Meituan successfully defends its position against Douyin, while Pinduoduo's horror story has just begun

![]() 09/10 2024

09/10 2024

![]() 460

460

The first-half results of internet stocks have been disclosed, and most internet companies have delivered average performances. Interestingly, the mid-year reports this time featured the passing of the baton between Pinduoduo and Meituan, two companies with their own horror stories. Pinduoduo, which has been encircling Taobao and JD.com, chose to "self-implode" its share price, while Meituan, which was rumored to be on the verge of being overtaken by Douyin before August, managed to defend its position.

I. Pinduoduo's Horror Story of Self-Implosion

Due to Pinduoduo's consistently strong performance exceeding expectations, the market has always had high expectations for the company's earnings, despite its low valuation. Especially after maintaining high growth in the first quarter, with recent share price fluctuations, the market's bets on this quarter's earnings became even heavier.

In terms of holdings, according to 13F filings, a total of 147 institutions with assets exceeding US$100 million established positions in Pinduoduo in the second quarter, an increase of 50% quarter-on-quarter. Additionally, 20% more institutions, or 269 in total, chose to increase their holdings. This means that over 400 institutions bought Pinduoduo shares in the second quarter.

Some Chinese institutions that were already heavily invested in Pinduoduo also increased their bets. Hillhouse Capital increased its holdings by approximately 1.57 million shares, worth over US$200 million. Tyr Capital purchased nearly US$250 million worth of shares, while Gao Yi Asset Management increased its holdings by approximately US$60 million. Sequoia China added nearly 14.9 million shares worth US$2 billion to its Pinduoduo holdings in the second quarter.

Why did so many institutions choose to buy Pinduoduo shares in the second quarter?

Firstly, the market expects Pinduoduo's domestic main platform to continue eroding Taobao and JD.com's market shares, especially as revenue growth for both Taobao and JD.com has stagnated. Naturally, this led to speculations that Pinduoduo's performance might not be bad, as it primarily competes with these two platforms.

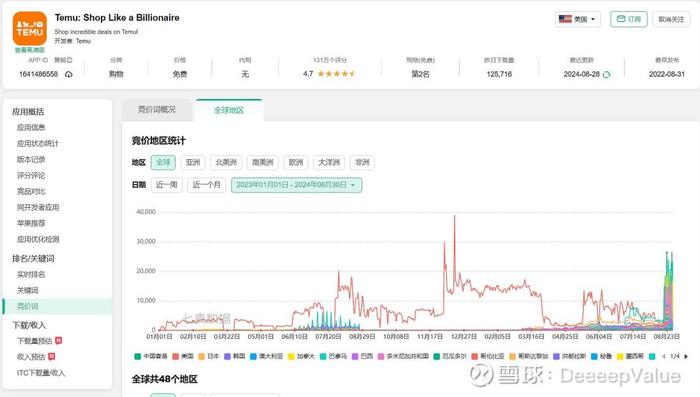

Although Temu faces political risks, the market typically views this part of the business as an optional upside surprise, without incorporating its valuation into Temu's overall valuation. Furthermore, amidst a trend of shareholder returns among many Chinese stocks this year, there have been speculations that even if Pinduoduo does not offer shareholder returns this year, it might do so in the next one to two years once the competitive landscape stabilizes.

However, during the earnings call, Pinduoduo's management team's self-imploding statements suppressed the share price, fully igniting market concerns and transforming Pinduoduo's narrative from a promising story to a horror story.

Management first vaguely stated that profits would decline, without clarifying whether it was a decrease in profit growth rate or a direct decline in profit amount, leaving the market confused. However, there were more suggestions of a profit decline in the third quarter.

Another point is that as of the second quarter, Pinduoduo held RMB 284.9 billion in cash and cash equivalents. Among US-listed companies without shareholder return plans, Pinduoduo had one of the largest cash reserves. Nevertheless, management stated that there would be no shareholder returns for several years to come, which was contrary to market expectations. It can be said that Pinduoduo's management punctured all the high expectations of the market.

There are two potential reasons behind Pinduoduo's management's statements.

