Takeout platforms compete for the first release of iPhone 16, will consumer electronics flood the instant retail market?

![]() 09/12 2024

09/12 2024

![]() 484

484

An Apple Authorized Reseller employee told Leitech that on the first day of the iPhone 15's release last year, they received more orders on Ele.me than they sold in three months offline.

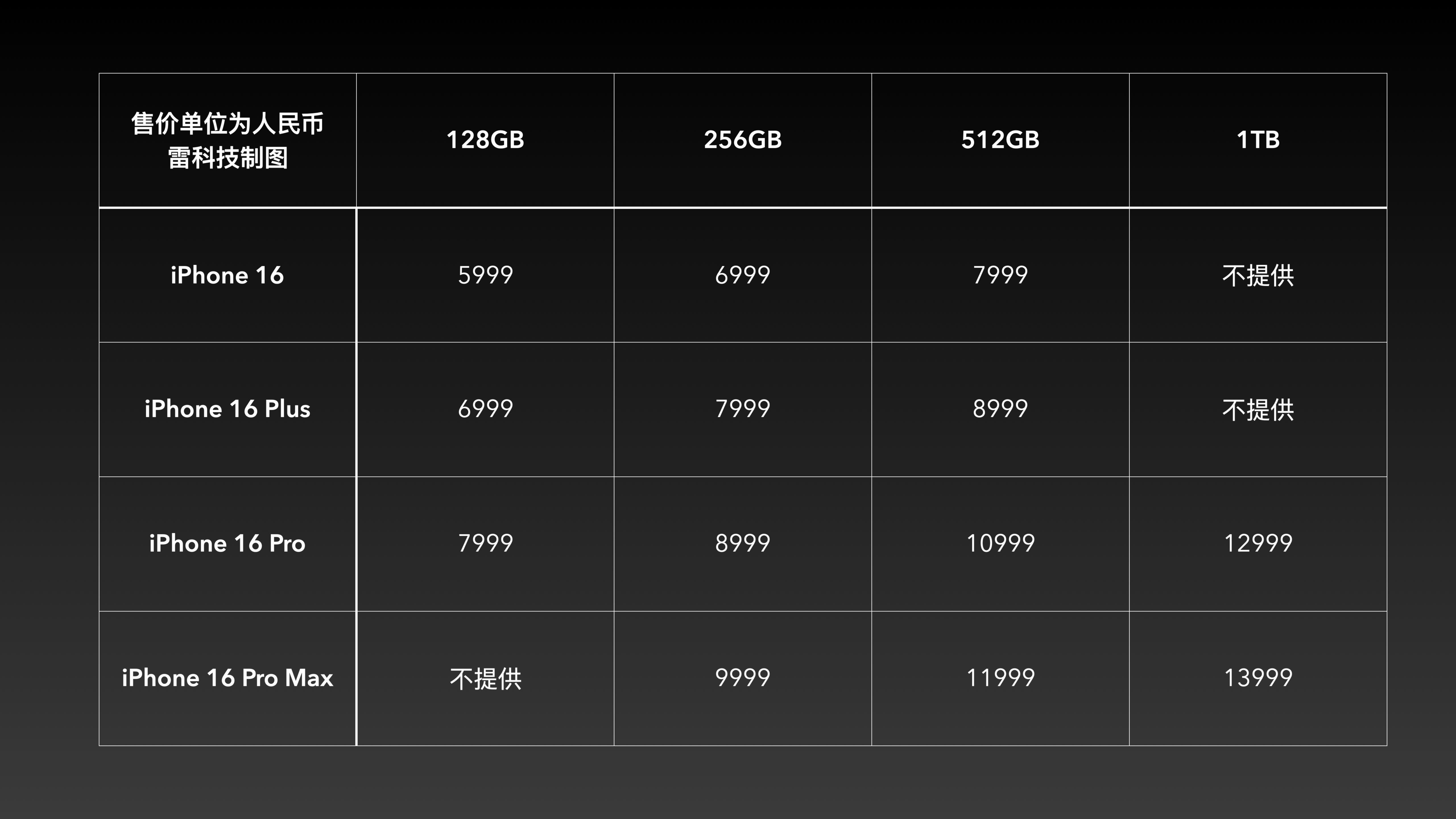

Apple released the iPhone 16 series on September 10. As the first AI-powered iPhone, the iPhone 16 series introduces numerous updates, including the second-generation 3nm A18/A18 Pro chip, an independent camera button, and a larger screen. More importantly, the iPhone 16 series offers "more for the same price": the starting prices for the iPhone 16 and iPhone 16 Plus are 5,999 yuan and 6,999 yuan, respectively, while the iPhone 16 Pro and iPhone 16 Pro Max start at 7,999 yuan and 9,999 yuan, respectively, matching the prices of the iPhone 15 series. "More for the same price" is effectively a price reduction, making the iPhone 16 series attractive to Apple users seeking an upgrade.

