E-commerce chaos feeds Hive Box

![]() 09/11 2024

09/11 2024

![]() 631

631

Huang Zheng is really something.

By proactively exposing risks and shockingly announcing that shareholders would not be rewarded for several years to come at the earnings call, he has set a precedent among Chinese ADRs. Terrified investors responded by voting with their feet, causing Pinduoduo's share price to plummet by more than 30% intraday on the day of the earnings call.

Behind this anticipated move of spreading rumors and causing panic, Pinduoduo has its own concerns.

Over the past two years, whether to defend their own turf or gain incremental market share, the "lowest price across the entire network" comparison system has become a standard feature of all e-commerce platforms, triggering a series of skirmishes against Pinduoduo. These awakened competitors have caused Pinduoduo, which has consistently maintained counter-cyclical growth, to show signs of slowing down, prompting management to become increasingly vigilant.

Regardless of how capital is gambled, it is ultimately the consumers who benefit the most from price wars involving all platforms, as they enjoy abnormally low prices for goods and even free shipping on returns.

While mainstream e-commerce platforms are biting the bullet and sacrificing profits to subsidize users, Hive Box, which recently submitted its IPO application to the Hong Kong Stock Exchange, has unexpectedly emerged from years of losses to achieve profitability.

As a courier service provider with a shared fate with e-commerce platforms, Hive Box should have struggled during the upstream melee, but how did it achieve this turnaround?

I. More affordable reverse logistics services

Regular shoppers are likely familiar with Hive Box lockers in their apartment buildings. After each shopping spree, the symphony of locker doors opening to deliver their purchases brings immediate gratification. Hive Box's primary business is providing the last 100 meters of delivery services through its smart lockers.

Couriers play a crucial role in e-commerce by ensuring smooth and efficient delivery of purchased goods, and the rise of the e-commerce industry has, in turn, fueled the growth of the courier industry, creating a mutually beneficial relationship.

However, as the growth rate of the e-commerce industry slows to low single digits, growth has become an obsession for many platforms. To attract consumers, e-commerce platforms have implemented more aggressive policies in recent years, offering extreme discounts and even mandating that sellers provide shipping insurance to cover return shipping costs.

With platforms condoning such behavior, consumers have not hesitated to take advantage. From 2021 to 2023, the return rate for branded stores increased from 24% to 35% in the first half of 2024, while the return rate for e-commerce platforms peaked at 60%.

This has directly led to a surge in demand for reverse logistics services (typically used for returns or exchanges). From 2019 to 2023, China's e-commerce reverse logistics volume grew at a compound annual growth rate of 22.7%.

As the largest owner of smart locker networks in China, Hive Box has captured a significant portion of this growing reverse logistics demand. The company's revenue from consumer smart delivery services grew rapidly from 150 million yuan in 2021 to 1.02 billion yuan in 2023, at a compound annual growth rate of 161.32%.

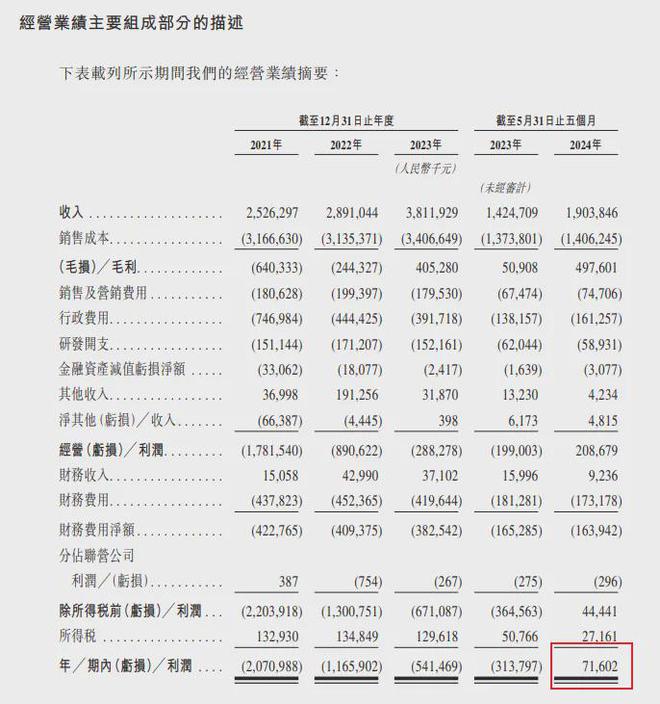

After three consecutive years of losses, Hive Box turned the corner and became profitable in the first five months of this year.

In addition to its abundant locker resources, Hive Box's ability to offer more affordable return shipping services is another major factor contributing to its significant improvement in performance.

