Pinduoduo's Idol - Is Costco the Ideal Retail Model?

![]() 09/11 2024

09/11 2024

![]() 448

448

Taking a look at the domestic pan-retail industry, both Pinduoduo in e-commerce and Pandalei in brick-and-mortar retail are widely regarded as benchmarks in their respective niche markets, even the optimal solutions within their respective business models. The most revered traits they share - prioritizing consumer interests above all else and pursuing excellence in operations (with the former emphasizing efficiency and the latter emphasizing quality) - are, to some extent, inherited from another overseas retail benchmark: Costco.

In this report, Dolphin Investment Research will delve into Costco's enduring reputation as a retail benchmark, examining its core strengths and scarcity value. We will explore the specific business models and operational strategies that differentiate Costco from its competitors, contributing to its unique advantages.

1. Reviewing Costco's past stock performance, its market capitalization has increased by approximately 19x since the turn of the millennium, with an annualized growth rate of roughly 12.8%. This significantly outperforms the S&P 500's annualized growth rate of 5.4% over the same period. However, compared to superstars that have multiplied their value by hundreds of times, Costco's growth is not the most impressive in terms of sheer magnitude.

Yet, in terms of annual returns, Costco only experienced four years of negative returns during extreme market conditions such as the dot-com bubble burst, the 2008 financial crisis, and the COVID-19 pandemic in 2020. In all other years, the stock delivered positive returns. Its rare corrections and near-100% certainty of gains (excluding market crashes) are truly exceptional.

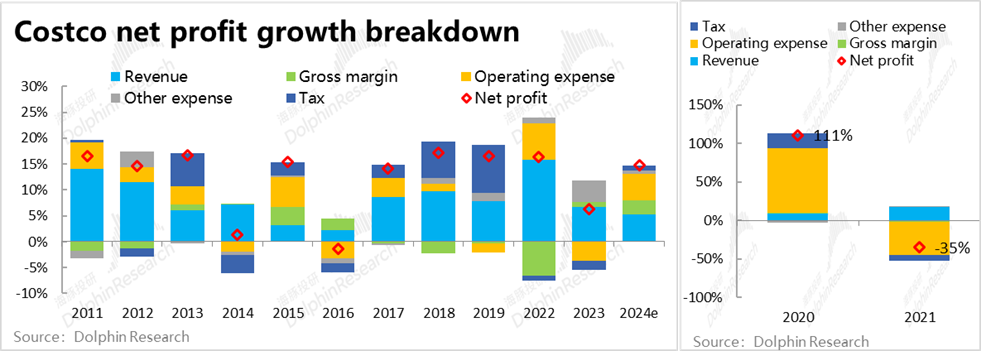

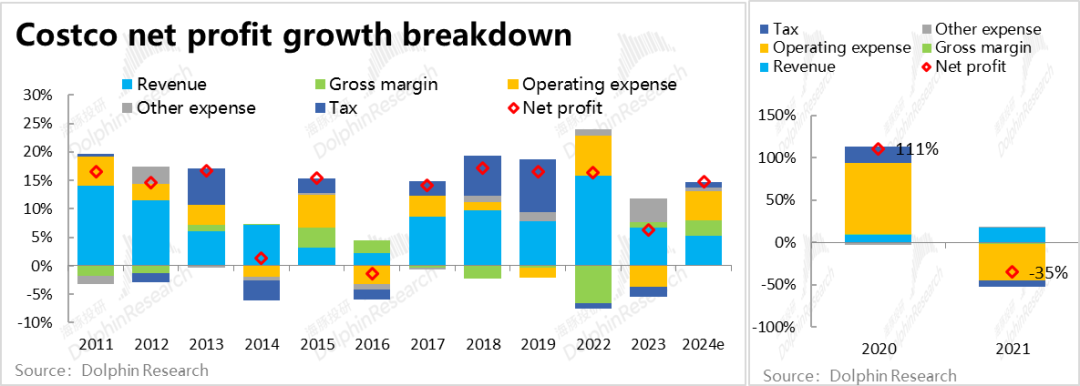

2. Breaking down the drivers of Costco's steady market capitalization growth, its P/E ratio has mostly fluctuated within the range of 20+x to 30x, indicating that valuation is not the primary contributor to its growth. Instead, the primary driver is its consistent annual net profit growth rate of never less than 10%, which has accumulated over time. Key factors contributing to profit growth, in descending order of importance, are revenue growth (blue), declining expense ratios (yellow), and reduced taxes in some years (dark blue).

In essence, Costco's success boils down to two key points:

① What has enabled Costco to sustainably grow its revenue over two decades, virtually ignoring fluctuations in macroeconomic conditions, consumer sentiment, and changing consumption habits and channels?

② What factors have allowed Costco to continuously improve operational efficiency and reduce costs over such a long period, enabling the company to incrementally increase its profit margins despite a largely stable gross margin?

As our first installment on Costco, we will focus on the first point, exploring how Costco has achieved consistent and cyclical-resistant revenue growth over decades, a crucial factor that sets it apart.

