Alibaba's "rectification and delisting" marks the renewed pursuit of Jack Ma's vision of a "century-old enterprise"

![]() 09/09 2024

09/09 2024

![]() 497

497

Alibaba has completed its three-year rectification process.

With a fine of 18.2 billion yuan and a three-year rectification period, Alibaba has finally addressed the issue of its platform's ecological monopoly under the supervision of regulatory authorities.

Alibaba has faced challenges over the past three years, with its market value dropping from over $480 billion in September 2021 to less than $200 billion today, while Amazon's market value stands at $1.8 trillion.

Alibaba's revenue growth rate plummeted from 40% in 2021 to just 1.8% in 2023 but recovered slightly to 8.34% in fiscal year 2024.

In April of this year, Jack Ma stated in Alibaba's internal network that it was necessary to "bravely admit and correct mistakes" and "recognize oneself."

What issues does Alibaba need to "admit and correct," and how should it "recognize itself"? After rectification, how can Alibaba achieve Jack Ma's vision of becoming a "century-old enterprise"?

These questions deserve deep consideration.

01

How has Alibaba fared over the past three years?

Alibaba's journey over the past three years can be summarized in two words: rectification and transformation.

Alibaba's main rectification issue during this period was the monopolistic practice of "either-or" choices, which led to a fine of 4% of its domestic sales in China in 2019 and a three-year rectification period.

These three years of rectification coincided with rapid changes in the internet industry.

During this period, JD.com remained stable, Pinduoduo grew rapidly, and live streaming e-commerce emerged, with platforms like Douyin, Kuaishou, and Xiaohongshu becoming new growth drivers in various e-commerce sectors.

In the local services sector, Alibaba once again fell short in its competition with Meituan. Yu Yongfu, who oversaw Alibaba's local services business, stepped down, and the focus shifted to Amap. There were even rumors that Alibaba might sell Ele.me.

By "recognizing oneself," Jack Ma likely meant that Alibaba must acknowledge that the times have changed.

In March 2023, Alibaba initiated a structural reform, dividing into six major business groups (Alibaba Cloud Intelligence, Taobao-Tmall Business, Local Services, International Digital Commerce, Cainiao, and Digital Media and Entertainment) and multiple business companies under the Alibaba Group.

The purpose of this structural reform was decentralization, empowering each vertical business with a complete corporate structure.

At that time, Daniel Zhang, Dai Shan, Yu Yongfu, Jiang Fan, Wan Lin, and Fan Luyuan oversaw Alibaba's core businesses, each with more decision-making power and transitioning from managers to entrepreneurs.

Many underestimated the significance of these changes, which may indicate a shift in Alibaba's aggressive corporate culture.

In the past, Alibaba and Tencent acquired many companies, but Alibaba tended to integrate them forcefully, while Tencent often retained the original management and decision-making teams. This approach reflected different priorities in efficiency and control.

However, this led to accusations of ecological monopoly.

The structural reform was a necessary step for Alibaba, which had lost much of its competitiveness. The aim was to address the "big company disease" and break the monopoly by taking drastic measures.

Alibaba's reform was clearly aimed at preparing for independent listings in the future and addressing the bloated organizational structure that hindered swift decision-making.

Alibaba's market value has taken a significant hit, dropping by over 58% from $480 billion to less than $200 billion in three years. This decline reflects undervaluation, especially for Alibaba Cloud, which is still growing.

Alibaba needs a reevaluation and a comprehensive transformation.

The 1+6+N reform was purposeful and carries Alibaba's future hopes. Unexpectedly, it turned out to be Daniel Zhang's last major initiative as CEO.

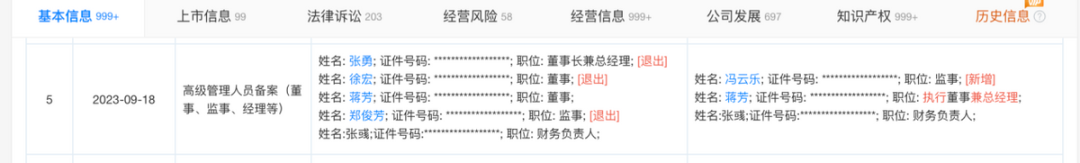

In September last year, Daniel Zhang stepped down, and Joseph Tsai succeeded him as Chairman of the Alibaba Group Board of Directors, while Wu Yongming took over as CEO. According to Tianyancha, Daniel Zhang resigned from Alibaba's senior management on September 18, 2023.

With the return of Alibaba veterans like Joseph Tsai to the forefront, it seems that the ambitious reform will continue. Regarding this new round of reform, Jack Ma summarized: "We must change bad habits and eliminate vested interests."

Who cultivated these "bad habits" and benefited from "vested interests"?

The news of a corrupt employee embezzling 130 million yuan from an e-commerce platform speaks volumes.

Consider this: When Jack Ma stepped down as CEO, Alibaba had fewer than 40,000 employees. By the end of 2022, this number had grown to nearly 240,000, exceeding 210,000 by the end of 2023.

For a company of Alibaba's size, efficiency is a significant concern.

Some business segments struggle to contribute profits. Despite Alibaba's diverse business lines, its core businesses, apart from finance, revolve around Alipay and local services.

According to Alibaba's FY24 annual report, the local services segment's loss narrowed to 9.812 billion yuan. However, years of losses have made this segment a drag on the group's overall performance.

In the local services sector, Alibaba has consistently lagged behind Meituan. Since 2021, with Douyin's entry into this market, the competition between Meituan and Douyin has intensified, further pressuring Alibaba's local services business.

In the internet industry, the most vulnerable players are often those that fade into obscurity, gradually forgotten by the market.

