Li Xiang's sales defense: Price concessions lead to lower gross margin

![]() 09/12 2024

09/12 2024

![]() 477

477

Amidst fierce competition in the automotive market, Li Xiang Auto (02015.HK) is showing signs of slower growth. In the first half of the year, Li Xiang Auto's revenue growth rate fell to its lowest level since its listing for the same period, despite still reporting a net profit of RMB 1.692 billion, a near 50% year-on-year decline. Notably, the company incurred an operating loss of RMB 117 million but ultimately achieved profitability thanks to its nearly RMB 100 billion in cash and investments.

Securities Star has observed that in balancing sales and profits, Li Xiang Auto chose to prioritize sales. Fueled by the popularity of its flagship model, the Li Xiang L6, Li Xiang Auto led the pack of new energy vehicle brands in sales during the first half of the year. However, the strong sales of the lower-priced L6 and price reductions across the product line negatively impacted the company's overall gross margin.

Currently, Li Xiang Auto, which made its name with extended-range electric vehicles (EREVs), is facing intense competition from peers. Since the beginning of the year, several automakers have launched EREVs, eyeing this niche market. While its core market is under pressure, Li Xiang Auto has also encountered setbacks in the pure electric vehicle (BEV) segment. Following the setback with the MEGA model, the launch of other BEV products has been postponed until the first half of next year, posing a significant challenge for the company as it expands into the BEV market.

01. Achieving profitability through financial investments

Despite exceeding expectations for full-year 2023 performance, Li Xiang Auto's revenue grew without a corresponding increase in profits during the first half of this year. While the company maintained profitability, its automobile sales performance was under pressure.

According to the company's mid-year report for 2024, Li Xiang Auto generated revenue of RMB 57.312 billion in the first half, up 20.8% year-on-year, but marking the slowest growth rate since its listing in August 2021. For comparison, revenue growth rates for the same periods in 2022 and 2023 were 112.38% and 159.31%, respectively.

In terms of revenue structure, vehicle sales contributed RMB 54.571 billion, up 17.87% year-on-year. The slower growth rate in vehicle sales compared to overall revenue was due to increased deliveries partially offset by a decline in average selling prices resulting from changes in product mix and pricing strategies. Additionally, other sales and service revenue amounted to RMB 2.741 billion, a significant 140.31% increase year-on-year.

On a quarterly basis, Li Xiang Auto generated revenue of RMB 25.634 billion and RMB 31.678 billion in the first and second quarters, respectively, representing year-on-year growth rates of 36.44% and 10.6%. Notably, the first quarter's revenue growth fell below the triple-digit rates achieved in the previous three quarters, while the second quarter saw further deceleration.

Securities Star notes that Li Xiang Auto's expenses surged in the first half of the year. Research and development expenses increased by 42.04% year-on-year to RMB 6.076 billion, primarily due to increased spending on expanding the product portfolio and technology, as well as higher salaries. Meanwhile, selling, general, and administrative expenses rose 46.48% year-on-year to RMB 5.793 billion from RMB 3.955 billion in the same period last year, primarily driven by higher salaries and increased rental expenses and other costs associated with the expansion of the sales and service network. Together, these two expense items totaled RMB 11.869 billion, exceeding the gross profit of RMB 11.461 billion for the period, resulting in an operating loss of RMB 117 million.

Despite an overall operating loss in the first half, Li Xiang Auto managed to turn around in the second quarter, posting an operating profit of RMB 468 million, compared to an operating loss of RMB 585 million in the first quarter.

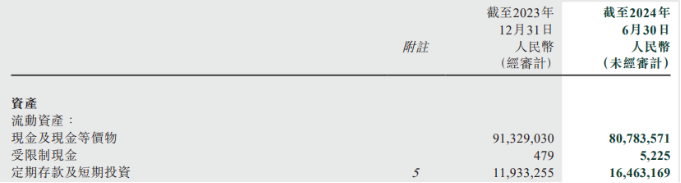

Benefiting from its substantial cash reserves, including cash and cash equivalents, time deposits, and short-term investments totaling RMB 97.2 billion, Li Xiang Auto's interest income and net investment income surged 69.53% year-on-year to RMB 1.439 billion from RMB 849 million in the same period last year. Thanks to these financial gains, Li Xiang Auto reported a net profit of RMB 1.692 billion for the first half of the year, but this still represented a 47.84% year-on-year decline.

Securities Star notes that Li Xiang Auto has intensified its investment efforts this year. Data shows that the company's time deposits and short-term investments increased from RMB 11.933 billion at the end of last year to RMB 16.463 billion in the first half of this year, an increase of RMB 4.53 billion. Meanwhile, cash and cash equivalents declined by RMB 10.545 billion to RMB 80.784 billion over the same period.

02. Li Xiang L6 propels sales

In terms of sales, Li Xiang Auto is on a rapid growth trajectory. In the first half of the year, its deliveries surged 35.8% year-on-year to 188,900 units. By the end of June, cumulative deliveries had reached 822,300 units, making Li Xiang Auto the first Chinese new energy vehicle brand to surpass the 800,000-unit milestone.

