Market will pay for iPhone 16, but Apple's AI is still not a game-changer

![]() 09/09 2024

09/09 2024

![]() 563

563

Every September, the most anticipated event in the tech world is undoubtedly Apple's new product launch. At 1 AM tonight, Apple's Fall Event will kick off, featuring the newly designed iPhone 16 series, a thinner and lighter Apple Watch X, and the AirPods Max in various colors.

Unlike previous years, when incremental innovations in new devices were increasingly criticized, Apple has preemptively played its trump card with AI, effortlessly raising consumer expectations.

However, since AI became a hot trend, AI-powered phones are no longer a novel concept. They were even reheated by major domestic phone manufacturers at the end of last year. In this race, Apple seems to have arrived late. More importantly, AI has yet to make our smartphones significantly smarter, and Apple is no exception.

Is Apple starting to rely on gimmicks?

Despite consistent criticism after each new iPhone launch, the market's response is more telling. Apple's massive fan base keeps its position in the high-end market rock-solid. According to current leaks, some upgrades in the iPhone 16 series are attractive to consumers. For instance, all models will feature the A18 processor, with the A18 Pro adopting a 6+6 architecture, boasting neural engine computing power that even surpasses the M4 chip in the iPad Pro.

Additionally, a capacitive 'capture button' will be added below the power button on the right side of the phone, facilitating focusing and taking photos.

Judging from current information, production volumes for the iPhone 16 are expected to exceed those of the iPhone 15, indicating Apple's optimism about sales.

However, these minor performance upgrades alone are unlikely to spur significant consumer demand for new devices. The main selling point of the new phones is AI, with Apple Intelligence making its debut. As the first truly AI-driven device, the iPhone 16 series embodies Apple's ambition to leverage AI technology for functional upgrades and even revolutionize the industry.

The domestic market is not short of AI phones, but more accurately, these are simply smart devices with generative AI and large models tacked on. These AI phones boast cutting-edge, popular, and flashy concepts that seem innovative, but in reality, they offer limited practical value. On the one hand, many so-called AI functions existed before being labeled as AI, and the integration of AI technology has not qualitatively improved these functions.

On the other hand, to showcase their AI prowess, phone manufacturers have developed seemingly tech-forward features that most people rarely use, lacking practical application scenarios.

From Apple Intelligence's perspective, Apple has chosen a different path from domestic phone manufacturers, but the actual experience isn't much better.

Reviews from overseas bloggers reveal that Apple Intelligence has yet to achieve global user information analysis. Users can only generate simple images, optimize text, record calls, and transcribe them into text – basic functions.

Utilizing the entire iPhone's stored and network information for comprehensive analysis to provide optimal solutions seems revolutionary and efficiency-enhancing in Apple's vision, but the accuracy of these solutions is questionable. Even globally popular AI chatbots like ChatGPT can sometimes spout nonsense.

While Siri's transformation into a new intelligent assistant is likely to debut next year, it won't stop Apple from leveraging the AI trend to turn around its fortunes in the capital markets. On August 29, Citigroup analysts named Apple as their 2025 "AI pick of the year," surpassing NVIDIA and network equipment manufacturer Arista. The AI wave sparked by domestic giants has finally reached the other side of the ocean.

The pain of price hikes is hard to bear

After Apple announced Apple Intelligence, the question of price hikes naturally became a focal point. It's rumored that the iPhone 16 and iPhone 16 Plus will retain the same starting prices as their predecessors, but the iPhone 16 Pro and iPhone 16 Pro Max are expected to see a $100 price increase.

Consumers' concern about price hikes in the iPhone 16 series isn't just about whether the phones are worth buying. If Apple makes AI phones a long-term strategy, the cost increases associated with exploring and integrating new technologies are likely to continually push up prices. This balance between cost and selling price is a challenge for all AI phone manufacturers. Too high a price hike will deter consumers, while not hiking prices may not guarantee profits.

For Apple, Chinese consumers tend to prioritize cost-effectiveness when upgrading their phones, adding pressure to price the new devices competitively.

