CATL's Half-Year Revenue Hits 30.4 Billion Yuan, Marking a Boom in Profits

![]() 08/04 2025

08/04 2025

![]() 506

506

Earning 170 Million Yuan Per Day

Author | Wang Lei

Editor | Qin Zhangyong

CATL has amassed 30 billion yuan in just half a year, showcasing its impressive profitability.

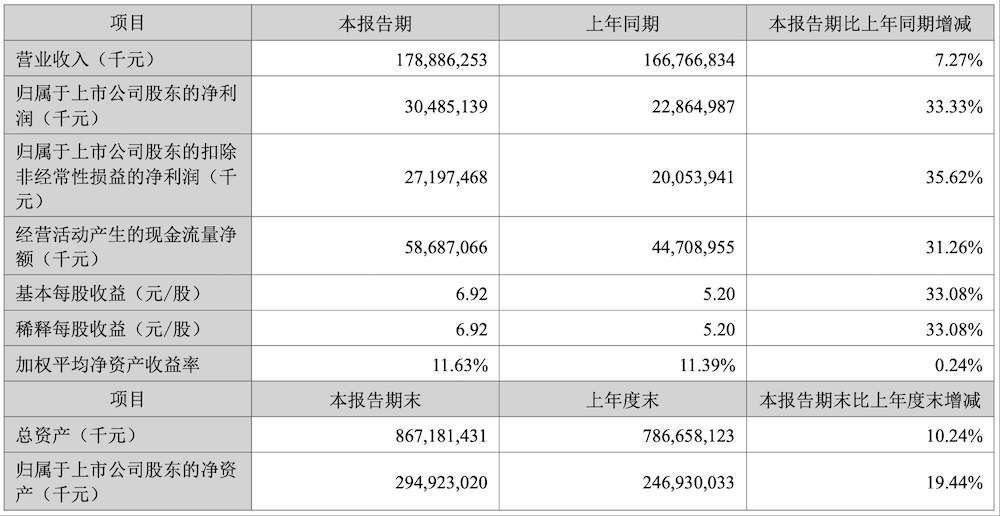

CATL released its half-year financial report, reporting a total revenue of 178.886 billion yuan and a net profit attributable to shareholders of 30.485 billion yuan, a year-on-year increase of 33.33%. With a market share of 38.1%, the company continues to dominate the global power battery market.

This translates to a daily net profit of 170 million yuan.

It is often said that "the higher you climb, the colder it gets." As CATL expands, maintaining high growth rates inevitably faces challenges. However, CATL appears to have defied this rule.

Interestingly, this outstanding financial performance did not generate significant buzz in the capital market. As of today's market close, CATL's Hong Kong stock price fell by 4.78%, closing at HK$406.2.

01

Where Does the Growth Come From?

Let's first examine the core indicators in this half-year report. CATL achieved a total revenue of 178.886 billion yuan in the first half of the year, up 7.27% year-on-year. The net profit attributable to shareholders reached 30.485 billion yuan, up 33.33% year-on-year.

This means that in the first half of 2025, CATL earned 170 million yuan per day, compared to less than 140 million yuan per day last year.

Moreover, it is evident that profit growth significantly outpaced revenue growth, indicating that CATL not only sold more but also earned more per sale. The financial report shows that the comprehensive gross profit margin increased to 25.02%, up 1.57% from the same period last year.

Even after deducting non-recurring gains and losses, the net profit attributable to shareholders reached 27.2 billion yuan, with a year-on-year growth rate of 35.62%.

According to SNE Research data, from January to May 2025, CATL's global market share of power battery usage reached 38.1%, ranking first globally, but only increasing by 0.6 percentage points compared to the same period last year.

With robust performance in core indicators, CATL's other financial data also showed positive growth across the board.

The net cash flow generated from operating activities was 58.687 billion yuan, compared to 44.709 billion yuan in the same period last year, representing a year-on-year increase of 31.26%. Cash and cash equivalents amounted to 323.785 billion yuan, up 42.60% year-on-year. The company's total assets reached 867.181 billion yuan, an increase of 10.24% from the end of the previous year.

Additionally, CATL's R&D investment reached 10.095 billion yuan in the first half of the year, up 17.48% year-on-year. Unlike other companies that increase revenue but not profits, CATL's profits grow in tandem with its sales.

