Behind the Rise of Honor in Europe: A High-End Battle for Survival in Huawei's Shadow

![]() 09/24 2024

09/24 2024

![]() 489

489

Facing Huawei's strong comeback and Apple's technological advantages, Honor needs to strengthen its hardware and software to enhance its competitiveness.

@Tech Insights Original

Both Honor and Huawei were in the spotlight in September.

First, Huawei released its smartphone Mate XT, once again attracting global attention. With its tri-fold design, the device starts at a price of 19,999 yuan, while on second-hand platforms, the Mate XT starts at a minimum of 30,000 yuan.

Meanwhile, Honor participated in IFA (Internationale Funkausstellung Berlin), one of Europe's largest consumer electronics exhibitions, for the third time. At the crowded booth, CEO Zhao Ming revealed that Honor's design for a tri-fold phone was completed a year ahead of schedule, implying that even Huawei, its former parent company, could not compete with Honor.

Having separated from Huawei for four years, Honor faces both pressure from Huawei's return to the market and the need to fulfill capital commitments. While interviews with Honor's executives show confidence, market performance has yet to be convincing.

The future direction of Honor remains uncertain, but it is currently in a dilemma.

Part.1

The Pseudo-Proposition of Honor's High-End Market Entry?

Foldable phones are seen as a key tool for entering the high-end market.

Huawei's launch of its tri-fold phone instantly sparked a new round of competition among smartphone manufacturers, with many following suit in the foldable phone market, competing fiercely across various dimensions from form factor to pricing. This frenzy of investment is fueled by the imminent explosion of the high-end phone market.

IDC's latest quarterly smartphone forecast report predicts that shipments of foldable phones in China will reach approximately 10.68 million units in 2024, an increase of 52.4% year-on-year. By 2028, shipments of foldable phones in China are expected to exceed 17 million units, with a five-year compound annual growth rate of 19.8%.

Faced with this blue ocean, Honor clearly does not want to miss out on the opportunity. Honor has already developed three different folding form factors: horizontal inward-folding, horizontal outward-folding, and vertical folding, creating a comprehensive foldable product matrix.

Capitalizing on the market buzz around Huawei's new phone, Honor showcased its tri-fold phone, the Honor Magic V3, at IFA 2024. CEO Zhao Ming told the media that Honor's technological preparations are in place, refuting accusations of copying Huawei and even suggesting that Honor's innovations surpass those of Huawei. The phone is expected to be released by the end of this year or the first quarter of next year.

This timely announcement is clearly a shot in the arm for Honor, using Huawei's pioneering model as a benchmark to attract attention without fear of being accused of riding on Huawei's coattails. Honor obviously cannot afford to miss this promotional opportunity.

However, it's worth noting that Honor's market share is not primarily supported by high-end phones. Its market positioning and strategy may focus more on the mid-range market. Therefore, with a solid presence in the mid-to-low price segment, Honor is eager to shed its reputation for cost-effectiveness. During the 6.18 shopping festival in 2024, the only Honor phone to rank on JD.com's self-operated mobile phone sales list was the Honor X50, coming in fifth place with a price range of 1,399 to 1,999 yuan, far below the sales of high-end players like Apple and Huawei.

In fact, Honor's confident stance towards the high-end market does not align with its current market position. According to data from Canalys, in the first quarter of 2024, Apple held a 54% market share in China's smartphone market for devices priced above $600, a year-over-year decrease of 25%. During the same period, Huawei's market share was 26%, an increase of 67% year-over-year. Honor's market share, however, was only 6%, a significant distance from the top players.

Facing an insurmountable challenge from strong competitors, Honor must also confront a shrinking market. Data from CINNO Research shows that in the first half of 2024, cumulative shipments of foldable phones in China reached 4.98 million units, an increase of 121% year-on-year, with a penetration rate of 3.6%. While this seems encouraging, overall smartphone sales still need time to recover.

