Wu Yongming helps Jiang Fan get back on the horse, is Alibaba quietly preparing for a leadership transition?

![]() 11/26 2024

11/26 2024

![]() 567

567

Text/Leon

Editor/cc Sun Congying

After being demoted for four years, Jiang Fan, once the "crown prince," returned to the power center of Alibaba at the end of 2024.

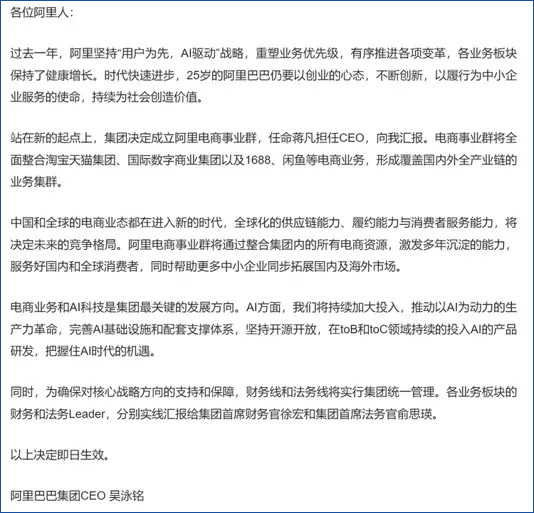

On November 21, Alibaba Group underwent a major business reorganization, with CEO Wu Yongming announcing in an email to all employees the establishment of the Alibaba E-commerce Business Group, which fully integrates e-commerce businesses such as Taobao Group, International Digital Commerce Group, 1688, and Xianyu, appointing Jiang Fan as CEO, who will report to Wu Yongming.

Wu Yongming pointed out: Both China and the global e-commerce landscape are entering a new era. The Alibaba E-commerce Business Group will serve domestic and global consumers by integrating all e-commerce resources within the group, while helping more SMEs simultaneously expand their domestic and overseas markets. E-commerce business and AI technology are the group's most critical development directions.

E-commerce business is the foundation of the Alibaba Group, but it became shaky in the later period of Daniel Zhang's tenure as CEO. Jack Ma emphasized multiple times that Alibaba should return to Taobao and the internet, so he personally appointed Wu Yongming, one of the "Eighteen Disciples," to return as the group's CEO and appointed Simon Cai as chairman to reverse the declining trend.

During his tenure as Alibaba Group CEO for over a year, Wu Yongming has focused on only two things: returning to e-commerce and technological innovation, the two strategic focuses he has always emphasized – "User First, AI-Driven." In fact, this is similar to Jack Ma's successful experience during Alibaba's 1.0 era: prioritizing users and overthrowing eBay China by offering free transaction fees on Taobao; and technological innovation by acquiring Yahoo China to obtain search technology, significantly enhancing Taobao's shopping experience.

Now, in Alibaba's 3.0 era, the new retail and high-price strategies of the Daniel Zhang era have been completely rejected. Facing the siege from Pinduoduo and live streaming e-commerce, Alibaba is reshaping its business priorities, with returning to e-commerce being the most important aspect. In this context, Jiang Fan, who once thrived with Taobao and Tmall, is undoubtedly the best candidate.

Jiang Fan, the "Savior" of the Smart Ones

Born in 1985, Jiang Fan is like the male protagonist in a thrilling novel: admitted to Fudan University at 18 without taking the entrance exam, he smoothly entered Google China after graduation. In 2010, he founded the mobile developer service platform "Youmeng," which was acquired by Alibaba for $80 million three years later, making him financially independent at 28.

Instead of leaving Alibaba, Jiang Fan chose to continue working. In 2014, Daniel Zhang recognized Jiang Fan's potential and promoted him to "Senior Director," responsible for the overall operation of mobile Taobao. That year, Jiang Fan led his team to increase DAU from 30 million to 60 million; incubated Taobao Live, creating a surge in traffic, and further increased DAU to 110 million, much to Daniel Zhang's satisfaction, solidifying Jiang Fan's position within Alibaba. (For details, see: Daniel Zhang Initiates "Centralized" Structural Adjustment, Jiang Fan, Born in the Late 1980s, Moves to the Center)

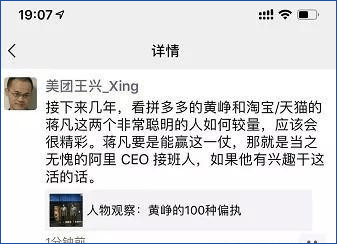

Subsequently, Jiang Fan successively served as President of Taobao/Tmall, Chairman and CEO of Tmall, and became Alibaba's youngest partner. Jiang Fan's youthful prowess even garnered praise from Wang Xing, the founder of Meituan: "In the coming years, it will be exciting to watch the rivalry between Huang Zheng of Pinduoduo and Jiang Fan of Taobao/Tmall, two incredibly intelligent individuals."

