"It's getting harder and harder to be an Amazon seller."

![]() 09/09 2024

09/09 2024

![]() 658

658

"The myth of getting rich through Amazon side hustles is gone forever."

"When I saw this news, it sent a chill down my spine."

Recently, Xiao Li's small Amazon store has shown some signs of improvement, but she is still worried. The reason is that recently, an important message about violations in Amazon's internal messaging system has been circulating among sellers.

The message revealed that Amazon's US site (US) has increased penalties for sellers who violate rules when communicating with consumers through the backend messaging system (i.e., email). The previous approach was to issue a warning and allow sellers to appeal, but now it has changed to directly closing the store and not accepting appeals.

In short, Amazon has taken stricter measures against violations in internal messaging: once a violation is detected, the store will be directly closed and no appeals will be accepted.

"I just filed a complaint against the store that infringed on my rights. I haven't even made any money yet, and now this rule comes out. To be honest, I'm already a little regretful for getting into this circle," Xiao Li's frustration is not unique.

At some point, the cross-border e-commerce industry has been echoing with the sentiment that "it's getting harder and harder to succeed on Amazon." "Surviving" has become a short-term goal for many stores, let alone making money.

As intermediaries who once eagerly promoted the myths of "making 500,000 yuan a year by freelancing casually" and "getting rich through Amazon side hustles" can no longer easily convince people,

Will Amazon follow in the footsteps of China's e-commerce market, where competition is fierce and margins are thin?

01

"It's getting harder and harder to succeed on Amazon"

Changes in the overall environment affect everyone, and this statement is particularly relevant to the cross-border e-commerce industry.

In September 2021, during the so-called "Amazon Account Suspension Incident," over 1,000 businesses and more than 50,000 accounts were affected. Xiao Li's mentor, "Yong Ge," who guided her on her cross-border e-commerce journey, experienced that storm firsthand.

"Before 2021, we were frantically opening new stores, and the success rate of new products was very high at that time. Even if some products didn't perform well, we could still boost them through operational means or gray market tactics. They might not last long, but rarely resulted in unsold inventory or losses. Back then, rumors circulated that Amazon would sell anything and everything, and you could make money from it."

Apart from the account suspension incident, the pandemic was another major factor contributing to the decline of Amazon sellers in China. According to him, after 2022, too many new sellers entered the Amazon platform, causing a surge in traffic and advertising costs for many beginners who had only been in the game for a year or two.

In a recent survey of Amazon sellers conducted by Remazing, 75% of brand manufacturers reported an average increase of 20% in search advertising budgets compared to 2021. Looking back from 2023, Amazon's advertising revenue reached $38 billion in 2022, surpassing traditional media companies and global newspaper publishers.

"In the past two or three years, developing new products has become significantly more challenging. The probability of breaking through using conventional white-hat tactics has become slim."

The white-hat tactics mentioned by Yong Ge are industry jargon, referring to promoting products through methods allowed by Amazon (without engaging in brushing orders, fake reviews, exploiting system vulnerabilities, or other violations). In simpler terms, it means operating in compliance with Amazon's policies.

"Nowadays, if a new product can achieve even a tenth of its potential, it's considered a success. Most of the time, it's a complete failure. In the past two years, I haven't seen many emerging sellers making a splash; instead, I've seen many who entered the market only to withdraw later."

Xiao Li is a distant relative of Yong Ge. After experiencing career setbacks in recent years, she started her small Amazon store under Yong Ge's guidance. "To be honest, our recent sales have been ridiculously low. I thought we were doing the worst, but it turns out many others are in the same boat. We have a pile of unsold inventory, and our July sales dropped by around 20% compared to June. In the past few days, our order volume has plummeted by 50%. I posted about it, and it resonated with many other sellers."

Image source: Provided by seller

It's not just small and medium-sized sellers who are feeling the chill. On May 28th this year, Ge Xuguang, CEO and cross-border business head of Aiyi Home, posted a long message on WeChat Moments announcing that Aiyi Home was exiting the cross-border e-commerce sector, abandoning all its global stores and brands. He himself would also leave the company and the cross-border e-commerce industry.

