Sales and share prices soar, but NIO seeks growth by “going downmarket”

![]() 09/10 2024

09/10 2024

![]() 645

645

As the Hong Kong stock market's mid-year reporting season draws to a close, the positive impact of some companies' financial reports continues to unfold.

On September 9, NIO closed at HK$38.55, marking a significant increase of 13.05%. Newswise, NIO Group recently released its unaudited financial results for the second quarter of 2024. The data showed that revenue for the quarter reached RMB 17.45 billion (RMB hereinafter), representing a year-on-year growth of 98.9%; vehicle deliveries totaled 57,400 units, a year-on-year increase of 143.9%.

Compared to the decline in sales in the first quarter, NIO's second-quarter sales performance staged a turnaround, perhaps giving investors renewed confidence in the company's growth potential.

The question is, can NIO sustain this growth momentum?

Pushing forward amidst billions in losses, investing heavily in everything from car sales to battery swap stations

Put another way, this question is about evaluating NIO's long-term investment value. The key lies in comprehensively considering the company's sustainable operating capabilities, growth rate, and market potential.

First and foremost, sustainable operations are paramount. After all, to see the light at the end of the tunnel, one must first endure the darkness.

While NIO's cash and cash equivalents, restricted cash, short-term investments, and long-term time deposits totaled RMB 41.6 billion as of June 30, 2024, its cash flow remains a source of concern for investors.

Surging sales cannot obscure NIO's persistent high losses. From 2018 to the first half of this year, NIO's cumulative net losses exceeded RMB 96 billion.

Behind these near-RMB 100 billion in losses lies the inability of revenue growth to keep pace with cost increases.

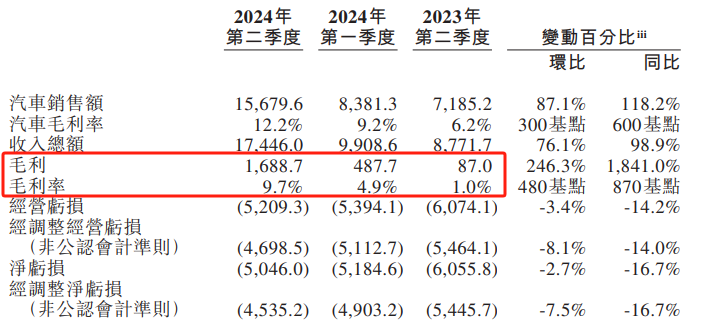

Despite the surge in second-quarter sales, NIO's overall first-half profit performance did not significantly improve from the same period last year. Specifically, in the second quarter, the company's net loss was still substantial at RMB 5.046 billion. Compared to a 118.2% year-on-year increase in automotive sales, the loss narrowed by only 16.7% year-on-year.

Several factors contribute to this phenomenon, including high expenses across NIO's automotive business and the significant investments and low returns of its energy replenishment network construction.

As a high-end automotive brand targeting the price range above RMB 300,000, NIO should theoretically have strong revenue-generating capabilities. However, maintaining this positioning also leads to high expenses. In the second quarter, NIO's selling, general, and administrative expenses reached RMB 3.757 billion, an increase of 25.38% quarter-on-quarter; research and development expenses amounted to RMB 3.2185 billion, up 12.4% from the first quarter.

These expenses can be considered "phased rigid expenses" for NIO, representing necessary investments in brand building, product promotion, and the continuous growth of its sales network.

It is foreseeable that with the launch of NIO's second brand, Letao, and the opening of 105 new stores, these rigid expenses will remain at a high level.

In addition to expenses related to the automotive business, NIO's persistent high losses are also attributable to its investments in energy replenishment infrastructure.

Currently, most mainstream automakers have deployed energy replenishment networks. However, while building charging stations, NIO also operates the largest network of battery swap stations nationwide. NIO owners can choose between charging and battery swapping services, providing a diverse range of options that significantly enhance the user experience but also add to costs.

These costs are substantial. Qin Lihong, President of NIO, has stated that the cost of a single battery swap station is approximately RMB 3 million. As of September 8, NIO had deployed 2,508 battery swap stations nationwide. Based on this figure, the company's fixed costs for battery swap station construction alone have reached RMB 7.524 billion, not including various post-operational costs.

NIO also plans to achieve "county-level charging coverage" by the first half of next year, ensuring that every county is equipped with NIO charging stations. This underscores NIO's continued heavy investments in infrastructure.

In investing, certainty determines the odds of success, and the high investments and uncertainties associated with energy replenishment network construction pose risks. To share these risks, NIO has launched the "Charging Partner" program, apparently aiming to build out its energy replenishment system at a lower cost.

However, "revenue enhancement" is more crucial than "cost reduction." During a previous earnings call, William Li, Chairman and CEO of NIO, mentioned that the company could achieve profitability for its main brand with monthly sales of 30,000 units and a gross margin of 20%.

Based on the current financial report, NIO's main brand is still far from achieving these targets. In response, NIO has prioritized increasing the gross margin of automotive sales. Li previously stated, "Starting in June, we will focus on adjusting our product mix, increasing the proportion of high-gross-margin products in our first-tier lineup, and narrowing short-term promotional policies."

Currently, emphasizing gross margin may suggest that NIO has a longer-term goal for its main brand to achieve monthly sales of 30,000 units. After all, achieving a sales surge for products priced above RMB 300,000 is no easy feat.

For this reason, NIO is pinning its hopes for scale growth on its new brands.

Will a multi-brand development strategy become a new engine of growth?

Growth rate is crucial for NIO to turn a profit.

The economies of scale in the automotive industry are significant. As scale increases, research and development, administrative, and other costs are expected to be diluted, thereby enhancing NIO Group's overall profitability.

