Apple's journey to become the 'AI茅' is only halfway there

![]() 09/11 2024

09/11 2024

![]() 453

453

Perhaps the biggest highlight of this year's Apple event was its timing with Huawei's event, or its announcement of a new Tencent mobile game, but definitely not the iPhone 16.

On September 10, Apple's fall product launch event coincided with Huawei's Extraordinary Brand Ceremony, and the iPhone 16 series was unveiled on the same day as the HUAWEI Mate XT.

However, the selling points of the new products from the two manufacturers differed significantly. Huawei placed greater emphasis on the "leading, innovative, and disruptive" nature of its tri-foldable smartphone, while Apple garnered much attention for its Apple Intelligence. CEO Tim Cook stated that the new iPhone 16 was designed from the ground up for AI, "marking the beginning of an exciting new era."

Despite Apple bestowing special significance on the iPhone 16, in terms of pricing, the four new models in the iPhone 16 series were priced the same as their iPhone 15 counterparts, unlike Huawei's starting price of 19,999 yuan. This pricing strategy reflects the unprecedented market challenges faced by Apple.

Of course, some argue that this pricing effectively captures the "buy new, not old" consumer mindset, and coupled with the launch of Apple Intelligence, Apple's smartphone sales are expected to grow significantly in the second half of the year.

So, will Apple stage a triumphant comeback, or will it continue to struggle against adversity?

I. After declining sales, Apple failed to change the "rules of the game"

Apple's "incremental innovation" approach has long been criticized. CNN reported that since the introduction of the 5G-enabled iPhone 12 in 2020, Apple has offered few compelling reasons for consumers to upgrade, resulting in sluggish iPhone sales over the past few years.

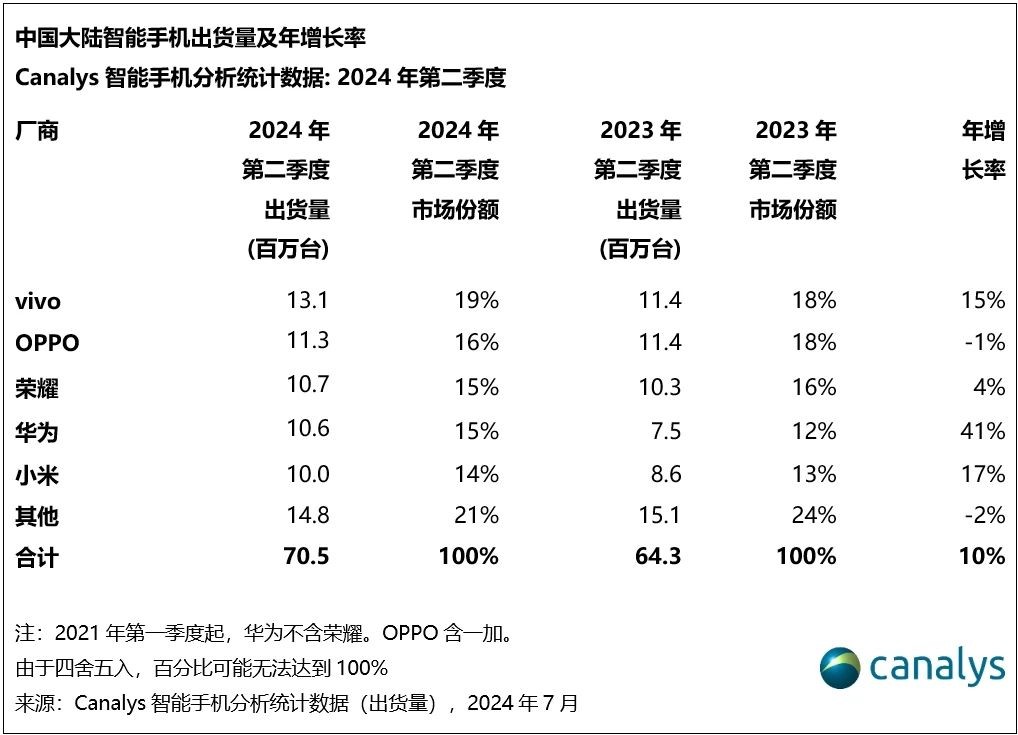

Losing innovation means losing the "soul" for a tech company. Consequently, Apple has gradually fallen behind in the fiercely competitive Chinese market in recent years. According to Canalys data, the Chinese mainland smartphone market experienced further recovery in the second quarter of 2024, with shipments growing 10% year-on-year to return to the 70 million unit level. However, Apple fell to sixth place in shipments, with its market share slightly declining by 2% year-on-year to 14%. This translated to a 6.5% year-on-year decline in revenue from Greater China in Apple's fiscal third quarter of 2024.