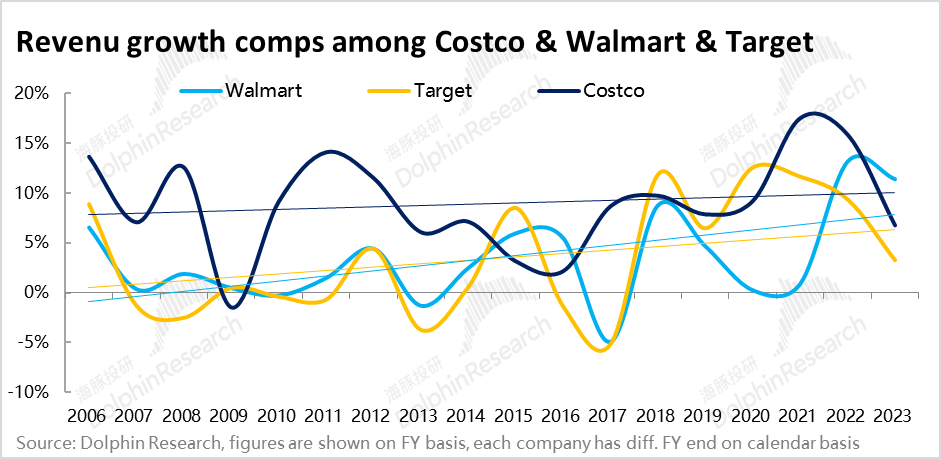

1. From 2005 to 2023, Costco's revenue grew at a compound annual growth rate (CAGR) of 8.8%, significantly higher than the 3.3% CAGR of Walmart and Target over the same period. In the highly mature offline retail industry, Costco demonstrates relatively higher growth potential.

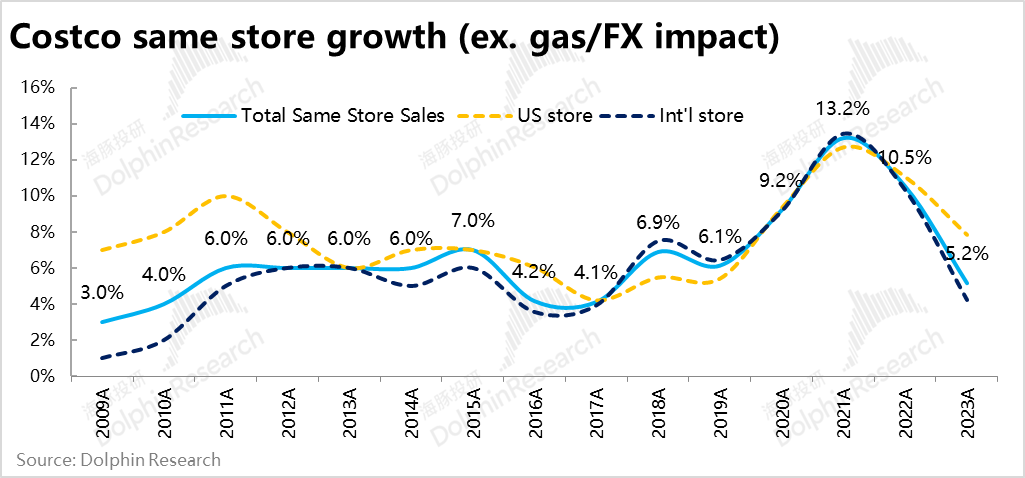

2. With the exception of a few instances, Costco has consistently opened only 15 to 30 new stores annually over the past two decades, indicating that its growth is not solely driven by store expansion. Excluding new store openings, exchange rate fluctuations, and gasoline price volatility, Costco's same-store sales CAGR from 2009 to 2023 was 6%, higher than that of its peers. Even during the 2009 financial crisis, same-store sales still grew by 3%, demonstrating remarkable macroeconomic resilience.

3. What factors contribute to Costco's loyal customer base, stable customer traffic, and sales? In terms of the core value proposition of "saving money," Costco adopts a "hard discount" model that directly benefits consumers. This means offering low prices without compromising on product quality or relying on low-cost white-label or flawed branded products. Instead, Costco compresses its own gross margin to pass on savings directly to customers.

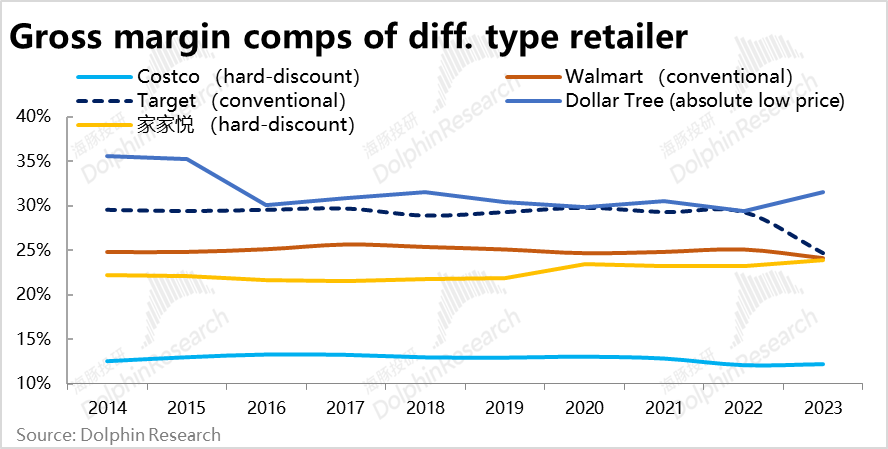

As evidence, Costco's gross margin has consistently hovered around 12% to 13% over the past decade, with no signs of increase. This is significantly lower than the 25% to 35% gross margins of both conventional supermarket models like Walmart and Target and ultra-low-priced retailers like Dollar Tree, highlighting Costco's commitment to maintaining a low gross margin.