Firstly, domestic competition has intensified, with Pinduoduo, Taobao, and JD.com all increasing subsidies to merchants. Investors are concerned about whether Pinduoduo's domestic main platform's alpha has peaked. Secondly, without dividends or share repurchases, investors wonder if the capital expenditures for both the domestic main platform and overseas Temu will increase, and to what extent, as well as how long these expenditures will be sustained.

The first concern stems from Pinduoduo's second-quarter revenue. Advertising revenue reached RMB 49.1 billion, a year-on-year increase of 29%, compared to 56% growth in the previous quarter. Sellers generally predicted a 33% growth rate for the second quarter, while some optimistic buyers expected even higher growth. Transaction-based revenue amounted to RMB 47.9 billion, lower than the market's expectation of approximately RMB 50 billion. In other words, both Pinduoduo's main platform and Temu underperformed expectations.

While it would be an exaggeration to say that the financial report was terrible, under the pessimistic guidance of management, the market amplified concerns about the peaking and declining growth of both the main platform and Temu.

On one hand, online retail sales growth halved in the second quarter, with year-on-year growth rates dropping from approximately 11-12% in the first quarter to 5-6% in the second quarter. The weakening macroeconomic environment is increasingly impacting the e-commerce market. Although Pinduoduo still outperformed Taobao and JD.com, it is rumored that Douyin's growth has also significantly slowed in the past two months, painting a bleak overall picture.

Under increasing macroeconomic pressure, Pinduoduo's performance in the second quarter was no longer as robust as in previous quarters, despite the challenging macroeconomic environment. Now, Pinduoduo's alpha has encountered an inflection point affected by macro factors.

On the other hand, according to Dolphin Investment Research estimates, Pinduoduo's combined monetization rate for advertising and commissions on its main platform exceeded 4.5%, but the year-on-year increase in monetization rate narrowed significantly compared to the previous quarter. When both revenue growth and monetization rate improvement slow down, this leads the market to doubt the high-growth potential of Pinduoduo's main platform.

Another reason for the expected profit decline is concerns about increased capital expenditures. Although Pinduoduo's cost control remained effective in the second quarter, maximizing human efficiency, it still had to face the issue of increased capital expenditures amid macroeconomic pressure and intensifying competition.

Recently, Pinduoduo's domestic competitors, including Taobao, JD.com, and Douyin, have increased subsidies to merchants, and Pinduoduo has followed suit. Overseas, Temu is not only competing with Amazon but also gradually intensifying its rivalry with Shein, as evidenced by increased advertising spending and mutual lawsuits between the two in August.

Perhaps based on these two potential concerns, Pinduoduo effectively shorted itself, directly puncturing its special pricing model of high expectations but low valuation, thus initiating its own horror story.

Regarding Pinduoduo's valuation going forward, investors may prefer to wait and see how the company performs in the third quarter. Only by observing whether the actual performance aligns with management's pessimistic outlook and resolving doubts about rising fees can investors' concerns be addressed. However, based on this quarter's results, it is clear that macroeconomic weakness has already begun to affect Pinduoduo's alpha.

II. Meituan: A Company Haunted by Horror Stories but Refuses to Die

As Pinduoduo's horror story unfolded, Meituan successfully defended its position with its second-quarter results, fending off Douyin and alleviating concerns that it would be overtaken by the latter.

Meituan can be considered one of the internet companies with the most horror stories. For instance, in 2021, social security issues sent its share price plummeting. In 2022, Douyin intensified its local life services, and in 2023, it ventured into food delivery and was rumored to acquire Ele.me. Over the past three years, Meituan has faced increasingly significant horror stories each year.

This year, the two primary concerns are the intensifying competition in local life services, with rumors of increased subsidies by Douyin in July, raising worries about Meituan's profitability in store visits, and the rumored acquisition of Ele.me by Douyin since last year, often argued on the basis of Douyin offering more subsidies to merchants and engaging in a price war with Meituan to gain market share.

