European Auto Market: April's Intense UK Competition Highlights Sales Decline and Chinese Brand Breakthroughs

![]() 05/09 2025

05/09 2025

![]() 587

587

In April 2025, the UK new car market encountered a chill, with sales dipping 10.4% year-on-year, marking the first consecutive declines in years. Amidst the overall market downturn, the electric vehicle segment defied the trend, showcasing growth, with Chinese brands like BYD emerging as formidable players.

We delve into the UK market's sales structure, brand competitiveness, and the specific performance of Chinese brands. We also explore the ongoing power transition and market restructuring in the UK auto market, alongside the globalization path of Chinese automakers.

01

Overall Decline in the UK Auto Market,

Steady Progress in Electrification Transition,

Subtle Changes in Brand Landscape

In April 2025, new car registrations in the UK totaled 120,331, down 10.4% year-on-year, marking the sixth straight decline in nearly seven months and indicating market fatigue.

However, buoyed by March's robust performance, cumulative sales for the first four months of the year still managed a 3.1% year-on-year growth, reaching 700,833 vehicles. This underscores the market's overall recovery momentum despite short-term fluctuations.

The Diverse Powertrain Battle: Internal Combustion Retreats, Plug-in Hybrids and Pure Electrics Rise

In the powertrain mix, traditional internal combustion engine models' share significantly declined:

◎ Gasoline car sales plummeted 22%, with market share dropping from 56.1% last year to 48.8%.

◎ Diesel car sales fell 26.2% year-on-year, leaving only a 5.3% market share. Meanwhile, electrified models collectively surged:

◎ Pure electric vehicle (BEV) sales reached 24,558, up 8.1% year-on-year, with market share increasing to 20.4% (from 16.9% last year).

◎ Plug-in hybrid models (PHEV) surged 34.1% year-on-year, with market share reaching 11.7% (from 7.8% last year).

◎ Traditional hybrids (HEV) saw a slight 2.9% year-on-year decline but still held a 13.8% market share.

Cumulatively, in the first four months of 2025, BEV sales grew 35.2%, PHEV sales by 27.7%, and HEV sales by 14.6%, while gasoline and diesel models declined by 10% and 13.2%, respectively. This rapid powertrain transformation reflects the UK market's response to low-carbon travel policies and substantial shifts in consumer behavior.

From a sales channel perspective, private car purchases fell 7.9%, fleet purchases by 11.9%, and business purchases by 10.9%. However, private car purchases have risen 6.3% year-to-date, indicating resilient consumer spending confidence despite April's downturn.

New Brand Competition Landscape: Traditional Powers Under Pressure, New Rivals Ascending

◎ Volkswagen, despite a 21% year-on-year decline, held onto the top spot with 10,474 vehicles (8.7% share).

◎ Kia bucked the trend among mainstream brands with a 3.4% increase, moving up to second place.

◎ BMW and Audi ranked third and fourth, respectively, but both experienced double-digit declines.

◎ Peugeot (+37.9%) and BYD (+654.1%) stood out. Peugeot entered the top ten models list at eighth place with the 2008 model, pushing the brand overall to seventh. BYD sold 2,511 vehicles, primarily electric models like the Atto 3, exceeding a 2% market share for the first time and jumping to 18th place in brand rankings, surpassing traditional brands like Seat and Mazda.

