Xiaohongshu's Dream of Breaking into the Gaming Circle

![]() 09/26 2024

09/26 2024

![]() 668

668

Xiaohongshu strives to break gender boundaries and aggressively enter the gaming marketing scene, but compared to the mature market performances of Douyin and Bilibili, Xiaohongshu, still in its infancy, faces challenges in breaking the duopoly.

Xiaohongshu is increasingly adopting a Bilibili-like approach, accelerating its commercial layout in the gaming sector.

During the recent Mid-Autumn Festival holiday, Xiaohongshu Games partnered with "Legends of Runeterra" to host a women's tournament for the first time offline. In July this year, Xiaohongshu made its debut at ChinaJoy, one of the most prestigious and influential annual events in the global digital entertainment industry, with the slogan "New Gaming Frontier, Breaking Circles with New Ecosystem," revealing its ambitions.

Backing up these ambitions are Xiaohongshu's rapidly growing data. According to data shared by the Xiaohongshu team at ChinaJoy, Xiaohongshu has 110 million gaming users, and gaming content is one of the fastest-growing categories on the platform, with daily exposure exceeding 2 billion.

Game developers are also flocking to Xiaohongshu. Xinshang has noticed that over the past few months, top games like "Genshin Impact" and "Party Animals" have launched intensive promotional campaigns on Xiaohongshu. As early as April this year, "Genshin Impact" suspended its sign-in activities on Weibo and moved them to Xiaohongshu instead.

"Xiaohongshu will promote more high-quality games, open up app download capabilities for the first time, and implement an incentive fund support program. By guiding trends, expanding word-of-mouth, boosting sales, and driving conversions across domains, we aim to foster the development of more game developers on the Xiaohongshu platform," said Zhao Weichen, General Manager of Xiaohongshu's Internet and Entertainment Industry Group, in an exclusive interview with Sina Tech.

The vision is promising, but Xiaohongshu's journey to capture a slice of the gaming marketing pie won't be easy, especially with 70% of its user base consisting of women and the formidable competition from Douyin and Bilibili.

01 Expanding User Boundaries

As everyone knows, Xiaohongshu's user base is predominantly female. Even as Xiaohongshu's user base has rapidly expanded in recent years, with monthly active users exceeding 300 million, women still account for 70% of its users.

Success and failure both stem from the same source. With a strong "female" label, Xiaohongshu's community content and advertising business tend to focus more on beauty, fashion, dining, and home decor, making it difficult to attract a broader range of users and advertisers to some extent.

Industry insiders analyze that due to its user demographics, Xiaohongshu's advertising clients have primarily focused on the consumer goods industry, with limited presence in gaming, automobiles, e-commerce, digital electronics, and other sectors. However, these clients account for nearly half of the revenue generated from commercialization efforts by other major platforms. For example, in the second quarter of this year, Bilibili's top five advertisers came from gaming, e-commerce, digital electronics, food and beverage, and automobiles.

Like many social platforms that have grown from small beginnings, Xiaohongshu faces the challenge of expanding its user base. Achieving this without compromising the community's atmosphere is indeed a difficult task.

From all angles, gaming is indeed a solid choice, aligning with Xiaohongshu's dual aspirations of growth and commercialization. On the one hand, while traditional gaming primarily targets young male audiences with strong spending power, gaming encompasses a wide range of genres, from casual to hardcore, appealing to a broad audience regardless of space, distance, age, or gender. This includes topics that spark widespread discussions, such as the recent 3A game "Black Myth: Wukong."

In the view of Zhang Shule, an internet industry analyst, it's entirely reasonable for Xiaohongshu to prioritize gaming content. As they explore diversified ways to monetize traffic, gaming serves as a quick path to conversion and a form of "grass-roots marketing."

"As a content distribution platform, Xiaohongshu's users will always be courted by game developers, especially in today's increasingly competitive gaming landscape," said Zhang Shule.

Similar to platforms that have hit a ceiling in user growth, China's gaming market has also reached a bottleneck, with natural user growth nearly exhausted and traffic costs rising. Coupled with continued tight restrictions on game approvals, game developers find themselves in a Stock competition , intensifying marketing battles.

