How should we respond as multiple parties begin to slow down their electric transformation?

![]() 09/11 2024

09/11 2024

![]() 656

656

Automakers with genuine strength will also help China's automotive industry nurture a mature and robust smart electric vehicle supply chain, thereby enabling participation in global market competition.

For a long time, the century-old internal combustion engine has been a 'burden' that many companies have sought to shed. However, just this year, the once-vigorous electric transformation in Europe and the United States encountered headwinds.

Mercedes-Benz Group stated that due to disappointing electric vehicle sales, the company will extend the sales period for internal combustion engine vehicles. Toyota Motor Corporation expects its operating income for this fiscal year to decrease by one-fifth, and it is relying on hybrid vehicles to address declining production. While BMW has performed better in electric vehicles, it has also pointed out issues such as rising manufacturing costs.

Just a week ago, Swedish automaker Volvo Cars announced that, amid the continuing struggles of the electric vehicle market, it has abandoned its goal of selling only electric vehicles by 2030.

Why withdraw the electric vehicle transformation goal?

Multiple factors drive the adjustments to electric strategies, one very practical reason being that, aside from a few automakers like Tesla and BYD, the electric vehicle businesses of most automakers continue to operate at a loss.

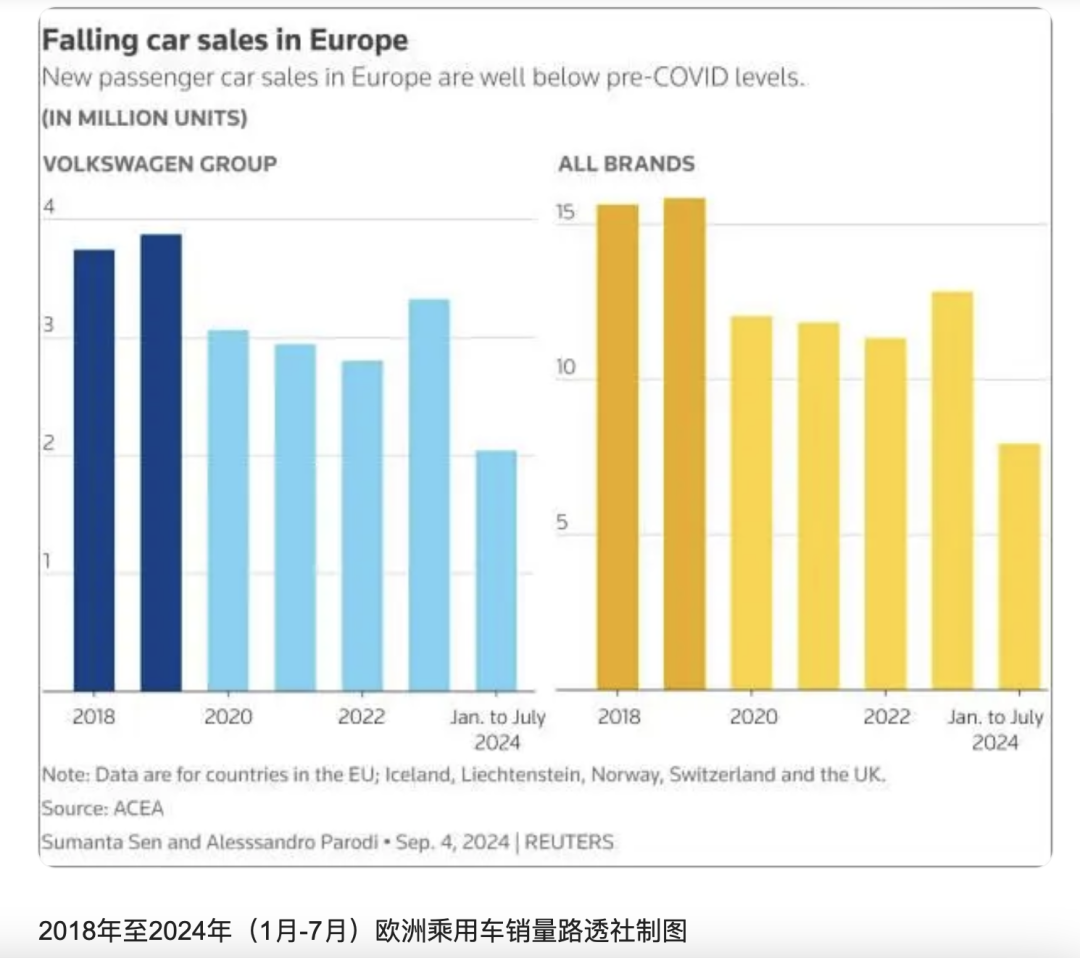

Taking Volkswagen Group as an example, affected by a combination of factors such as lackluster electric transformation, the threat of price wars, and weakening demand in the premium market, Volkswagen Group's previously announced first-half 2024 financial results were 'unsatisfactory.'

