Big drop! Huawei's triple-folding phone scalper price plunges, revealing the truth of market demand

![]() 09/26 2024

09/26 2024

![]() 490

490

Huawei's first triple-folding phone, the Mate XT, was initially hyped by scalpers upon its launch, but due to insufficient actual demand and excessive pricing, the market premium quickly declined, reflecting the need to cultivate consumer acceptance in the foldable phone market.

@TechInsights Original

Shocking! Huawei's first triple-folding phone, the Mate XT, saw a cliff-like drop in market premium just days after its launch.

Perhaps it was the over 6 million pre-orders for the Huawei Mate XT before its launch that gave scalpers immense confidence, leading them to jack up prices by amounts ranging from RMB 30,000 to RMB 160,000.

On September 24, Jiemian News found on Taobao, Xianyu, Depp, and multiple offline dealer channels that the current premium for the Huawei Mate XT had dropped below RMB 10,000, with some channels and models available for a few thousand yuan above the official price.

Part.1

Scalper Market Encounters Avalanche

'In the past few days, speculating on this phone was like trading stocks, like riding a roller coaster,' said one scalper, who noted that he had received orders at a quote of RMB 90,000 on the day of launch (September 20), with quotes dropping to around RMB 40,000 on September 22 and below RMB 30,000 by September 24. Another scalper posted, 'First time being a scalper and getting burned, dropping RMB 4-5k a day.' Since the official launch of Huawei's triple-folding phone, scalper quotes have plummeted.

However, scalpers remain relatively calm at present. This scalper said that even though the premium had shrunk, it hadn't yet reached the point of being 'stuck in their hands,' and that the Mate XT had been his most profitable model in recent years.

Why has the price of the Mate XT changed so dramatically in such a short period?

Scalpers share the common view that the Mate XT generated significant buzz, attracting not only 'professional scalpers' but also many 'individual scalpers' who joined in. These individual scalpers do not have specific profit targets and are content with any profit they can make, which has also contributed to the rapid price decline to some extent.

Based on feedback from many netizens, the main factors behind the cliff-like drop in the scalper market price of Huawei's triple-folding phone, the Mate XT, include the following:

First, there is insufficient actual demand for this phone. For most consumers, foldable phones are not an essential device in daily life, and the potential consumer group for such phones is relatively limited.

Second, the pricing of this phone is not affordable. As a high-end product line under the Huawei brand, even at the official starting price of RMB 20,000, it is beyond the reach of most ordinary consumers.

More importantly, Yu Chengdong, CEO of Huawei's Consumer BG, said at the delivery ceremony that sales had far exceeded expectations, and that they were now working overtime to expand production capacity. 'It will still take some time in the short term, so please be patient.'

Earlier, TF International Securities analyst Guo Mingqi increased his shipment forecast for Huawei's triple-folding phone, the Mate XT, from 500,000 to 1 million units based on the latest supply chain survey data.

Part.2

China Leads the Foldable Phone Market

In the electronics industry, new phone models are often favored by scalpers upon their launch each year. Due to tight supply of new phones, scalpers often purchase large quantities, driving up secondary market prices and reselling the high-priced goods to consumers eager for upgrades, earning a profit in the process.

However, it is worth noting that while such speculation is not always successful, last year's bursting of the Apple new product premium bubble caused significant losses for many scalpers.

The Huawei Mate XT experienced a brief speculation boom due to its unique triple-folding design and advanced technology. As consumers gradually return to rationality, the plunge in scalper prices was inevitable.

At present, mainstream smartphone manufacturers have basically completed the comprehensive layout and iterative upgrades of their foldable phone product lines. In the foldable phone market competition, Chinese manufacturers have demonstrated strong competitiveness.

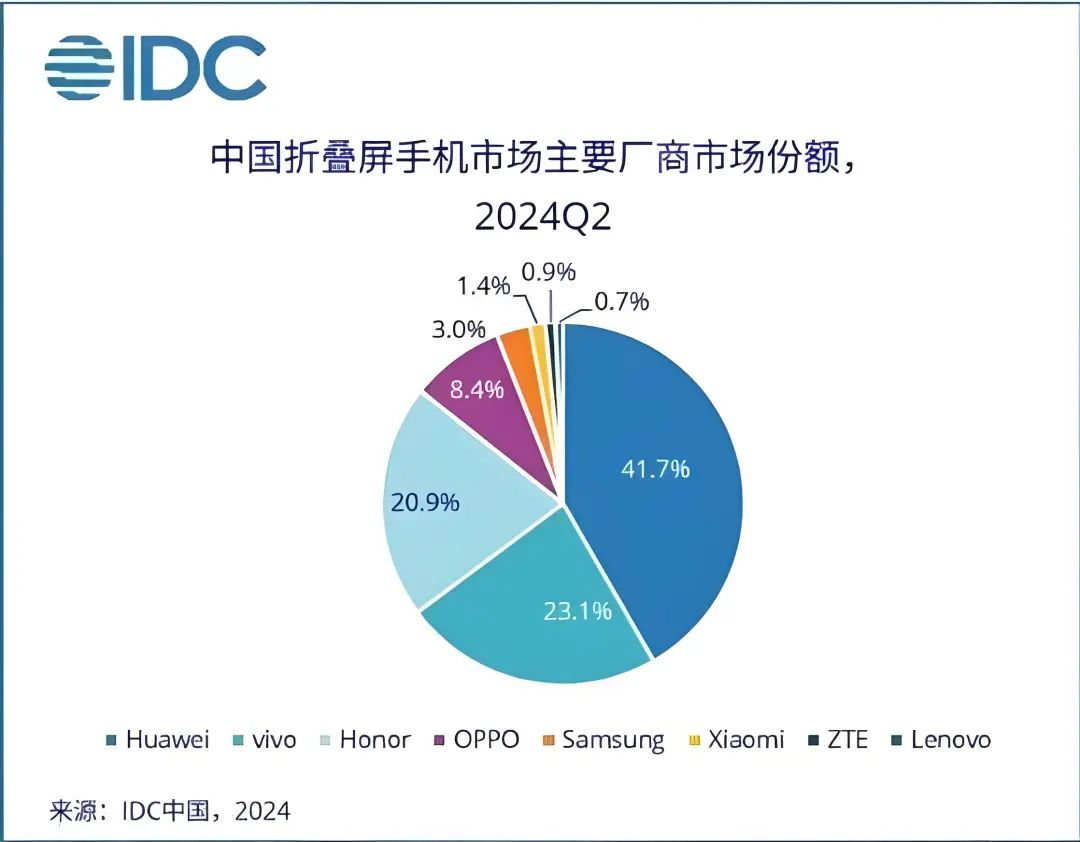

According to IDC data, shipments of foldable phones in China reached approximately 2.57 million units in Q2 2024, an increase of 104.6% year-on-year. Huawei led the market with a 41.7% share. IDC predicts that shipments of foldable phones in China are expected to climb to 10.68 million units in 2024, an increase of 52.4% year-on-year.

It is expected that shipments of foldable phones in China will exceed 17 million units by 2028, with a five-year compound annual growth rate of 19.8%. China's foldable phone market is expected to maintain a global market share of around 40% in the long run.

However, while Guo Mingqi increased his shipment forecast for Huawei in his report, he lowered his estimate for global foldable phone shipments in 2024 from 30 million to 15 million units. The main reasons for the downgrade are that software design fails to fully utilize the larger screen size and that foldable phones lack durability. Not everyone can afford to hold a RMB 20,000 triple-folding phone like Zhou Hongyi did when covering instant noodles.