(Image source: Leitech)

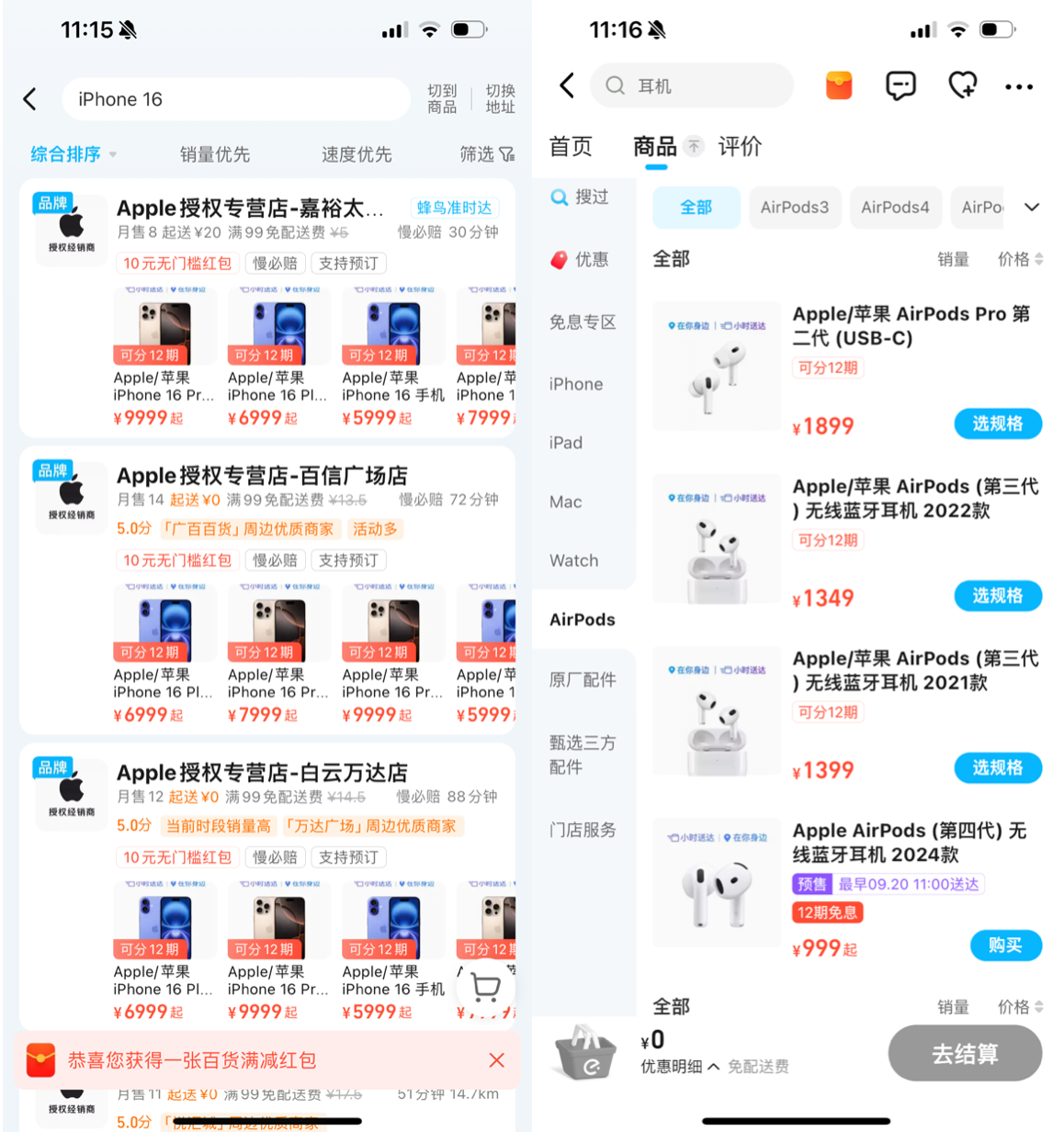

Apple has announced that pre-orders for the entire iPhone 16 series will begin on September 13, with sales commencing on September 20. Similar to last year, major e-commerce platforms are competing to offer the first release of the iPhone 16, with a particular focus on takeout platforms that offer "buy and get immediately." Shortly after Apple's event, Ele.me announced its collaboration with nearly 4,000 Apple Authorized Resellers to support pre-sales and on-day sales of the new iPhone 16. On the day of the official release (September 20), Ele.me customers can receive their new phones within half an hour of purchase.

Is selling phones on takeout platforms just a marketing gimmick? The answer is no. For takeout platforms, digital and 3C products have become core categories, while for these product categories and more, takeout platforms have emerged as the "third pole" beyond traditional e-commerce and offline retail.

Are users so eager to buy the iPhone 16 via takeout delivery that they don't want to wait?

This isn't the first time platforms like Ele.me, Meituan, and Hema have competed for the first release of a new iPhone. In May 2023, Ele.me welcomed its first batch of over 500 Apple Authorized Resellers, offering a full range of products including iPhones, iPads, and Watches. Last year, during the first release of the iPhone 15, Ele.me successfully stood out by selling iPhones. Today, the number of Apple Authorized Resellers on Ele.me has grown to nearly 4,000, covering 335 cities, with popular sales of iPhone 15 and iPhone 14 series, as well as iPads, ahead of the new product launch.

(Image source: Ele.me App)

Users accustomed to purchasing phones on traditional e-commerce platforms may wonder why so many people choose takeout platforms. Many might first think of "emergency scenarios," such as when one of Leitech's friends accidentally dropped their iPhone down the drain and immediately asked their roommate to order a replacement on Ele.me for immediate delivery and use. Leitech has encountered similar situations before, like forgetting charging cables and adapters while on a business trip to Shanghai and having them delivered promptly by Ele.me's Blue Knight delivery service.