4. While Costco offers lower prices compared to its peers, its products are generally synonymous with quality. This combination of "saving money" and "high quality" is one of the key reasons why Costco attracts and retains a loyal customer base. Positioned as a mid-range retailer, Costco's average basket size exceeds $100, double that of competitors Walmart and Target, which average around $50 per transaction.

By deliberately targeting the relatively well-defined middle-class consumer segment, Costco benefits from their stronger spending power and theoretically more stable daily consumption expenditure, contributing to its cyclical resilience.

5. In terms of product and service variety, Costco adopts a strategy of both addition and subtraction.

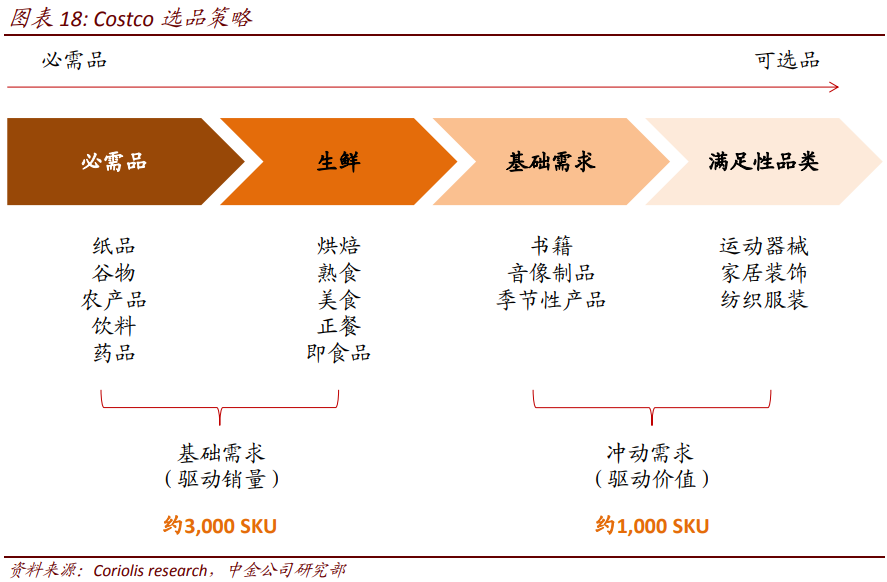

In terms of total SKU count, Costco opts for "less but better." With an average SKU count of around 4,000, significantly lower than the 20,000 or so SKUs found in conventional supermarkets, Costco allocates three-quarters of its SKUs to high-frequency, essential items like food and daily necessities. The remaining quarter is dedicated to lower-frequency, optional items like apparel, home goods, electronics, and toys.

This curated and limited product range reduces decision-making costs for consumers and simplifies supply chain management, enhancing both cost-effectiveness and operational efficiency (we will delve deeper into costs and efficiency in our next installment).

The concentration of three-quarters of SKUs on high-demand, frequently purchased daily items drives stable and frequent customer traffic, contributing to relatively stable revenue. Additionally, categories like fresh and frozen foods are not well-suited for online sales, helping Costco mitigate the impact of online retail.

