Xiaomi regains its position as the world's second largest smartphone brand! Chinese phone makers encircle and attack Apple!

![]() 09/30 2024

09/30 2024

![]() 494

494

Author: Lushi Ming

Editor: Dafeng

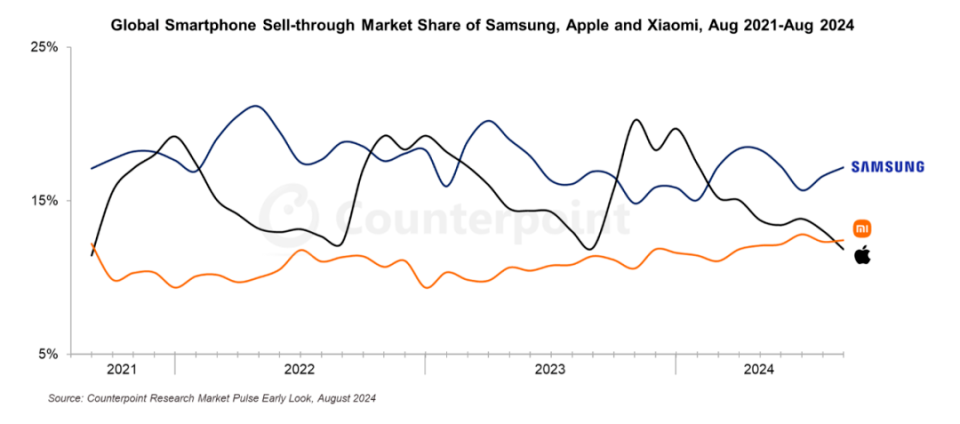

Recently, the smartphone industry has been buzzing with activity, first with Apple and Huawei engaging in a fierce competition, followed by Xiaomi's unexpected surge. According to a report released by market research firm Counterpoint Research, Xiaomi surpassed Apple in smartphone sales in August this year, becoming the world's second-largest smartphone brand after Samsung. Meanwhile, renowned analyst Ming-Chi Kuo's latest report indicates that pre-orders for the iPhone 16 series during its launch weekend are expected to reach 37 million units, a decrease of approximately 12.7% compared to the same period for the iPhone 15 series the previous year. The poor performance of the iPhone 16 Pro series has been a key factor in this decline. The dynamics of the smartphone industry are gradually becoming clearer, with Apple facing increasing pressure from Chinese phone makers, and the global market landscape undergoing subtle changes.

01

Xiaomi Returns to Second Place, Global Strategy Begins to Take Effect

As early as the second quarter of 2021, Xiaomi surpassed Apple to become the world's second-largest smartphone brand. At that time, Xiaomi achieved a market share of 17% in the second quarter of 2021 with a growth rate of 83%, while Apple ranked third with a market share of 14%. Three years later, Xiaomi has once again regained its position as the world's second-largest smartphone brand. According to Counterpoint, there are two main reasons for Xiaomi's resurgence. Firstly, Apple's iPhone typically experiences a seasonal sales slowdown before the release of its new models in September. At the same time, although Xiaomi's sales remained flat month-on-month in August, Chinese brands were among the fastest-growing in the first half of the year, with sales growing by 22% year-on-year. Even though growth is expected to slow in the second half of the year due to the base effect, Counterpoint expects Xiaomi to still achieve strong double-digit percentage growth for the full year.

Source: Counterpoint

Tarun Pathak, Research Director of Counterpoint's smartphone sector, said that Xiaomi has adopted a more streamlined product strategy this year, focusing on creating one flagship model in each price segment rather than launching multiple devices in the same market segment.

In other words, while other brands are flooding the market with multiple devices in the same price range, Xiaomi insists on launching only one flagship model in each market segment, which has helped it achieve good results in both the entry-level and high-end markets. In addition to the impact of Xiaomi's product strategy, the current global economic pressures have also contributed to the strong performance of Xiaomi's entry-level to mid-range devices. When the global economy is doing well, Apple has no trouble selling its iPhones. However, with consumers becoming more cautious and price-sensitive when purchasing new devices, Xiaomi, which has long been synonymous with "cost-effectiveness" and has a deep presence in the mid-to-low-end market, has seen significant gains. Models such as the Redmi 13C, Redmi Note 13, and Xiaomi 14 have sold well in India, Latin America, Southeast Asia, the Middle East, and Africa, outperforming popular models like the Samsung Galaxy A05 and significantly increasing Xiaomi's market share.