While "emergencies" are not high-frequency necessities, the fundamental reason users prefer takeout platforms for phone purchases is their habit of instant retail with "zero wait" times. Apple fans looking to be among the first to experience the new iPhone 16 want to get their hands on it as soon as possible, as the sense of fulfillment and excitement differs significantly based on how early they receive it. Enthusiasts in the tech world can attest to this. Currently, takeout platforms offer the most efficient delivery. Theoretically, users could also buy phones in-store, but inventory might not be available, and traveling to and from the store takes time. Given that the first release day falls on a Friday (September 20), office workers are unlikely to make a special trip just for a phone.

(Image source: Ele.me App)

Furthermore, Ele.me consistently offers value-added services like installment payments, sealed packaging, and dedicated delivery, some of which are even more detailed than those provided by official websites and e-commerce platforms.

Another advantageous scenario for instant retail is gift-giving. During holidays like New Year's, Chinese Valentine's Day, and Mid-Autumn Festival, placing an order on a takeout platform is the fastest way to send an iPhone as a gift, offering the best experience for both the giver and receiver. Offline gift-giving scenarios involve higher decision-making and execution costs, while e-commerce platforms come with uncertainty in delivery times. Even if you buy a gift for someone, they still have to wait for the package. Takeout platforms, on the other hand, offer immediate delivery with high certainty and a sense of ceremony, making them a popular choice for gift selection.

Ele.me's backend data shows that sales of products commonly gifted, such as iPhones, AirPods, Apple Watches, and iPads, peak around holidays like New Year's, Chinese Valentine's Day, and Mid-Autumn Festival. During the upcoming new product season, it's expected that many users will purchase iPhone 16s on Ele.me as gifts.

Once users experience the convenience of instant retail, they won't go back

Users have long been accustomed to purchasing everything on takeout platforms, and instant retail has become the biggest growth driver for the e-commerce industry in recent years. According to the "China Instant Delivery Industry Research Report" released by Ele.me's New Service Center in collaboration with iResearch Consulting, the local instant e-commerce industry now exhibits three key characteristics: full-time coverage, comprehensive category offerings, and all-scenario services. These features have opened up broader new spaces and incremental development opportunities for local commodity retail and lifestyle services. Over the next five years, the instant delivery industry is projected to double in size, from approximately 341 billion yuan in 2023 to over 810 billion yuan in 2028, becoming a rare bright spot with consistent double-digit annual growth.