Aiyi Home, a major brand that sold billions of dollars worth of mattresses on Amazon annually and was once among the top players in Amazon's mattress category, has thus exited the stage of cross-border e-commerce. Last year, its total revenue across all channels was still 1.37 billion yuan, but it could not withstand the high cost of goods lost and may have earned less than it lost.

02

Amazon tightens policies despite its size advantage

If you keep up with Amazon's recent developments, you might detect a familiar scent from domestic e-commerce.

On September 2nd, Amazon updated its international return policy for self-fulfilled sellers. The previous 5-day return window was shortened to 2 days. If sellers fail to respond within the specified time, Amazon may issue refunds to customers on their behalf and deduct the corresponding amount from the seller's account.

At the end of August, Amazon began tightening its policies on violations in internal messaging, increasing penalties for such violations to "direct store closure without appeal."

Earlier, at the end of July, rumors that previously free member-exclusive benefits would become chargeable during Black Friday and Cyber Monday spread like wildfire in the Amazon community. Recently, sellers have received email notifications confirming this news.

The relentless pressure and aggressiveness of these changes remind many of the early years of domestic e-commerce.

"I used to try my hand at Taobao and JD.com in China, but profits dwindled over the years, so I turned to Amazon. I know this feeling all too well; it's exactly the same as a few years ago," said Huang, a seasoned e-commerce veteran, with a mix of certainty and helplessness.

Many believe that Amazon's aggressive moves stem from the rise of domestic cross-border giants, bringing intense competitive pressure.

In recent years, the two most significant structural changes in the e-commerce market have been the rise of live streaming e-commerce, which has opened up new channels and transformed the industry, and the continued popularity of cross-border e-commerce. Under the logic of going global, players like SHEIN, AliExpress, Temu, and TikTok Shop have caused a stir overseas, posing a significant challenge to Amazon, the global e-commerce giant.

According to data released by the Ministry of Commerce, China's cross-border e-commerce trade volume has grown more than tenfold in the past five years. In particular, Temu and SHEIN have achieved explosive growth in Amazon's largest market, the United States, by launching aggressive online marketing campaigns and offering cheap Chinese-made products, especially duty-free products under trade rules.

According to data.ai, Amazon's global user base grew by 4% year-on-year in October 2023. In contrast, Temu and SHEIN saw their user bases surge by 2.6 times combined. These two apps saw nearly five times as many new downloads in the United States as Amazon. That month, Amazon's user base in the United States declined by 8% year-on-year, with usage time down 20% compared to the previous year, indicating a visible erosion of its fundamentals.

Just as Taobao and JD.com once struggled against Pinduoduo, low prices remain the key to success, and there's simply no way to compete.

David Zapolsky, Amazon's top public policy executive, has publicly stated that this is a "concerning trend" and even called on global regulators to further scrutinize the situation.

In June this year, Amazon announced at an event with Chinese sellers that it plans to launch a discount store focused on selling unbranded items priced below $20, seen as a direct response to the low-price strategies of Temu and SHEIN.

However, currently, Temu and SHEIN cannot compete with Amazon in terms of logistics time. It is reported that Temu's delivery time averages 4 to 22 days, while SHEIN products take 3 to 14 days to arrive. Amazon has taken measures to speed up delivery from two days to one day or less.

Image source: China News Service

Cross-border industry research data also shows that Amazon's gross merchandise volume (GMV) reached $350 billion in the first half of 2024, nearly three times that of the second-place player, making it the clear leader. Among China's top four cross-border e-commerce platforms, AliExpress and SHEIN both had GMV of $30 billion; Temu had GMV of $20 billion; and TikTok Shop had GMV of $10.7 billion.

The gap is still significant, and it will be difficult to see significant changes in the short term.

Obviously, Amazon's tightening of rules is not solely driven by anxiety over its size advantage.

03

Lagging behind in live streaming e-commerce, Amazon struggles with new e-commerce trends

What truly concerns Amazon is its lag in live streaming e-commerce.

In recent years, Taobao has been overshadowed by Pinduoduo, primarily due to price differences, but its well-established live streaming ecosystem, led by top influencers like Li Jiaqi and Wei Ya, keeps it at the forefront of new e-commerce formats like live streaming and product seeding. This is where Taobao differs most from Pinduoduo.

