JD.com's Spin-offs: Gains and Losses

![]() 10/10 2024

10/10 2024

![]() 663

663

JD.com's ambitious spin-off and IPO plans are gathering momentum.

Recently, JD Industrial submitted its IPO application to list on the Hong Kong Stock Exchange. If successful, it will become the third company spun off from JD.com Group to go public and the sixth in the JD.com ecosystem, following JD Logistics and JD Health. The post-spinoff growth and capital feast achieved by JD Logistics and JD Health have been lucrative for JD.com, leading to the subsequent spin-offs of JD Industrial, JD Technology, and JD Property Development. However, JD.com's enthusiasm for spin-offs cannot fully compensate for its setbacks in its primary battleground. In the e-commerce market, JD.com is gradually falling behind as competitors like Taobao, Douyin, and Pinduoduo continue to gain ground. Could this be related to JD.com's recent business focus choices?

JD Industrial IPO

Recently, JD Industrial Co., Ltd. (hereinafter referred to as "JD Industrial") submitted its IPO prospectus, aiming to list on the main board of the Hong Kong Stock Exchange.

If successful, JD Industrial will become the third company spun off from JD.com Group to go public and the sixth in the JD.com ecosystem, following JD.com Group, JD Logistics, JD Health, Dada Nexus Limited (DADA), and Deppon Logistics Co., Ltd. (603056.SH).

In addition to JD Industrial, other companies within the JD.com ecosystem that have spun off and are awaiting IPO include JD Technology (formerly JD Finance and later JD FinTech) and JD Property Development.

Compared to other spun-off businesses, JD Industrial is more closely related to JD.com's core e-commerce platform.

In July 2017, JD.com Group began operating its industrial supply chain business as an independent business unit, and the following year, it became a first-tier category on JD.com, gaining a homepage entry point. After acquiring Suzhou Gongpinhui in 2020, JD Industrial established its current business structure.

JD.com is primarily a B2C e-commerce platform focused on consumer goods. Building on this foundation, JD Industrial can be understood as a B2B version of JD.com, specializing in industrial product procurement and sales.

As its business has grown and matured, JD Industrial has established platforms such as JD Wujincheng (mro.jd.com), JD Gongpinhui (vipmro.com), and Taipu Intelligent Supply Chain, complemented by offline entities like distribution centers, JD Work Cabinets, front-end warehouses, and smart mobile warehouses, to serve B-end customers.

China boasts the world's most comprehensive industrial system and the largest industrial output value. However, the industrial supply chain is highly fragmented in terms of supply and demand, with redundant distribution levels and insufficient standardization, leading to high operational costs, low efficiency, and lack of procurement transparency. There is significant room for improvement in the digitalization and intelligence of China's supply chain market.

Building on this vast market and gradually addressing related pain points, JD Industrial has become the leading player in China's industrial supply chain market within just a few short years. It has partnered with over 90,000 manufacturers, offers 41.66 million SKUs, and serves over 9,900 key customers, accounting for approximately 50% of China's Fortune 500 companies and over 40% of the global Fortune 500 list.

Based on this, the company has received high market recognition. In 2020, JD Industrial secured a Series A funding of $230 million from third-party investors such as GGV Capital and Sequoia China. In 2021 and 2023, it received two additional rounds of funding totaling $406 million, with a valuation of $6.7 billion at the beginning of 2023.