During the pandemic, users turned to takeout platforms for groceries and daily necessities mostly out of necessity, but the habit of instant retail shopping persisted due to its exceptional experience. Ordering with a few taps on a takeout platform and waiting at home for about half an hour to receive the goods offers a far superior shopping experience compared to offline or online shopping, which involves travel time, queuing, and product selection.

What is the significance of "instant" in instant retail? Consider this analogy: While we can theoretically chat with friends via email for free, people prefer using instant messaging (IM) platforms like WeChat because of the certainty in message delivery and receipt. It's not a technical issue but a habit; you trust that the recipient will see and reply to your message promptly. This certainty is akin to what instant e-commerce offers, as opposed to the uncertainty associated with email. In essence, the "instant" nature of instant e-commerce and instant messaging share the same core values: high certainty, minimal waiting time, and seeing is believing.

(Image source: novochat.co)

Why do many Apple fans continue to think of iPhones even when Apple's innovations seem lackluster? It's because of the excellent experience that's hard to give up. Instant retail, with its short wait times, low time costs, and superior shopping experience, creates a similar effect, making users unlikely to return to traditional shopping methods. Data shows that China's instant retail user base is growing rapidly, with young people comprising a significant portion who demand faster delivery than other age groups. According to iResearch Consulting, post-85s and post-90s individuals account for over 64.6% of instant retail users. An Accenture study reports that over 50% of post-95s consumers expect to receive their purchases on the same day or even within half a day. Driven by food delivery and the pandemic, young people have grown accustomed to purchasing everything on instant retail platforms like Ele.me.

The competition among takeout platforms for the first release of the iPhone 16 is a microcosm of the rapid popularization of instant retail.

Ele.me sells iPhones, turning instant retail into a second growth curve

Ele.me's involvement in selling iPhones is not a spur-of-the-moment decision but part of a long-term strategy in the digital and 3C space.

In previous years, Ele.me primarily focused on food delivery and didn't give much attention to digital and 3C products. Some local dealers of these products "spontaneously" opened takeout stores on Ele.me to acquire orders, eventually leading to the official entry of major brands like Huawei, Xiaomi, OPPO, and Vivo. For example, Huawei collaborated with Ele.me for the first release of its flagship Mate 40 series in 2020. Later, Ele.me officially embraced digital and 3C products in instant retail. In September 2022, over 3,000 Xiaomi stores nationwide joined Ele.me, followed by Suning.com becoming the first home appliance and 3C chain retailer to enter the platform in May 2023, with all 600 of its initial stores successfully listed, offering over 3,000 mobile phones, PCs, and home appliances.