The data shows that while Volkswagen Group's revenue slightly increased in the first half of the year, profits declined sharply. In the first half, total revenue was €158.8 billion (approximately RMB 1.25 trillion), up 1.6% year-on-year, but operating profit fell 11.4% year-on-year to just €10.05 billion (approximately RMB 79.14 billion).

The financial reports of several other European automakers were also less than ideal, urgently requiring lucrative internal combustion engine vehicles to improve performance.

Affected by weak demand for electric vehicles and a downturn in the Chinese market, Mercedes-Benz's net profit in the second quarter declined 16% year-on-year, and by 20% in the first half year-on-year, prompting the company to revise downward its adjusted sales return rate for its core passenger car division for the full year. BMW Group's net profit in the first half declined 14.6% year-on-year, primarily due to intensified competition and weak demand in the Chinese market affecting revenue.

Automotive News Europe noted, 'German automakers are growing increasingly pessimistic about their prospects after experiencing a disappointing earnings season. During this earnings season, companies like Volkswagen Group and Mercedes-Benz have seen declining electric vehicle sales and weak performance in China.'

Electric vehicles have also suffered a severe setback in the American market across the Atlantic Ocean, with sales growth slowing significantly and even stagnating at times. Facing a rapidly cooling market, traditional American automakers that were previously actively transforming into electric vehicles have begun to unanimously slam on the brakes, cutting production or even abandoning electric vehicle models, instead resuming increased production of internal combustion engine vehicles.

Compared to its ambitious pursuit of electric vehicles just a few years ago, Ford Motor Company has significantly slowed its electric strategy after entering 2024, shifting from pursuing electric vehicle sales and market share to a more practical profit outlook.

According to Ford's current plans, it will prioritize the launch of more market-preferred hybrid models. In the field of electric vehicles, Ford will focus on the commercial vehicle market, planning to launch a commercial van in 2026 and two electric pickups in 2027. It is worth noting that the launch dates for these two electric pickups have already been postponed twice.

In terms of sales alone, Ford's electric vehicle growth is not poor, even ranking second in the US behind only Tesla. However, behind these sales lie significant losses.

In the second quarter of this year, Ford's electric vehicle division incurred a pre-tax loss of $1.1 billion, compounded by increased warranty costs for older vehicles eroding profits, ultimately resulting in a 4.5% year-on-year decline in Ford's overall net profit for the quarter and a 27% year-on-year decline in adjusted pre-tax profit. Ford also expects its electric vehicle division to lose between $5 billion and $5.5 billion in 2024.

This situation of selling electric vehicles at a loss is obviously not what Ford wants to see. According to Ford's adjusted strategy, if an electric vehicle cannot demonstrate a profit outlook within the first year of its launch, it is not worth releasing. In other words, Ford will not continue to sell more electric vehicles at a significant loss just to expand its market share in the electric vehicle segment.

As such, Ford has temporarily shelved the release of some electric vehicle models to strengthen the production of high-margin pickup truck models.

It is evident that not abandoning internal combustion engine products too early and relying on their strong profitability to reserve strength for subsequent electric transformation has become a common practice among many European and American automakers.

This also reveals that traditional automakers currently prioritize models that generate profits and have robust market demand, even if they emit significant amounts of emissions and are unrelated to environmental protection, such as pickup trucks. In the face of market sales and actual profits, the electric transformation strategy can only be temporarily sacrificed.

Chinese automakers frequently respond

Currently, the electric vehicle markets in Europe and the United States are at a stage of uncertain prospects. Taking the US market as an example, the high US loan interest rates have dampened consumers' willingness to purchase vehicles, while the high prices of electric vehicles, lack of public charging infrastructure, and severe depreciation of used electric vehicles have made consumers hesitant to buy electric vehicles for many reasons.

According to a recent survey by McKinsey, more than half (51%) of Tesla owners in the US chose to repurchase internal combustion engine vehicles when buying their next car, with 10% opting for hybrids, 6% for plug-in hybrids, and less than one-third (32%) choosing to continue buying electric vehicles.