However, Amazon has fallen behind in this area.

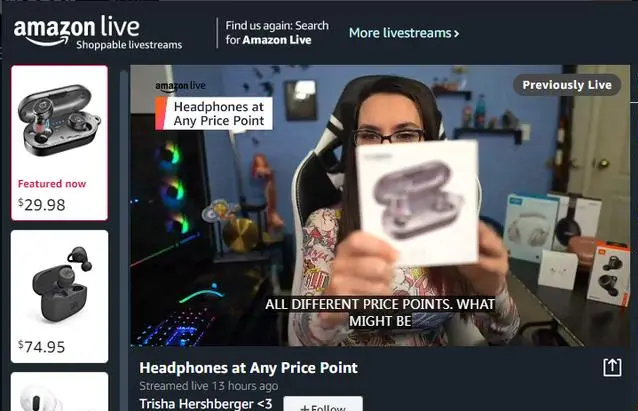

In fact, Amazon launched its live streaming shopping service, Amazon Live, as early as February 2019, but this format has remained relatively underwhelming for a long time.

Conservatism is a major issue.

In the early days, Amazon Live was more of a "one-way" presentation by hosts, lacking interactivity. Most live streams lasted less than 10 minutes, and broadcast times were irregular.

Later, Amazon imposed nearly stringent rules on live streaming, requiring influencers to share Amazon live stream hyperlinks across different social channels, strictly adhering to livestream rules, not exaggerating promotional prices, refraining from slandering or belittling competitors, not using reviews older than one year, and avoiding discussing products without samples...

These numerous restrictions have handcuffed hosts and frustrated viewers.

Image source: E-commerce News

Whether it's incentivizing sellers to engage in live streaming or guiding consumers to make purchases in live streams, Amazon has done very little. Without traffic, it's impossible to attract sellers and key opinion leaders (KOLs), who are unwilling to invest their efforts. As a result, the situation stagnates.

Moreover, Amazon was also slow to embrace short videos.

It wasn't until February of this year that Amazon launched a short video posting feature, allowing merchants to post images, descriptive captions, and links to related product pages to promote their brands and products. However, TikTok had already entered this space through its social media attributes, gaining a first-mover advantage.

In the second half of this year, Pacsun, a top-selling fashion brand on Amazon and a popular American streetwear brand, shifted its focus to TikTok, achieving over $1 million in weekly live streaming GMV and topping both the TikTok Shop Best Sellers list and TikTok Women's Clothing Live Streaming list. Before this, Pacsun's official TikTok account had amassed 2 million followers and over 30 million likes. Without the existing traffic, such success would have been impossible.

It's worth noting that TikTok Shop didn't officially launch in the U.S. market until September 2023.

Compared to its Chinese competitors, Amazon lacks the soil, audience, and effective experience in live streaming e-commerce. As social platforms like Instagram, Facebook, YouTube, and Twitter have also embraced live streaming, Amazon, with its lack of social media genes, has little assurance of controlling the flow of traffic from them.

By January of this year, Amazon's live streaming website, Twitch, had laid off 35% of its staff, including senior executives like the Chief Product Officer, Chief Customer Officer, and Chief Content Officer. Amazon's live streaming journey has stagnated rather than progressed.

04

Closing Remarks

While Amazon still enjoys a significant market share advantage, with Temu and SHEIN continuing their rapid growth, the question remains: will Amazon's future mirror that of Taobao when it faced Pinduoduo's rise, watching helplessly as its competitor thrives? At least for now, the possibility exists.

However, there may be many other X-factors at play.

For example, Amazon is still recruiting a large number of female hosts on its European sites, trying to unlock the potential of its platform's traffic.

Furthermore, Amazon benefits from a stable regulatory environment, unlike domestic e-commerce players venturing into cross-border e-commerce, which face significant risks. For now and the foreseeable future, Amazon is still in a relatively comfortable position.

However, as the saying goes, "big waters hold big fish." Looking back in 10 or 20 years, the current competition may merely be a ripple in the larger waves to come. Who will emerge victorious remains to be seen.