Is Samsung retreating from China?

![]() 09/24 2024

09/24 2024

![]() 607

607

Recently, everyone has been focusing on the latest developments of Huawei Mate XT foldable phone and iPhone 16, while Samsung's layoffs and the deregistration of Samsung Tianjin have gone relatively unnoticed. As the world's top smartphone seller, Samsung has little presence in China.

However, Samsung has not left mainland China; on the contrary, it has been quietly making a fortune in recent years.

Despite its weakened position, Samsung is a company that has risen to prominence by skillfully utilizing both deterministic and stochastic factors.

Samsung currently faces fierce market competition, with Chinese brands continually capturing market share in smartphones, TVs, monitors, and other products. However, as long as China's chip industry has not truly risen and major power competitions persist, Samsung will continue to hold a significant global market share.

Samsung's only concern is that it is becoming increasingly cautious and conservative, losing its once ambitious spirit.

Written by Haoran

This article is originally created by Shangyin Club. For reprinting, please contact the back office.

Another Setback in Mobile Business

Recently, media reports stated that due to the continuing sluggish sales of smartphones and TVs, Samsung Electronics will lay off employees in its China sales department.

The initial round of layoffs is expected to reduce the workforce by 130, accounting for approximately 8% of the total 1,600 employees in the China sales department, with the possibility of an additional 30% reduction next year.

Separately, other media outlets have reported that the operating status of Sino-Korean joint venture Tianjin Samsung Electronics Co., Ltd. has changed from active to deregistered.

However, neither Samsung's layoffs nor any other moves have garnered much attention from Chinese consumers, as Samsung has virtually disappeared from the Chinese C-end electronics market.

We follow the battles between Huawei and Apple's new products, but we know little about what Samsung has released or what their products look like.

This is in stark contrast to Samsung's position as the world's top smartphone shipper for 12 consecutive years and the leader in the global TV market with a market share of over 30% for 18 consecutive years.

In 2013, when Samsung mobile phones were at their peak in China, they held a 20% market share. However, since then, their market share has plummeted to just 0.8% by 2018.

Samsung TVs, refrigerators, and washing machines were once common household appliances, but now they are rarely seen in Chinese homes.

The only reminder of Samsung's presence is its sponsorship of various variety shows, where it promotes its foldable phones.

2019 marked the beginning of the foldable phone era, and Samsung was a pioneer in this field, launching the first foldable phone, the Galaxy Fold, ahead of Huawei.

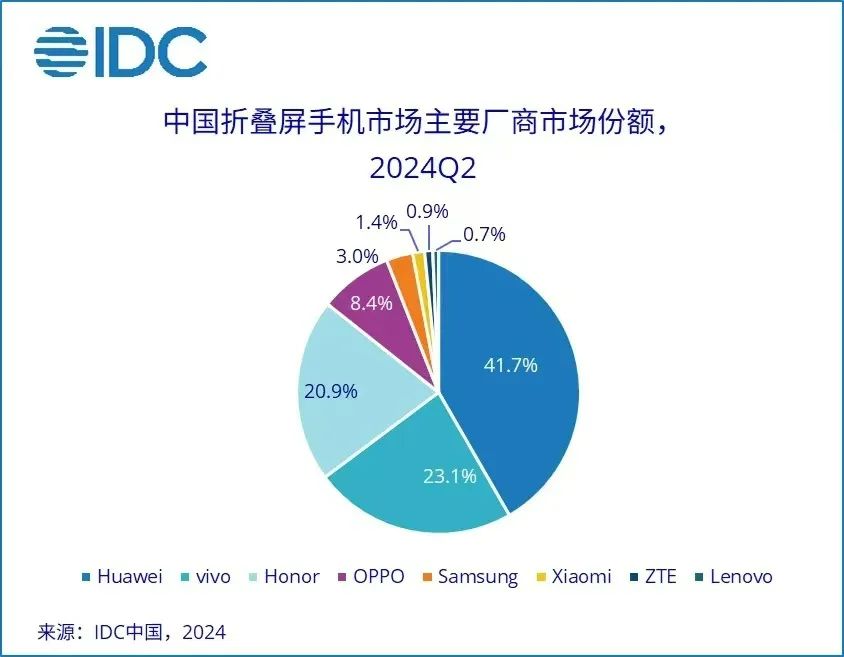

At that time, Huawei was continuously suppressed by the United States, providing Samsung with a rare opportunity for growth. By 2021, Samsung's foldable phones accounted for 93% of the global market share, while Huawei's share was just 6%.

