Paid reading supports half of Zhihu's revenue, is profitability in sight?

![]() 12/02 2024

12/02 2024

![]() 680

680

"Is Zhihu's profitability entering the countdown? However, behind the rising popularity of paid reading, the monthly active user base is shrinking, and the urgency of profitability remains a challenge."

@TechNews Original

"Now, Zhihu has truly become a 'storytelling platform.'"

When the third-quarter financial report was released, Zhihu Salt Selection member Zhu Lin made such a comment. As a long-time user of Zhihu, Zhu Lin has witnessed Zhihu's struggles and transformation from a Q&A community to a short story platform.

Originally, Zhu Lin visited Zhihu mostly to search for professional and valuable knowledge. Now, she visits it to read novels during work breaks. "My boss doesn't mind if I read Zhihu at work, but it's a different story if I open Tomato Novels," she said.

Zhihu's paid reading business has indeed grown rapidly in recent years.

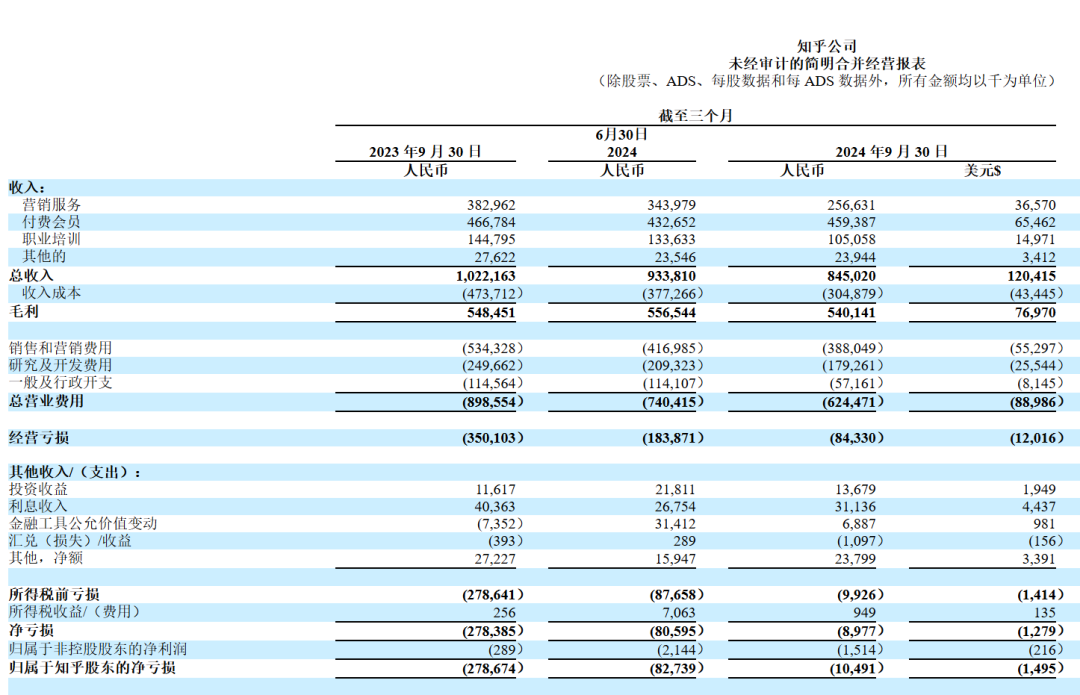

According to its recently released financial report, in the third quarter of 2024, Zhihu's total revenue was 845 million yuan. Among them, the paid reading business contributed the most, with operating revenue of 4.59 billion yuan, accounting for 54% of total revenue and approximately twice that of the marketing services business.

It is noteworthy that Zhihu vigorously developed short stories and launched its Salt Selection membership program in 2019, when marketing services were still the main revenue driver.

Although the transformation has shown some improvement, it still seems difficult for Zhihu to alleviate its "thirst" for profitability. Although Zhihu's net loss narrowed by 96.8% year-on-year in the third quarter, the loss was still as high as 9 million yuan, which also set a record for the lowest quarterly net loss since its IPO.

Additionally, Zhihu's monthly active user base has also shrunk. In the third quarter, its monthly average active users (MAUs) reached 81.1 million, recovering from the previous quarter but still significantly lower than the peak of over 100 million MAUs.

Also in the third quarter, neighboring Bilibili achieved profitability for the first time thanks to its gaming business. Meanwhile, after 13 years of operation, Zhihu is still struggling in the quagmire of losses. How far is it from profitability?