Meanwhile, after abandoning its automotive ambitions, Apple has placed its hopes on AI and wearable devices, but these have also underperformed. According to IDC, Apple has yet to sell 100,000 Vision Pros in a single quarter since its February launch. Sales in the US reached approximately 80,000 units in the second quarter, with expectations of a 75% decline this quarter to just over 19,000 units. This suggests that the headset will not sell more than 500,000 units in 2024, well below Apple's target of 1 million units.

With both smartphone and wearable device sales falling short of expectations, the launch of the new iPhone 16 represents Apple's last chance for a turnaround this year.

Specifically, the Apple event showcased the following:

1. The announcement that Apple Intelligence will launch in October, initially in the US, followed by English-speaking markets (Australia, Canada, New Zealand, South Africa, UK) in December, and then China, France, Japan, and Spain next year.

2. The iPhone 16 series, featuring new camera control buttons and the latest A18 chip, with pricing unchanged from the 15 series.

3. The redesigned Apple Watch Series 10 with sleep apnea detection, and the upgraded AirPods Max in orange, purple, and starlight colors.

Despite the official confirmation of the Apple Intelligence launch date following the WWDC 2024, the event itself failed to generate much excitement for the new products, with even the announcement of Tencent's new game "Honor of Kings: World" stealing the spotlight.

In fact, compared to the popularity of tri-foldable smartphones, Apple's "AI" innovation has received less favorable reviews. With Huawei's Mate XT Extraordinary Master now open for pre-orders, over 3 million people have signed up on Huawei's official website. In contrast, according to analyst Ming-Chi Kuo, Apple has ordered slightly fewer iPhone 16 models than the iPhone 15, contradicting the notion that Apple Intelligence will drive iPhone upgrades.

Image credit: Huawei Mall

Market reaction to Apple's new products after the event was relatively muted.

Many market observers believe that the event did not showcase anything that could change the game and signal significant revenue growth for Apple.

The reason is simple: capital markets are becoming increasingly cautious about the commercialization of AI, fearing that companies investing heavily in AI may struggle to see quick returns. For example, BlackRock has stated that overall AI capital expenditures have the potential to drive a wave of transformation driven by disruptive or structural trends.

In an article in China Newsweek, Zhang Xiaorong, Dean of the Institute of Deep Technology Research, echoed this sentiment, stating, "AI technology is advancing at an increasingly rapid pace, requiring companies to continuously invest in R&D. However, under the current technological framework, it is difficult for companies to introduce groundbreaking products or services that meet the rapidly changing market demands. Without clear advantages, current investments may not lead to technological breakthroughs or increased market share, thereby failing to drive revenue growth."

In other words, the path to AI commercialization is long and arduous. Moreover, for Apple to strengthen its existing competitive advantage with AI, it must not only endure a protracted period but also outcompete its rivals.