According to Canalys, global smartphone shipments totaled 1.14 billion units in 2023, a 4% decrease and a decade-low. It is projected that global smartphone shipments will rebound by only 3% year-on-year to 1.2 billion units in 2024, driven primarily by the budget-sensitive segments (i.e., mid-to-low price range of $150-249) and high-end price range ($600-799). However, it is worth noting that most of this market growth is coming from India and the Middle East/Africa, and it remains uncertain whether Honor can tap into these markets.

Perhaps Zhao Ming's confidence stems from Europe. According to a report by Counterpoint Research, Honor surpassed Samsung in the European foldable phone market share for the first time in Q2 2024, becoming the leader in Western Europe. In the first half of 2024, sales of large foldable phones in Europe grew by 133%, with 70% of this growth coming from Honor. Compared to the first half of 2023, Honor's sales grew by 22 times in the first half of 2024.

By defeating Samsung, Honor has achieved a significant victory, demonstrating its unwavering determination to take on the high-end market head-on.

Part.2

Apple's AI Phone Launch and Honor's Disillusionment

It is undeniable that Honor, aspiring to capture a share of the high-end market, faces the formidable challenge of Apple.

On September 10, Apple unveiled its first AI-powered iPhone 16, with CEO Tim Cook heralding a new and exciting era. In Honor's own narrative, it stands alongside Huawei and Apple as one of the three major players in the industry. However, ironically, it is Honor that may end up being disillusioned by Apple's latest launch.

Compared to Apple, Honor's past advantage lay in AI. On January 10, 2024, Honor officially released MagicOS 8.0, its proprietary operating system, along with its first end-side platform-level AI model, "Magic Large Model," featuring 7 billion parameters. The system boasts the slogan "The more you use it, the better it gets; the more you use it, the more it understands you," positioning it as a personalized operating system.

In reality, Honor's confidence stems from its systematic design of hardware and software, rooted in the question it posed to itself: When discussing AI in the mobile industry, almost everyone relies on third-party AI capabilities. Where is our own value and contribution?

Honor's answer lies in an AI-powered personalized, full-scenario operating system. On this development path, Honor is committed to continuously investing in its operating system and hardware, a decision driven by technical logic that cannot be avoided.

However, it is important to note that Honor's approach to hardware is more about control than creation. Take its AI defocusing eye protection technology as an example. By employing optical biomimetic methods and graphical algorithms, Honor achieves an equivalent defocusing visual effect for some image content, inhibiting the backward growth of the eye axis and alleviating myopia development and transient myopia symptoms. The focus of this innovation lies in application-level development.

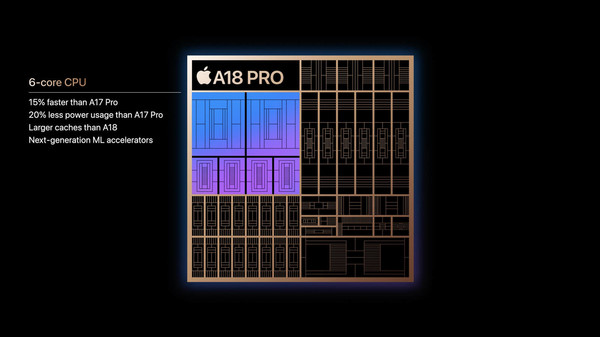

In contrast, Apple's new iPhone 16 garnered significant attention due in large part to its updated A18 Pro bionic chip. With two high-performance cores and four energy-efficient cores, the chip boasts a 15% increase in processing speed and a 20% reduction in energy consumption. In graphics processing, the A18 Pro features a new six-core GPU architecture, delivering a 20% performance boost over the A17 Pro. Additionally, the chip possesses powerful video encoding capabilities, supporting double the data processing speed. Importantly, the A18 Pro is the world's first smartphone chip to adopt second-generation 3-nanometer transistors.