01

Paid reading heats up, Zhihu becomes a 'storytelling platform'

"Storytelling platform," "short story platform," and "compilation of stories" have become labels for Zhihu in recent years. Although the paid reading business only accounted for more than half of total revenue in the third quarter of 2023, it had already shown its pillar status in the first quarter of that year, with revenue reaching 455 million yuan, accounting for 45.8% of total revenue.

The growing number of monthly subscribers supports Zhihu's online literature world. In the first quarter of 2022, Zhihu had an average of only 6.9 million monthly subscribers. By the third quarter of this year, this number had grown to 16.5 million, achieving year-on-year and quarter-on-quarter growth.

Zhu Lin is one of Zhihu's vast monthly subscriber base. She told "TechNews" that she has been a subscriber to the Salt Selection membership program on and off for about two years, using it during work breaks and when she can't sleep at night. "A story is only a few ten thousand words long and can be finished in two to three hours, making it suitable for reading during work breaks to clear one's mind," she said.

There are two reasons that attract Zhu Lin to pay for the subscription: firstly, the Salt Selection membership is not expensive, costing less than ten yuan per month during limited-time promotions, and allows access to all stories. In contrast, she usually spends over ten or even twenty yuan on a single novel on Jinjiang Literature City or Qidian. Secondly, Zhihu's short stories do not require waiting for updates, providing an immediate sense of satisfaction after reading.

In the view of Zhang Shule, an analyst in the entertainment industry, the points mentioned by Zhu Lin are precisely where Zhihu's strategy of focusing on short stories shines. Unlike traditional online literature platforms that focus on novels, short stories are more adaptable to market trends and the values of contemporary young people, to some extent satisfying the potential demand of regular paid online literature users.

Zhu Lin deeply feels this. She said that when reading female-frequented novels on Jinjiang Literature City or Tomato Novels, she feels that the mainstream of creation still revolves around mistreating female characters, who must endure much suffering to win the love of the male lead. Although she might have liked this style initially, she gradually found it unappealing and shifted her reading preferences from "ancient romance" or "modern romance" to "no couple" and "female-led" stories.

In contrast, Zhu Lin feels that many classic short stories on Zhihu are more aligned with the values of current young people, making them easier to read without conflicting with one's personal beliefs. For example, in traditional time-travel stories, the female lead often stays in the ancient world for the male lead, but on Zhihu, stories often depict the male lead betraying the female lead, who then returns to the modern world with the help of a system to restart her life, garnering praise from readers in the comments section.

"The growth of Zhihu's paid reading business is predictable," Zhang Shule said. "The paid model for online literature is well-established, and users' willingness to pay has been cultivated. Zhihu has found the differentiating factor of short stories, making it natural to unleash its users' paying ability."

The potential of online literature IP is enormous. It can not only generate revenue through subscriptions but also through adaptations into film and television content, achieving multifaceted success. Especially in the current hot short drama market, short stories are naturally well-suited for adaptation.

"TechNews" noticed that since last year, several classic IPs from Zhihu have been adapted for the big screen. For example, the TV series "Fragrant Secret" produced by Yu Zheng's company is adapted from the novel "Washing Away the Lead," which is praised by readers as one of the "Three Wonders of Zhihu." The popular short drama "Writing" this year is adapted from the story of the same name created by Zhihu Salt Selection author "Lin Yannian." The popular short drama "I Opened a Supermarket on the Long March" during the National Day holiday is also adapted from a popular Zhihu novel, "Su Meimei's Supermarket."

However, Zhang Shule also pointed out that although film and television adaptations can help Zhihu diversify its revenue channels, it has only recently focused on short stories, so the number of content with IP adaptation potential is limited. Moreover, short stories are inherently difficult to adapt. It remains to be seen whether this will generate more revenue for Zhihu.

"We must also consider the potential risks of IP adaptations, such as copyright disputes and market adaptability, which may pose brand risks to the platform," further stated Yang Huaiyu, an analyst in the consumer goods industry.

02

Monthly active users are shrinking, with a limited ceiling

Although online literature is popular and supports half of Zhihu's revenue, its ceiling is also evident.

Financial report data shows that in the third quarter of 2024, Zhihu's paid reading business revenue reached 459 million yuan, with an average of 16.5 million monthly subscribers. Based on these figures, the average monthly consumption per subscriber is less than 10 yuan.

In sharp contrast, the online literature group, which includes platforms like Qidian and QQ Reading, had an average monthly consumption of 31.7 yuan per paid user in the first half of the year, more than three times that of Zhihu users.

