"Price reduction" cannot save joint venture brands

![]() 09/11 2024

09/11 2024

![]() 662

662

What challenges will traditional automakers, who lack significant influence in the new energy sector, encounter as the electric vehicle trend sweeps across the country?

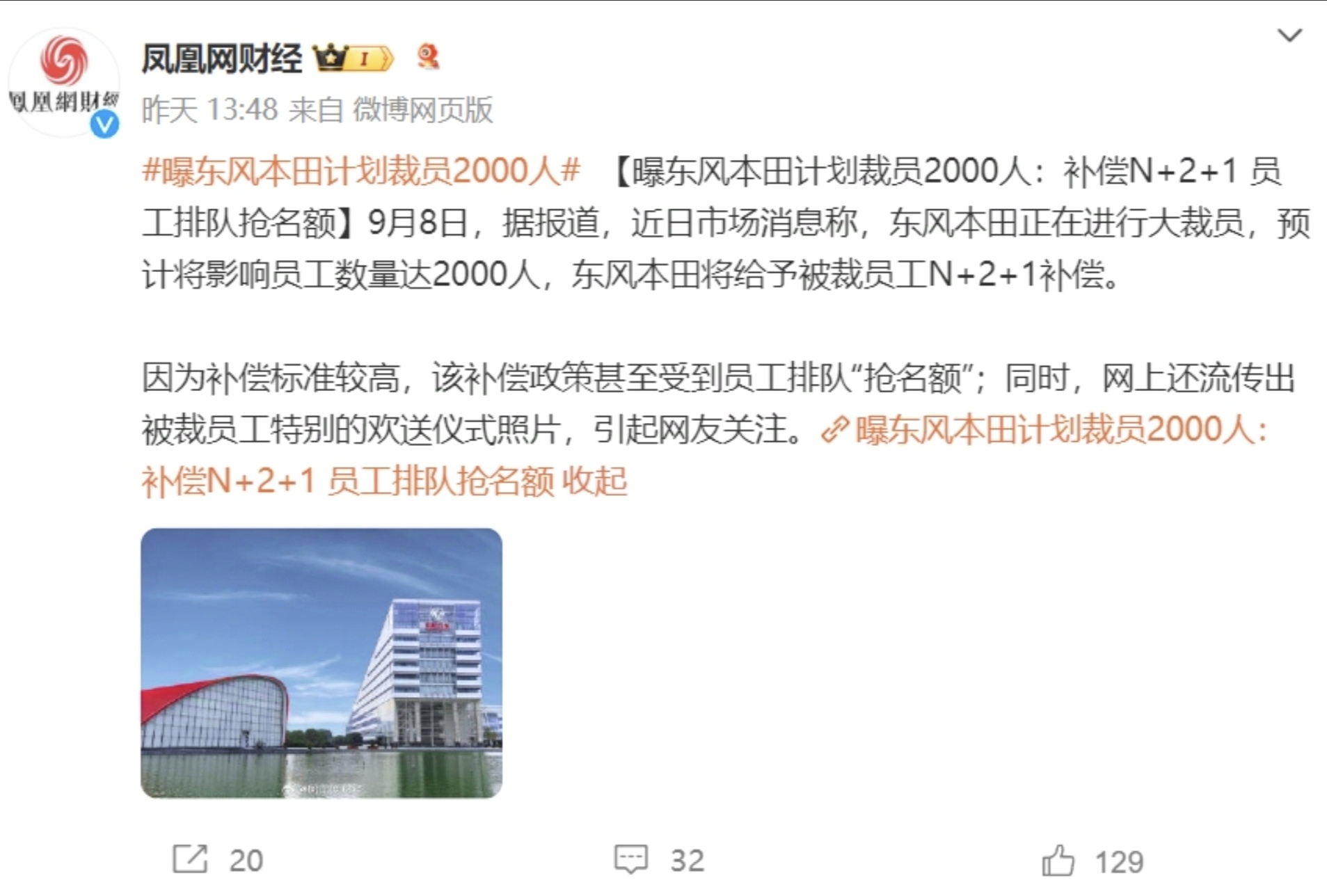

On September 9, reports from ifeng.com Finance and IT Home claimed that Dongfeng Honda would implement a layoff plan affecting 2,000 employees, with laid-off workers potentially receiving "N+2+1" compensation packages.