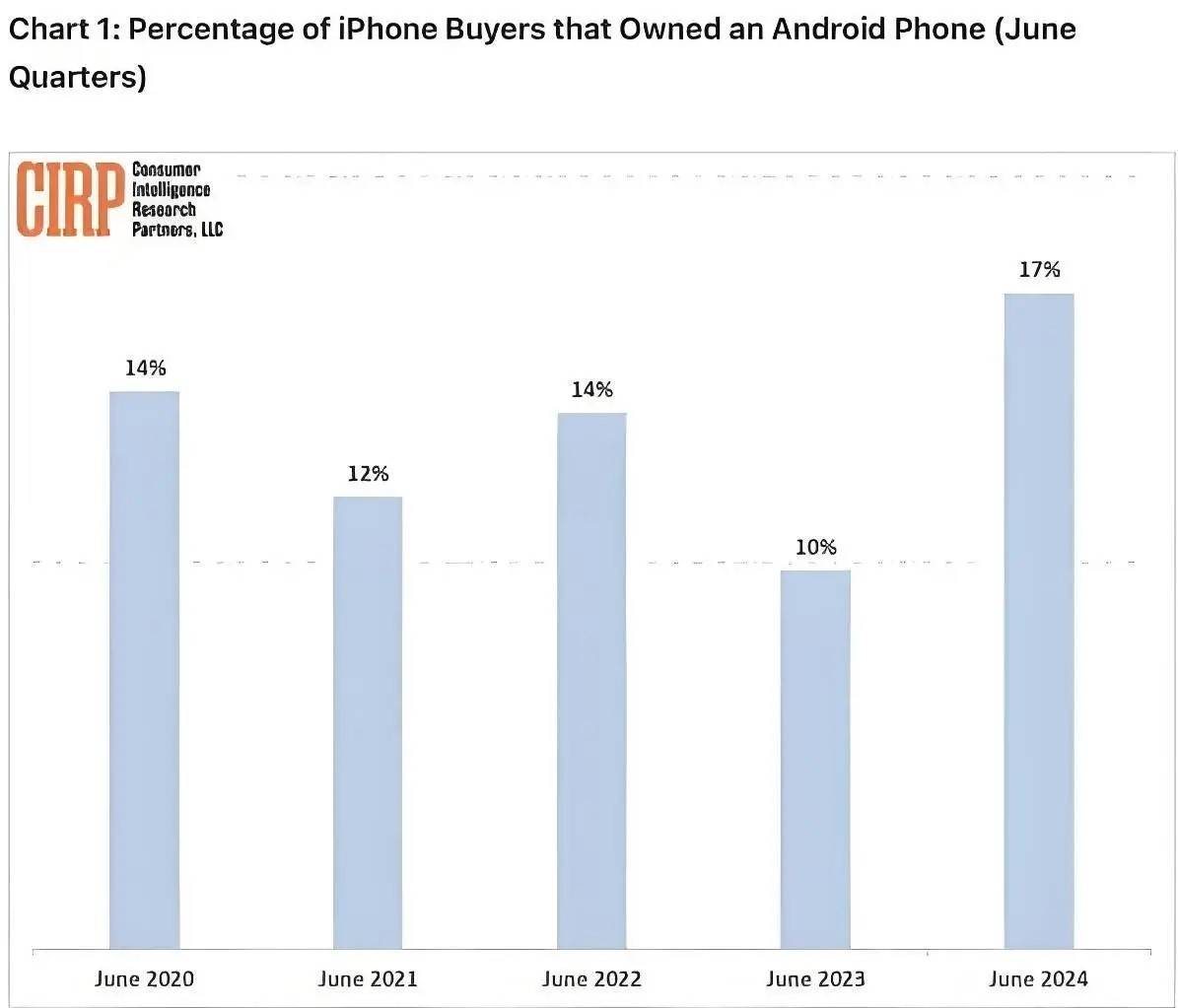

According to a report by Consumer Intelligence Research Partners (CIRP), 17% of iPhone buyers in the second quarter of this year switched from Android, a five-year high and almost double the same period last year (10%).

