Taobao takes the first shot in interconnection and interoperability, can e-commerce find a way out of involution?

![]() 09/09 2024

09/09 2024

![]() 581

581

The saying goes, "All things in the world must eventually unite after being divided for a long time, and eventually divide again after being united for a long time."

Recently, Taobao launched a consultation on its merchant platform, planning to add WeChat Pay functionality. Although the interconnection between WeChat and Taobao had been anticipated, with WeChat Pay already interconnected with Taobao Lite, and applications such as Ele.me, Youku, Damai, Kaola, and Shuqi having integrated WeChat Pay in 2021, the news still caused a stir in public opinion, quickly becoming the hottest industry topic.

The significant reaction from public opinion is largely influenced by the traditional narrative logic of the industry: platforms prefer to keep their resources within, aiming to create a closed-loop system for traffic and ecosystem. While the tearing down of walls benefits user experience, it's not necessarily something platforms are willing to do voluntarily.

Over the past few days, we've carefully analyzed and reassessed the history of the internet's development to gain a more rational perspective on interconnection and interoperability. Our core viewpoints are as follows:

Firstly, both closure and interconnection are inevitable outcomes of industry competition. While closure has its rationality, interconnection is also inevitable.

Secondly, by taking the lead in interconnecting with WeChat, Taobao has set an example of openness for the industry and gained the initiative in the new stage of development, particularly helping to increase its penetration in lower-tier markets.

Thirdly, while interconnection may seem simple in concept, its operational threshold is high. Taobao has undergone a lengthy preparation period and employed a comprehensive strategy to achieve this.

Breaking the involution: sharing resources through interconnection

Looking back at the past decade of mobile internet development, it becomes apparent that "closure" has been the dominant theme.

Why did mobile internet companies choose this path in their early stages of development? Is there an inherent necessity behind this choice?

During periods of rapid industry growth, companies strive to maximize traffic and user base to strengthen their competitiveness. This is typically achieved through business expansion or investments, keeping user behavior within the platform ecosystem. During this time, nearly all companies became "heavier," shifting from selling traffic to selling services in hopes of securing a ticket to the mobile internet game.

A popular term during this period was "closed-loop ecosystem." Tencent often humbly described its phenomenal product WeChat as only "half a ticket." What was the other half? A rich product ecosystem to create a closed-loop for traffic. Looking back, WeChat's non-interconnection with Taobao was actually what WeChat preferred, ensuring that its shopping scenarios wouldn't be redirected elsewhere, leading to strategic partnerships with JD.com and Pinduoduo.

Many view this period negatively, believing that the "closed system" came at the expense of user experience, labeling it a dark chapter in the industry. However, we don't entirely disagree. In fact, many of our current model innovations largely benefit from "closure dividends."

Within a relatively "closed" system, Taobao can comprehensively oversee merchants' information flow, transactions, payments, and logistics, effectively enhancing platform governance. In contrast, micro-entrepreneurs, who were once booming, have mostly disappeared, while Taobao remains China's largest online trading platform. The former's over-openness and lack of platform neutrality hindered their service and product quality, ultimately leading to their downfall.

If closure is driven by commercial competition, interconnection is an inevitable step in industry development.

The internet industry has moved beyond demographic dividends and entered a stage of stock competition, with "involution" becoming a buzzword in recent years.

What is "involution"? Fundamentally, it's the inertial thinking of the closed era, where companies compete for limited resources, believing success requires seizing more from competitors. This reflects the common "zero-sum game" mindset in business.

However, cooperation is just as important as competition in business.

The two circles in the image represent Company A and Company B, each with their own user base and a high degree of user overlap (a typical involution scenario). Under the involution mindset, both companies must strive to seize market share from each other, making it difficult and inefficient.

Under a cooperation mindset, the companies' perspectives and strategies change entirely: theoretically, they can share users, with their combined user base being "A+B-overlap."