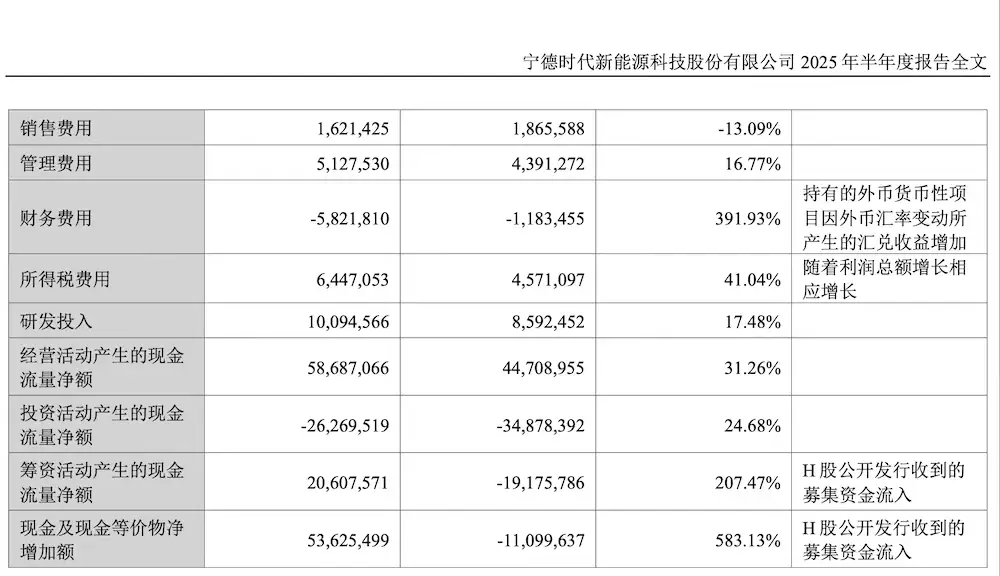

By further analyzing CATL's profit sources, it is clear that the ultra-high profit growth rate is not solely driven by business operations. Besides having strong cash flow, the over HK$40 billion raised in Hong Kong also played a crucial role.

In May this year, CATL successfully listed on the main board of the Hong Kong Stock Exchange, offering a total of 155 million shares globally (after exercising the over-allotment option) at an issue price of HK$263.00 per share, raising approximately HK$41 billion in total.

The cash and cash equivalents also benefited from the fund inflow from the public offering of H shares, surging from -1.1 billion yuan to 5.36 billion yuan, representing a 583% increase.

Similarly, other income amounted to 6.1 billion yuan, an increase of 700 million yuan year-on-year. Therefore, the profit in the first half of the year was positively impacted by the fund-raising in Hong Kong to a certain extent.

Moreover, the net cash flow generated from CATL's financing activities reached 20.6 billion yuan, compared to a net outflow of 19.1 billion yuan in the same period last year. The difference is roughly equivalent to the amount of funds raised through H shares.

02

Overseas Expansion as the Focus

Of course, the fund-raising in Hong Kong can be considered an "icing on the cake" for CATL. Returning to the fundamentals of its business, CATL remains the industry leader.

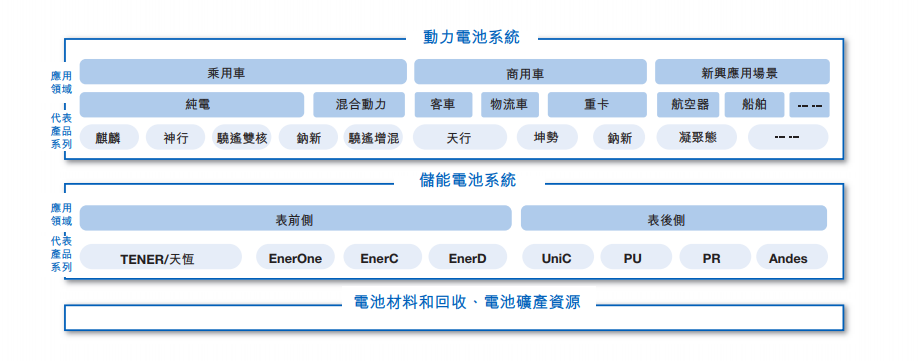

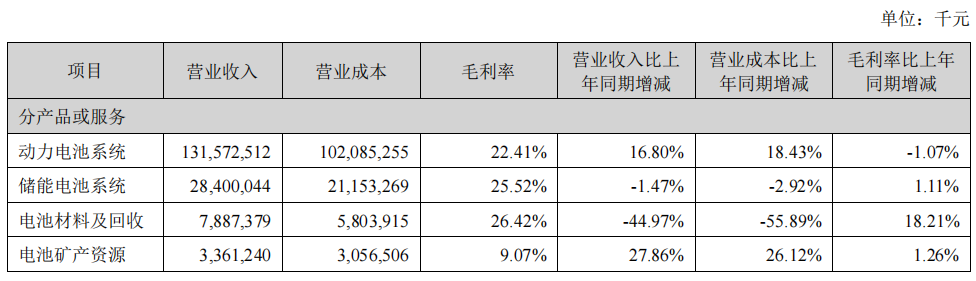

In terms of individual business lines, the power battery system business was the primary driver of CATL's revenue growth, achieving revenue of 131.573 billion yuan, up 16.80% year-on-year, accounting for over 73% of total revenue.