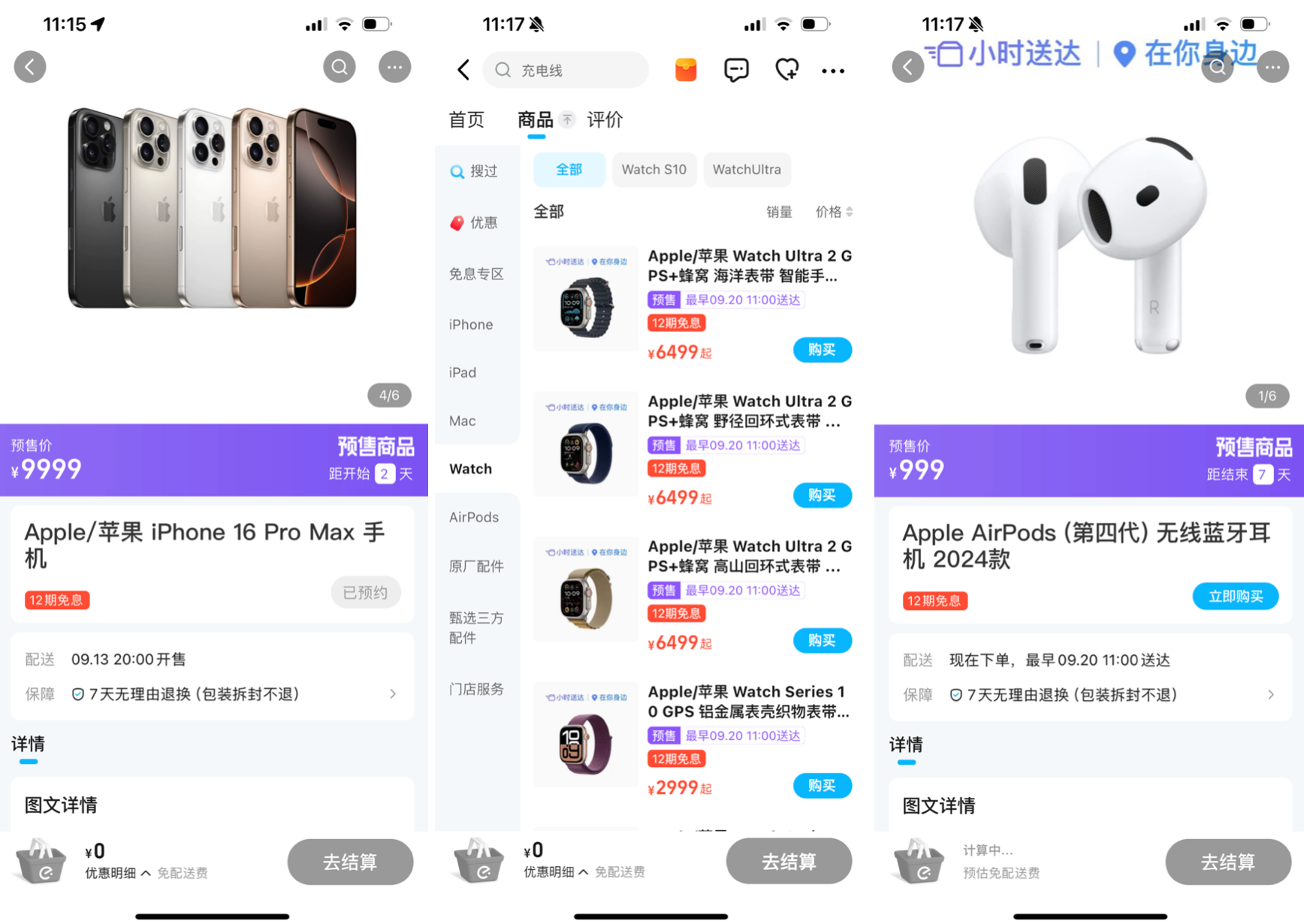

(Image source: Ele.me App)

Why are takeout platforms increasingly reliant on Apple and others? There are three main reasons:

1. Naturally arising demand on the platform. As mentioned earlier, some local digital and 3C merchants proactively opened takeout stores to acquire orders, while consumers gradually grew accustomed to searching for and purchasing everything on takeout platforms during the pandemic. As supply and demand strengthened, the platform's role became organizing the supply side more systematically, offering value-added services like interest-free installments and dedicated delivery, efficiently connecting supply and demand, and creating opportunities for local merchants to transform online, attract younger customers, and increase business.

Thus, the demand for instant retail didn't emerge out of thin air but naturally grew on the platform.

2. Finding new growth beyond food delivery. Food delivery is the foundation and core business of takeout platforms, but it faces a limitation: users only need three meals a day, perhaps with an additional snack or afternoon tea. So, how can platforms sustain growth when everyone orders food on them? The answers are twofold: a) offer more personalized dining experiences, like fruit cutting or expanded afternoon tea options, by "digging deeper" into dining scenarios; b) expand into non-food categories like 3C digital products, beauty products, pharmaceuticals, daily necessities, and general merchandise, all of which are comparable markets to food and theoretically sellable on takeout platforms.

Takeout platforms have consistently pursued this strategy, strengthening their food delivery base while expanding into key industries like pharmaceuticals, fresh produce, supermarkets, alcohol, and general merchandise to enrich their product offerings. In March 2023, Ele.me clearly outlined its long-term strategy of "1+2," where "1" represents maintaining a healthy growth as a home delivery dining platform that understands consumers better, and "2" represents two new growth tracks: instant retail with Ele.me's unique characteristics and an instant logistics network for market value expansion.

3. Maximizing delivery capacity utilization. The city's instant logistics network, Fengniao, and its underlying supercomputing platform are the cornerstones of Ele.me. With over 4 million active riders annually, Ele.me uses its merchant and logistics supercomputing platforms to manage tens of millions of orders daily.

