ICT market under pressure, H3C seeks growth through AI?

![]() 09/12 2024

09/12 2024

![]() 663

663

Written by Bazhen

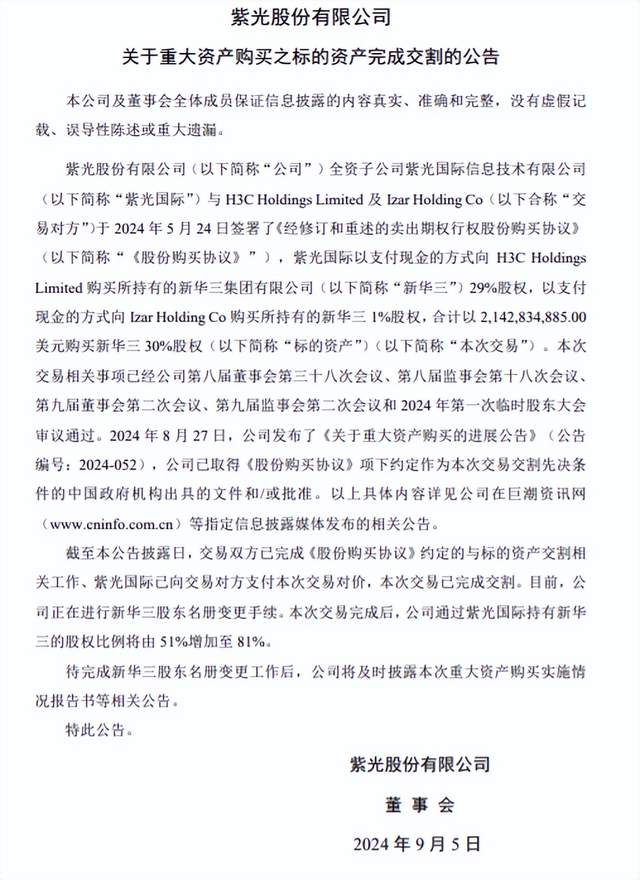

On September 5, Unisplendour announced that the parties involved in the Share Purchase Agreement signed on May 24, 2024, have completed the relevant consideration payment and asset transfer. As a result, the company's equity stake in H3C through Unis International will increase from 51% to 81%.

Image source: Unisplendour announcement

Looking back at H3C's history, it has had a tumultuous journey with multiple changes in ownership, involving Huawei, 3Com, HP, Unisplendour, and others.

I. A Turbulent Past with Frequent Changes in Ownership

Tracing back to H3C's history, it was once a company with a pure Huawei lineage.

In 2003, to counter Cisco's challenge, Huawei and US network card provider 3Com jointly established a joint venture, Huawei 3Com, headquartered in Hangzhou. This was the predecessor of today's H3C, with Huawei and 3Com holding 51% and 49% stakes, respectively.

Backed by two giants, Huawei 3Com soared from the start, quickly establishing a significant position in China's data communication hardware market within just over two years.

Image source: H3C official website

In 2005, perhaps to focus on other pressing tasks, Huawei transferred 2% of Huawei 3Com's shares to 3Com for US$28 million. This made 3Com the majority shareholder and the company was renamed H3C Communications (H3C), accompanied by a new logo.

In 2006, Huawei completely divested its remaining 49% stake in Huawei 3Com to 3Com, making H3C fully owned by 3Com.

However, due to poor management, 3Com had to put H3C up for sale in 2007. Eventually, HP acquired H3C in 2010.

It is rumored that Huawei had intended to repurchase H3C, which it had founded, but was constrained by uncontrollable factors and had to abandon the plan. Thus, the rumor that H3C was Huawei's "abandoned child" may be biased.

Nonetheless, H3C, spun off from Huawei, embarked on a turbulent journey.

Four years after HP's acquisition, H3C once again found itself at a crossroads. HP, citing financial considerations, chose to divest H3C and sold all its shares to Unisplendour in two tranches in 2015 and 2024, with Yu Yingtao appointed as CEO.

Unisplendour, a state-owned enterprise, is likely to be H3C's permanent home.

Over the course of its 20-year history, H3C has changed hands seven times. A reliable and stable top-level structure is crucial for a company's stable operation. H3C's tumultuous past and the recent downturn in the ICT industry have inevitably impacted its progress.

II. Pressure on the ICT Market, H3C Moves Slowly

According to IDC statistics, H3C has long maintained a leading position in China's ICT infrastructure products market:

From 2021 to 2023, H3C's market share in China's Ethernet switch market was 35.2%, 33.6%, and 32.9%, ranking second.