The survey also revealed that nearly half (46%) of US electric vehicle owners prefer to switch back to internal combustion engine vehicles for their next car. Notably, this proportion of abandoning electric vehicles is significantly higher than the global average of 29%.

The biggest factor affecting electric vehicle sales is the lack of public charging infrastructure in the US.

Last year, the US Department of Energy's National Renewable Energy Laboratory estimated that the US would need 1.2 million charging stations by 2030 to achieve the Biden administration's goal of electric vehicles accounting for more than half of all vehicle sales. This charging network density significantly exceeds the Biden administration's expectations. Currently, there are fewer than 200,000 public charging stations in the US.

It is also undeniable that macroeconomic policy uncertainties have caused traditional automakers to temporarily adopt a wait-and-see approach regarding electric vehicle strategies. The current US presidential election is fiercely contested, and Trump has announced that if he is re-elected, he will revoke all electric vehicle subsidies and charging infrastructure construction plans implemented by the Biden administration, putting electric and internal combustion engine vehicles on an equal footing in competition.

Amid such uncertainties, traditional automakers already selling electric vehicles at a loss have even less incentive to continue investing in the electric vehicle sector.

Facing the gradual slowdown of electrification in Europe and the US, Chinese automakers have frequently responded.

Industry insiders point out that the lack of demand for electric vehicles in Europe and the US is partly due to their high individual prices. For example, the average price of an electric vehicle in the US is nearly $13,000 more expensive than that of an internal combustion engine vehicle, while local gasoline prices are cheaper than electricity prices. Meanwhile, US consumers have always preferred large vehicles, but in the era of electric vehicles, large vehicles imply large batteries, directly leading to a surge in raw material and other costs.

In terms of electric drive systems, manufacturing, and supply chains, China's advantages in the field of low-cost electric vehicles are already evident.

Taking pricing as an example, Chinese automakers, including BYD, have a cost advantage in the field of new energy vehicle manufacturing. For instance, the overseas selling price of BYD Dolphin is around €7,000 cheaper than Volkswagen's cheapest ID.3, and even the price of Volkswagen's ID.3 produced in China is more than half cheaper than the same model produced in Europe.

However, among European and American countries, only Tesla currently has outstanding production cost control capabilities.

Cui Dongshu, Secretary-General of the China Passenger Car Association, said, 'Technological challenges are one of the factors contributing to the slowdown in the pace of electrification (in Europe and the US). Currently, there are still many issues in terms of battery energy density, charging speed, and recycling in their batteries, and addressing these issues requires time and R&D investment, which are not feasible for European and American automakers to accomplish in the short term.'

At the same time, for automotive giants like Germany, the government's cancellation of electric vehicle subsidies reflects fiscal pressure and protection of the existing traditional automotive industrial structure.

It cannot be denied that some Chinese brands also face difficulties in profitability.

In July this year, the penetration rate of new energy passenger cars in China surpassed 50% for the first time, reversing positions with traditional internal combustion engine vehicles. However, only a handful of automakers can amortize production, R&D, and manufacturing costs on a large scale. Nevertheless, this does not mean that the Chinese automotive market has lost its profitability.

Cui Dongshu also stated that the overall profit levels of Chinese automakers have not declined significantly. The current changes in corporate profits are more of a manifestation of profit diversion.

Therefore, even though automakers have invested heavily in technologies such as electric drive systems, software, and hardware during their development process, becoming a major factor affecting automakers' profits, possessing and promoting mature technologies can also bring substantial returns to automakers.

Taking Thalys as an example, in the first half of this year, the company achieved a net profit of RMB 1.405 billion in the second quarter, a year-on-year increase of 295.4%. Analysts believe that this is inseparable from the strong growth and technological advancements in Thalys' new energy vehicle business. Thanks to Huawei's technological support and vigorous promotion in intelligent driving, Thalys has gained recognition in the market and achieved a large-scale cost reduction strategy.

As the technology provider, Huawei's Automotive BU is also gradually moving towards profitability through the empowerment of HarmonyOS Intelligent Driving. Richard Yu, Chairman of Huawei Intelligent Solutions BU, stated in August that the BU will officially achieve profitability by the end of this year.

However, even as many automakers gradually drop out of the technological and scale elimination race during the electric vehicle development process, automakers with genuine strength will help nurture a mature and robust smart electric vehicle supply chain for China's automotive industry, thereby enabling participation in global market competition.

Note: Some images are sourced from the internet. Please contact us for removal if there is any infringement.