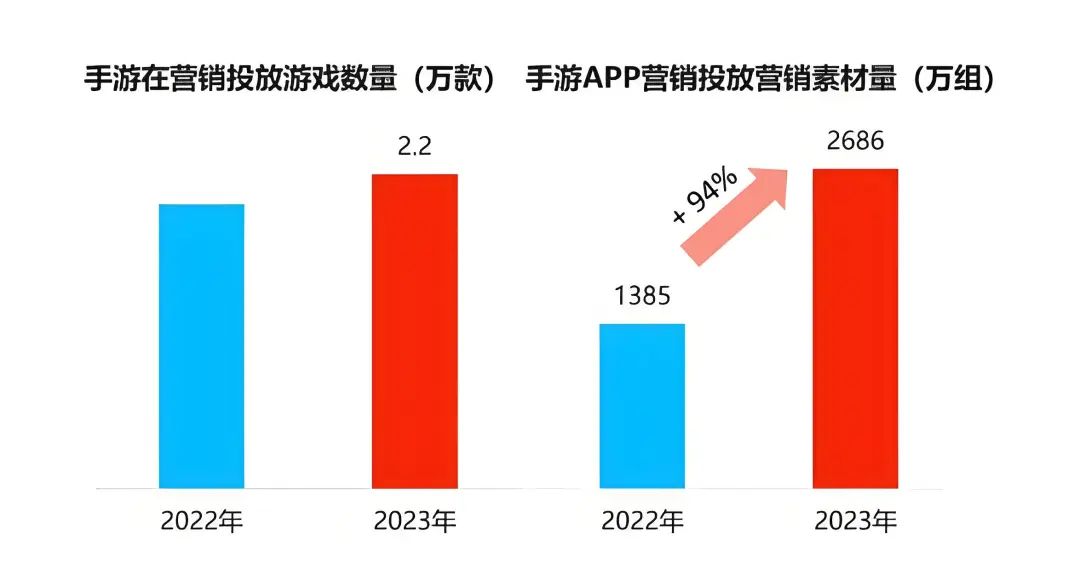

According to Fastdata, the volume of gaming advertising materials in 2023 grew by over three times compared to the previous year, with over 13 million pieces of advertising material for mobile games alone in the first half of the year.

Additionally, according to Gamewisp statistics, game developers' total sales expenses have increased annually. In 2023, the combined sales expenses of 23 A-share listed companies primarily engaged in gaming amounted to RMB 22.431 billion, a year-on-year increase of 13%, with a significant portion directly allocated to advertising.

However, the traditional user acquisition model's ROI (Return on Investment) continues to decline, with conversion rates remaining low. In terms of material usage efficiency, the average usage duration of a single mobile game's new materials in 2023 was 3.8 days, a relatively low figure that has steadily declined over the past five years. This has prompted game developers to shift from direct user acquisition to long-term "grass-roots marketing," and Xiaohongshu represents a new frontier with untapped traffic potential.

In this sense, Xiaohongshu's focus on gaming content can be seen as a mutual pursuit between the platform and game developers.

02 Challenges of Long-Chain Grass-Roots Marketing

Among various platforms, Xiaohongshu stands out for its "human touch"—ordinary people helping ordinary people. This extends to gaming content, where Xiaohongshu maintains its people-centric approach. Most gaming-related posts revolve around the themes of gaming and daily life, such as sharing gaming peripherals, exploring branded stores, or traveling with games. In contrast, hardcore content like strategy guides, gameplay discussions, and plot recaps is relatively scarce.

Based on this, Xiaohongshu's official keyword for gaming content is "breaking circles," evident in its various initiatives throughout the year.

During this summer vacation, Xiaohongshu collaborated with ten popular game IPs like "Arena of Valor," "Genshin Impact," "Party Animals," and "Love in Space" to launch the "Game City Crossover Plan" at Shanghai Metro Line 2's People's Square Station. Characters from these games appeared on escalator companion screens, creating an immersive experience that transcended dimensions. Furthermore, Xiaohongshu hosted a special exhibition, "Archiving My Memories on Xiaohongshu," at the China Audio-Video and Digital Publishing Association Game Museum, showcasing ordinary users' gaming-related posts on the platform.

In addition to Xiaohongshu's typical KFS (Key Figure Seeding) approach, which involves partnering with KOLs to generate high-quality posts, amplify them through feed ads, and precisely target users through search engine optimization, Zhao Weichen previously stated that Xiaohongshu would also drive traffic to in-app mini-programs through multiple entry points and continuously attract users through live broadcasts by anchors and official game streams. Currently, this system retains 70% of users, with an average session duration of 60.4 minutes.