During the same period, H3C's market share in China's enterprise network router market was 31.3%, 31.8%, and 30.9%, also ranking second.

From 2021 to 2023, H3C led China's enterprise-class WLAN market with a share of 28.4%, 27.9%, and 27.4%, respectively, for 15 consecutive years.

Additionally, H3C achieved second, top three, second, top two, and first positions in China's x86 server market, storage market, security hardware market, hyper-converged infrastructure market, and network management software market during the same period, respectively. In particular, it led China's network management software market for seven consecutive years from 2017 to 2023.

Despite this, as the ICT industry enters a downturn, with declining smartphone shipments, cost-cutting by internet giants, and mounting chip inventories, H3C faces unprecedented growth pressure.

Financially, H3C's revenue grew to RMB 44.351 billion, RMB 49.81 billion, and RMB 51.939 billion from 2021 to 2023, with corresponding year-on-year growth rates of 20.5%, 12.3%, and 4.3%, respectively. Its gross margin was 28.10% and 26.25% in 2022 and 2023, respectively, while its net profit attributable to shareholders was RMB 3.285 billion and RMB 2.987 billion, respectively.

Image source: Unisplendour announcement

It is evident that H3C's revenue growth is slowing down year by year, showing signs of stagnation, and its profitability is declining rather than increasing.

Fortunately, while domestic business stagnates, international business is picking up, to some extent offsetting the downturn. According to Node Finance calculations, H3C's international revenue grew by 19.74% in 2023, while domestic revenue increased by only 3.68%.

As the saying goes, "When the river is full, the brook overflows; when the river is dry, the brook runs dry." Facing challenges, H3C has implemented cost-saving and efficiency-enhancing measures. In late 2023, CEO Yu Yingtao sent an internal letter announcing that mid-to-senior executives and high-level employees would voluntarily take a 10%-20% pay cut for one year and that significant layoffs would be undertaken.

In the first half of 2024, Unisplendour reported that H3C's revenue reached RMB 26.428 billion, up 5.75% year-on-year, with operating profit of RMB 1.996 billion, up 12.91% year-on-year.

Specifically, domestic government and enterprise revenue was RMB 20.212 billion, domestic operator revenue was RMB 5.019 billion, and international revenue was RMB 1.198 billion.

Image source: H3C official account

III. Betting on AI: Opportunities and Challenges

Amidst increasing competition and a complex and ever-changing environment, seeking new business opportunities and growth has become imperative for all micro-enterprises.

Like Alibaba, Tencent, Baidu, Huawei, and other high-tech companies, H3C has also set its sights on AI.

Gartner predicts that 80% of global enterprises will use generative AI by 2026. McKinsey forecasts that AI could contribute US$25.6 trillion to the global economy by 2030, with generative AI accounting for up to US$7.9 trillion. As one of the world's largest digital economies, China is expected to contribute approximately US$2 trillion, or one-third of the total.

With ample opportunities, H3C is fully committed.

Guan Zhiqiang, Vice President and General Manager of H3C's Enterprise Business Unit, said, "AI will bring changes to all industries in the future, and it will significantly impact our work and lives. This is why H3C considers expanding its AI capabilities from an organizational and future development perspective."

In June 2023, H3C launched Lingxi, China's first private large language model for various industries, and formulated a "1+N" large model strategy: building upon Lingxi, it will openly collaborate with industry-leading general and industry-specific large models to provide customized, exclusive, and scalable intelligent services for vertical industries and exclusive regional customers.

Image source: H3C official website

Meanwhile, H3C has developed the AIGC Lingxi all-in-one machine, integrating vertical models, software applications, AI applications, networking, computing, storage, and other hardware capabilities. This integrated solution offers out-of-the-box usability, open compatibility, security compliance, and flexible deployment.

In fact, H3C established its AI Research Institute in 2018. In early 2023, it strengthened its AI layout and established a dedicated AI and Innovative Technology Systems Department as a strategic focus to expand its AI business.

Theoretically, leveraging its years of experience and technology, H3C could forge a new growth path and expand its revenue and profit margins. However, deploying large models in the B2B sector faces significant challenges, including computing power, algorithms, and costs.

According to Node Finance observations, current B2B large model explorations are still in their infancy, with preliminary attempts and no mature case studies, let alone profitability.

Furthermore, with intense competition in the large model space, H3C faces an uphill battle.

Therefore, it remains uncertain how this AI wave will impact H3C's performance and how long it will take to manifest.