Xiaopeng is coming to compete, making it harder for GAC Aion

![]() 09/09 2024

09/09 2024

![]() 629

629

Recently, the automotive industry has been releasing financial reports. Unlike the growth seen at the top of the industry, GAC Motor, an established automaker, has taken a downward trajectory.

In the first half of 2024, GAC Group achieved operating revenue of RMB 45.808 billion, a year-on-year decrease of 25.62%. After deducting non-recurring gains and losses, net profit was -RMB 338 million, a year-on-year decline of 112.51%.

The group attributed this change in performance primarily to the impact of the "price war" in the domestic automotive industry. Unfortunately, there is no time to lament the past as new challenges have already arisen.

To survive, He Xiaopeng has flipped the table by introducing the Xiaopeng MONA M03 to target the low-end market for sales. GAC Aion has inadvertently become collateral damage in this move.

Within 48 hours of its launch, the Xiaopeng MONA M03 received over 30,000 pre-orders, providing a temporary reprieve for Xiaopeng. However, while Xiaopeng rejoices, GAC Aion continues to struggle in the quagmire. Its low-end models are trapped in the limbo of ride-hailing services, while its high-end Hyperion brand has garnered attention solely due to an incident involving the hand of Zhou Hongyi being pinched in a car door.

Now facing competition from Xiaopeng, GAC Aion's situation has become even more difficult.

01

The Low-End Battle

The term "flipping the table" is used because the Xiaopeng MONA M03's starting price of RMB 119,800 has set a new low for Xiaopeng models, while still incorporating its signature intelligent driving technology.

Mid-to-low-end models (RMB 119,800-129,800) offer L2-level autonomous driving capabilities, enabling smart cruise control, automatic parking, and more. The Max version (RMB 155,800) boasts urban high-level autonomous driving capabilities, with no restrictions on cities or routes, but will be delivered at a later date.

Xiaopeng positions the M03 as the "first smart pure electric hatchback loved by young people," emphasizing its affordability and aiming to capture the low-end market.

According to He Xiaopeng, the development of the Xiaopeng MONA M03 took four years and an investment of up to RMB 4 billion. It was comprehensively benchmarked against models priced above RMB 200,000, achieving optimal performance in exterior design, interior, intelligent driving, and smart cockpit features.

The best-selling pure electric A-segment sedan is the BYD Qin. Insiders claim that the low-end version of the MONA is benchmarked against the BYD Qin EV, striving to achieve "higher quality at the same price or lower price for the same quality." The high-end version aims to compete with Tesla's Model 3.

On the surface, it appears that Xiaopeng is poaching customers from BYD with the MONA M03. However, the customer bases for pure electric and hybrid vehicles do not fully overlap. With its strong cost reduction capabilities and leading sales figures, BYD is not afraid of competition. The true collateral damage is felt by GAC Aion.

An important segment of the low-end market is the ride-hailing service market.

When the Xiaopeng MONA M03 was first unveiled, He Xiaopeng denied that there would be a dedicated ride-hailing version, eager to distance it from the ride-hailing label. Nonetheless, the M03 is well-suited for ride-hailing services.

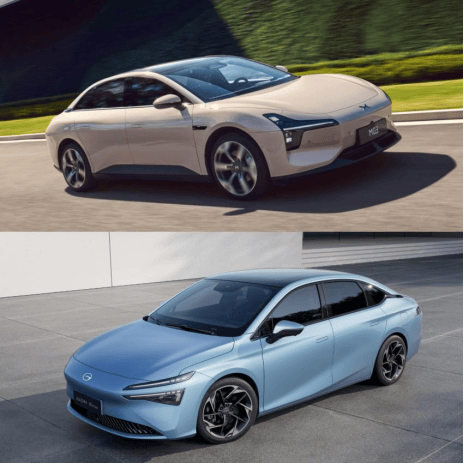

△Xiaopeng MONA M03 (top) and GAC Aion S MAX (bottom)

Tracing its origins, three years ago, as the new energy vehicle (NEV) boom was in full swing, Didi, the leading domestic ride-hailing service provider, also wanted a piece of the pie. The "Da Vinci" manufacturing plan gave birth to the predecessor of the M03. When Didi exited the vehicle manufacturing business in 2023, it sold its automotive operations to Xiaopeng, which was slightly behind in the race, in exchange for a 3.31% stake in Xiaopeng Motors. In other words, the basic design of the M03 fully considered the needs of the B-end market.