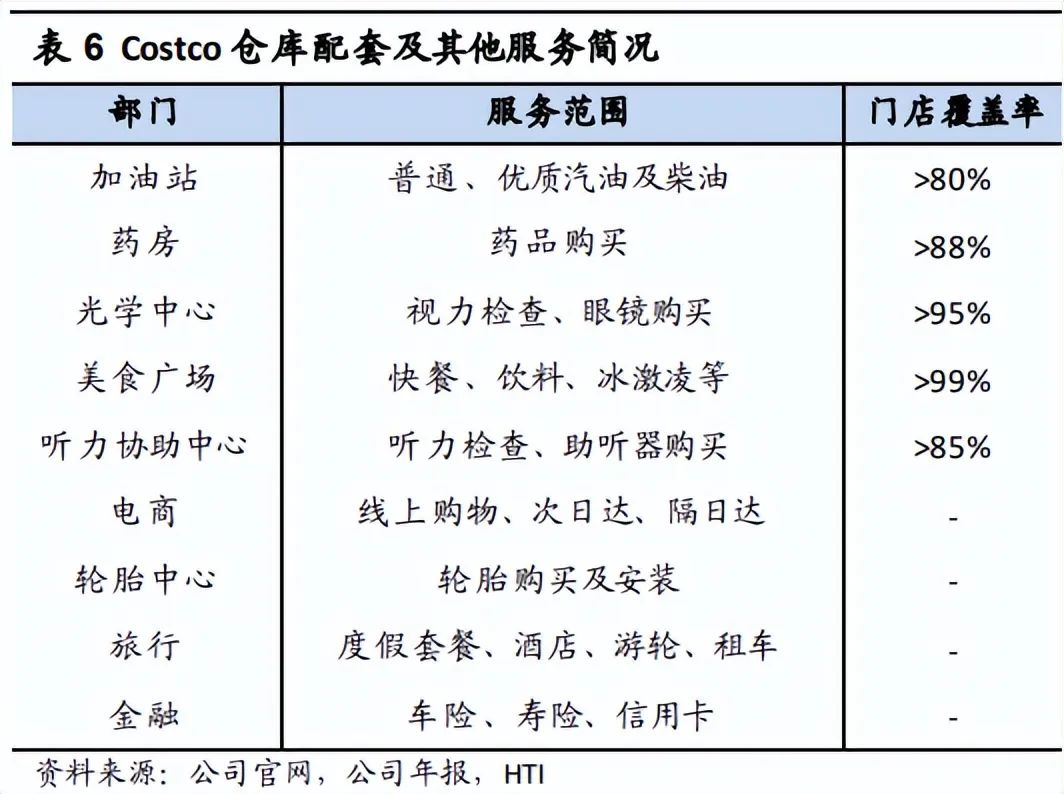

6. On the "addition" front, Costco expands into higher-priced, higher-margin optional products and services beyond its core low-priced, high-frequency offerings. These services, such as low-cost gasoline and dining options, pharmacies, vision and hearing tests, auto repairs, travel bookings, insurance, and credit cards, not only enhance customer loyalty but also boost sales and profits. Leveraging the substantial customer traffic generated by its core business, even non-core services contribute to Costco's profit growth due to their low incremental cost and high profit margins.

7. In summary, Costco has made numerous strategic sacrifices. Rather than pursuing rapid growth, it conservatively expands stores to ensure success and stable same-store sales growth. Instead of maximizing profit margins, it deliberately maintains a low gross margin to benefit consumers. Instead of expanding its customer base without bounds, it actively targets a specific customer segment to better align supply and demand. And rather than offering a wide range of products, it focuses on high-quality, essential items that are largely immune to economic and technological cycles, ensuring stable demand. While these choices may limit overall growth and profitability, they contribute to remarkable stability. The trade-offs are worth pondering.

In our next installment, we will delve deeper into Costco's operations, management, and efficiency, exploring how the company achieves impressive and steadily growing profits despite its many self-imposed constraints and the industry's lowest gross margins.

Below is the main text analysis content

I. What Makes Costco So Valuable? Steady Growth Over Speed

1. Stability Trumps High Growth Rates

As mentioned in the introduction, one of the questions we aim to answer is: What makes Costco a compelling investment from an investor's perspective? Looking at its past performance, we can observe the following:

① Impressive Yet Not Spectacular Growth: Since the turn of the millennium, Costco's market capitalization has increased nearly 19x (with an annualized growth rate of approximately 12.8%), significantly outperforming the S&P 500's cumulative growth of roughly 2.7x over the same period. However, compared to stocks like Nvidia, which has increased over 1000x in the same timeframe (even excluding recent AI-driven gains, Nvidia's cumulative growth from 2000 to 2022 was still over 100x), Costco's gains, while substantial, are not extraordinary. (Based on cumulative stock price gains since 2000, Costco ranks around 250th.)

② Certainty Wins: Since the turn of the millennium, Costco's stock price has declined in only four years: during the dot-com bubble burst from 2000 to 2002, the 2008 global financial crisis, and the onset of the COVID-19 pandemic in early 2020. In other words, Costco's few negative years can largely be attributed to historical market crashes. Excluding these extreme market downturns, Costco has delivered a 100% win rate and a virtually risk-free investment option.

Combining these two points, while Costco's annualized growth rate is impressive yet not breathtaking, its true rarity lies in its ability to consistently outperform the market, experience few corrections, and provide a highly certain investment experience.

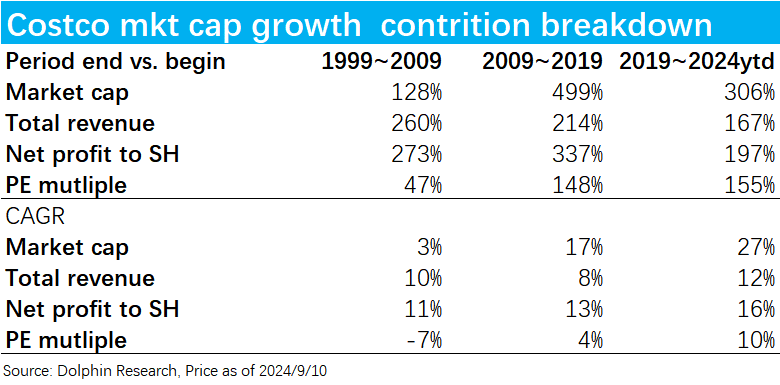

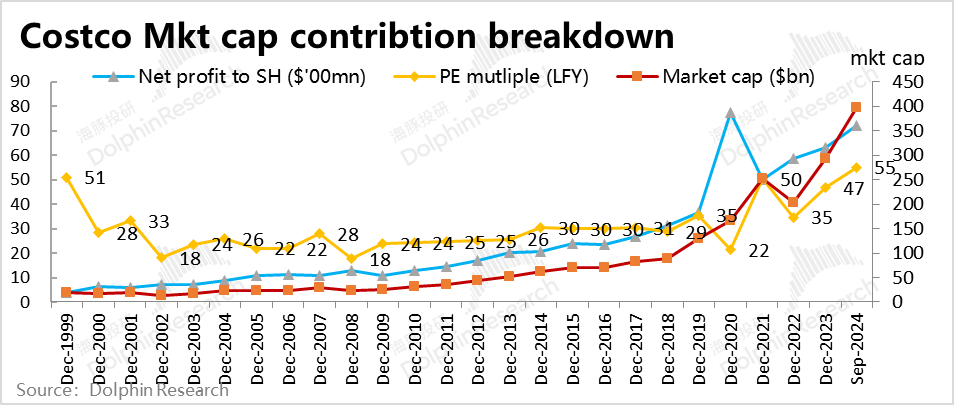

Deconstructing the drivers of Costco's approximately 17x market capitalization growth over the past 25 years, we can see the following trends by decade:

① From the end of 1999 to the end of 2009, Costco's market capitalization remained largely stagnant, with a cumulative growth of nearly 28% and an annualized growth rate of just 3%. This was primarily due to the bursting of the valuation bubble and subsequent significant corrections. Before the dot-com bubble burst, Costco's P/E ratio peaked at 50x in 1999 and contracted by 52% (annualized -7%) to 24x by the end of 2009. Despite this, revenue and net profit grew at annualized rates of 10% and 11%, respectively, indicating solid operational performance.

② From 2009 to 2019, Costco's market capitalization increased nearly 4x, primarily driven by strong operational performance (with revenue and profit growing at annualized rates of 8% and 13%, respectively) and modest valuation expansion (from 24x to 35x, or an annualized increase of 4%).

③ Since 2019, fueled by the largest quantitative easing program in U.S. history, Costco's market capitalization has surged, driven by both valuation and earnings growth. Of the company's 27% annualized market capitalization growth over the past five years, approximately 10% can be attributed to valuation appreciation (with Costco's current P/E ratio again exceeding 50x), while earnings growth of 16% has been the primary driver. This earnings growth has, in turn, supported the elevated valuation.

As evident from the above analysis, Costco's market capitalization growth over the past 25 years has been largely driven by profit growth, with valuation multiples playing a significant role only during the initial and final stages of this period. Coincidentally, Costco's P/E ratio at the end of 1999 and currently are both above 50x, raising questions about whether Costco and the current U.S. stock market valuations (or degree of bubble) have reached dot-com era levels, and whether history may repeat itself.

2. Revenue Growth as the Cornerstone, Enhanced by Efficiency Gains and Cost Reductions

As seen above, Costco's market capitalization growth, with the exception of periods influenced by stock market bubbles and corrections, has largely been fueled by "steady and sustained" profit growth. Let's delve into the key drivers behind Costco's 13.4% annualized net profit growth since 2010:

By breaking down these factors, we can clearly see that Costco's profit growth over the past decade has primarily been driven by revenue growth (blue), declining expense ratios (yellow), and, to a lesser extent, tax reductions in some years (dark blue). Gross margin (green) has not contributed positively on a sustained basis. (The significant fluctuations in 2020 and 2021 due to the pandemic do not reflect long-term trends.)

Through this breakdown, we can summarize the secrets behind Costco's nearly uninterrupted profit growth and stock returns over the past few decades into two simple points:

① What has enabled Costco to sustainably grow its revenue over two decades, virtually ignoring fluctuations in macroeconomic conditions, consumer sentiment, and changing consumption habits and channels?

② What factors have allowed Costco to continuously improve operational efficiency and reduce costs over such a long period, enabling the company to incrementally increase its profit margins despite a largely stable gross margin?

II. The Source of Costco's Cross-Cycle Consumer Preference

Based on the identified analysis directions, let's first explore the reasons behind Costco's sustained revenue growth. From 2005 to 2023, Costco's revenue grew at a CAGR of 8.8%. While this 8.8% CAGR may not seem exceptionally high in absolute terms, it is notable when compared to Costco's largest competitors, Walmart and Target, which achieved a CAGR of only 3.3% over the same period. This clearly demonstrates Costco's relatively high growth potential within the highly mature and slow-growing grocery retail industry.

And compared to the negative growth troughs experienced by Walmart and Target in multiple periods, Costco has only experienced negative revenue growth once in the past 20 years, during the 2008-2009 financial crisis. This demonstrates Costco's relatively low volatility in growth and its strong ability to withstand macroeconomic cycles.

1. "Conservative" Store Opening Rhythm & Single-Store Growth Across Cycles

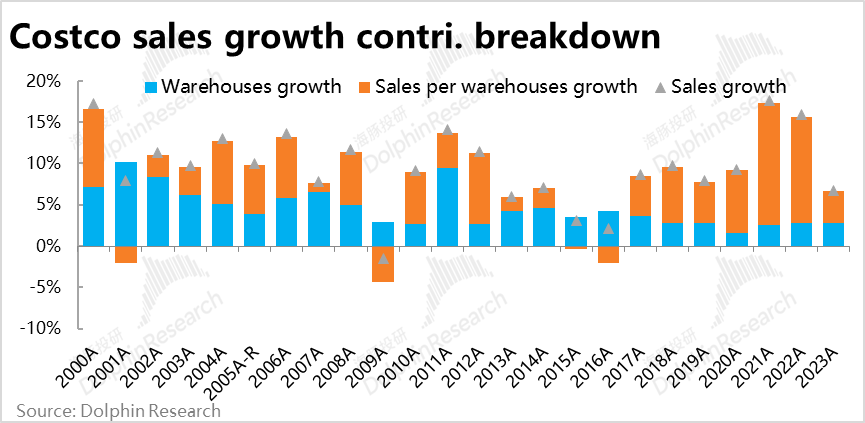

Breaking down the drivers of Costco's revenue growth, from 2000 to the present, the contributions of average sales per store and store count growth to overall growth have been roughly equal. Both have achieved a compound annual growth rate (CAGR) of 4.5% from 2000 to 2023. Moreover, since 2017, the contribution of sales per store has significantly surpassed that of new store openings. Therefore, Costco's stable growth is not solely reliant on new store openings; sustained sales growth per store is even more crucial.