Notably, due to setbacks with the MEGA model, Li Xiang Auto's sales dipped 39% quarter-on-quarter to 80,400 units in the first quarter, but the company bounced back to deliver over 100,000 units in the second quarter.

This rebound was fueled by the success of the Li Xiang L6, which was launched on April 18 with a price range of RMB 249,800 to RMB 279,800, making it the company's most affordable model to date. The L6, which is priced below RMB 300,000, delivered over 50,000 units in its first three months on the market and surpassed 20,000 units in monthly deliveries starting in June.

Statistics show that the L6 accounted for approximately 36% of Li Xiang Auto's total sales in the second quarter, with 39,200 units delivered. Driven by the L6, Li Xiang Auto delivered a total of 108,600 new vehicles in the second quarter, up 25.48% year-on-year and 35.05% quarter-on-quarter.

On April 22, Li Xiang Auto announced a new pricing structure, with price reductions across its entire product line except for the newly launched L6. The L7, L8, and L9 models saw price drops of RMB 18,000 to RMB 20,000, while the MEGA was reduced by RMB 30,000 to RMB 529,800.

Securities Star observes that the strong sales of the L6 and price reductions across the product line have lowered Li Xiang Auto's average selling price per vehicle. In the first half of the year, the average selling price per vehicle was RMB 288,800, down RMB 44,000 year-on-year from RMB 332,800, returning to levels last seen during the heyday of the Li Xiang ONE in 2021. On a quarterly basis, the average selling price per vehicle was RMB 279,200 in the second quarter, down from RMB 301,600 in the first quarter.

Delving deeper, the trade-off between price and volume has also impacted gross margin. In the first half of the year, Li Xiang Auto's vehicle gross margin declined to 19% from 20.5% in the same period last year. Consequently, the company's overall gross margin fell to 20% from 21.2% year-on-year.

Against this backdrop, how will Li Xiang Auto increase its gross margin in the third quarter? During the second-quarter earnings call, the company responded that while its guided vehicle gross margin for the previous quarter (Q2) was around 18%, it actually achieved 18.7%, reflecting the company's efforts, product mix, and final deliveries. For Q3, the company expects vehicle gross margin to rebound, surpassing 19%, with overall gross margin exceeding 20%.

03. Intensifying competition in the EREV segment

Previously, Li Xiang Auto differentiated itself by pioneering extended-range electric vehicles (EREVs) and became the first new energy vehicle brand to achieve profitability. While the company's sales still rely heavily on EREVs, relying solely on this technology is not enough to ensure long-term success.

Firstly, policy changes pose risks to EREVs. Media reports indicate that since last year, EREVs and plug-in hybrid electric vehicles (PHEVs) have been excluded from the exclusive new energy vehicle license plates in Shanghai. In Beijing, while EREVs are eligible for green license plates, they require a gasoline vehicle quota, effectively treating them similar to conventional gasoline vehicles. If policies become stricter on vehicle emissions, EREVs could face significant challenges.

Secondly, the EREV market is becoming increasingly competitive as new players enter the fray. This year has seen the launch of EREV SUVs such as the Nezha L, Leapmotor C10, and SL03 G318, with the Nezha L priced as low as RMB 129,900 to RMB 162,900. On August 30, AITO unveiled the AITO 07, an EREV SUV targeting the Li Xiang L6 and AITO M7. The AITO 07 offers both pure electric and extended-range versions, with some models expected to be priced around RMB 250,000.

In particular, competition between AITO and Li Xiang Auto is intense. In the first three months of this year, AITO surpassed Li Xiang Auto in monthly sales, though Li Xiang Auto retained a narrow lead of 7,800 units over AITO's 182,000 units for the first half of the year. On August 26, AITO unveiled the M7 Pro, a direct competitor to the Li Xiang L6, priced at a similar RMB 249,800. Li Xiang Auto's Chairman, Li Xiang, has acknowledged that HarmonyOS is the company's strongest competitor in the market and that both parties will coexist healthily in the long run.

With several new AITO models set to launch in the second half of the year, including the M7 Pro and five-seat M9, Li Xiang Auto may face even stiffer competition during this period, as it grapples with a product lull.

For Li Xiang Auto, maintaining its current market position while exploring new growth avenues requires more than just EREVs. However, the underwhelming performance of the MEGA, the company's first pure electric MPV, has cast a shadow over its BEV ambitions.

The MEGA failed to meet expectations, selling only 3,229 units in its first month on the market, largely due to a backlog of orders accumulated over the previous six months. Deliveries fell below 1,000 units in May and remained low at 654 units in July.

Li Xiang reflected that the company's mismanagement of the MEGA's market timing and overemphasis on sales targets contributed to the model's struggles.

Now, Li Xiang Auto has slowed its product launch pace and rescheduled the launch of its pure electric SUVs for the first half of next year. Li Xiang emphasized that for these SUVs, the company needs to address two key issues: designing attractive exteriors and ensuring the availability of over 2,000 supercharging stations upon delivery. According to Li Xiang Auto's product roadmap, by 2025, the company aims to have a diverse lineup comprising five EREVs, one super flagship (MEGA), and five BEVs, effectively splitting the market between EREVs and BEVs. (Originally published on Securities Star, Author: Lu Wenyan)