In March of this year, Yu Yongfu, Chairman of the Local Life Group and CEO of Ele.me, stepped down, amid speculation that Alibaba's local services business had underperformed.

Beyond local services, Alibaba's e-commerce business also faces new challenges.

Pinduoduo's market value approaching that of Alibaba is a landmark event, suggesting that the growth potential of the e-commerce market has been underestimated. In response, Liu Qiangdong is repositioning JD.com around low prices, while Jack Ma has unusually emphasized a return to Taobao's core.

While strategic setbacks were not Daniel Zhang's intention, his background as a CFO-turned-CEO inevitably led to a perception that Alibaba placed too much emphasis on performance and overlooked competitive strategy.

Looking at Alibaba's financials, FY24 revenue exceeded 940 billion yuan, setting a new record, with operating profit surpassing 100 billion yuan, regaining past glories. However, performance is fleeting, and strategic opportunities lost in the market may never return.

Alibaba's e-commerce business entered a new era in Q4 2021, when its China retail e-commerce revenue declined for the first time, marking four consecutive quarters of decline. Meanwhile, Pinduoduo and Douyin's combined GMV surpassed half of Alibaba's domestic e-commerce business.

Since then, Alibaba's e-commerce business has entered a new era. Unfortunately, Alibaba's management did not fully grasp this shift.

Unlike Jack Ma's reflections on "bad habits" and "vested interests," Joseph Tsai's approach is more direct.

In an interview, Joseph Tsai stated, "We forgot who our real customers are. To some extent, we have reaped what we sowed. We must define our direction and structure our company accordingly."

Alibaba's real customers are not Wall Street investors or mainland buyers of Hong Kong stocks but every user who pays for purchases on Taobao or orders dinner through Ele.me.

Whether in local services or e-commerce, serving these users effectively with appropriate strategies is likely Alibaba's true north.

Alibaba must change in 2024, and it must do so urgently. This sense of urgency is precisely what Jack Ma wants to see.

02

Antitrust achievements and new opportunities for interconnection

For Alibaba to change, becoming more open is crucial.

The completion of Alibaba's rectification, alongside the news of WeChat Pay's integration into Taobao, marked another milestone in internet interconnection.

On September 4, Taobao announced a public consultation on integrating WeChat Pay, suggesting a potential full integration in the future.

The addition of WeChat Pay to Taobao is undoubtedly a positive development.

This early announcement is noteworthy. First, it demonstrates that the 18.2 billion yuan fine and three-year rectification have borne fruit, showcasing Alibaba's commitment. Second, it hints at greater openness from Tencent, as Taobao has taken the initiative.

For merchants, the integration of WeChat Pay on Taobao not only adds a payment channel but also opens up possibilities for accessing the WeChat ecosystem.

WeChat's vast user base has been well-tapped by JD.com and Pinduoduo, but Taobao has yet to fully capitalize. Alibaba's hunger for traffic stems from its tool-based nature, where products like Taobao and Alipay are inherently traffic-hungry.

In contrast, content and social products like Tencent's WeChat and Douyin/Kuaishou thrive on their own traffic. WeChat's user base represents a fertile ground for Alibaba to explore.

Beyond expected growth, the integration of WeChat Pay opens new possibilities for Taobao, such as the potential for a Taobao mini-program on WeChat.

This integration signals a gradual tearing down of the ecological walls between Alibaba and Tencent.

However, opening payment gateways may not be enough. Alibaba needs to seek opportunities within the Tencent ecosystem, just as JD.com, Taobao, and Pinduoduo desire incremental growth within Alibaba's ecosystem. True interconnection and openness require mutual access.

Such openness brings both benefits and drawbacks for Alibaba.

On the positive side, it opens up new growth avenues beyond Alibaba's existing ecosystem, benefiting both e-commerce and local services. However, it may weaken Alibaba's foundations.

Alibaba's closed ecosystem, built around Alipay and Taobao, was designed to maximize revenue through practices like blocking external links and enforcing "either-or" choices. These practices contributed to accusations of monopoly.

Monopoly, at its core, is a competitive strategy that seeks to avoid competition. Michael Porter, the father of competitive strategy, believes that avoiding competition is the best strategy. However, this strategy relies on Alipay's ability to generate continuous traffic as a critical transaction tool.

Today, the growth potential of tool-based products has diminished. The rise of content platforms like Douyin and Kuaishou, along with the shift from tool-based to content-driven traffic, underscores this trend.

As Alibaba's ecosystem opens up further, its local services and e-commerce businesses may face more direct competition from players like Meituan, JD.com, and Pinduoduo. This openness may also complicate Alipay's payment business.

For example, will Alipay's share of e-commerce transactions be eroded by WeChat Pay, which excels in high-frequency, low-value transactions? Alipay has been promoting small transactions through campaigns like "tap-to-pay" and red envelopes, highlighting the importance of DAU and user habits in driving traffic and transactions.

With Taobao and Tmall integrating WeChat Pay, will Alipay's e-commerce transaction volume be affected? This remains to be seen.

Currently, Alipay is exploring content strategies to address this challenge. The video tab has been prominently placed in Alipay's navigation bar, and the app invested 1 billion yuan in cash subsidies for content in June 2023. However, tool platforms' success in content is rare, and users may not engage with Alipay content as they do with social media.

In conclusion, Wu Yongming's first public letter as Alibaba's new CEO emphasized a shift to a user-centric perspective, prioritizing user needs above all else. While this sounds simple, balancing user and business needs can be challenging.

As Alibaba completes its three-year rectification and embarks on an open ecosystem strategy, it will be fascinating to see how Wu Yongming leads the company into new horizons.

Disclaimer: This article is based on publicly available information and does not guarantee completeness or timeliness. Investment decisions should be made independently, as the stock market involves risks. This article does not constitute investment advice.