For employees already considering leaving, this compensation package is indeed enticing. Moreover, due to the generous compensation standards, rumors have circulated online about employees lining up to compete for layoff positions. The blogger "Dianjuge Shuo Diandongche" revealed that Leapmotor set up a recruitment booth right outside Dongfeng Honda's second factory after hearing related rumors, offering jobs ranging from operators to senior managers.

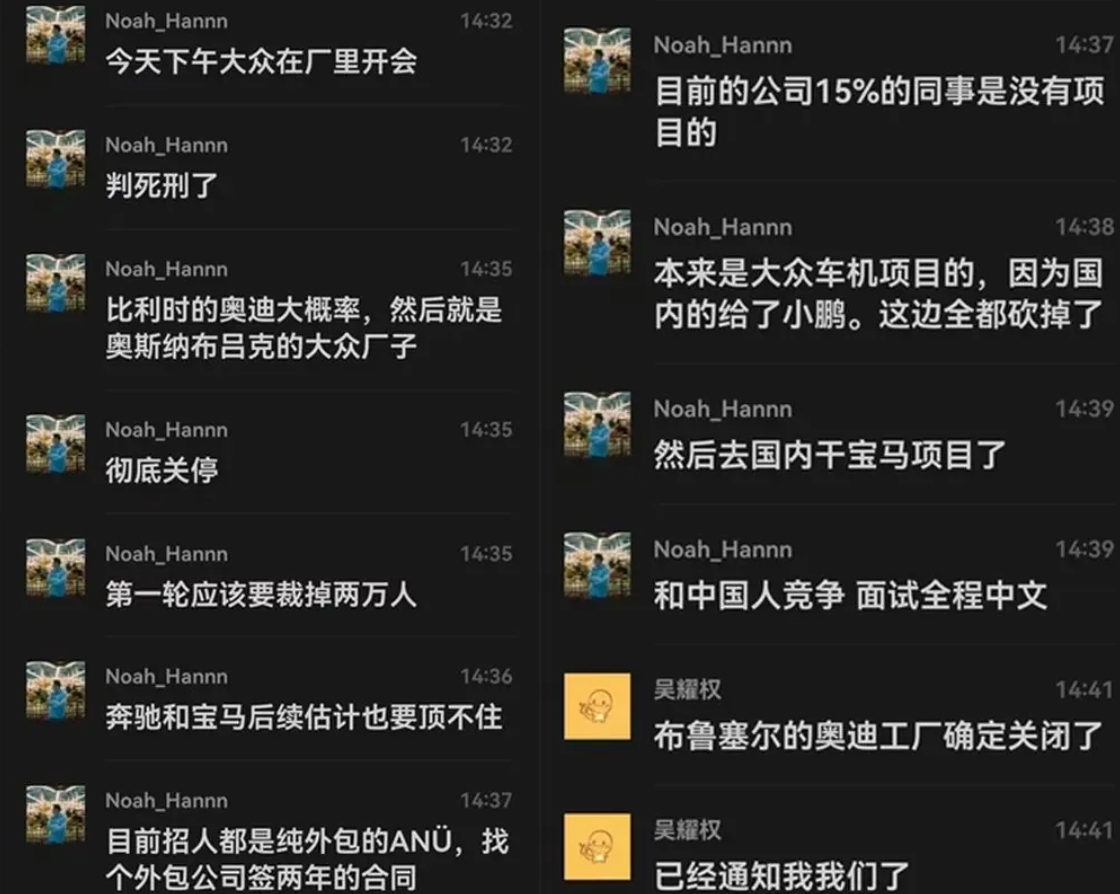

Coincidentally, on the same evening, news of layoffs at Volkswagen Group also emerged, with the first round potentially affecting 20,000 employees. Under the wave of layoffs at Volkswagen, overseas employees are being reassigned to BMW China. However, as of press time, neither Dongfeng Honda nor Volkswagen Group has responded to the layoff rumors.

Honda enjoyed significant appeal during the era of gasoline-powered vehicles. Both Dongfeng Honda and Guangqi Honda boasted multiple products with monthly sales easily exceeding 10,000 units. However, as the automotive industry transitions to electrification, Honda's market dominance has gradually declined. According to official figures, Honda's domestic sales in August reached 57,000 units, a year-on-year decrease of 44.3%, marking the second consecutive month of over 40% year-on-year decline.