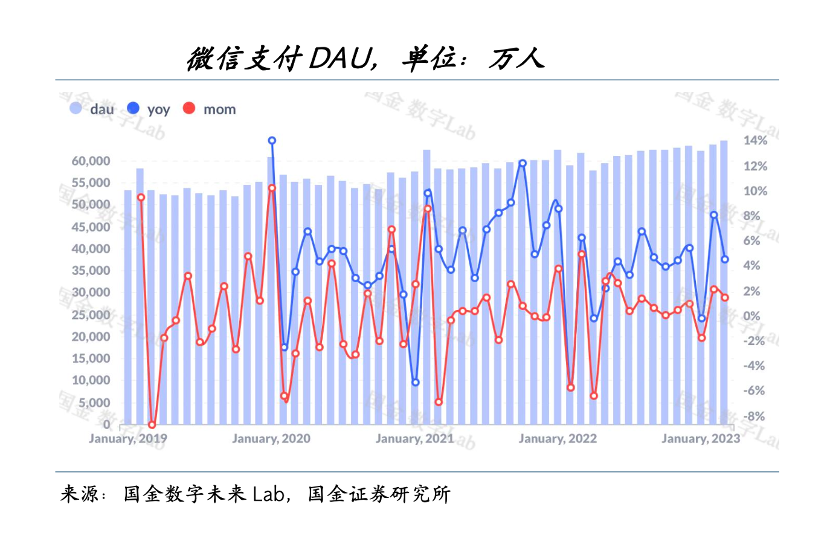

By integrating WeChat Pay, Taobao and WeChat can now interconnect products and share users. As WeChat Pay has a significant advantage in lower-tier markets, this aligns with Taobao's strategy to increase its presence there, leading to a significant increase in Taobao users.

Wall Street institutions share a similar view. Morgan Stanley believes that by integrating WeChat Pay, Taobao/Tmall can further penetrate lower-tier cities, stabilizing market share, as hundreds of millions of WeChat Pay users are not Alipay users (mainly in lower-tier cities).

Goldman Sachs also issued a report stating that the partnership will help Taobao/Tmall tap into new lower-tier city users and enhance convenience for existing users.

Setting aside moral judgments, we gain a different perspective on internet companies' "interconnection" and "closure":

1) In different development cycles, both interconnection and closure have their rationales.

2) In the new development stage, cooperation and interconnection are the only ways to break the "involution" and "growth" dilemmas. The partnership between Taobao and WeChat is inevitable, not driven by external forces.

3) Taobao's integration of WeChat Pay sets a good precedent. We hope other players can quickly capture this trend to adapt to the new stage of industry development, such as JD.com potentially integrating Alipay.

The threshold for interconnection is not low

Given interconnection's many advantages, does it automatically lead to positive outcomes when platforms interconnect? The answer is no.

Let's review some of Taobao's recent opening-up initiatives:

Before 618 in 2024, Taobao Star Missions, under Ali Mama's Ecological Content Marketing Center, launched a deep partnership with Douyin's Star Chart, jointly introduction a full-link content marketing solution called Star Cube Plan.

In September 2023, Ali Mama deepened its cooperation with Tencent Advertising, allowing high-quality ad traffic from WeChat Video Accounts, Moments, and Mini Programs to directly link to Taobao/Tmall stores, product details, and live streams via Ali Mama UD effect advertising.

Before officially integrating WeChat Pay, Taobao had done extensive preparatory work, bridging traffic and data links between platforms to facilitate shopping for users of Douyin, WeChat, and Bilibili on Taobao.

Earlier, we used the failure of micro-entrepreneurs as an example to demonstrate the importance of platforms controlling core data like information flow and transaction flow for effective governance. Conversely, if interconnection comes at the cost of platforms losing insight into these core elements, Taobao may face new governance challenges, ultimately impacting user experience.

These partnerships can be seen as prerequisites for Taobao's integration of WeChat Pay. They align with the current context of interconnection, enabling user sharing between platforms. Without seamless user flow, payment tools alone are insufficient. Additionally, platforms continue to strengthen their governance capabilities through various mechanisms to avoid service disruptions post-interconnection, as this is their core competitiveness.

To maximize the benefits of interconnection, platforms must provide more convenient and high-quality services to users. Interconnection is not just about opening a "gateway"; it's a highly demanding operation that requires:

1) A systematic approach. While we may be "shocked" by Taobao's integration with WeChat Pay, we overlook the preparatory work Taobao has done to facilitate user access from WeChat, Douyin, and other platforms. Qualitative change requires the accumulation of small, intricate quantitative changes; rushing the process is unwise.

2) A systematic mindset across departments and industries. Openness should be more than just a slogan or excuse.

3) Taobao has set a good precedent for the industry. Many companies are likely analyzing industry trends, such as Taobao's potential market share gains in lower-tier cities. Followers must first leave their comfort zones. For example, could JD.com try Alipay Mini Programs, given its long-term growth within WeChat's ecosystem? We eagerly await developments.

Taobao's integration of WeChat Pay is a significant industry event. Contrary to traditional narratives, we view it not as a reluctant move but as a proactive strategy for Taobao to gain a competitive edge in this new development stage.

Now that Taobao has made its move, let's see how others respond.