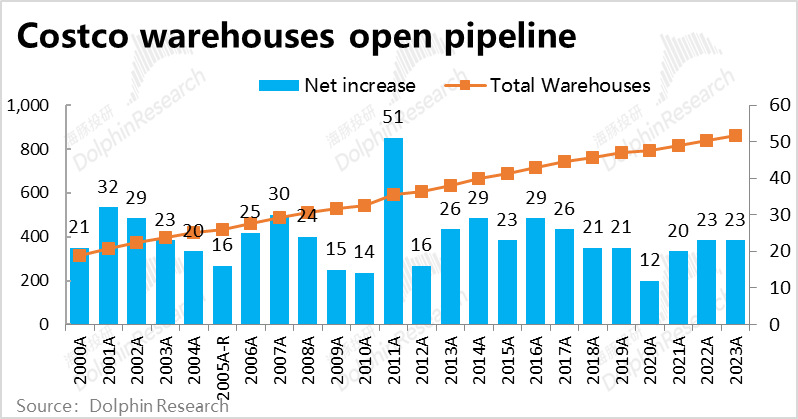

Furthermore, Costco's total number of stores (referred to as warehouses by Costco) has grown from 313 in the new millennium to over 860 today. Excluding outliers, Costco has consistently opened approximately 15-30 new stores annually over the past two decades.

Unlike the rapid expansion strategies commonly seen in the internet or "influencer retail" sectors, where companies quickly open stores to capture market share (even if it means incurring losses initially) and then focus on cost reduction and efficiency gains to unlock profits, Costco has adhered to a steady and measured expansion approach. Even as its revenue and store count have multiplied since the new millennium, Costco's store opening rhythm remains unchanged, if not overly conservative.

From a subjective perspective, a rapid expansion strategy can potentially catapult a company to the top of a niche market within a few years, followed by Refined operation , profit release, and market share defense. However, as the saying goes, "What comes fast, goes fast." Companies or brands that grow rapidly can quickly fade into obscurity as consumer preferences or other external factors change.

In contrast, Costco's slow and steady expansion has sustained its industry-leading position and above-average growth over several decades. While the former may not be a prerequisite for the latter, Costco's "slow and steady wins the race" approach is undoubtedly worth pondering for investors. In subsequent sections, we will delve deeper into the managerial choices and objective constraints behind Costco's prudent store opening strategy.

Costco's sustained and stable sales growth per store is even rarer and more valuable. Over the past 25 years, Costco's average sales per store have grown at a compound annual rate of 4.5%. Excluding the drag from newly opened stores and uncontrollable factors like exchange rate fluctuations and gasoline price volatility, Costco's comparable same-store sales growth has actually reached 6% from 2009 to 2023. Even during the financial crisis in 2009, comparable same-store sales still grew by 3% year-over-year. In other words, Costco's consistently stable sales growth per store, which rarely falters, is a crucial factor enabling its performance to transcend economic and consumer cycles.

2. What is True Affordability? Soft Discounts vs. Hard Discounts

So what has Costco done right to achieve this stable growth across cycles? Following the classic retail framework of "save, variety, speed, quality," let's start from the most crucial aspect of "save." In fact, "value retail" can be further divided into three categories: soft discounts, hard discounts, and absolute low prices:

① Low-Price Stores: These emphasize absolute low prices for goods, often within a specific price range, such as ten-yuan or hundred-yuan stores. However, one of the primary reasons for these low prices is that the products sold are inherently low-cost, such as white-label or private-label products. In many cases, despite their low costs, these stores can still achieve relatively high markups (or gross margins).

② Soft Discounts: This model achieves ultra-low prices by selling imperfect, near-expiration, or off-season products. The low prices in this model stem from the flaws inherent in the products themselves, though most of these products carry established brand names.

Therefore, the primary value proposition for retailers in this model lies in their ability to establish strong relationships with brands, ensure stable supply chains, and excel in product selection and consumer insights to maximize the sell-through rate of imperfect products (rather than allowing them to accumulate as dead stock).

③ Hard Discounts: In this model, retailers achieve low prices by optimizing supply chains, enhancing operational efficiency, and/or producing their own goods, thereby compressing their own gross margins to pass on savings to consumers. Importantly, the products sold under hard discounts are of good quality, sometimes even superior, and their absolute prices are often not low.

In contrast to the first two models, where low prices are often attributable to external factors related to the products themselves, hard discounts rely more on internal factors, namely retailers' own operational efficiency, to achieve low prices. As a result, hard discounts tend to have the lowest profit margins among the three "value retail" models, making them closest to a low-margin, high-volume business model.