All of these advancements underscore Apple's commitment to AI, despite its later entry into the field compared to Honor. However, Apple boasts a hardware advantage that Honor cannot match: chip capability. In contrast to Honor's AI-powered smart hardware approach, Apple's chip represents the assurance of hardware-based AI.

Technically, controlling the underlying layer means establishing layout capabilities, discourse power, and a moat. Clearly, Honor does not lead Apple in terms of hardware. Let's then consider the advantage of Honor's software foundation: its open mobile operating system.

Undeniably, compared to Apple's closed system, Honor's Android-based operating system, derived from Android, facilitates deeper integration with third-party applications, transcending the boundaries of various scenarios and shaping a robust software ecosystem.

However, this advantage may be unexpectedly compromised. Recently, the European Commission officially demanded that Apple open its iOS and iPadOS operating systems within six months to improve compatibility with third-party devices and applications, or face fines of up to 10% of the company's global annual turnover.

Clearly, Apple faces a difficult choice between remaining closed or opening up its system. If Apple chooses to open its system, Honor's software ecosystem advantage may disappear altogether.

Facing Apple's formidable combination of hardware and software, Honor has a steep hill to climb.

Part.3

The Inevitable IPO Milestone

In the face of Apple's formidable new phone launch, one domestic smartphone manufacturer chose to confront it head-on, holding a product launch event on the same day and showcasing a tech-savvy new phone that significantly diverted attention away from Apple's latest offering.

Unfortunately, this bold manufacturer was not Honor but rather Huawei, which Honor inherited the market from four years ago.

Four years ago, to preserve its smartphone business under extreme pressure, Huawei spun off the Honor brand. Since then, Honor has repeatedly expressed its intention to go public, a stance markedly different from Huawei's tradition. Nevertheless, after Honor's independence, its performance in the smartphone market has been outstanding.

Honor's downturn was brief. Public data shows that before its independence, Honor held approximately 15% of the domestic market share. In the early stages of independence, its market share plummeted to 3%. However, due to its close ties with Huawei, Honor inherited a significant portion of Huawei's market share. According to IDC, by 2022, Honor's domestic market share reached 18.1%, ranking second, with shipments up 34.4% year-on-year to approximately 51.77 million units, making it the only brand among the top five smartphone manufacturers to achieve double-digit growth.

Clearly, Honor's success stems from Huawei's support. However, once Huawei returns to the market, Honor will undoubtedly be the most impacted manufacturer, and this day arrived sooner than expected.

Over the past five years, due to U.S. sanctions, Huawei's smartphone shipments plummeted, reaching just 28 million units in 2022 and accounting for only 2% of the global market share. However, just one year later, Huawei surprised the market by launching the Mate60 5G series without warning, officially announcing its return to the smartphone throne.

