Relying on IPO to survive? Flashback Technology, with a gross margin of less than 5%, faces a life-or-death battle

![]() 10/17 2024

10/17 2024

![]() 720

720

This is an unimaginable contrast.

In 2023, Flashback Technology completed its Series D funding round, and based on the funding amount and equity stake sold, its valuation was approximately US$343 million, while Renrenche, a competitor in the same field, closed at a market value of approximately US$420 million on the same day.

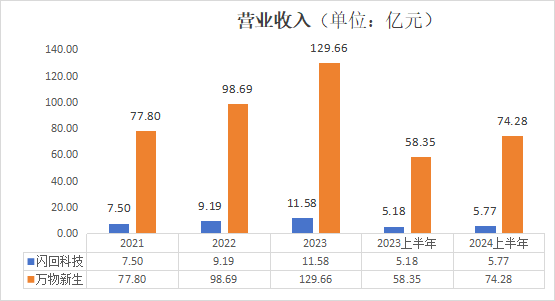

However, Flashback Technology's revenue in 2023 was less than one-tenth of Renrenche's.

So, are the investors being charitable or foolish? Neither.

There's no such thing as a free lunch. One of the conditions for the US$8 million Series D funding round was that if Flashback Technology failed to reach an agreement by December 31, 2024, it would be required to redeem the investors' equity. The redemption price would be the higher of: (1) the investment amount paid by the Series D investors plus 8% simple interest per year minus any dividends already paid; or (2) the fair value of the shares held by the Series D investors at that time.

Perhaps due to this, Flashback Technology is once again racing to list on the Hong Kong Stock Exchange after its IPO prospectus expired in February of this year.

Upon closer inspection of the prospectus, we find that Flashback Technology's IPO is less a capital feast and more of a life-or-death struggle.

1. Gross margin below 5%, making it difficult for Flashback Technology to generate profits

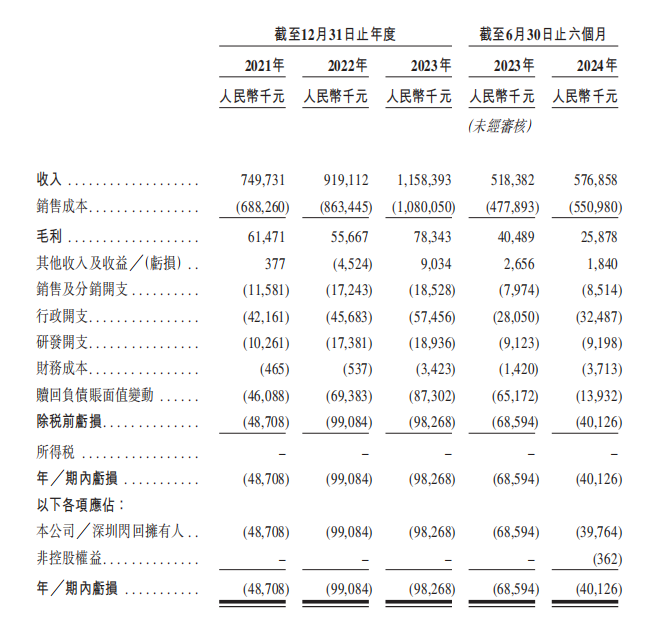

From 2021 to the first half of 2024, Flashback Technology incurred pre-tax losses of RMB 48 million, 99 million, 98 million, 65 million, and 40 million, respectively.

As can be seen from the data disclosed in Flashback Technology's prospectus, part of the reason for the losses is the change in the carrying value of a large amount of "redemption liabilities."

However, even if we exclude this factor, Flashback Technology is still operating at a loss, and its profitability is declining. By the first half of 2024, its gross margin on sales was only 4.49%, compared to 18.43% for Renrenche in the same industry. It is worth noting that even Renrenche, with a gross margin of 18.43%, is still incurring losses, let alone Flashback Technology.

In terms of revenue growth, Flashback Technology has not demonstrated the high growth expected of its current size.

