Apple's shining moment was stolen by Huawei!

![]() 09/25 2024

09/25 2024

![]() 586

586

Before the Mid-Autumn Festival, the tech circle's "Spring Festival Gala" failed to deliver a thrilling showdown. Apple's most boring event ever, devoid of its usual technological wow factor, significantly dimmed the spotlight on its head-to-head competition with Huawei.

This underscores the harsh reality of the market: failing to consistently introduce innovative products can easily erode consumer appeal. Despite widespread attention and coverage, the narrative surrounding Apple's event has subtly shifted – the company is losing its innovative edge.

To date, Apple has yet to embrace foldable screens, let alone triple-folding ones. In contrast, Huawei's Mate XT stands out for its groundbreaking hardware. On the software front, Apple's AI offerings were unimpressive, promising future capabilities that remain distant.

The mobile phone industry has faced criticism for stagnation in innovation, with AI and foldable screens emerging as key areas of progress. This head-to-head battle elicited mixed reviews, raising questions about whether Huawei has taken up the mantle of innovation leadership and who will shape the future alongside Apple.

01

No Game-Changing AI from Apple

The incremental updates in the iPhone 16 series were largely anticipated.

Larger screens, vertically oriented cameras, three eye-catching new colors, and even a slight reduction in battery capacity for some models. The standard version sticks to the same old 60Hz refresh rate, reflecting Apple's precise cost-cutting measures.

Apple introduced a side-mounted, gesture-controlled camera button, a feature previously seen on Sony and Nokia phones, making on-screen adjustments less convenient.

The most anticipated update was AI, a crucial direction for the smartphone industry. Domestic brands like Huawei, Xiaomi, OPPO, and Vivo, along with Samsung, have all embraced AI as a selling point. When Apple abandoned its automotive ambitions, it doubled down on AI. Hence, expectations for Apple's AI offering were high.

However, the event left many disappointed.

Apple presented an AI-assisted system that manages emails, prioritizes summaries, and finds relevant photos based on descriptions. Yet, features like AI image recognition, text generation, summarization, and cross-app integration are already prevalent on Android and available through third-party apps.

Apple's lack of confidence is evident. News of the iPhone 17 emerged soon after the iPhone 16's announcement, a rare occurrence. This suggests that Apple's hopes of reversing iPhone sales slumps globally may be unrealistic, with some market analysts adopting a wait-and-see approach towards the iPhone 16 series.

Furthermore, Apple's AI capabilities are still in their infancy, with staggered rollouts across regions and a potential delay until next year for China. This delays user adoption and may discourage potential buyers.

On the bright side, Apple's deep integration of AI technology avoids user experience fragmentation, opening up new possibilities for future products and services – a direction the industry is evolving towards.

Domestic competitors have also been active in this space. As the “Singles' Day” shopping festival approaches in October, Chinese brands will compete fiercely, with AI as a key battleground.

At the recent IFA (International Funkausstellung Berlin), Honor CEO Zhao Ming unveiled the industry's first AI Agent, declaring, “Honor's AI Agent will precede Apple in mobile integration.”

This underscores that while Apple was an early entrant in the AI race, it has fallen behind. In 2011, when Apple introduced Siri, such a scenario was unimaginable. Apple's missed opportunities contributed to a 10% stock price drop in Q1 2023, even prompting Warren Buffett to sell shares.

The AI landscape is fiercely competitive, leaving little room for Apple to drag its feet.

02

Triple-Folding Screens: A Different Dimension of Competition

While Apple continues to incrementally improve, Huawei's event showcased groundbreaking innovations.

The Mate XT, a triple-folding phone reminiscent of an imperial scroll, offers single, dual, and triple-screen modes. At 12.8mm thick in single-screen mode, it unfolds to a 10.2-inch display with a minimal thickness of 3.6mm, weighing 306g.

The Mate XT's uniqueness lies in its manufacturing challenges and target audience.

Adding an extra screen and hinge significantly increases technical complexity, requiring breakthroughs in screen and hinge technology. Yu Chengdong revealed that Huawei spent five years developing the revolutionary Huawei Tiangong Hinge System for seamless dual-direction folding.

Priced between RMB 19,999 and RMB 23,999, the Mate XT is a luxury product aimed at entrepreneurs and high-net-worth individuals, rather than mainstream consumers. Its exclusivity and rarity have driven resale prices as high as RMB 90,000, earning it the nickname “electronic investment product.”

However, this pricing strategy diverges from the industry trend of lowering foldable phone prices for wider adoption. Thus, the Mate XT's popularity may not translate into broader market growth for foldables.

In Q1 2024, China shipped 1.86 million foldable phones, with Huawei leading with a 44.1% market share, followed by Honor (26.7%). In Q2, Huawei maintained its lead (41.7%), with vivo (23.1%) and Honor (20.9%) close behind.

While competitors' foldables are comparable in terms of thinness, adaptability, and even surpass Huawei in some specifications at lower prices, they struggle to compete against Huawei's brand power and differentiation.

Foldable phones' key advantages lie in practicality and differentiation, catering to high-end users seeking unique experiences. Yu Chengdong demonstrated scenarios like immersive reading and entertainment on the Mate XT's larger screen, emphasizing its value beyond mere functionality.

Moreover, the “emotional value” of owning a cutting-edge device, as one netizen put it, “might outweigh that of a luxury watch.” Here, brand power trumps product features, positioning Huawei in a different competitive dimension from its rivals.

Nevertheless, Huawei must remain vigilant about sustaining this “emotional value” over the long term.

03

Who Will Reign Supreme?

Apple's dominance in China has waned in recent years.