However, Zhou Zhou, who has worked in game marketing for nine years, told Xinshang that while marketing games on Xiaohongshu is suitable for KOCs (Key Opinion Consumers) and creators without a significant following can still gain good exposure, the effectiveness ultimately depends on the game's foundation.

"First, the game's audience must include women, have strong social attributes, and be easy to pick up. Secondly, the game content must be engaging, stimulating UGC production from players in terms of graphics and storyline. Without these conditions, it's difficult to achieve results," said Zhou Zhou.

Despite Xiaohongshu's emphasis on enhancing user interaction, reputation maintenance, and circle-breaking for game developers, the abundance of UGC content lacks focus. For game developers, player conversion rates remain questionable.

As a gamer and Xiaohongshu user, I believe this may be because much of the gaming-related content on Xiaohongshu is overly entertaining, with discussions centered on emotions and social aspects. This creates a sense of segregation, making it difficult for potential new users to effectively access core gameplay and process information, thereby hindering their interest in the game.

"Overall, Xiaohongshu's gaming grass-roots marketing chain is relatively long. For project teams prioritizing speed, most will still choose platforms like Douyin and Bilibili with higher conversion efficiency," noted Zhou Zhou.

03 The Squeeze from Douyin and Bilibili

According to Zhou Zhou, game project teams prioritize Douyin and Bilibili over Xiaohongshu for promotional channels. Compared horizontally, Xiaohongshu lacks distinct advantages in specific content products. For instance, Douyin excels at spreading gaming experiences and entertaining content like memes, while Bilibili leverages its platform for game guides, reviews, and commentary videos more effectively.

Moreover, platforms like Douyin and Bilibili boast more mature marketing, interaction, and infrastructure capabilities in gaming.

Taking the popular game "Party Animals" as an example, the topic has garnered 42.05 billion views on Xiaohongshu but an astonishing 200.06 billion plays on Douyin, nearly five times more.

Beyond these factors, platform attributes also contribute to the differences. While Xiaohongshu allows video posting, its content primarily consists of images and texts. In contrast, both Douyin and Bilibili are video platforms with broader user bases and more focused user profiles.

According to the "2024 China Game Marketing Trends Report," there are 425 million users interested in gaming on short video platforms, with male users accounting for over 60% of gaming consumption and over 80% playing games weekly.

It's also worth noting the strategic layouts within the gaming industry. As China's largest anime community, gaming has always been a crucial business for Bilibili. Through investments and operations in gaming projects, Bilibili has accumulated extensive industry knowledge and experience, both in self-developed and licensed games, fostering deeper partnerships with game developers.

As for Douyin, backed by ByteDance, it has seen steady growth in game content submissions and views, with a particular focus on mini-games. Data shows that from Q2 2023 to Q1 2024, the user base of Douyin mini-games grew by 100%, and the number of mini-game products increased by 70%.

Regarding Xiaohongshu, both its gaming content creator base and partnerships with game developers are still in their infancy. Its recent collaboration with taptap to launch the Spotlight Game Creation Challenge, aiming to reach more independent game developers, is a step in the right direction but still in its early stages.

Apart from navigating fierce external competition, Xiaohongshu must also strike a balance between excessive marketing that may harm user ecosystems and swift monetization. According to previous 36Kr reports, Xiaohongshu aims to increase its ADS (Ad Load) by 2 percentage points to 12% in 2024, implying that ad-related content may become more prevalent in users' feeds.

In Zhang Shule's view, Xiaohongshu's focus on gaming is primarily a supplementary means of monetization, with its primary direction remaining buyer-centric e-commerce.

Focusing on the gaming business, gaming represents just one vertical in Xiaohongshu's advertising strategy. Besides gaming, Xiaohongshu has also made inroads into sectors like automobiles, digital electronics, pop culture toys, maternity and baby products, non-K12 education, pan-entertainment, and local lifestyle, achieving multifaceted growth.

For a community platform, balancing traffic, user engagement, and community atmosphere is challenging.

At this stage, Xiaohongshu must expand its user base, consider commercial monetization, and ensure its unique community atmosphere remains undiluted—a difficult task but a necessary path for any community platform seeking growth.

For Xiaohongshu, whether it aims to capitalize on the gaming pie or other vertical opportunities, its immediate priority is to advance platform commercialization. Currently, gaps in Xiaohongshu's data analysis and algorithms compared to other mature platforms significantly limit its ability to provide in-depth user insights and facilitate commercial monetization for brands.