In practice, Costco's gross margin has consistently hovered around 12-13% for over a decade, significantly below the industry average, and the company has never expressed any intention to increase it. In contrast, both conventional supermarket chains like Walmart and Target and absolute low-price retailers like Dollar Tree (the American equivalent of a ten-yuan store) have gross margins ranging from 25% to 35%. Across markets, Chinese retailers adopting the hard discount model, such as Jiajiayue, also have gross margins of 20-25%.

In terms of pricing, Costco's prices for comparable products are generally 10-40% lower than those at Walmart (which has the largest scale and should theoretically benefit from the strongest economies of scale). Meanwhile, prices at other smaller, regional supermarket chains are 60-70% higher than at Costco.

Therefore, whether across different retail formats or markets, Costco stands out as the most committed to maintaining low gross margins. Costco's low prices do not stem from low-quality or flawed products or from "squeezing" suppliers but rather from internally compressing its own gross margins and operational efficiency to pass on the most savings to consumers at the lowest markups.

3. "Affordable Quality" is the Winning Formula

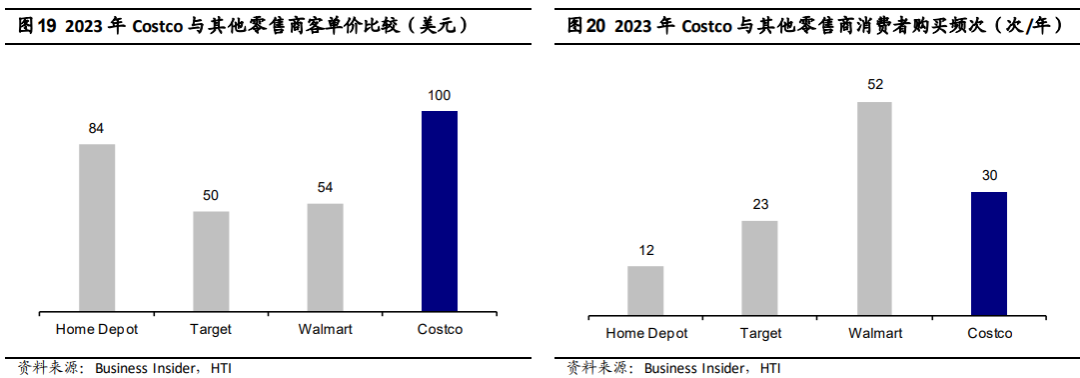

Despite its name suggesting discounts, Costco actually positions itself as catering to middle-class consumers. According to research, the average shopping basket size at Costco is over $100, double that of competitors Walmart and Target, which hover around $50+. (Note that this is distinct from Costco's lower prices for comparable products, as mentioned earlier.)

Qualitatively, Costco's products are widely regarded as synonymous with quality on various social media platforms. Examples include the use of "high-quality animal cream" as an ingredient and the sourcing of "imported premium durian," among others, which serve as testament to their product quality.

In other words, Costco excels in both "save" and "quality," offering relatively low prices without compromising on product quality. This dual focus is a primary reason why Costco can maintain stable and loyal customer traffic across cycles.

Furthermore, Costco's middle-class positioning offers two additional notable advantages:

First, by setting a membership threshold and selling relatively expensive, high-quality products, Costco actively selects and defines a relatively narrow and well-defined customer base, enabling it to offer tailored products and services that enhance conversion rates. Moreover, middle-class and higher-income households are theoretically more resilient to risks and exhibit less volatility in their daily spending, which may contribute to Costco's lower volatility in sales per store compared to its peers.

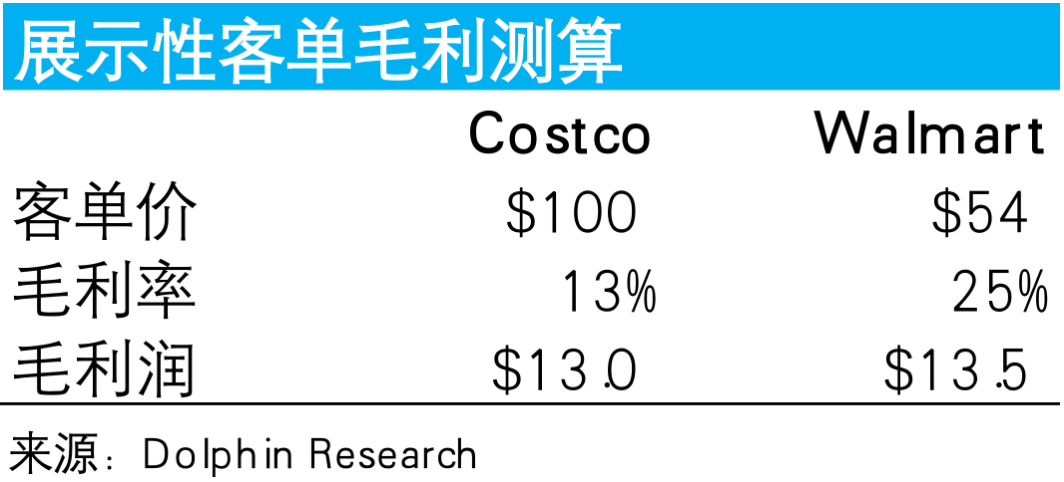

Second, the significantly higher average spending per customer allows Costco to maintain a comparable average gross profit per customer, despite its notably lower markup (or gross margin), providing sufficient headroom to cover other operating expenses. As a result, even without considering membership income, Costco's theoretical profit margin in its pure retail operations is not necessarily narrower than that of its peers.