From a configuration standpoint, to reduce costs and save space, the M03 employs a torsion beam suspension, resulting in a lower overall price. The pure electric powertrain further reduces operating costs, with potential customers already inquiring about warranties for commercial vehicles on online forums.

Although GAC Aion emerged as the sales champion among emerging automakers in 2023, a concerning issue is its over-reliance on the ride-hailing market. In 2023, sales to the ride-hailing market accounted for 45.8% of GAC Aion's total sales, with a market share exceeding 25%, higher than that of BYD.

This over-reliance on the ride-hailing market has also impacted GAC Aion's IPO process. Originally planning to list on the STAR Market in 2023, aiming to become the "first stock of new energy vehicles," its valuation once reached RMB 100 billion. However, due to changes in the competitive landscape, it has shifted its focus to the Hong Kong stock market, but there has been limited news about its progress.

Gu Huinan, general manager of GAC Aion, stated, "GAC Aion does not lack funds. The IPO is not about raising money; it's about resolving institutional and mechanism issues.""

Regardless, GAC Aion still faces multiple challenges that require urgent resolution.

02

The Ride-Hailing Cage

For GAC Aion, the current external environment is not favorable, and neither is its internal state.

In the early stages of the new energy wave, the B-end demand was relatively stable, and vigorously developing the ride-hailing market was a shortcut to enter the game.

When the AION S was launched a few years ago, it offered a spacious interior, long range, and a futuristic design for less than RMB 150,000, attracting significant attention from consumers. However, in the face of subsequent market competition, GAC Aion sought sales by deploying some AION S vehicles to the ride-hailing and taxi markets.