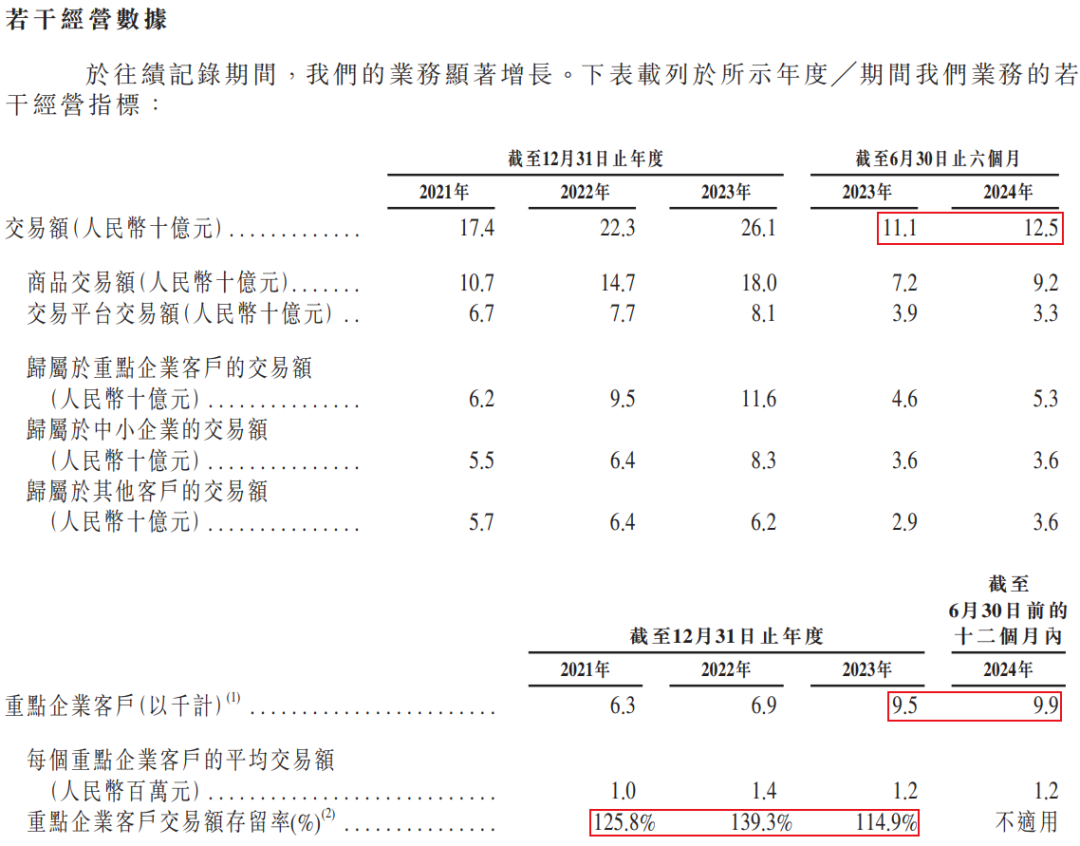

After rapid growth, JD Industrial has gradually encountered its own growth bottleneck in recent years, with key indicators such as transaction volume, number of key customers, average transaction value per key customer, and key customer retention rate showing declining or even negative growth trends.

Nevertheless, with the support of the JD.com ecosystem, JD Industrial has still achieved rapid business growth. From 2021 to 2023, the company's revenue was 10.345 billion yuan, 14.135 billion yuan, and 17.336 billion yuan, respectively, with annual net profits of -1.259 billion yuan, -1.269 billion yuan, and 4.799 million yuan, respectively. In the first half of 2024, the company's revenue increased by 20.3% year-on-year to 8.62 billion yuan, and its net profit was 291 million yuan, finally achieving substantial profitability ahead of its IPO.

Advantages of Spin-offs

Spin-offs involve separating businesses within a group that have growth potential and imagination into independent entities, allowing them to raise capital and potentially go public. This can facilitate business upgrades and achieve two-way interactions between the business and capital levels. In the history of China's internet industry, the most successful spin-off case is Maoyan Entertainment (01896.HK). Meituan's movie ticketing segment began independent operations in 2012, launched the Maoyan app in 2013, established an independent legal entity in 2015, took over related businesses from Dianping, and was officially spun off from Meituan in 2016.

Subsequently, Enlight Media became Maoyan's major shareholder, endowing it with film distribution capabilities. With the support of Enlight Media, Meituan, and Tencent Holdings (00700.HK), Maoyan Entertainment successfully went public in 2019. Today, it is not only China's largest online ticketing platform and online movie community but also one of the largest film distributors in the Chinese market. A single channel spun off by Meituan, with the support of industry giants like Enlight Media (300251.SZ) and Tencent, has rewritten the rules of China's film market. This is a prime example of the successful integration of the internet and the real economy. Although JD.com Group's (09618.HK) spin-offs have not been as radical as Meituan's spin-off of Maoyan, they have also yielded substantial benefits. JD Logistics (02618.HK) has deepened its presence in the supply chain business beyond its well-known JD Express delivery service. Today, it is one of the most formidable competitors to SF Holdings, China's leading express delivery company.