Take Dongfeng Honda as an example. The Honda CR-V, which once easily sold over 10,000 units per month, sold only 9,673 units in July. Similarly, the Honda Civic, hailed as a "god car" by many young consumers, sold just 3,186 units in the same month. It's worth noting that the Honda Civic was once a regular top-10 finisher in domestic passenger car sales rankings.

With declining sales of gasoline-powered vehicles and inadequate transformation towards new energy vehicles, Honda in China is left with little choice but to rely on its existing customer base. Despite years of electric vehicle development, Dongfeng Honda, as a renowned automaker, cannot be unaware of the need for electrification. However, it seems unable to introduce products that can halt the decline in sales.

While layoff news remains uncertain, production capacity optimization is a fact

According to Honda China's official announcement, the company is optimizing production capacity to accelerate its electrification transformation. Dongfeng Honda will suspend operations at its second production line, with an annual capacity of 240,000 units, in November this year. Meanwhile, Guangqi Honda will close its fourth production line, with a capacity of 50,000 units, in October.

To accelerate electrification, Dongfeng Honda's new electric-specific plant will commence operations in September, while Guangqi Honda's new new energy plant will open in November.

From a market sales perspective, Honda currently lacks a truly popular new energy vehicle. Its official electrified models primarily rely on hybrid powertrains, with true "green license plate" vehicles like the Honda CR-V Hybrid and Honda e:N series experiencing dismal monthly sales. By suspending two production lines and investing in new energy plants, Honda is displaying a bold "burn the boats" mentality.

However, whether Honda can secure a foothold in the final electrification competition remains uncertain. On one hand, Honda's current new energy vehicle sales are dismal, especially for Dongfeng Honda's e:NS series and Guangqi Honda's e:NP series, which offer little incentive for consumers to make a purchase. On the other hand, Dongfeng Honda's upcoming Lingxi L, first unveiled at the Beijing Auto Show, has yet to provide much product information. Currently, only the news of its launch in the second half of this year is known, but the long time span is gradually diminishing user interest.

While Dongfeng Honda has Lingxi L in the pipeline, Guangqi Honda's electrification plan focuses on strengthening the e:NP series product matrix, aiming to launch five e:NP pure electric vehicles by 2027, effectively introducing one new model per year.

For Honda at this stage, allocating more production capacity to new energy vehicles is just the prerequisite for popularity. The urgent task is to attract more domestic consumers to pay for new energy products. As many traditional brands transition to new energy, even influential brands like Honda need to quickly win over domestic consumers or risk being ridiculed as a "no-name electric vehicle" by netizens.

Joint venture brands tread on thin ice

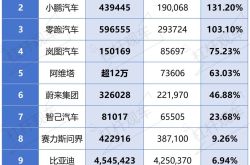

On September 9, the China Passenger Car Association (CPCA) released the latest passenger vehicle market report. Data showed that 1.905 million passenger vehicles were sold domestically in August, down 1.0% year-on-year but up 10.8% month-on-month. Among them, 1.027 million new energy vehicles were sold, up 43.2% year-on-year and 17% month-on-month, resulting in a new energy penetration rate of 53.9%, a record high.