However, even smart people make mistakes. As everyone knows, in 2020, Jiang Fan was demoted and suspended by Alibaba, losing his partnership status and missing the opportunity to compete with Huang Zheng. For Jiang Fan, who had always been on a smooth path, the two years he was sidelined due to the "infidelity scandal" were indeed the darkest times. (For details, see: Jiang Fan Clears His Name, Zhang Dayi Unsatisfied and Seizes Traffic)

Just as people lamented the fall of the "crown prince," Jiang Fan suddenly returned in 2022, assigned by the group to oversee the "Overseas Digital Commerce Segment" comprising multiple overseas companies such as AliExpress, International Trade (ICBU), and Lazada. In 2023, this segment was officially established as the Alibaba International Digital Commerce Group, becoming one of the six business groups in the "1+6+N" structure. Jiang Fan served as CEO and subsequently became an Alibaba partner again in July of the same year.

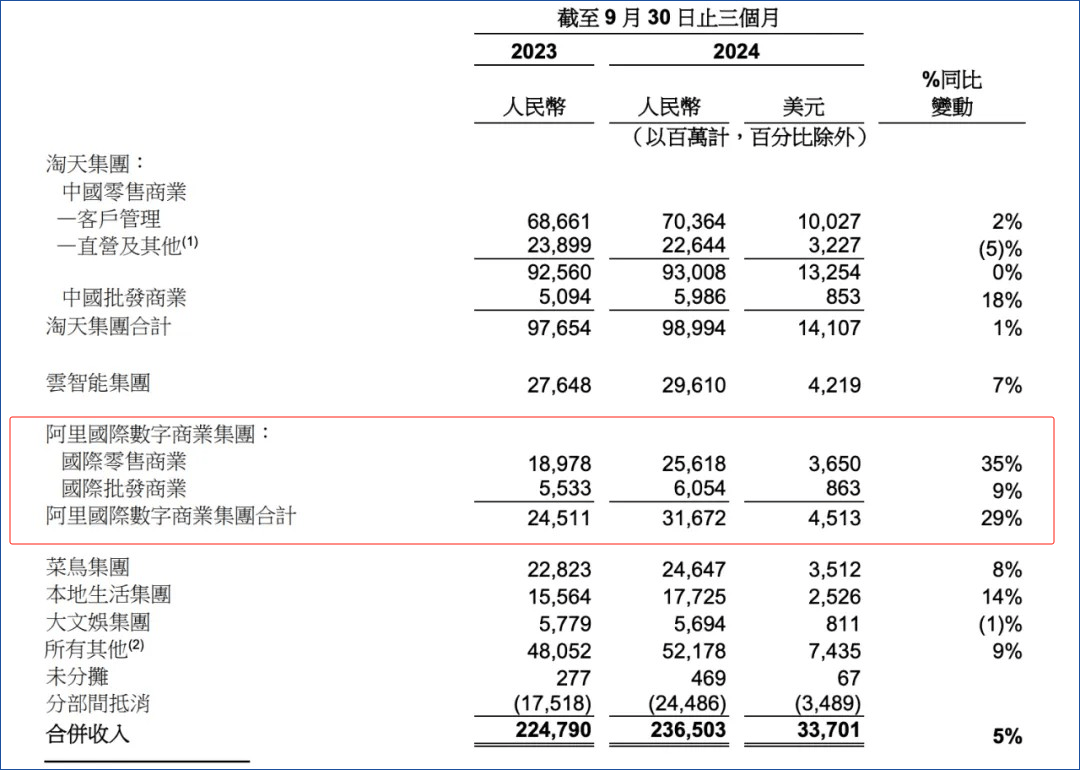

His rapid promotion after returning once again proved Jiang Fan's business prowess. According to Alibaba Group's 2024 fiscal year report (April 1, 2023, to March 31, 2024), the revenue of the Alibaba International Digital Commerce Group increased by 46% year-on-year, while that of the Taobao Group was only 5% during the same period. The quarterly financial report for the July-September period ending September 30 showed that the revenue of the Alibaba International Digital Commerce Group increased by 29% year-on-year, still the highest growth among Alibaba's six major business groups, while that of Taobao was only 1%. Of course, this is also related to the saturation of China's e-commerce market.

During his tenure overseeing Alibaba's overseas e-commerce business, Jiang Fan essentially accomplished two major tasks: first, integrating various resources to improve efficiency; second, formulating operational strategies tailored to different markets.