JD Health (06618.HK) has evolved beyond being just an online pharmacy or an e-commerce platform for buying medicine on JD.com. It has become an innovative model that integrates medical and healthcare products with health services. Similarly, JD Industrial is not limited to its current focus on MRO (Maintenance, Repair, and Operations) products but is transitioning towards specialized MRO products and deeper BOM (Bill of Materials) products, which encompass raw materials and components. The business directions of JD.com ecosystem companies in recent years have been similar. Amidst China's shift to an internet economy with a stock-based growth model and slowing growth rates, JD.com has primarily focused on deepening its local market presence to enhance business value.

As a result, these companies have achieved comparable business performance, with some decline in operating data and revenue growth rates but significant improvements in profitability. Would this have been possible without spin-offs, allowing JD Logistics, JD Health, and JD Industrial to explore third-party business and deepen service levels?

The growth of JD.com ecosystem companies at the business level is evident to all. Of course, the wealth effect of spin-offs and IPOs is also immediate. The spin-off journey of JD.com ecosystem companies has followed a similar path: business independence, company formation, with JD.com Group retaining a controlling stake and Liu Qiangdong (Richard Liu) holding a portion of the equity, while attracting various industrial capital investors. Each IPO becomes a wealth feast for the JD.com ecosystem and its investors. Many share the cake, but Liu Qiangdong is undoubtedly the one who slices it.

Disadvantages of Spin-offs

However, controversies surrounding spin-offs have always existed. If spin-offs were truly a win-win situation, Tencent Holdings could have spun off its businesses beyond social media, such as Tencent Games, Tencent Video, and Tenpay, potentially positioning them among the top internet companies like Tencent Music Entertainment Group (TME). Last year, Alibaba Group restructured its organization into a 1+6+N model, planning to spin off and list businesses like Cainiao Network, Hema Supermarket, and Alibaba Cloud.

As the market environment changed, Alibaba suspended its spin-off plans, instead focusing on strengthening synergies between Taobao, Tmall, and its international digital commerce, Cainiao Network, and Alibaba Cloud businesses, which is more conducive to its current development. Yes, after spin-offs and IPOs, each listed company operates independently, which can affect synergies between various businesses within the group and with its core business, thereby impacting the overall operational efficiency of the entire system. After all, these business synergies exist in the form of related-party transactions. To maintain independence, listed companies strive to reduce the proportion of related-party transactions. Taking JD Industrial as an example, last year, the company provided services to JD.com ecosystem companies worth nearly 500 million yuan and procured products and services, including technology and traffic, logistics and warehousing, marketing, and payment, totaling over 1.3 billion yuan from JD.com ecosystem companies.

In recent years, companies like JD Logistics and JD Health have emphasized the growth and proportion of third-party business, gradually reducing the share of related-party transactions. In the first half of 2024, JD Logistics' internal customer revenue accounted for slightly more than 30% of its total revenue. More importantly, spin-offs can weaken the competitiveness of the parent company. The result is that while a plethora of listed companies may emerge, the overall competitiveness of the system may stagnate or even decline. The JD.com ecosystem is currently facing such a risk. JD Logistics, JD Health, and JD Industrial are leading players in their respective niche markets.

However, JD.com Group itself is in a relatively passive position in its core e-commerce market, overshadowed by Alibaba Group (09988.HK), Pinduoduo, and even Douyin E-commerce. Last year, Alibaba's China retail GMV ranged between 7 and 8 trillion yuan, with annual revenue exceeding 430 billion yuan and profits approaching 200 billion yuan. During the same period, Pinduoduo reported revenue of 247.639 billion yuan, an increase of 89.7% year-on-year, and net income attributable to shareholders of 60.027 billion yuan, an increase of 90.3% year-on-year. In 2023, Douyin E-commerce's GMV was approximately 2.7 trillion yuan, with a target of 4 trillion yuan for 2024. In comparison, JD.com Group's growth and profitability pale in comparison.

In 2023, the company's revenue was 1084.7 billion yuan, an increase of 3.7% year-on-year, with a net profit of 23.257 billion yuan, an increase of 140.0% year-on-year. This year, the winds of change are blowing in the e-commerce market. Taobao, Pinduoduo (PDD), and Douyin have all made it clear that they are no longer simply pursuing absolute low prices but are returning to a logic of GMV growth. Meanwhile, JD.com continues to adhere to its low-price strategy, recently launching a "lightning action" called "Dark Night and High Wind." Amid this mismatched competition, how will the competitive landscape of China's e-commerce market evolve?