According to the prospectus, Flashback Technology generated revenues of RMB 750 million, 919 million, 1.158 billion, and 577 million in 2021, 2022, 2023, and the first half of 2024, respectively, representing revenue growth rates of 48.8%, 22.6%, 26%, and 11.3%. Although revenue increased, the growth rates fluctuated and remained relatively low. In comparison, Renrenche's revenues were RMB 7.78 billion, 9.869 billion, 12.966 billion, and 7.428 billion in the same periods, with growth rates of 60.15%, 26.85%, 31.37%, and 27.29%, respectively.

Generally speaking, it is easier for smaller companies to achieve high growth rates due to their smaller revenue base, while larger companies face more challenges. This is one of the reasons why early-stage companies can often command higher valuations. However, in the case of Renrenche and Flashback Technology, the situation is reversed.

With both revenue growth and gross margin trailing the industry leaders, Flashback Technology's future appears uncertain.

2. Debt pressure reaches its peak, and the IPO becomes a life-or-death struggle

According to the balance sheet data, the current liability ratio was approximately 321% as of June 2024 and increased to 327% by the end of July. Such a high current liability ratio indicates significant short-term debt repayment pressure for the company, and its short-term solvency is clearly inadequate.

The primary reason for the high current liability ratio is the redemption liabilities of up to RMB 750 million. Even excluding these liabilities, Flashback Technology's net assets are only RMB 78 million.

Based on the prospectus, Flashback Technology has multiple valuation adjustment mechanisms (VAMs) in place, and the redemption liabilities amount to RMB 751 million. According to the Series D investor agreement, the investors require Flashback Technology to complete a qualified IPO by December 31, 2024, or else the company will face pressure to repurchase its equity.

This may be an insurmountable burden for Flashback Technology's financial reserves.

Moreover, Flashback Technology's current business model and industry position do not allow it to alleviate pressure by occupying working capital from upstream and downstream parties; instead, it must advance large sums of money, further increasing liquidity pressure.

Flashback Technology operates through partnerships with upstream suppliers rather than opening a large number of its own offline stores. However, this business model has not provided the company with strong cash flow. From 2021 to 2023 and the first half of 2024, Flashback Technology's net cash generated from operating activities was -RMB 6.399 million, -RMB 43.736 million, -RMB 47.774 million, and -RMB 121 million, respectively.

In general, adopting a light asset model without opening stores should reduce financial pressure. However, Flashback Technology's reliance on upstream partners has led to a loss of dominance in its partnerships. From 2021 to 2023 and the first half of 2024, Flashback Technology advanced RMB 135 million, 177 million, 330 million, and 121 million in promotional discounts to upstream mobile phone manufacturers, respectively.

Compared to the net cash generated from operating activities, such large advances and insufficient short-term solvency are bound to have adverse effects on daily operations.

In its prospectus, Flashback Technology states that the net proceeds from the IPO will be primarily used to further strengthen strategic partnerships with upstream resource partners to continue expanding the scope of its transaction services and national coverage, and to consolidate its market position in China's offline trade-in mobile phone recycling services; to further increase technical and R&D capabilities to continuously enhance business product and operational efficiency; to increase marketing efforts and explore new sales channels to steadily increase sales and profit margins; to make strategic investments or potential acquisitions in companies whose products or services complement those currently offered by Flashback Technology and align with its growth strategy; and for working capital and general corporate purposes.

It is evident that Flashback Technology is aware of the shortcomings of its business model and hopes to improve through the IPO.

But will the capital markets buy into this?

If the IPO is not successfully completed, the company's cash reserves will not be sufficient to cover the maturing RMB 150 million bank loan and RMB 750 million redemption liabilities. Therefore, the success of this IPO is crucial and can be described as a "life-or-death struggle." If the IPO is successful, the company can seek to fight another day; if it fails, the debt burden will be overwhelming, and even the interest payments resulting from the VAMs alone will be a heavy financial burden.