A multi-brand strategy is a good choice for achieving high growth rates. Traditional automakers have long employed brand matrices, and among new energy vehicle makers, BYD has launched premium new energy vehicle brands such as Yangwang and FANGCHENGBAO.

However, unlike BYD, which aims to elevate its sub-brands to premium pricing, NIO appears more focused on trading price for volume. Li previously stated that the NIO brand will continue to focus on maintaining a high gross margin to ensure profitability, while the new product line of its second brand, Letao, will primarily shoulder the task of driving sales growth. In the early stages, product sales volume will take precedence over gross margin.

In other words, NIO's multi-brand strategy primarily involves launching lower-priced, cost-effective models, essentially a disguised form of price reduction.

The strategy of "going downmarket" to boost volume is sound. Xpeng, which was also struggling with lagging sales, successfully capitalized on cost reductions in automotive technology by launching its sub-brand MONA, pricing its electric sedan below RMB 150,000. It is reported that Xpeng MONA M03 received over 10,000 pre-orders within 52 minutes of its launch and surpassed 30,000 pre-orders within 48 hours.

The issue lies in the pricing strategy of NIO's second brand, Letao, which gives a sense of being caught between two worlds.

The pre-sale price of Letao's first product, the L60, starts at RMB 219,900, positioning it as a pure electric mid-size SUV aimed at the mainstream family market.

After the price announcement, many noted the L60's cost-effectiveness compared to the Tesla Model Y. However, a closer look at the market reveals that this price range and positioning already hosts a slew of competitors, including the all-new IM Zhipi LS6, Avitar 07, and Zeekr 7X.

The RMB 200,000-300,000 price range is inherently highly competitive, far exceeding the competition faced by NIO's main brand in the above-RMB 300,000 price bracket. As a new brand, it remains uncertain whether Letao can emerge victorious in this fiercely competitive market.

Regarding Letao's expectations, Li mentioned that the L60's supply chain is prepared for monthly deliveries of 10,000 units this year, with a target of reaching 20,000 monthly deliveries next year.

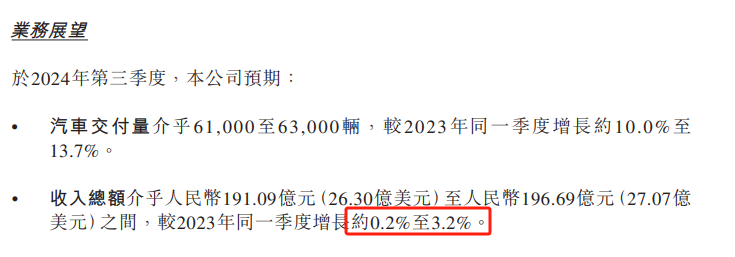

Given NIO's overall business outlook, the company has set ambitious targets for Letao to drive sales growth. However, amid fierce competition, NIO's expectations for revenue growth from its new brand appear modest. For the third quarter of 2024, NIO expects vehicle deliveries to range between 61,000 and 63,000 units, representing year-on-year growth of approximately 10.0% to 13.7%; total revenue is projected to be between RMB 19.109 billion and RMB 19.669 billion, up approximately 0.2% to 3.2% year-on-year.

Under the target of monthly Letao deliveries of 10,000 units, overall revenue growth is nearly stagnant. Combined with the statement that "product sales volume takes precedence over gross margin," this brand may not become a significant engine of growth for NIO in the short term.

Compared to BYD's push into premium markets to boost profit margins and Xpeng's pursuit of ultimate cost-effectiveness, NIO's sub-brand strategy, which directly targets the mainstream price range and the most competitive segment, seems somewhat puzzling.

Conclusion

Behind soaring share prices, is NIO a growth investment opportunity?

NIO is widely recognized for its high product quality and exceptional energy replenishment experience. However, the key indicators determining long-term investment value are more direct: profitability, growth rate, and market potential.

The market potential is undoubtedly vast. The new energy vehicle industry is currently in its growth phase, maintaining a high market growth rate. According to data from the China Association of Automobile Manufacturers, China's new energy vehicle production and sales reached 4.929 million and 4.944 million units, respectively, from January to June 2024, representing year-on-year increases of 30.1% and 32%, respectively, with a market share of 35.2%.

Nevertheless, NIO's profitability and growth rate are fraught with uncertainties.

Regarding profitability, high marketing expenses and significant investments in energy replenishment infrastructure cast doubts on the company's earning potential. Additionally, the fact that other mainstream automakers have not followed suit with battery swapping solutions also raises concerns about NIO's long-term value.

It's worth noting that Tesla demonstrated battery swapping technology as early as 2013 but ultimately abandoned it in favor of focusing on supercharging technology. Throughout history, it has been an inevitable trend for "technological advancements" to replace "compromises."

While NIO has stated, "Is superfast charging technology advancing so rapidly that battery swapping will soon be obsolete? — No!" the mere fact that this question is being raised speaks volumes. As Huang Zheng, the founder of Pinduoduo, once recalled in his conversations with Warren Buffett, "Buffett made me realize the power of simplicity and common sense." Good or bad, sometimes the answer is self-evident when viewed with an unbiased mind. If it's not immediately apparent, it's probably not good enough."

Image source: NIO WeChat official account

Moreover, regarding growth rate, whether the sub-brand Letao can meet expectations is a crucial factor determining the company's share price movement.

In addition to the Letao L60, scheduled for delivery at the end of September, NIO also anticipates delivering its third brand, Firefly, next year. For NIO, the launch of these sub-brands represents another crucial milestone following the initial delivery of its main brand and the development of battery swapping technology.

How much room for imagination does NIO's future hold? Let's wait and see if these uncertainties can turn into certainties.