Redmi 13C Source: Xiaomi's official website

In addition to leveraging price advantages in the global market for entry-level and mid-range devices, Xiaomi has also made inroads into the high-end market in recent years with the launch of foldable and Ultra series phones, giving users more options and increasing fan loyalty. The Xiaomi 14 series (excluding the Ultra model) has seen its sales surge by 163% in the tenth month after its launch compared to the Xiaomi 13 series, with cumulative sales exceeding 6 million units. Some bloggers predict that the total lifetime sales of the Xiaomi 14 series may reach about 1.6 times that of the Xiaomi 13 series, or approximately 8 to 11 million units. Regardless of the reasons, Xiaomi's return to the world's second-largest smartphone brand is of great significance not only to Xiaomi itself but also to many other Chinese phone brands.

02

iPhone 16 Encounters a Cold Reception, Apple's Market Value Plummets

In contrast to the continuous growth of Chinese phone makers like Xiaomi, Apple has had a difficult year, with its former glory fading fast. As the world's second-largest economy, China has always been one of Apple's most important overseas markets. However, according to the latest report released by market research firm Canalys on June 7, Apple's share of the high-end smartphone market in China declined significantly in the first quarter of 2024, down 25% year-on-year.

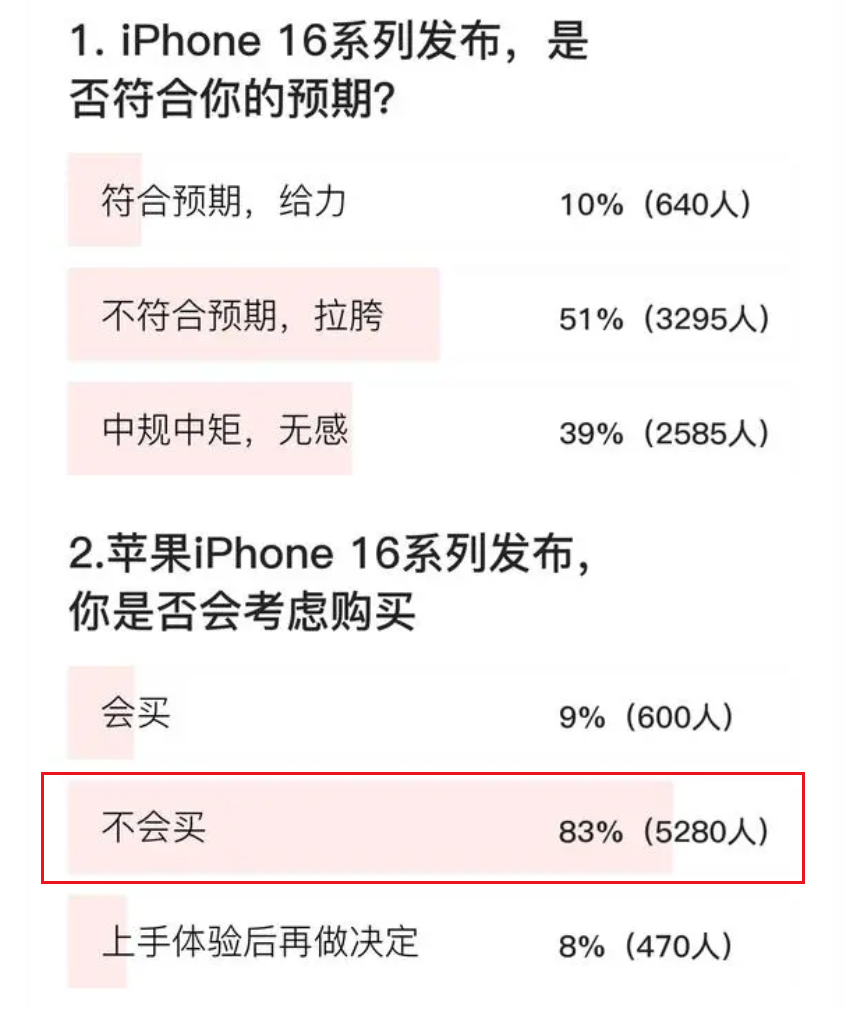

In the second quarter of this year, Apple's sales in China fell by 3.1% year-on-year, and its market share dropped to sixth place. The recently launched iPhone 16 series has also faced criticism due to a decrease of about 12.7% in pre-order sales during its first weekend compared to the same period for the iPhone 15 series the previous year. In a survey conducted by ifeng.com on the annual flagship iPhone, 24,000 netizens participated. More than half (51%) of respondents believed that the iPhone 16 series did not meet expectations, with 39% considering it average, and only 10% finding it satisfactory. Regarding whether they would purchase the new model, over 83% of respondents said they would not buy it, with 10% considering it and 7% deciding after experiencing it.