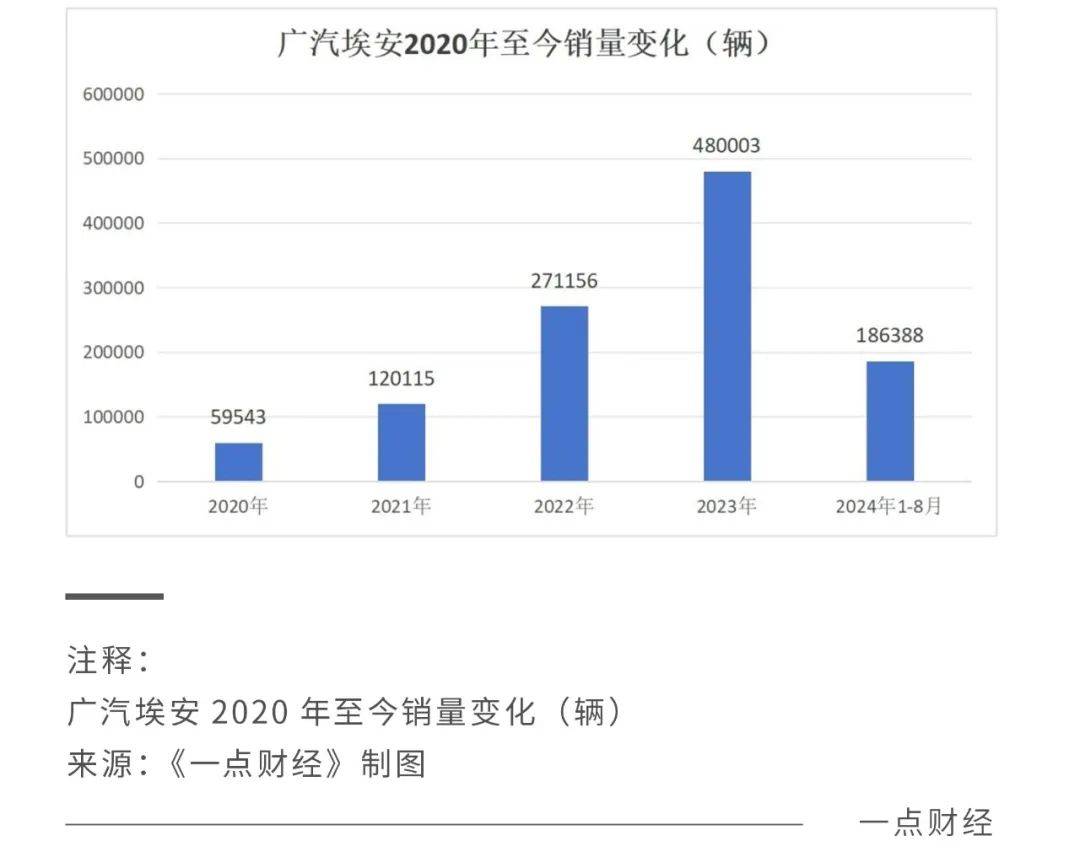

GAC Aion did reap the benefits. From 2020 to 2022, its sales reached 55,900, 120,200, and 271,200 units, respectively. In 2023, sales peaked at 480,000 units, representing a year-on-year increase of 77.02%, second only to BYD and Tesla China in new energy vehicle sales rankings.

However, the glory was fleeting. This year, fatigue has become evident, and a series of cost-cutting measures have been reported, although GAC Aion vigorously denies cutting benefits. Nonetheless, the declining figures speak for themselves.

In August, GAC Aion sold 31,000 units, a year-on-year decrease of 29.44%. Cumulative sales from January to August reached 186,000 units, a year-on-year decline of 7.74%, making it the brand with the largest decline within the group in both dimensions. GAC Aion has experienced a decline in sales for seven consecutive months, and with a 2024 sales target of 700,000 units, it has only achieved 27% of its goal so far, facing considerable pressure in the second half of the year.

GAC Aion's lack of staying power is evident. The root cause lies in the fact that taking shortcuts is not a long-term solution; ultimately, it must return to direct market competition.

However, GAC Aion's predicament appears entrenched. On the one hand, the ceiling of the ride-hailing market is visible; on the other hand, its models lack sufficient competitiveness to capture the C-end market.

According to the "Statistical Report on the Development of China's Internet," in 2023, the number of ride-hailing users in China reached 528 million, representing a year-on-year increase of approximately 44.7%. However, the number of ride-hailing drivers also increased by 127.3% during the same period.

Since the second half of last year, multiple regions have issued warnings about excess capacity in the ride-hailing market, with news of "ride-hailing market saturation" and "order declines" frequently trending on social media. According to the China Passenger Car Association, 848,000 new ride-hailing vehicles were sold in China in 2023, with a 23% increase in new energy ride-hailing vehicles, reaching a penetration rate of 90%.

The ride-hailing label has become deeply ingrained in the public perception of GAC Aion. To avoid being constrained by niche markets, GAC Aion has long taken measures to break free from the "ride-hailing cage," but with limited success. For example, models such as the AION S Plus and AION S Max have failed to win over a wide range of C-end customers.

In terms of marketing and promotion, GAC Aion is eager to showcase its technological prowess but often appears to be overzealous. For instance, its promotion of graphene batteries and other technologies is still far from large-scale implementation, inevitably raising suspicions of self-promotion.

Beyond technology, factors contributing to the popularity of a model, such as brand strength, advanced autonomous driving capabilities, and exceptional cost-effectiveness, are also lacking in GAC Aion's arsenal.

On July 23, GAC Aion's second-generation AION V (Tyrannosaurus) was launched, positioning itself as a "new rugged intelligent SUV" targeting the A-segment pure electric market between RMB 130,000 and 190,000. Its sales target is to become the top two in its niche market, aiming to break free from the ride-hailing market's constraints.

However, in this market, GAC Aion faces numerous competitors, such as NIO and Nezha, which are accelerating their efforts. Whether GAC Aion can stand out from the crowd remains to be seen over time.