As we discussed in previous articles, it's crucial to remember how Ele.me lost to Meituan in the food delivery business. Simply having access to Douyin's traffic interface does not automatically reverse Meituan's established scale effects and fulfillment rates in food delivery. Moreover, in the current macroeconomic environment, burning money to gain market share is unlikely. Consequently, the notion of Douyin's food delivery service has receded from public discourse recently, with its scale remaining stagnant. This indirectly proves that Meituan's strongest moat lies in its delivery capabilities, which are not easily shaken.

This year, with Meituan, Alibaba, and JD.com all stepping up their efforts in instant delivery, the horror story of food delivery has transformed into a battle between Douyin and Meituan for local instant retail business.

However, it's worth noting that since Douyin lacks delivery capabilities and relies on third-party delivery services, it primarily plays the role of transaction commission taker in the instant delivery business. In contrast, companies with delivery capabilities like Meituan, Ele.me, and Dada enjoy a larger share of the pie. From this perspective, Meituan has a higher ceiling in the instant delivery business and can accept more orders.

Going forward, the instant delivery market will primarily be shared between Meituan and Ele.me. Given Meituan's current 70% share of the food delivery market and Ele.me's 30%, it will not be difficult for Meituan to capture 60-70% of the instant delivery market. Especially as Alibaba struggles with Pinduoduo and prioritizes profitability, it is unlikely to engage in a price war with Meituan over instant delivery. As such, Meituan has significant potential to improve its profit margins, particularly in areas where penetration is still low, such as instant delivery, as well as in reducing losses in its new businesses like Xiaoxiang (a grocery delivery service) and online grocery shopping.

Meituan's year-on-year growth rate for instant delivery revenue in the second quarter was 13%, still slightly lower than the growth rate of order volume but with a significantly narrowed gap of just 1.2 percentage points between the two. Notably, the average revenue per delivery is stabilizing, indicating an improvement in the profitability of this segment.

It can be said that Meituan has successfully defended against Douyin's attacks in food delivery and instant delivery. However, Meituan has indeed faced significant threats in the local life services competition, which led to a drop in its market value to over RMB 300 billion at the beginning of the year. Since local life services are Meituan's primary source of revenue, there has been ongoing uncertainty about the "profit floor" for both Douyin and Meituan in this business segment, which the market had not fully grasped before.

According to the second-quarter report, Meituan's commission and advertising revenue grew by 19.7% and 20.1% year-on-year, respectively. Order volume increased by over 60% year-on-year. Considering the decline in average order value, the actual growth rate may be between 35-40% or even higher, significantly exceeding market expectations of approximately 25%.

The operating profit margin for store visit business has returned to 35%, and the number of annual active merchants has reached an all-time high, demonstrating that Meituan's store visit business has not been impacted. However, it would be inaccurate to say that Meituan is counterattacking Douyin; rather, both Meituan and Douyin have chosen to prioritize profitability over simply undercutting prices to gain market share. In other words, when competitors realize that burning money to gain market share is not feasible, they all prioritize profitability.

Of course, one cannot solely rely on the first-quarter report to conclude that the competition between Meituan and Douyin has ended. However, it is evident that business profit margins are recovering, reducing the likelihood of further deterioration.

Moving forward, Meituan's competitive landscape will improve. Firstly, its core store visit business has successfully defended its position, with profit margins recovering. Secondly, the instant delivery industry is experiencing growth, and current penetration rates are still low. Alibaba's Ele.me prioritizes profitability, and its main business is already preoccupied with competition from Pinduoduo. As a result, both companies tend to prioritize profitability over aggressive price wars. Thirdly, the potential for new businesses to reduce losses exists.

In the second quarter, Meituan approved a new share repurchase program of US$1 billion, bringing the total repurchases in the quarter to over US$2 billion and approximately 4% of its total share capital for the full year. With such growth potential and shareholder returns, Meituan was essentially the standout performer among internet stocks in the second quarter. However, considering Meituan's potential overseas expansion and increased investment in new businesses, the likelihood of further enhancing shareholder returns may be lower. At this stage, growth remains the primary focus.

Similarly, high-growth Pinduoduo chose to self-implode and discourage investors, offering no shareholder returns. This significant divergence in expectations underscores the challenges facing the company as it seeks to overcome its horror story.