Within six months of taking office, Jiang Fan integrated the cross-border businesses of Taobao Global, Lazada, and AliExpress into AliExpress for unified management and introduced a fully-managed + semi-managed operating model for sellers to enhance efficiency. Subsequently, he launched the "AliExpress Choice" brand in Spain, Brazil, the United States, South Korea, and the Middle East, leading to a surge in orders. He also rationally utilized Cainiao's logistics resources within the group, introducing free shipping services for consumers and improving logistics speed.

This combination of strategies yielded remarkable results. According to Statista data, AliExpress's market share continued to expand in 2023, ranking top three in Spain, New Zealand, and Brazil with market shares reaching 38%, 28%, and 25%, respectively. At this point, AliExpress joins Temu, SHEIN, and TikTok Shop as the "Four Little Dragons" of Chinese e-commerce going overseas.

In the internet industry, which is full of concepts and bubbles, there are many "star" professionals with inflated reputations; however, Jiang Fan is different, receiving high praise from the public. This is not only because he understands technology and is low-key and pragmatic but also because his entrepreneurial experience has endowed him with exceptional acumen, proficiency in bidirectional thinking, and strong execution capabilities.

A widely circulated anecdote on LinkedIn may illustrate this point: Daniel Zhang and Jiang Fan's offices face each other. Daniel Zhang is a workaholic, always the first to arrive and the last to leave. In contrast, Jiang Fan's office is often empty. The contrast between a diligent ordinary person and a capable smart one often leads enterprises to favor the latter.

Certainly, Jiang Fan is also incredibly lucky, encountering growth opportunities every time he is entrusted with important responsibilities; moreover, he has the ability to seize these opportunities and ride the wave.

This restructuring of Alibaba and Jiang Fan's return undoubtedly fill Alibaba's internal team and investors with anticipation. Compared to the Daniel Zhang era, Wu Yongming faces a more complex market, which may also be why Jiang Fan is once again being pushed into a key position. So, what challenges will the Alibaba E-commerce Business Group, led by Jiang Fan, face?

The Three-Year Plan to "Revitalize E-commerce"

Based on various data, China's consumer market is still in a slow recovery process in 2024. Market saturation and price competition are issues faced by all major e-commerce platforms.

According to statistics released by the National Bureau of Statistics, China's total retail sales of consumer goods in the first three quarters amounted to 35.3564 trillion yuan, a year-on-year increase of 3.3%. In October, total retail sales of consumer goods increased by 4.8% year-on-year, 1.6 percentage points faster than in September, maintaining a trend of accelerated growth for two consecutive months. This growth can be attributed to the home appliance trade-in campaign that began in September and the preheating activities for Double 11, which stimulated some consumer demand.

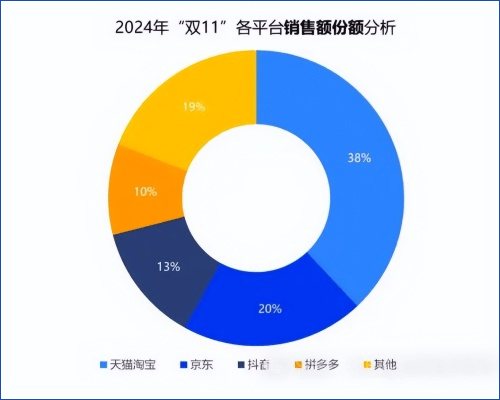

Overall, the 2024 Double 11 sales performance exceeded expectations. According to data monitored by Synergy Data, the total sales during the 24th Double 11 period reached 1.4418 trillion yuan, a year-on-year increase of 26.6%. Fudan Consumption Big Data shows that Taobao/Tmall took first place with a 38% sales share, followed by JD.com, while Douyin, with a 13% share, defeated Pinduoduo (10%) to enter the top three.

According to Taobao/Tmall's battle report, during the entire Double 11 period on Tmall, 589 brands achieved sales exceeding 100 million yuan, a year-on-year increase of 46.5%, setting a new record. Specifically, it mentioned leading 3C brands such as Apple, Midea, and Xiaomi, top-tier luxury brands in cosmetics, and mid-to-high-end apparel brands like Bosideng and Gofans.

Meanwhile, the growth in the number of Taobao/Tmall's 88VIP members also exceeded expectations, reaching 46 million in the third quarter of this year. The number of 88VIP members placing orders during Double 11 increased by over 50% year-on-year.

According to Analysys data, Taobao/Tmall achieved a year-on-year increase of 10.2% in transaction volume. It is expected that the revenue growth of Taobao/Tmall will exceed expectations in the fourth quarter.