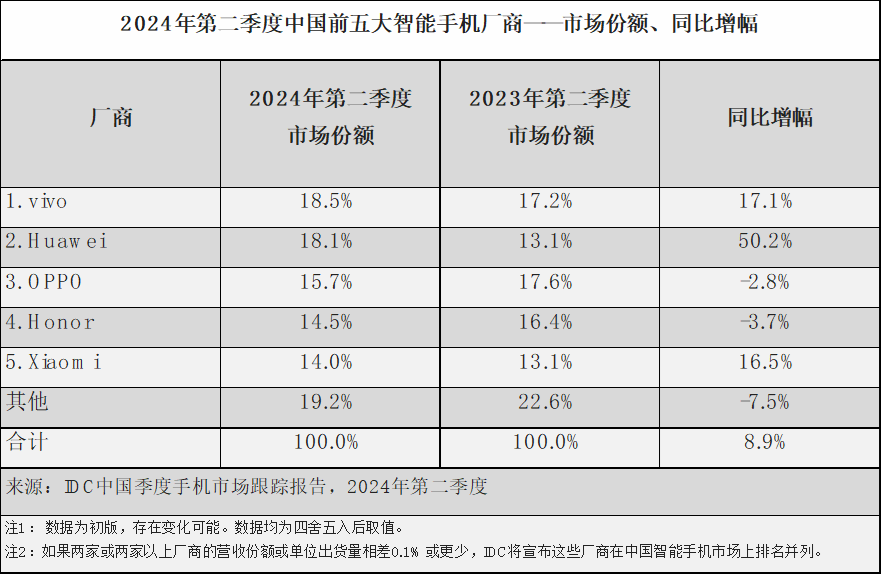

IDC data shows that in the fourth quarter of last year, the launch of new devices such as the Mate60 series drove a 36.2% increase in Huawei's sales, making it the fastest-growing vendor among the top five. Looking at market share data from a single quarter perspective, Huawei's upward trend becomes even more apparent. In the first quarter of 2023, Huawei and Honor held market shares of 8.6% and 16.1%, respectively. By the first quarter of 2024, Huawei's share had risen to 17.0%, while Honor's increased slightly to 17.1%.

Although both companies rank among the top two in the domestic market, competition is inevitable given their product features, positioning, and target audience.

The trend is already visible. In the second quarter of this year, Honor's shipments decreased by 3.7% year-on-year, and its market share dropped to 14.5%, ranking fourth, while Huawei jumped to second place.

Ren Zhengfei's words bidding farewell to Honor still echo in our ears: "Be Huawei's strongest competitor, surpass Huawei, and even shout to defeat Huawei!" Yet before Honor could defeat Huawei, Huawei was already preparing to sever ties with its former subsidiary. Media reports indicate that in a certain province, Huawei has issued notices to dealers, clearly distinguishing itself from Honor. Honor's core dealers have gradually withdrawn from Huawei's high-end phone lists, and it is rumored that key channels (KAs) that previously participated in Honor's launch events will cease all new store construction and renovations, including experience stores.

Faced with immense pressure from Huawei, Honor has no room to retreat. If it fails in the domestic market and cannot break through in the global market, Honor's situation becomes precarious.

Therefore, after Honor's high-end foldable phones rapidly gained market share in Western Europe, Zhao Ming stated that Honor aims to make Europe its "second home market," with overseas sales exceeding those in China in the next three to five years. In developed markets, demand for low-end phones has gradually waned, and the market is calling for a brand that can compete with Apple and Samsung. This aligns with Honor's global strategic goals.

Obviously, this is one of the few market highlights for Honor at present. By leveraging publicity, Honor can maintain suspense in its capital story, and investors' expectations are simple: going public and delivering results to all investors.

Earlier, rumors circulated in the market about Honor's IPO plans, with a valuation of 200 billion yuan and plans to submit materials for a ChiNext listing in 2024. According to media reports citing insiders, Honor is expected to go public on the A-share market within the year or early next year.

In response to this, Honor said, "Honor plans to initiate the corresponding shareholding system reform in the fourth quarter of this year and initiate the IPO process in due course thereafter, and the company will disclose relevant financial data during the corresponding process. From January 1, 2021 to the present, Honor has not received support from the Shenzhen Municipal Government beyond that provided to ordinary enterprises."

The response to rumors about the Shenzhen Municipal Government is not groundless. When Honor was spun off from Huawei, several Shenzhen state-owned enterprises joined forces with more than 30 Honor dealers to jointly establish Shenzhen Zhixin New Information Technology Co., Ltd., which became the takeover party, and the actual controller behind it was the State-owned Assets Supervision and Administration Commission of Shenzhen Municipal People's Government. Although the SASAC did not promote Honor's shareholding reform in the early stages, it has been four years since then. It is not difficult to speculate what the attitude of the SASAC, as an investor, is.

After Honor's highly anticipated independence, its performance at every device replacement node seems to always fall short of expectations. Now, as the user replacement cycle has increased to 51 months, how to make up for market and capital expectations has become a problem that Honor must solve.

Honor can no longer avoid this coming-of-age ceremony of IPO.