The increase in new users isn't entirely good news, as many were driven by Apple's significant price cuts. They might switch back to Android if a suitable flagship phone becomes available. More concerning for Apple, new users often prefer cost-effective models over the latest releases, making the autumn launches less appealing.

At the same time, a higher percentage of new users means a lower proportion of existing iPhone users upgrading.

New users switching from Android aren't necessarily loyal fans, and even dedicated Apple fans may not embrace the AI phones.

Judging from domestic consumers' attitudes towards AI phones, while some express willingness to try them, most are lukewarm or even Disgusting . "Phone manufacturers slap on a large model and call their phones AI-powered. Some even launch AI calling and AI voice assistant features, hyping how smart their AI phones are," said a digital product enthusiast. "I've tried the AI drawing feature on several phones, and the results are ridiculous."

Can Apple's AI make Siri truly intelligent? This is questionable. Consumers are unlikely to be satisfied with mediocre experiences at a high cost. Like domestic phone manufacturers, Apple lacks a killer AI application that truly delivers innovative experiences and unleashes pent-up demand, especially among loyal fans who eagerly await annual upgrades.

Therefore, price hikes must be approached with caution.

AI can't save Greater China's decline

With its AI strategy, Apple vows to upgrade its hardware, and Wall Street is enthusiastic, predicting that with Apple Intelligence, the company will shine in the AI device era. In contrast, the domestic market is more reserved.

Partly because the Chinese version of the iPhone 16 series won't support Apple Intelligence, and future phone integrations with ChatGPT will also be unavailable in China, dampening consumer enthusiasm. Moreover, the concept of AI phones is nothing new in China, making Apple's bet on AI for phone innovation seem like a follow-the-leader move.

Ultimately, Apple's anxiety is increasingly evident in the Chinese market.

According to Apple's fiscal third-quarter results ending June 29, revenue in Greater China was $14.728 billion, down 6.5% year-on-year, falling short of both last year's level and analysts' expectations of $15.3 billion. In fact, Apple's revenue in Greater China has shown a declining trend for some time. In fiscal Q4 2023 (natural Q3), revenue was $15.084 billion, down 2.5% from $15.470 billion a year earlier.

While the 2023 decline could be attributed to the overall contraction of China's smartphone market, blaming market conditions for this year's performance is harder. According to the latest quarterly mobile phone tracker report by IDC, China's smartphone shipments reached approximately 71.58 million units in Q2 2024, up 8.9% year-on-year.

Benefiting from the global smartphone market recovery, there's optimism about the growth of AI phones. Counterpoint Research reports that generative AI phones will account for 11% of overall smartphone shipments in 2024, rising to 43% by 2027. However, will AI functionality immediately boost phone sales?

In the high-end segment, Samsung's S24 series, the company's first generative AI-supported smartphone, performed well, but its success is more attributable to price cuts than its Galaxy AI technology. Despite Samsung's hopes for the S24 series to revitalize its struggling Chinese market, AI functionality alone hasn't enticed Chinese consumers to pay more.

Judging from current market reactions, Apple's AI innovations aren't particularly impressive, and it's uncertain if they'll boost iPhone 16 sales.

Another factor not to be overlooked is Huawei's simultaneous phone launch, clearly targeting Apple. Its tri-foldable phone has piqued domestic consumers' interest. Within hours of its announcement, pre-orders surpassed 896,000.

Huawei's high-profile showcase isn't just a challenge to Apple but a bet on which form factor – foldable phones or AI-powered phones – will define the future. For now, foldables are gradually dominating the high-end market.

The smartphone market is recovering, and manufacturers are eager to find growth opportunities. Apple is no exception, but it seems far-fetched to expect AI phones to revolutionize the industry overnight. Apple's entry will only complicate the competition in this space.

Daotmt (formerly known as WaitDaodao) is a new media outlet focused on the internet and tech industry. Follow us on WeChat (ID: daotmt) for more original content. This article is original and any form of reproduction without proper attribution is prohibited.