Therefore, what Alibaba's senior management observed from Double 11 was not consumption downgrading but "consumption grading." During a conference call on November 16, Wu Yongming clearly stated that in the strategic cycle of the next three years, they will further clarify the priorities of Taobao/Tmall's business – User First, specifically focusing on three aspects: versatile Taobao, consumption grading and price competitiveness, and user value trade-offs. In short, Taobao will continue to offer subsidies of up to 10 billion yuan and promote low prices through Taobao Factory; highlight Tmall's advantageous categories such as mid-to-high-end apparel, luxury cosmetics, and premium 3C products; and improve consumer retention and purchase frequency through iterative AI technology and operational models.

From these three dimensions, Jiang Fan is basically well-versed. Integrating resources and supply chains and optimizing operational models with technology as the underlying logic are his strengths.

Regarding overseas markets, Wu Yongming mentioned building supply chain networks, the AI+digital retail model, and achieving breakthroughs in key emerging regions. Jiang Fan has actually partially achieved these during his tenure, with the main tasks now being to explore the implementation of the AI+digital retail model, such as addressing issues related to cross-language translation and multinational customer service.

Is Wu Yongming Paving the Way for Jiang Fan?

An interesting point is that Wu Yongming is Alibaba's fourth employee, China's first generation of programmers, with a technical background; similarly, Jiang Fan graduated from Fudan University's Computer Science Department. They are 10 years apart, belonging to the "post-75s" and "post-85s" generations, both sharing low-key and pragmatic personalities. This appointment of Jiang Fan to a key position inevitably sparks speculation about whether it is paving the way for a successor.

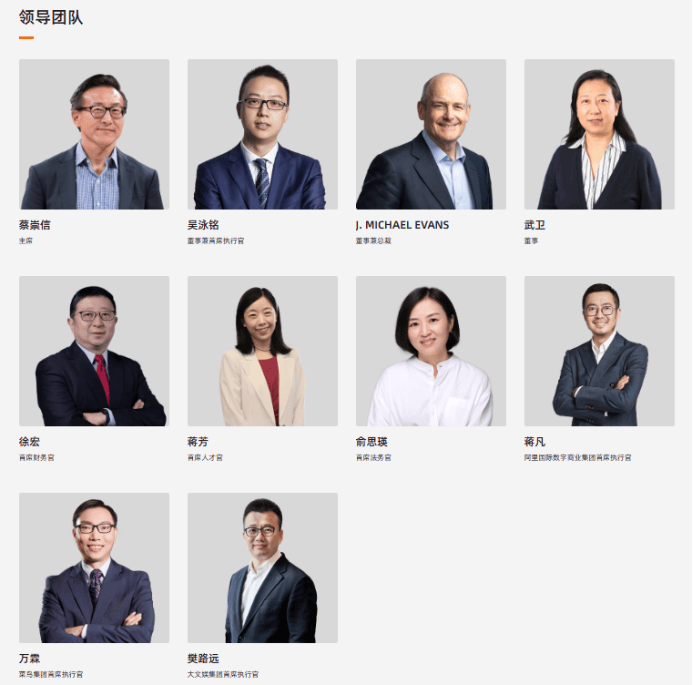

On Alibaba's official website's leadership team page, besides Joseph Tsai, Wu Yongming, and Jiang Fang, the three returning "Eighteen Disciples" (the eighteen founders of Alibaba), Jiang Fan is the youngest partner and also oversees Alibaba's core business.

Wu Yongming was born in 1975, ten years older than Jiang Fan. Since taking office, Wu Yongming has been promoting the youthification of the management team, with older management personnel such as Yu Yongfu, Hou Yi, Wang Hai, and Liu Peng successively "retiring" from Alibaba. A group of post-85 executives, including Wu Jia, Chen Weiye, and Cheng Daofang, have taken up positions. Currently, among Alibaba's new generation of executives, none can match Jiang Fan in terms of performance and achievements.

Thus, the "three-year strategic cycle" proposed by Wu Yongming earlier is the first trial that Jiang Fan will face. If he can successfully pass this assessment, it will not only bring new possibilities to Alibaba's e-commerce business but also solidify his position as the "heir apparent." This adjustment to the e-commerce business is not only an important strategic adjustment for Alibaba but also a crucial move in Alibaba's steady succession plan. Perhaps after Jiang Fan achieves new successes, the "crown prince" will also be officially appointed as expected. It seems that in June 2023, during Alibaba's business trough, Jack Ma personally appointed the technologically-oriented Wu Yongming to return, merely to facilitate a smooth transition in business and management.