However, as Chinese phone manufacturers entered the foldable phone market and domestic suppliers in the foldable phone industry chain intensified their efforts, the foldable phone market underwent a major shakeup in less than three years.

In the first quarter of this year, Samsung's global market share of foldable phones plummeted to 23%, with the remaining 77% of the market being captured by Chinese brands.

Despite Samsung's aggressive promotion of its new foldable phones through major variety shows, it has failed to regain the attention of consumers, and currently holds just a 3% market share in this segment.

From this perspective, it may be more challenging for Samsung to emerge from the "others" category in the Chinese mobile phone market than for Chinese mobile phone brands to penetrate the European and American markets.

Still Making a Quiet Fortune

Some may argue that even if Samsung leaves China, it will still be the world's top seller of mobile phones and TVs, indicating that the Chinese market is not as crucial for the company.

Firstly, Samsung has never left China. Even today, amidst geopolitical tensions and talk of the "end of globalization," the global economy remains highly interconnected and cannot be easily disentangled.

It is widely believed that the trigger for Samsung's withdrawal from the Chinese mobile phone market was the infamous "explosion" of the Note 7 phone. After the incident, Samsung treated Chinese consumers differently, which coincided with the deterioration of Sino-South Korean relations due to the deployment of the THAAD missile defense system in South Korea.

This series of events dealt a heavy blow to Samsung's mobile phone business in China, leading to a significant market contraction. Consequently, Samsung gradually transferred its mobile phone production facilities in China to Vietnam and India.

In 2018, Samsung closed its factories in Shenzhen and Tianjin, followed by the closure of its last remaining mobile phone factory in Huizhou and its TV factory in Kunshan, Suzhou, the following year. The next year, Samsung's last computer factory in China, also located in Suzhou, ceased operations.

In contrast, Samsung has increased its investments in Vietnam and India, particularly in Vietnam, where manufacturing is considered more advanced than in India.

Since 2008, Samsung has invested over $22 billion in Vietnam, establishing six factories, one research and development center, and one sales company there. Vietnam-based Samsung accounts for one-third of Samsung's total output value.

This superpower company is deeply embedded in Vietnam's economic structure, contributing one-quarter of the country's GDP.

However, Samsung has not completely retreated from China but has instead selectively expanded and contracted its operations.

As Samsung withdrew its production facilities from China, it made a strategic decision: by 2020, 20% of its mobile phones would be produced by ODM (Original Design Manufacturer) factories. In 2018, this figure was just 3%.

What is an ODM factory?

An ODM factory is one that designs and manufactures products according to the standards set by a brand like Samsung, with Samsung branding the final products. The factory earns a processing fee for its work.

ODM factories produce products without their own brands. The better they perform, the less likely they are to develop their own brands, as this would create conflicts with their major ODM clients. Brand building is not a task that everyone can undertake and requires significant investment and market selection.

China's mainland ODM production capacity for smartphones is overwhelmingly dominant globally, with representative players such as Huaqin Technology, Wintech, and Longcheer Technology accounting for over 75% of the global ODM market share.

Last year, Wintech secured ODM orders for 25 million mobile phones and 20 million tablets from Samsung. This year, it has secured even more significant orders for over 40 million mobile phones from Samsung.

In other words, many Samsung mobile phones are manufactured by domestic ODM factories in China.

More importantly, while Samsung withdrew its C-end electronics production facilities from China, it actually increased its investments in the B-end semiconductor memory and MLCC (Multi-Layer Ceramic Capacitors) sectors.

Samsung operates memory chip factories in Xi'an and Suzhou. The Suzhou factory specializes in the assembly and testing of memories, memory modules, and integrated circuits.

The Xi'an factory is Samsung's largest investment project in China, primarily manufacturing 3D NAND flash memory chips. Construction began in 2012, with subsequent phases added in subsequent years. Despite geopolitical tensions, the factory has continued to expand, with cumulative investments reaching $28 billion.

Samsung's Xi'an factory is now the world's largest NAND flash memory production base, accounting for over 40% of Samsung Electronics' total NAND chip output and 15% of global capacity.

For Samsung, semiconductors are a more profitable business than mobile phones.