As shipping insurance compensation mechanisms have expanded, "wool pullers" have emerged, exploiting loopholes in these rules to profit from shipping rate differences. They often target merchants offering shipping insurance, place orders, and then return the items. Since shipping insurance typically covers a fixed amount of around 12 yuan, but self-shipped returns can cost as little as 5 yuan, these individuals can earn a profit of 7 yuan per return, enough for a meal.

Hive Box's smart lockers facilitate centralized package collection, reducing transportation costs for courier companies. This advantage allows Hive Box to negotiate more favorable logistics procurement prices, enabling it to offer lower return shipping rates. Lower shipping rates mean more profit margins for "wool pullers," making Hive Box a preferred choice.

Leveraging the growth in upstream reverse logistics demand, Hive Box has leveraged its advantages to win over consumers and turn around its performance. However, the company recognizes that whether offering returns or storage services, its core business remains focused on smart lockers. In today's volatile business environment, diversification is the key to long-term success.

But every additional business line brings with it additional costs, making stable profitability elusive as the costs of diversification continue to rise.

II. Irreducible Costs

In its early days, Hive Box primarily generated revenue from couriers depositing packages and customers retrieving overdue packages, leading to a limited profit model and high operating costs. With each locker costing tens of thousands of yuan and Hive Box owning 330,000 smart lockers, the pressure on its cost structure was immense.

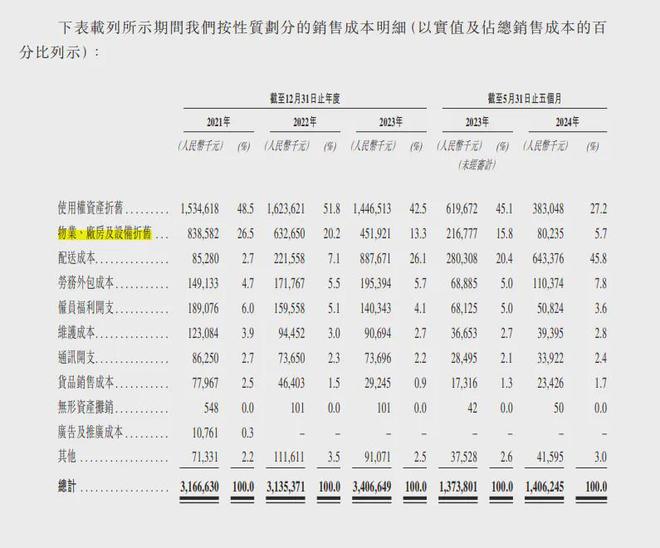

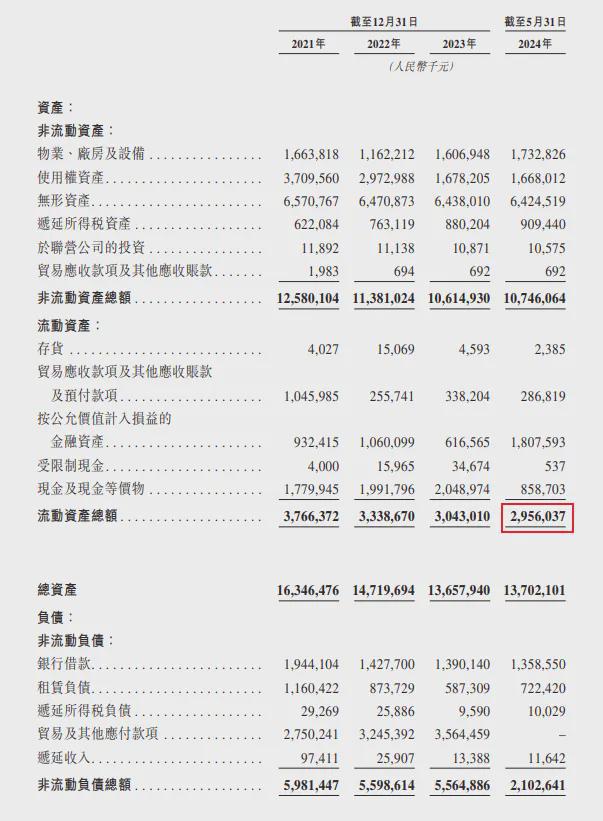

As of the first five months of this year, 88.9% of Hive Box's 1.73 billion yuan in property, plant, and equipment was attributed to its smart lockers. In 2021, 47.1% of its 3.71 billion yuan in right-of-use assets was also tied to smart lockers, contributing to depreciation expenses that accounted for 74.9% of total sales costs that year.

The significant upfront investment in fixed assets was the primary driver of Hive Box's initial losses.

However, by the end of 2023, some Hive Box smart lockers that had been in operation for more than five years had fully depreciated, reducing the depreciation expenses included in sales costs. This significantly improved the company's profitability, with a gross margin of 26.1%, nearly 16 percentage points higher than the previous year.