II. With numerous AI-powered smartphone manufacturers emerging, can Apple seize the initiative?

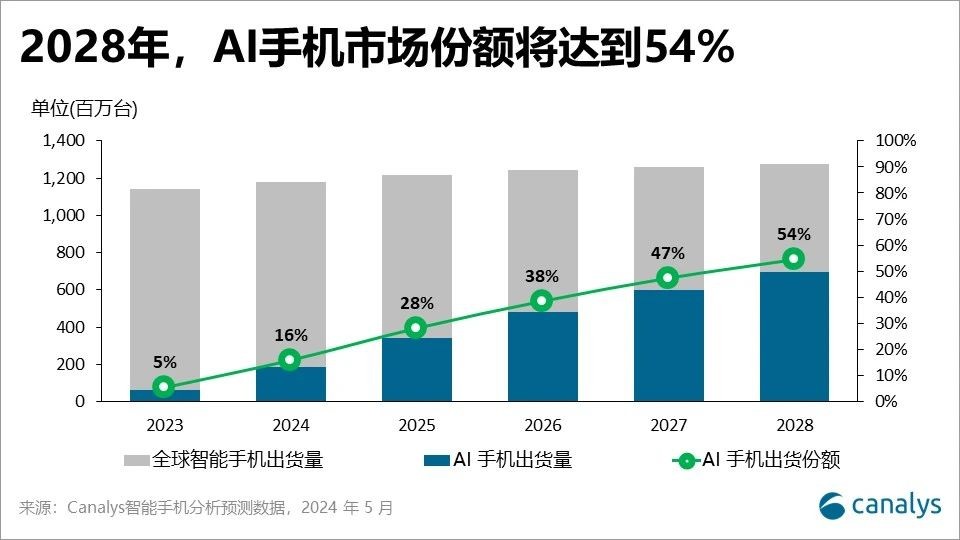

The trend towards AI-powered smartphones is inevitable. According to Canalys, 16% of global smartphone shipments in 2024 were AI-powered, and this figure is expected to surge to 54% by 2028, with the AI smartphone market growing at a CAGR of 63%.

As the next significant growth area for smartphones, more and more manufacturers are investing in AI.

In China, leading brands such as Honor, OPPO, vivo, and Xiaomi have all entered the AI race since 2023, formulating and announcing their AI strategies. Samsung, Apple's primary global competitor, has also introduced the Galaxy S24 series, marking a new chapter in AI smartphones.

Image credit: Orient Securities

However, AI smartphones demand higher hardware requirements, including chip memory, battery life, and cooling systems. The foundational infrastructure for deploying large language models on smartphones is already in place. Therefore, among hardware and software innovations, software services may take precedence.

At the event, Apple's software vice president Craig Federighi showcased four application scenarios for Apple Intelligence: communication (AI-generated emails, texts, and documents, or emoji creation); memory reliving (inputting text to search through past photos and videos); priority management (automatically organizing emails and apps, generating summaries instead of push notifications); and new Siri capabilities (hundreds of new tasks Siri can perform).

It is evident that Apple Intelligence primarily represents "incremental innovation" built upon existing applications, falling short of "disruption." Tech journalist Mark Gurman bluntly stated, "Don't get your hopes up for the iPhone 16," noting that its design is similar to its predecessor, and the much-anticipated AI features will be rolled out in phases, failing to create a "supercycle" that would boost iPhone 16 sales.

Apart from lacking innovation, Apple's other significant challenge is its reliance on third-party developers for its AI ecosystem due to the absence of an in-house large language model. IDC analyst Ryan Reith pointed out that while consumers may be interested in Apple Intelligence, the presence of GPT and other solutions means they can already use AI on their existing devices, making it difficult for Apple Intelligence to directly drive new purchases.

Looking ahead, the trend towards AI smartphones remains unchanged, but the smartphone market is already mature with limited growth potential. Canalys projects that global smartphone shipments will grow modestly at a CAGR of 2% from 2024 to 2028. As competition among AI smartphone manufacturers intensifies, Apple's lack of a unique advantage in AI smartphones casts doubt on its future potential.

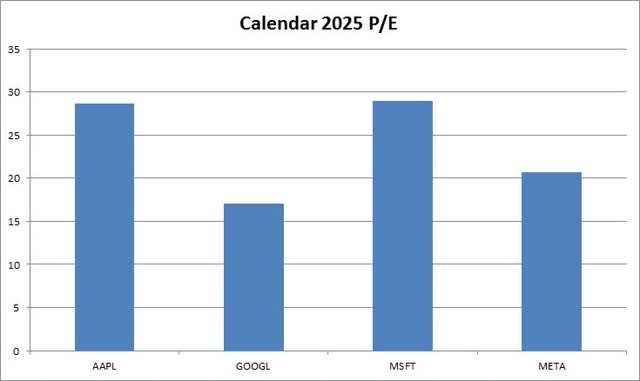

Meanwhile, in terms of valuation, Apple also lacks unique appeal among "AI concept stocks." Analyst Bill Maurer noted that Apple's P/E ratio is almost 29 times its estimated earnings for fiscal year 2025 (ending in September). This figure is roughly in line with Microsoft but, on a percentage basis, Apple's revenue and earnings growth is expected to be only about half of Microsoft's. Alphabet and Meta, which are growing at a similar pace to Microsoft, also have more reasonable valuations.

Standing on the cusp of a significant upgrade cycle driven by AI, Apple's combination of high valuation and underwhelming performance warrants a reassessment.

Source: U.S. Stock Research Society