03

The Growing Pains of the New Energy Transition

GAC Aion's downturn reflects the challenges faced by GAC Motor in transitioning to the new energy era.

Amid the wave of new energy transitions, joint ventures have struggled in the Chinese market in recent years, and competition among domestic automakers has intensified, putting pressure on GAC Motor as well.

Financial report data shows that from January to June, sales of GAC Honda, a joint venture brand, were 207,900 units, down 28.28% year-on-year. Sales of GAC Toyota were 336,000 units, down 25.80% year-on-year. Neither brand fared much better than GAC Aion, contributing to GAC Motor's decline in both revenue and net profit in the first half of this year.

GAC Motor attributed this primarily to the "price war" in the domestic automotive industry and increased business and government investments. However, beyond external factors, the lack of competitiveness in its products is undeniable.

To shed the "ride-hailing label," GAC Aion launched the luxury pure electric brand Hyperion in September 2022, aiming to make inroads into the mid-to-high-end new energy market. Its first product, the pure electric supercar Hyperion SSR, had a pre-sale price of RMB 1.286 million, with subsequent models including the Hyperion GT sedan and Hyperion HT SUV priced in the RMB 200,000 range.

△Hyperion HT Source: Hyperion Official Website

However, Hyperion has struggled to make waves in the market. Total sales in 2023 were only 8,087 units, and sales in the first half of this year were just over 6,000 units, less than what some competitors sell in a single month.

Moreover, to this day, the Hyperion brand remains relatively unknown, with only two notable incidents bringing it into the spotlight—both of them negative. In June, Zhou Qi, a player for the Chinese Basketball Association's Guangdong Hongyuan Team, publicly criticized Hyperion for failing to fulfill a promised car delivery, which was later resolved with a fulfillment announcement from Hyperion. In July, Zhou Hongyi, the founder of 360 Group, accidentally pinched his finger in the gull-wing door of a Hyperion HT while testing its anti-pinch function, raising questions about the brand's technical capabilities.

The underlying reason for Hyperion's struggles lies in GAC Aion's sluggish response to market changes, missing out on the opportunity presented by plug-in hybrids, ultimately resulting in a lack of product competitiveness.

GAC Motor has focused on developing pure electric vehicles through GAC Aion, while the faster-growing plug-in hybrid market has only been tested on individual models from brands such as GAC Trumpchi.

As a high-end brand, Hyperion has not only failed to keep pace with industry-leading technologies but also faces the sudden onslaught of the "price war." To achieve its goal of expanding into the high-end market and elevating the image of GAC Aion, Hyperion must find a more effective path forward.

Gu Huinan has hinted at future plans, stating that last year, all new Hyperion models were launched within six months of their announcement. With the subsequent independent operation of the brand, the completion of factory construction, and the implementation of technologies such as the M25 super electric drive, Hyperion will enter a phase of full-speed development. Meanwhile, GAC Aion will consider complementing its product line with extended-range and plug-in hybrid models, with specific models potentially launching next year.

Faced with the relentless advance of competitors' plug-in hybrid models, GAC Motor itself does not have sufficiently powerful plug-in hybrid products to counterattack. Based on current plans, GAC Motor's main push will come next year, but it remains unclear how the market will evolve by then. Regardless, GAC Motor needs to pick up the pace.

04

Conclusion

At a June conference, Zeng Qinghong, Chairman of GAC Motor, criticized the price war, stating, "The purpose of a business is to make a profit and contribute to the country. We should have a broader perspective and a long-term outlook rather than engaging in short-term competition.""

However, competition is inherent and no one can remain immune. While industry leaders rapidly expand their markets and pursue scale strategies, cutting-edge technologies are also evolving rapidly.

GAC Motor started early in hybrid technology development but missed out on the plug-in hybrid opportunity due to inaccurate market assessments, ultimately leading to a lack of product competitiveness.

To further secure a place in the new energy vehicle era, GAC Motor must not only engage in the "price war" but also accelerate the pace of technological iteration.

Time is running out.