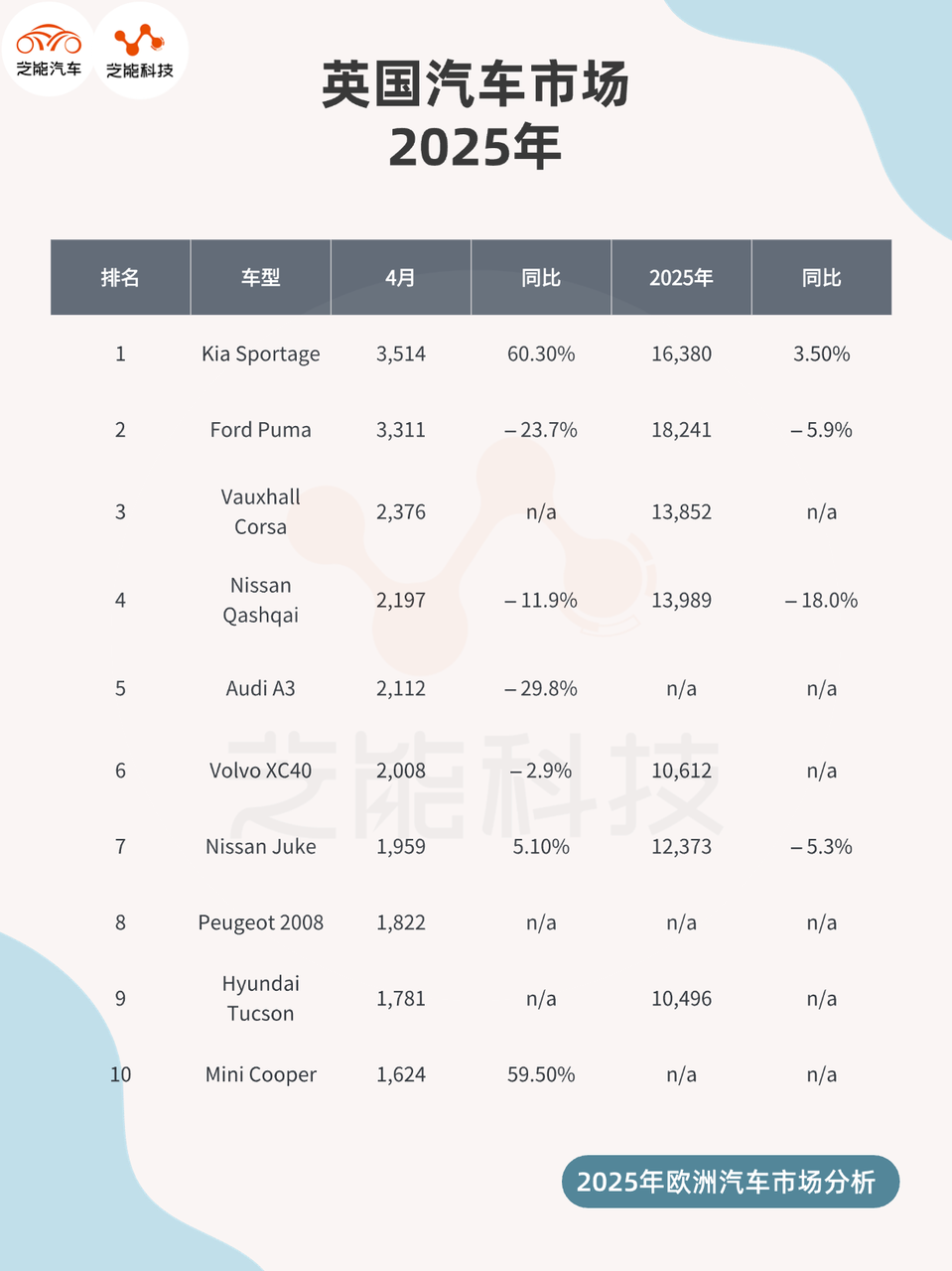

Kia Sportage increased 60.3% year-on-year, reclaiming the top sales spot with a 2.9% market share. Vauxhall Corsa rose to third place, while Nissan Qashqai and Audi A3 fell in the rankings. Peugeot 2008 and Hyundai Tucson also made the list.

Overall, Korean and French models are making inroads into segmented markets, breaking the long-standing monopoly of German, American, and Japanese brands.

02

Chinese Brands Making Strong Breakthroughs:

BYD Leading the Way,

"Three Emerging Forces" Gradually Gaining a Foothold

In April, MG maintained its lead among Chinese brands in the UK market with sales of 3,789 vehicles, accumulating 28,430 vehicles and becoming the most influential Chinese automaker locally.

BYD sold 2,511 vehicles in the UK market in April, a year-on-year increase of 654.1%, setting a new record for the second consecutive month. Its market share surpassed 2% for the first time, officially rising to 18th place in brand rankings and entering the mainstream category.

BYD's Atto 3 (overseas version of the Yuan Plus) has initially established a reputation in the UK. With subsequent models like the Seal and Dolphin arriving, coupled with its cost-effectiveness and endurance advantages, BYD is fortifying its position in the £20,000-35,000 electric vehicle price range. The company is accelerating cooperation with local channels and plans to expand offline showrooms and after-sales service networks to compete directly with mainstream brands.

Chery secured its first victory with 1,963 vehicles, accumulating 8,392 vehicles. Its Omoda and Jaecoo models showed growth potential. In April, the Jaecoo brand rose eight places to 25th, and Omoda rose two places to 29th. These models represent Chery's dual-pronged strategy in the "young + intelligent" (Omoda) and "off-road + luxury" (Jaecoo) segments.

Leapmotor rose five places to 35th. While its current sales volume is small, as a representative of Stellantis Group's strategic cooperation, its deep integration capabilities in entering the European market cannot be overlooked. As localization adaptations for products like the T03 and C10 are completed, Leapmotor aims for a monthly sales target of 2,000 vehicles.

The performance of the UK market in April 2025 signifies the collective "breakout" of Chinese auto brands in Europe's high-end mature markets. From BYD's sales breakthroughs to the growing popularity of Omoda and Jaecoo, to Leapmotor's nascent layout, it demonstrates the diversified strategies and brand upgrading of "Made in China" on the international stage.

Chi-Energy Technology believes that Chinese automakers' success in the UK is not solely due to price competition but also relies on their comprehensive capabilities in intelligence, design language, electric efficiency, and localized operations. In the second half of 2025, with more platform-based new vehicles and joint venture export strategies being implemented, the market share of Chinese brands in the UK is expected to further expand.

Summary

Pain and Reshaping Coexist,

Chinese Automakers Are Embracing Their "European Moment"

The UK auto market experienced a significant adjustment period in April 2025, with traditional powers under pressure, emerging brands emerging, and the power transition process accelerating.

Chinese auto brands, particularly BYD, Omoda, and Leapmotor, are no longer bystanders but key drivers of market change. The coming months will be crucial for Chinese brands to fully "gain a foothold" in the UK market. Chi-Energy Technology will continue to track their movements and analyze the profound changes in this global market competition landscape.