In the first five months of this year, Hive Box's sales costs amounted to 1.41 billion yuan, with depreciation of property, plant, and equipment contributing 460 million yuan, a year-on-year decrease of 61.4%. This depreciation accounted for only 5.7% of total sales costs, as depreciation of smart lockers in right-of-use assets had already been completed.

The reduction in depreciation expenses, like the increase in consumer payments, played a crucial role in turning around Hive Box's profitability. As total revenue grew by 36%, sales costs increased by only 2.4% year-on-year, resulting in a substantial improvement in short-term profitability.

To diversify its revenue streams beyond smart lockers, Hive Box ventured into new businesses such as service stations, laundry, and smart locker rentals. However, expanding into these new areas proved costly. As of the first five months of this year, delivery costs increased by 129.5% year-on-year, far outpacing the reduction in smart locker depreciation.

While fully depreciated smart lockers continue to generate revenue at zero cost, the savings from these lockers cannot keep pace with the escalating costs of new business initiatives. The temporary boost to profitability from depreciation completions is ultimately fleeting.

It is worth noting that some of the revenue growth fueled by upstream competition may not be sustainable, as evidenced by Pinduoduo's self-disclosure.

III. Uncertainty in the Future

While upstream competition has benefited Hive Box, the forced low pricing and shipping insurance practices in the industry are concerning. An industry that relies on cutting costs to satisfy consumer demands is unsustainable and will eventually harm long-term development by passing on costs to end-users.

Pinduoduo's self-disclosure highlights its wavering stance towards merchants, balancing between tightening the screws and easing the burden. However, over-exploitation of commercial traffic and increased commission income will inevitably have negative impacts on long-term operations, a realization shared by Pinduoduo's competitors.

In July, Douyin introduced incentives for merchants, including commission-free product listings and reduced deposit and technical service fees. Starting in August, Alibaba abandoned low-pricing strategies for some products. While not completely abandoning low prices, mainstream e-commerce platforms are shifting towards prioritizing GMV growth and industry health.

The easing of upstream e-commerce competition suggests a potential decrease in shipping insurance coverage and return rates, posing a risk of slower growth for downstream players like Hive Box.

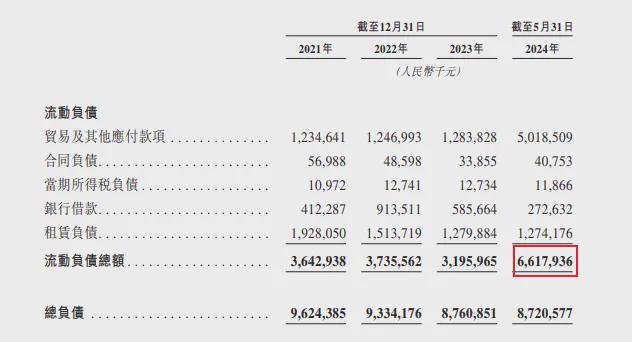

As of the latest data, Hive Box's current liabilities exceed its current assets by more than two times. Most of its current liabilities are trade payables to smart locker maintenance and reverse logistics service providers. Like upstream e-commerce platforms, Hive Box is also bleeding to offer more affordable services to consumers, essentially exchanging profits for growth.

Faced with high liquidity risks, Hive Box is eager to list and change its fortunes.

According to the Hurun Global Unicorn Index 2024, Hive Box is currently valued at up to 25 billion yuan. Given its unstable profit history, a price-to-sales (PS) valuation is adopted. With revenue growing at a year-on-year rate of 36% in the first half of the year and expectations of a 30% full-year growth due to events like Singles' Day, Hive Box is projected to generate 4.95 billion yuan in revenue. Based on a valuation of 25 billion yuan, Hive Box's pre-IPO PS ratio is 5, significantly higher than the average PS of around 1 for logistics and transport companies listed in Hong Kong.

Valuation reflects the market's expectations based on a company's development prospects. With unclear revenue and profit growth paths and a lack of long-term certainty, how can Hive Box convince the secondary market to pay a premium valuation far above industry averages? The risk of post-IPO valuation erosion is not insignificant.

Conclusion

While Hive Box has achieved impressive short-term results fueled by upstream competition, as both sides begin to recognize the destructive nature of their conflict, the benefits for the bystander will diminish.

Long-term success requires a focus on compound growth. When all companies in an industry thrive, competition is beneficial. However, when they all struggle and performance suffers, ineffective low-quality competition must cease. For the current e-commerce landscape, the higher growth rate of reverse logistics than forward logistics indicates that actual demand may not be as high as perceived. The high return rate is essentially a short-term phenomenon fueled by industry competition, casting doubt on Hive Box's long-term prospects built upon this foundation.