As illustrated in the following table, Costco and Walmart generate roughly $13 in gross profit per customer transaction on average. This is merely a preliminary point, and we will delve deeper into cost considerations later in the article.

4. Addition and Subtraction Coexist

In terms of "save" and "quality," Costco stands at the forefront of the industry. However, regarding "variety" or the richness of products and services, Costco's approach involves both addition and subtraction.

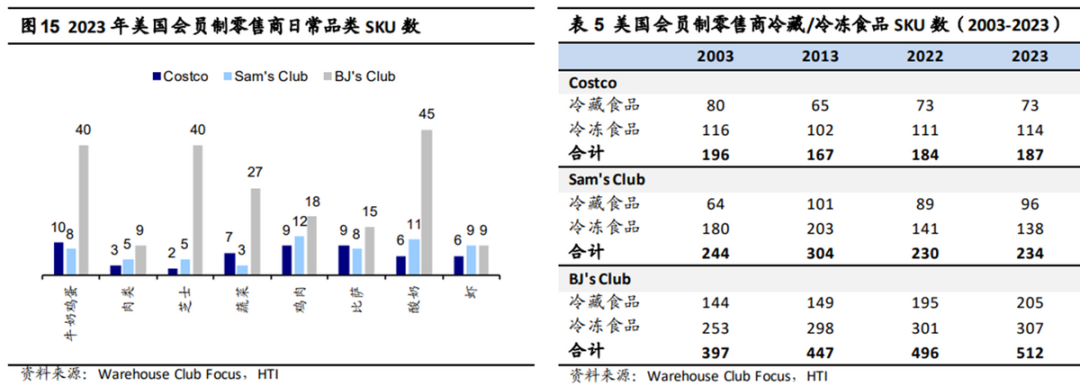

In terms of total SKU count, Costco opts for "less but better." Warehouse clubs like Costco, typically located in suburban areas with large store footprints, carry only around 4,000 SKUs, significantly fewer than the roughly 20,000 SKUs found in conventional supermarkets.

Even compared to fellow warehouse clubs like Sam's Club and BJ's Wholesale Club, Costco carries the fewest SKUs. For instance, in the categories of fresh and frozen foods, Costco's SKU count is roughly comparable to Sam's Club but still 30-40% lower, while it is more than half as many as BJ's.

In terms of product mix, Costco allocates three-quarters of its 4,000 SKUs to high-frequency, essential items like food and daily necessities, leaving only one-quarter for lower-frequency, optional items like apparel, home goods, electronics, and toys.

The combination of these two factors results in a curated selection of limited products, which effectively reduces decision-making costs for consumers (by avoiding overwhelming choice) and, to some extent, facilitates sales. Furthermore, focusing on a narrower range of popular or premium products simplifies product selection and supply chain management, helping to reduce costs (which we will discuss in more detail later).

In terms of category structure, concentrating three-quarters of SKUs on food and daily necessities—categories with relatively rigid demand and high purchase frequency regardless of economic cycles—creates a stable and frequent customer flow for Costco. By selling optional items with higher unit prices and profit margins, Costco can boost overall sales and profits.

From another perspective, food items, including fresh produce, chilled/frozen foods, and cooked meals, are inherently unsuited for online sales and delivery, which is one reason why Costco has not been significantly impacted by the rise of online shopping.

While Costco adopts a "subtraction" or "less but better" approach in terms of product offerings, it embraces "addition" when it comes to value-added services. Abstractly, business expansion can occur in two directions: expanding the same business into different scenarios, such as moving from offline retail to online; or integrating various business formats within the same scenario.

Costco chooses the latter approach, incorporating multiple types of services within its stores to provide customers with more convenient one-stop shopping experiences. Specifically, these include:

① Equally high-frequency fueling and catering services are mainly designed to increase consumer loyalty. Given Costco stores' typically remote locations and the prevalence of automobiles among American households, customers naturally extend their visits by refueling after arriving by car. Catering, on the other hand, offers an even more frequent consumption scenario than everyday shopping. The extremely low-priced rotisserie chickens, hot dogs, and cola drinks, among other popular items, are indeed part of Costco's strategy to attract and retain customers.

② Relatively low-frequency, optional services such as pharmacies, optometry, audiometry, and auto repairs offer higher profit margins. These services extend beyond core daily shopping, encompassing a transition from high-frequency to low-frequency needs, from necessities to options, and from products to services. They enrich the customer shopping experience and contribute to increased profitability to a certain extent.

③ Travel bookings, insurance, credit cards, and other more diversified offerings represent light-asset, high-margin channel-based businesses. These are essentially Costco's "secondary monetization" of the massive customer traffic generated by its primary operations. Since Costco's incremental customer acquisition costs for these channels are nearly zero, even though these areas are not Costco's core strengths, they still contribute to the company's profitability due to their low incremental costs and high profit margins.

- END -

// Reprint Authorization

This is an original article by Dolphin Investment Research. For reprinting, please obtain authorization.