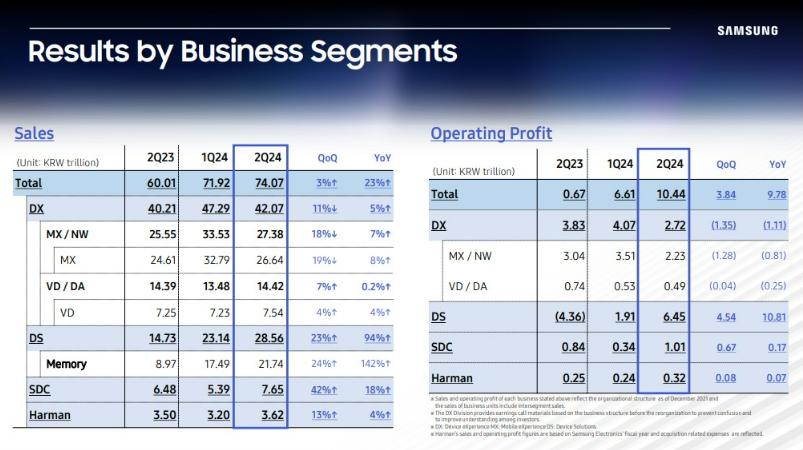

In Samsung's latest Q2 2024 financial report, the DS (Device Solutions) division, which oversees semiconductors, generated sales of 28.56 trillion Korean won and profits of 6.45 trillion Korean won, contributing 61.8% of the company's total profits.

In contrast, the combined profits of the MX (Mobile eXperience) division, which oversees smartphones, and the network business amounted to 2.23 trillion Korean won, contributing approximately 21.3% of total profits.

The figure above shows Samsung Electronics' Q2 financial report.

Making money through chips is much easier than selling mobile phones. To a large extent, Samsung's mobile phones are used to absorb a significant portion of its chip production capacity. Therefore, Samsung prefers a sea of mobile phones strategy, focusing on quantity over quality, offering a wide range of products from the A series to the Z series (using all 26 letters of the alphabet and still not enough).

Samsung still wants to return to the Chinese mobile phone market.

At the end of 2021, in an attempt to regain its footing in the Chinese market, Samsung established a dedicated team – the Business Innovation Team, directly controlled by Han Jong-hee, Vice Chairman and Head of the DX Division. This team comprises various departments and business units from across the company, supporting human resources and marketing efforts. Under this umbrella, there are the MX division overseeing mobile phones and the Consumer Electronics and Video Display (VD) division.

However, nearly three years have passed without significant results, as the Chinese mobile phone market is highly competitive. Even without the "explosion" incident or the THAAD deployment, Samsung's market share has gradually shrunk due to the influx of domestic mobile phone brands.

When Samsung first gained popularity in China, it was during a time when Nokia was on the decline and domestic brands like Huawei, Xiaomi, Oppo, and Vivo (collectively known as "HuamiOv") had not yet risen to prominence. The Chinese mobile phone market was a duopoly between Samsung and Apple, with Samsung employing a sea of mobile phones strategy to top sales charts, while Apple dominated profits with its flagship devices.

As domestic brands gained ground, Samsung struggled to compete on price and performance, leading to a gradual decline.

In contrast, the European and American markets lack strong local mobile phone brands besides Apple, with only Motorola and Nokia remaining but in decline.

Even abroad, Samsung mobile phones are facing significant challenges from Chinese brands. In Q2 of this year, Samsung lost its market share lead to OPPO in Vietnam, its home base, with Xiaomi closely trailing behind.

Beyond Vietnam, Samsung has also lost its market leadership to Chinese mobile phone brands in countries like Indonesia, the Philippines, Thailand, and Malaysia.

Samsung's Deterministic and Stochastic Factors

Despite its weakened overall strength, Samsung remains a formidable international superpower.

South Korea, with a population of less than 0.7% of the world's total, has nurtured this superpower company. In addition to mobile phones and TVs, Samsung is also the global leader in OLED technology and once surpassed Intel to become the world's top semiconductor company.

Samsung is one of the few technology enterprises worldwide that have established a complete industrial chain, encompassing semiconductor chips, memory, displays, batteries, and other key components, as well as its own assembly factories.

It has been argued that if all global mobile phone manufacturers were to "go it alone," Samsung would be the only one capable of producing phones without relying on external procurement.