Prior to the event, tensions between Apple and WeChat over revenue sharing sparked debates on whether Apple would support WeChat. In the face of an ultimatum, most netizens sided with WeChat, reflecting consumers' perception that Apple is no longer irreplaceable.

Market data supports this notion. IDC reports that iPhone global sales declined nearly 10% YoY in Q1 2024, the steepest drop among the top five brands. Consequently, iPhone revenue fell 10% YoY.

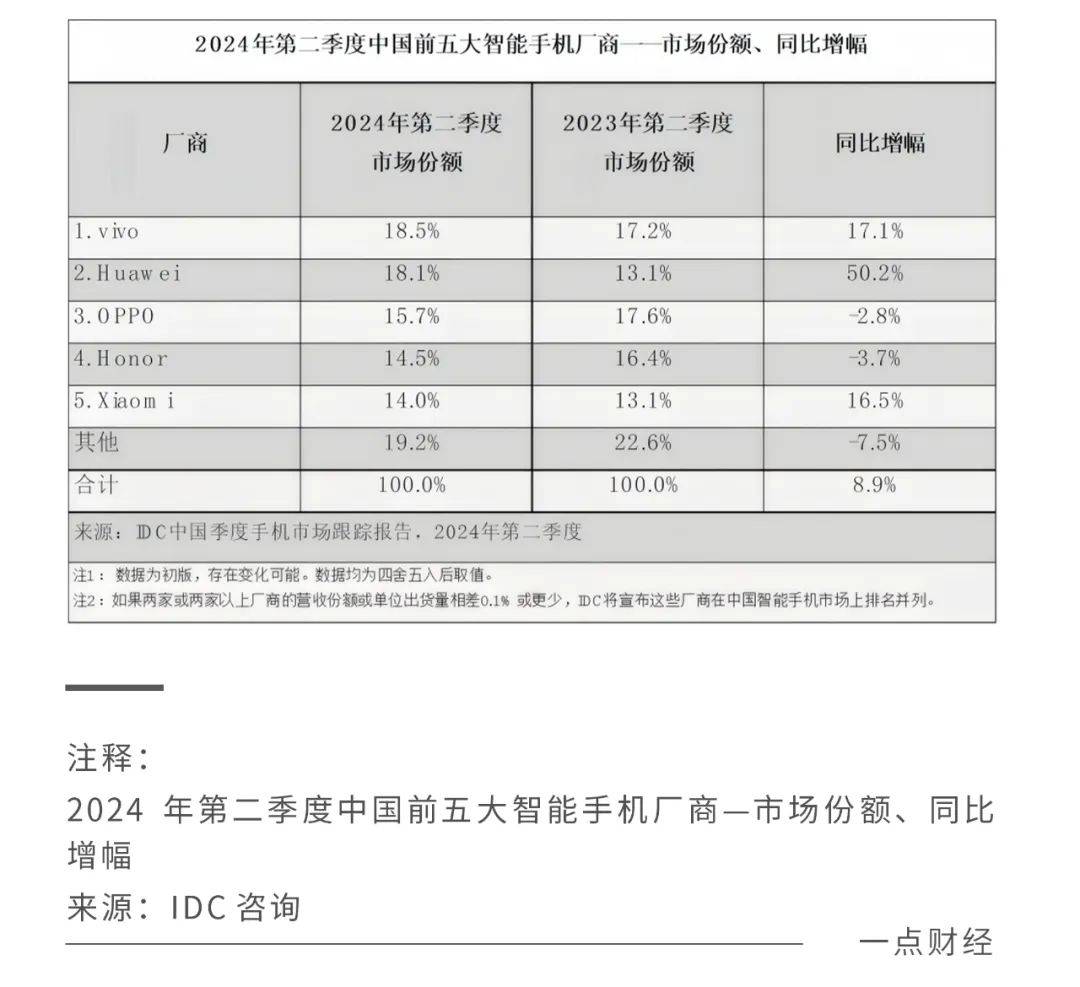

In China, the competition is even fiercer. IDC data shows that in Q2 2024, vivo, Huawei, OPPO, Honor, and Xiaomi topped smartphone shipments, with Apple falling into the “others” category.

The iPhone 16 series' underwhelming reception suggests it won't reverse the trend. Analyst Ming-Chi Kuo estimates pre-orders for the iPhone 16 series totaled around 37 million units, a 12.7% YoY decline due to weaker-than-expected demand.

It seems clear that Apple needs AI more than AI phones need Apple. In contrast, foldable phones rely on technological breakthroughs and brand strength, as exemplified by Huawei.

On the surface, foldable phones are growing rapidly. Counterpoint Research data shows a 49% YoY increase in global foldable phone shipments in Q1 2024, with Chinese vendors accounting for over half. However, foldables still account for less than 1.4% of the 1.167 billion global smartphone shipments in 2023, indicating a long way to go before mainstream adoption.

Current foldables are far from mature, facing challenges in hinge and screen stability, performance, battery life, and software compatibility. Moreover, foldable screens and hinges account for about 70% of a phone's cost, leaving room for cost reduction.

For now, traditional flat screens remain the optimal choice for daily communication. Huawei's true redefinition of foldables will hinge on the potential for widespread adoption of triple-folding designs.

Both AI and foldable technology aim to create market growth. Both are in their infancy, with technological advancements converging. As all players navigate the same waters, technological prowess and market insight will determine who emerges victorious.

04

Conclusion

With its innovative edge blunted, Apple has failed to lead the AI era. Rival brands, led by Huawei, are closing in, demonstrating Chinese brands' product confidence.

While Apple boasts strong ecosystem and user loyalty barriers, product innovation is crucial when brand loyalty wanes. As the saying goes, “A boat sailing against the current must strive continually to advance or it will surely retreat.” Time is running out for Apple to regain its footing.