Source: ifeng.com

In previous years, Apple's new iPhone models were often resold at a premium of around 800 yuan to recyclers who managed to secure them early. However, on the second day after pre-orders for the iPhone 16 series opened, scalpers reportedly offered price increases ranging from 50 to 400 yuan for the iPhone 16 Pro and Pro Max models, depending on memory configuration.

These negative news items have transmitted to the secondary market, causing investor concerns and affecting Apple's market value. Within just a week of the new phone's launch, Apple's market value decreased by 69 billion USD, equivalent to nearly 500 billion yuan. From a product perspective, Apple's significant decline in market value is not unwarranted. Compared to the iPhone 15 series, the iPhone 16 series offers relatively minor changes, primarily focused on adding a camera control button, upgrading and rearranging cameras, and slightly enlarging the screen on the 16 Pro series. This has led to criticism that Apple is "squeezing out" minor updates. Beyond hardware, the most substantial change in the iPhone 16 comes from software updates, notably the introduction of an AI tool called "Apple Intelligence." Unfortunately, this feature is unavailable to users in China, further dampening consumer purchase intentions. Of course, beyond product factors, the rapid rise of Chinese phone makers in recent years is the core reason behind the pressure on Apple.

03

Chinese Phone Makers Gain Momentum, Aiming for the Global Market

In recent years, the global smartphone market has become increasingly competitive. Chinese phone makers have continued to increase their R&D investments, focusing on technological innovation, product design, and user experience. Companies like Huawei, OPPO, vivo, and Xiaomi have narrowed the gap with Apple through technological innovation and differentiation strategies. Especially in the Chinese market, these companies have won a significant share by better understanding local consumer needs and providing tailored products and services. In addition to Xiaomi mentioned earlier, Huawei has engaged in a years-long "head-to-head" competition with Apple.

From the hard confrontation between Huawei's Mate 20 and Apple's iPhone XR in October 2018, to Huawei preemptively launching the Mate 50 to compete with the iPhone 14, and then the Mate 60 launching on the same day as the iPhone 16, Huawei has consistently challenged Apple. On September 10 of this year, when Apple launched the iPhone 16 series, Huawei unveiled its first mass-produced tri-fold phone, the Mate XT Extraordinary Master Series . This model not only Refreshing people's understanding of the form of mobile phones but also became Huawei's most expensive phone ever, starting at 19,999 yuan.

Source: Huawei's official website

Despite its high price, the Mate XT has not lost any of its popularity. Before its official launch, pre-orders for the Mate XT exceeded 4 million, demonstrating its high demand. In some e-commerce platforms, the phone has been priced as high as 100,000 yuan, earning it the nickname "electronic Moutai." The peak confrontation between Huawei's Mate XT and Apple's iPhone 16 not only occurred close in time but also in terms of technological content and market strategy. Huawei challenged Apple's traditional phone form factor with its revolutionary tri-fold design.

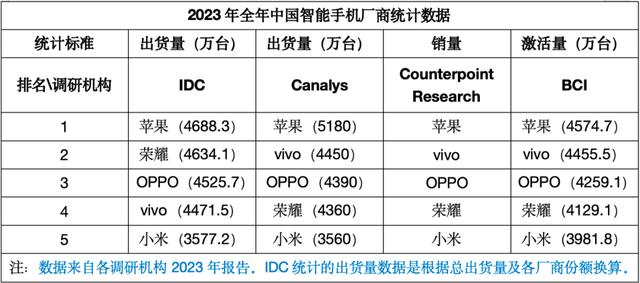

Looking back at the development of the Chinese smartphone market, it has been dominated by foreign brands such as Motorola, Sony Ericsson, Nokia, Samsung, and Apple for a long time. However, Chinese manufacturers have been catching up, from the early "Zhonghua Kulian" era to today's "Huawei, Xiaomi, OPPO, vivo" era. Chinese phone makers are rapidly emerging. According to IDC data, in 2023, the top five smartphone vendors in the Chinese market were Honor (17.1%), OPPO (16.7%), VIVO (16.5%), and Xiaomi (13.2%), with Apple being the only non-Chinese company on the list.

Source: IDC

Expanding our view to the global market, the market share and global competitiveness of Chinese brands are also increasing. Canalys data shows that in the second quarter of this year, the shipment share of Chinese phone makers in the global market for phones priced above 600 USD increased significantly, with Huawei and Xiaomi growing by 80% and 71%, respectively, and capturing 9% and 2% of the global market share.

The landscape of the global smartphone market has been constantly evolving. From Nokia and Motorola to Apple, which dominated the market for many years, it is time for a change. With the continuous growth of their global market share through strong technological and supply chain capabilities, Chinese phone makers like Huawei, Xiaomi, OPPO, and vivo are poised to achieve even greater successes in the future.