of nearly 50,000 units.

Moreover, with Tesla's ongoing "0% interest for 5 years" financing offer, it has attracted a significant number of potential customers who were previously on the fence.

Logically speaking, Model Y's position is still unshakeable.

Buying a Model Y is like buying an iPhone

With that introduction, let's delve into why Model Y has become such a hit among consumers, truly a blockbuster in China's automotive market.

There are two main reasons for this success: external and internal factors.

First and foremost, it must be acknowledged that for a long time, the submarket around the RMB 250,000 price point, where Model Y's main sales version resides, lacked any serious competition.

This allowed Model Y to thrive relatively easily in a "blue ocean" market. Coupled with the intensifying trend of electrification, a significant number of traditional fuel vehicle owners are looking to upgrade or replace their cars, making Model Y a natural first choice.

Of course, in addition to the boost from the external environment, Model Y's own outstanding features are essential.

It's undeniable that despite being on the market for some time and not yet undergoing a full generational change (only minor updates), Model Y continues to perform exceptionally well across multiple dimensions, including its electric drive system, range accuracy, energy efficiency, smart cabin maturity, driving experience, and charging infrastructure. Coupled with multiple price reductions, it has become increasingly affordable for consumers.

In summary, as the saying goes, "The proof of the pudding is in the eating." Behind its popularity lies solid product quality and value for money.

To draw an imperfect analogy, "In the smartphone market, Model Y is somewhat akin to an iPhone. While it may not excel in every spec, such as screen quality, camera performance, charging speed, battery life, or call quality, compared to domestic manufacturers that are constantly pushing the envelope, every new generation still attracts countless buyers willing to pay a premium for it."

Are they all easily deceived? Are they all being taken advantage of?

Rationally speaking, on the one hand, the iPhone's comprehensive user experience and tight integration with Apple's ecosystem keep consumers firmly locked in. On the other hand, the brand's inherent prestige cannot be ignored.

These two points also apply to Model Y.

It's not an exaggeration to say that if you spend over RMB 200,000 on a domestic new energy mid-sized SUV, you're bound to encounter questions about your choice and even some skepticism.

Conversely, if you purchase a Model Y, even though it may lack individuality or novelty and has a high chance of being a "street twin," it remains the safest, most cost-effective, and least risky option. It requires minimal justification and eliminates unnecessary hassles, instilling a sense of confidence.

Furthermore, Tesla's direct sales model and straightforward SKU offerings have contributed to Model Y's popularity. With the right timing, location, and people, a positive cycle has been established, fueling its growth momentum.

In other words, Model Y appears to be in its most comfortable groove. However, this does not mean it can rest easy.

Unseating the Champion Means Taking a Bite

Last September, after much anticipation, the Model 3 finally received a "refresh," with upgrades to its overall configuration. It was widely expected that the Model Y would quickly follow suit this year.

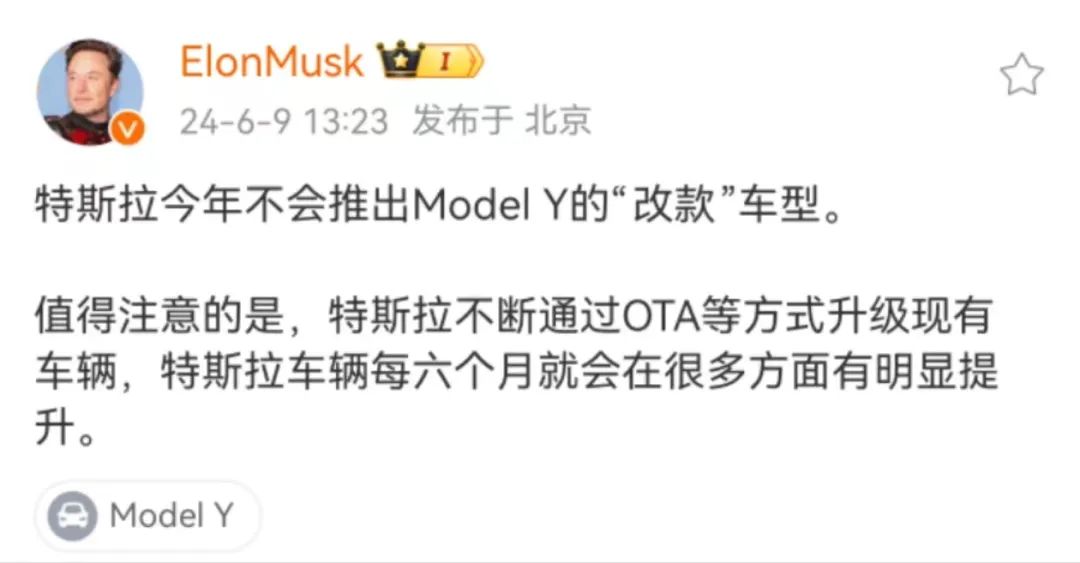

However, Tesla CEO Elon Musk's direct denial of such plans undoubtedly dashed those expectations.

Little did people know that just last week, the story took a new turn. Reports indicate that a five-seat refreshed version of the Model Y will officially launch in China in the first quarter of next year, featuring updates to its exterior, dimensions, interior, autonomous driving hardware, and battery capacity. A seven-seat version is also planned for the fourth quarter.

What I read between the lines is that in the face of this collective onslaught from domestic brands, Model Y is genuinely feeling the pressure.

After all, the product capabilities of the ZEEKR 7X, AVITAR 07, ZEEKR R7, and LeDao L60 can be considered the pinnacle of China's new energy mid-sized SUV offerings. Within a reasonable cost range, they are "fully equipped" and highly competitive.

In fact, these "Four Dragons" have been benchmarked against Model Y since their inception, aiming to be more refined, spacious, luxurious, powerful, and consumer-centric. Even in the face of the upcoming refreshed Model Y, they are ready to go head-to-head.

At the same time, unlike previous "Model Y killers," these "Four Dragons" have already gained widespread recognition among end consumers, further narrowing the gap with Tesla.

Moreover, it is foreseeable that to unseat Model Y, they will demonstrate sufficient sincerity, determination, and targeting in their pricing strategies, which are particularly sensitive to potential customers. The upcoming launch events will undoubtedly make direct comparisons to Model Y without hesitation.

Therefore, it's not alarmist to say that Model Y is facing its toughest battle since entering China. During a topic discussion this week, a colleague posed a more concrete question: "How will this encirclement effort impact Model Y?"

My answer was: "It will surely take a bite out of Model Y's market share."

More bluntly put, based on the precedent set by the refreshed Model 3, Model Y's stable monthly sales are likely to decline by 10,000 to 15,000 units, settling around 20,000 to 25,000 units. Furthermore, it's worth noting that the new energy mid-sized SUV market will continue to attract new entrants, turning the once "blue ocean" market into a "red ocean."

Model Y's future is fraught with uncertainty.

However, Tesla's usual modus operandi suggests that it will not allow its flagship model in China to sink into an inescapable quagmire. To defend its market share, it will have to become even more aggressive.

So, what will this American automaker do? Many people already have an inkling. As the competition intensifies, the landscape of this segment will continue to evolve and reshape.

As for who will emerge as the ultimate winner, it remains to be seen...