Currently, CATL's total production capacity is 345 GWh, with an output of 310 GWh, and a capacity utilization rate close to 90%. Additionally, there are 235 GWh of capacity under construction. As of the end of the reporting period, CATL had achieved cumulative global shipments of approximately 20 million power batteries and applied energy storage batteries to over 2,000 projects worldwide.

According to SNE Research data, from January to May 2025, CATL's global market share of power battery usage reached 38.1%, up 0.6% from the same period last year. It continues to rank first globally in terms of both shipments and market share.

However, the gross profit margin declined slightly by 1.07% year-on-year to 22.41%. CATL explained that the slight decline in the gross profit margin of the power battery system business is related to factors such as product mix, raw material prices, and customer negotiations. Overall, the company's gross profit margins for power and energy storage products have remained relatively stable.

The energy storage battery system business achieved revenue of 28.4 billion yuan, down 1.47% year-on-year, accounting for 15.88% of total revenue. Despite a slight decline in revenue, CATL's energy storage battery production still ranked first globally from January to June 2025. Moreover, the gross profit margin of the energy storage business was better than that of the power battery business, reaching 25.52%, up 1.11% year-on-year.

CATL's business with the highest gross profit margin is battery materials and recycling, reaching 26.42%, up 18.21 percentage points year-on-year. However, revenue declined significantly, down 44.97% year-on-year to 7.887 billion yuan, accounting for 4.4% of total revenue.

Revenue from the battery mineral resources segment was 3.361 billion yuan, up 27.86% year-on-year, with a gross profit margin of 9.07%. This segment primarily aims to hedge against risks arising from fluctuations in raw material prices.

From a regional perspective, CATL's revenue is divided into domestic and overseas markets. Currently, the domestic market is still the main driver, but growth momentum is increasingly reliant on overseas expansion.

In the first half of the year, domestic business revenue amounted to 117.678 billion yuan, accounting for 65.8% of total revenue, with a slight year-on-year increase of 1.24%. Overseas business revenue was only 61.208 billion yuan, accounting for 34.2% of total revenue, but increased by 21.14% year-on-year. Moreover, the gross profit margin of overseas business was higher than that of domestic business. During the reporting period, the gross profit margins for overseas and domestic businesses were 22.94% and 29.02%, respectively.

In fact, to expand overseas markets, CATL is actively strengthening its production capacity abroad. In the first half of the year, the company steadily advanced the construction of its Hungarian factory, the Spanish factory jointly established with Stellantis, and the Indonesian battery industry chain project.

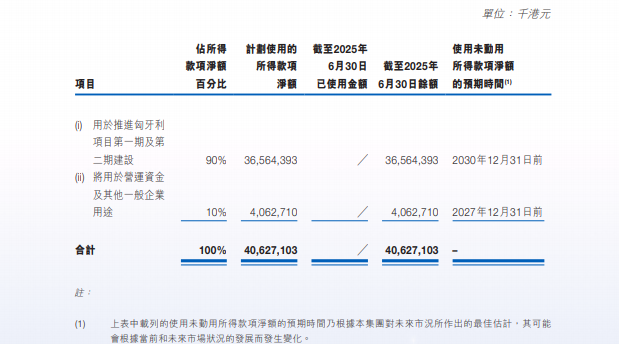

Moreover, CATL's fund-raising in Hong Kong this year is also aimed at overseas expansion, with 90% of the funds to be used for overseas capacity building, focusing on the first and second phases of the Hungarian factory project.

Turning to the domestic market, under the trend of many automakers "de-CATLing," such as Hongmeng Zhixing changing its strategy of exclusive supply from CATL by introducing China Aviation Lithium Battery into its Zhijie brand, CATL's market share is shrinking. Similar situations occurred with XPeng Motors, NIO, and Li Auto, who have introduced other battery suppliers.

Therefore, it is unrealistic to expect rapid domestic market growth within a short period, similar to what has been seen overseas. This is because in the domestic market, "everyone has what everyone else has." To break the current domestic situation, a "variable" that no one else has is needed. The answer is obvious – solid-state batteries.

During this earnings call, CATL specifically provided a timeline for the mass production of solid-state batteries for the first time, stating that it expects to achieve small-scale mass production by 2027. The supply chain will mature over a 3-5 year period, with large-scale applications expected around 2030.

From this perspective, not only CATL but also many other battery manufacturers and automakers have set 2027 as the target year for mass production of solid-state batteries. In this arms race, who will take the lead?