Moreover, most leading technology enterprises in the Fortune 500 list are supported by major powers, with the vast majority hailing from China and the United States, and a few from traditional industrial and economic powers like the United Kingdom, Germany, and Japan. Samsung stands out as a unique entity.

The rise of this superpower company is unparalleled.

While other companies can learn from Samsung's organizational management, which bears some similarities to Huawei's emphasis on organizational vitality, substantial investments in basic research, and the global recruitment of top scientific talents, there are also stochastic factors that Samsung has cleverly capitalized on, which cannot be easily replicated.

Although the rise of electronic industries in East Asian economies follows different paths, they generally share a similar trajectory. For latecomers, without the support of mysterious forces behind the scenes, it is impossible to withstand the endless losses during the technology catch-up period.

One critical factor in Samsung's rise was the unwavering support of the entire nation of South Korea.

In the 1970s, the core strategy of South Korea's industrial policy was to support large enterprises and chaebol (conglomerates), strictly controlling the entry of other companies into the electronics industry to allow Samsung, LG, Daewoo, and others to monopolize production.

The government granted these companies franchise rights and low-interest loans. Considering South Korea's high inflation rate at the time, the real interest rate on these loans was negative, making it attractive for them to borrow and expand into various sectors, even unrelated industries, in a clearly non-market-oriented investment decision.

This approach led to the emergence of giants like Samsung, which permeates every aspect of South Korean life. Three things that South Koreans cannot escape in life are death, taxes, and Samsung.

Samsung's international expansion was also fueled by the benefits of major power competitions.

Samsung underwent two rounds of international expansion. The first round occurred during the 1980s US-Japan technology war, when the US semiconductor hegemony was challenged, leading to sanctions and suppression against Japanese companies.

For example, the 1986 US-Japan Semiconductor Agreement limited Japanese semiconductor prices, forcing Japan to cede 20% of the market to other suppliers. In 1987, the US imposed a 100% tariff on Japanese-made computers and home appliances. Korean companies, including Samsung, filled the void left by Japan.

Furthermore, the US imposed technological restrictions on Japan, preventing Fujitsu from acquiring Fairchild Semiconductor, while supporting Korean companies like Samsung, LG, and Taiwan Semiconductor Manufacturing Company (TSMC).

Samsung even established strategic alliances with companies like Intel, Apple, and General Motors, obtaining nearly 1,500 patents in the US in 2001, vaulting it to fifth place globally, surpassing Japanese companies like Panasonic, Sony, and Hitachi. Samsung seized this opportunity to invest in China and Southeast Asia, establishing a global supply chain.

Samsung's second round of international expansion is the Sino-US technology war that began in 2018.

The market space released by the suppression of Huawei has been divided between Samsung and Apple.

Then the United States cut off China's access to semiconductor production equipment and technology, increasing China's chip demand gap, so Samsung's Xi'an and Suzhou semiconductor factories continued to expand production capacity.

In 2020, Samsung's sales in China accounted for one-third of its total sales. In the first half of this year, Samsung earned 32.3 trillion Korean won from the Chinese market, mainly chips. Last year, this figure was only 17.8 trillion Korean won, almost doubled!

This round of international expansion has also enabled Samsung to relocate its electronic product supply chain to Vietnam, spreading the risk of the industrial chain. Samsung is also investing in factories in the United States with the support of US preferential policies and tax subsidies. The United States dominates in semiconductor research and development, and combines with the manufacturing capabilities of Samsung and TSMC to further strengthen the semiconductor industry ecology.

Therefore, an important factor in Samsung's rise is the dividend of great power competition.

At present, Samsung is actually facing fierce international competition. Electronic products such as mobile phones and TVs are facing the impact of Chinese brands. The previous global best-selling monitor has also been surpassed by China's BOE, and according to estimates, Samsung's OLED field, which still has advantages, will also be surpassed by BOE in 2028.

Chinese brands are sharing Samsung's market share in Samsung's huge industrial chain, but as long as China's chip industry has not really risen, as long as the competition between big powers still exists, Europe, America and India are more inclined to Samsung brand, Samsung still has a considerable market share in the world.

The only thing Samsung is worried about may be that it is becoming more and more conservative - South Korean media found that over the past 10 years, the description in Samsung's financial statements has changed from the ambition to compete for the "world's first" to the prudence to "consolidate its position."