Food delivery exhibits clear "peak and off-peak" patterns, with lunch and dinner being the busiest times, especially at noon. Orders drop significantly during other hours. However, instant retail orders are more evenly distributed throughout the day. Therefore, more instant retail orders can theoretically balance delivery capacity, allowing riders to take on more orders, earn more money, and improve the platform's overall efficiency.

In fact, the growth of non-food instant retail orders has helped Ele.me significantly improve operational efficiency, drive unit economic benefits, and narrow losses. Alibaba's fiscal year 2024 (Q2 2023 to Q1 2024) saw robust order growth on Ele.me, driving a 19% year-on-year increase in quarterly revenue for the Local Life Group, reaching 59.802 billion yuan annually. The group has achieved 10 consecutive quarters of loss reduction since Q4 2021, with over 25% reduction in fiscal year 2024.

In conclusion, Ele.me aims not just to be a digital and 3C marketplace but a retail platform offering any product with "30-minute (or faster) delivery," potentially evolving into a "local version" of the all-purpose Taobao in the long run.

Why are platforms like Douyin, Kuaishou, and JD.com intensifying their efforts in local life services? It's unlikely they aim to redo food delivery; instead, they're eyeing the trillion-yuan instant retail market. As one of the few new frontiers in e-commerce and the internet industry, the instant retail sector is becoming increasingly competitive, with Ele.me already well ahead of the game.

More categories like digital and 3C products are rapidly embracing instant retail.

Recently, Leitech provided in-depth coverage of IFA (Internationale Funkausstellung Berlin), the world's leading trade show for consumer electronics and home appliances, in Berlin, Germany. All 2,200 participating digital and 3C home appliance brands, including Hisense, TCL, Haier, Changhong, Midea, Dreame, NARWAL, DJI, and Insta360, made a strong impression. However, Leitech also observed widespread anxiety among brands as AI concepts have been discussed from CES to IFA, yet products remain highly homogenized without revolutionary technologies or showcases. While it might be inappropriate to say that digital and 3C home appliances are in their "twilight years," it is undeniable that the industry desperately needs growth breakthroughs.

(IFA exhibition hall surrounded by Chinese brand advertisements, source: Lei Technology on-site filming)

Taking TVs as an example, according to data from Runto Research, in the first half of the year, the total shipments of branded TVs in the Chinese mainland market reached 16.39 million units, a year-on-year decrease of 4.2% from 2023. In fact, most categories are either declining or slightly increasing, due to various factors such as the macro environment and the lack of disruptive new technologies that can attract users to upgrade. How to break through growth? IFA showcases the "external competition" for overseas expansion; in the Chinese domestic market, channel transformation should be a top priority.

In 2024, after the decline of traditional stores such as GOME, the offline business format of 3C digital appliances is undergoing a major reshuffle. For example, stores of Huawei and Xiaomi are paying more attention to "selling cars"; other examples include IFLYTEK and DJI, which have accelerated the pace of offline store construction. Regardless of the changes, instant retail remains one of the few new formats with remaining dividends.

For 3C digital appliance brand stores, instant retail is not just about orders; it's also an important opportunity to inventory channel resources and achieve digital transformation.

An employee at an authorized Apple store revealed to Lei Technology that on the first day of iPhone 15's launch last year, they received more orders through Ele.me than they sold offline in three months. At the same time, many users only discovered their store's existence after placing orders on Ele.me, and only after being endorsed by the platform did they believe they were genuine authorized stores. They later made repeat purchases through Ele.me and in-store visits.

In summary, by embracing instant retail platforms represented by Ele.me, stores can achieve the following:

1. Expand their business radius, shifting from a passive wait-and-see approach to a proactive customer acquisition strategy.

2. Capture online traffic, increase store orders, and improve operational efficiency.

3. Explore home services, such as on-site screen protection installation, mobile phone repairs, and home appliance repairs.

4. Leverage online marketing, turning the store's online presence into a virtual business card, seizing key marketing moments, and utilizing platform tools to enhance visibility.

Digital 3C appliance brands such as Huawei, Xiaomi, and Apple are already taking action. Lei Technology believes that more digital 3C appliance brands, and even more categories, will join Ele.me and embrace the instant retail wave.

Source: Lei Technology