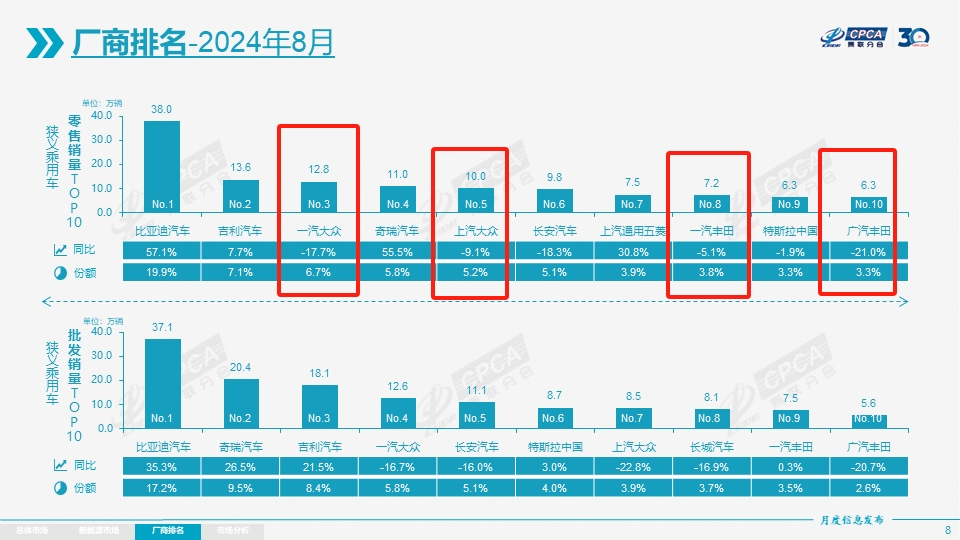

Therefore, in addition to Honda, other automakers relying primarily on gasoline-powered vehicles have been impacted to varying degrees by the automotive market. Looking at the top-selling joint venture brands, FAW-Volkswagen experienced a year-on-year decline of 17.7%, while GAC Toyota fared even worse with a staggering 21.1% year-on-year drop, the largest among the top 10 automakers in August sales.

Reviewing Toyota's new product planning in the domestic market, most new vehicles are facelifts, with only the all-new Camry, Prado, and Crown as genuinely new models. There are no new energy products. From the cumulative sales data for the first seven months, the Fenglanda is Toyota's only domestic model to surpass 100,000 units sold, while the Corolla Cross, RAV4, and RAV4 Hybrid also boast cumulative sales exceeding 95,000 units. However, star models like the Wildlander, Camry, and Corolla have sold over 50,000 units, while the Highlander, Levin, and Asia Dragon have experienced notable sales declines.

As for Nissan, Dongfeng Nissan seemingly relies heavily on the Sylphy and Qashqai, with other models contributing little. Its sole pure electric vehicle, the Ariya, holds virtually no sway in the market.

Among Japanese brands, Toyota demonstrates a strong sense of transformation, but its bZ series, which attracted sales through price cuts in the first half of the year, has seen diminishing returns from this strategy in the second half. In July, the Toyota bZ3 sold just 4,156 units, down from over 5,600 units in May.

Similarly, Volkswagen brands continue to rely on price cuts to attract customers. The new SAIC Volkswagen Tharu, launched at the Chengdu Auto Show, offers a "limited-time one-price" starting at 79,900 yuan, aiming to lure more family buyers. However, Volkswagen ID.4, ID.6, and ID.7 continue to underperform, with ID.3 still relying on price cuts to boost sales. Faced with the new energy transformation, joint venture brands seem unable to find effective strategies.

In contrast, Toyota appears to have pioneered a "breakthrough" approach. According to its plan, Toyota will focus on "range" and "intelligent driving equality." To address range anxiety, Toyota will develop solid-state batteries, with plans to equip vehicles with them starting in 2026. Initially, these vehicles will achieve a WLTP pure electric driving range of 1,000 km, which will later be extended to 1,200 km. Regarding "intelligent driving equality," GAC Toyota will introduce the Bozhi 3X, a model priced below 200,000 yuan, equipped with an L2++ advanced intelligent driving system.

In Lei Tech's view, Toyota's "breakthrough" approach involves seeking new advantages in the new energy market. Multiple new energy vehicles have proven that joint venture brands, with their current technology, are unlikely to compete effectively against domestic brands. Thus, Toyota's strategy is to "blaze new trails" and "build up strength" by leveraging technological leadership to gradually regain its market position.

Of course, for Toyota, such a move is undoubtedly a "big bet." However, compared to other joint venture brands' strategies of "trading price for volume" and "head-on competition," Toyota's plan appears more promising.

The electrification transformation of joint venture brands remains challenging. Even after launching relevant new energy flagship models, sales figures remain mediocre, providing opportunities for other new energy brands.

Take Leapmotor, which attempted to "poach" employees this time, as an example. Although its domestic influence pales in comparison to traditional automakers, Leapmotor boasts cost-effective advantages and consistently ranks among the top new energy vehicle brands in monthly sales, surpassing even veteran players like NIO and XPeng. It has even become the fourth Hong Kong-listed new energy vehicle startup.

Joint venture brands still possess influence and recognition. However, in the crucial moment of urgent electrification transformation, they have generally been slow to respond, resulting in a widening gap with domestic brands.

Of course, joint venture brands are not without opportunities. Years of technological and financial accumulation have equipped them with the capability to overcome current difficulties. However, if they fail to "go all in" now, no one can guarantee that some joint venture brands won't become the next "GAC Mitsubishi."

Source: Lei Tech