It seems that Zhihu's online literature business is somewhat "cheap." If prices are raised, there is a risk of losing paid users. Therefore, the core factor driving its growth is the expansion of the paid user base.

However, Zhihu's monthly average active users (MAUs) were 81.1 million in the third quarter of this year, a significant decrease from 110.5 million in the same period last year. This indicates that Zhihu's user base is shrinking, and the potential pool of paid users is also shrinking.

In Yang Huaiyu's view, this may be related to the ratio of paid to free content affecting user experience, coupled with changes in the market environment and increased competition. The risk lies in competing with similar platforms to continuously attract and retain users. The opportunity lies in the changing content consumption habits of internet users, with more people willing to pay for high-quality content.

"In the online literature field, where the ceiling is low, profitability is weak, and competition is increasingly fierce, how to promote the creation, sharing, and monetization of more high-quality and pain-point knowledge has become the key to Zhihu's current operations," Zhang Shule told "TechNews."

Online literature is ultimately a content industry, and the origin of all competition in the content industry lies in the competition for high-quality content. Compared with novels, short stories are limited in length, often around a few ten thousand words. To attract readers' attention, more effort needs to be put into thematic innovation and narrative structure, which also reveals the limitation of short stories: severe content homogenization.

Zhu Lin also feels that when reading novels on Zhihu, although the protagonists' names and occupations in pursuit-and-funeral novels of the same theme may differ, the plots are largely similar, making it easy to get bored after reading a few of them. "Although many novels have similar themes and stories, different authors have different writing skills, evoking various emotions in readers. Sometimes I am willing to read them, but short stories are different," she said.

As a Salt Selection creator, Lin Han has a different perspective. She started writing Salt Selection novels in June last year and has written six novels so far, but her total income does not exceed 20,000 yuan, with the majority coming from her first moderately successful novel.

There is no guaranteed minimum payment for Salt Selection novels, and authors' earnings depend entirely on traffic. However, "On Zhihu, only pseudo-humanistic and very lowbrow content gets traffic now," Lin Han said. "Things like vulgar descriptions and gross jokes are popular."

This is unbearable for Lin Han, who cannot bring herself to create content that panders to market demand against her principles. Additionally, because readers prefer unfinished novels, they will downvote unfinished ones, affecting their traffic. However, the platform's mechanism requires authors to post the first few thousand words before approval, making it difficult for them to gauge traffic early on.

"Writing novels on Zhihu has become less profitable," Lin Han told "TechNews," and the low pay and high investment have prompted her to stop writing. Juan shares a similar sentiment. She has been writing novels on Zhihu since 2019 and has written hundreds of short stories. However, in the past two years, she has noticed a decline in traffic and earnings, prompting her to stop contributing to Zhihu.

The core issue with the decline in traffic is that there are more writers than readers. Financial report data shows that Zhihu has an average of 16.5 million monthly subscribers but had 77.7 million content creators by the end of the third quarter, a year-on-year increase of 11.6%. The cumulative amount of content created reached 855 million, a year-on-year increase of 14.9%.

Regarding this, Zhang Shule believes that Zhihu's Salt Selection stories should not prioritize making money but should instead provide subsidies to high-quality creators to incentivize the production of high-quality content. "After all, high-quality content is the core of retaining users and can unleash more monetization potential, such as adaptations into film, television, and animation," he said.

03

Vowing to reduce losses, countdown to profitability

Profitability is a top priority for Zhihu now, especially as neighboring Bilibili has already achieved profitability. Zhihu's founder Zhou Yuan even stated during the earnings call that one of the two priorities for 2025 is to significantly reduce losses and approach full-year profitability.

However, Zhang Shule believes that achieving profitability for Zhihu is not that simple. "Zhihu's current marketing scenarios are insufficient to support its profitability," he said.

Currently, Zhihu's three main businesses are paid reading, advertising, and vocational training. The shrinking advertising business obviously cannot fulfill Zhihu's dream of profitability. As for the paid reading business, as mentioned earlier, its main issue is the limited ceiling. There are also doubts about whether users will continue to pay and whether strong growth can be sustained.

Vocational training seems to be a business that Zhihu holds high hopes for. In January this year, Zhihu held its first education conference, where Zhou Yuan disclosed for the first time the original intention and vision behind Zhihu's layout in vocational education. "Vocational education complements the other half of Zhihu's entrepreneurial vision, forming the 'complete body' of Zhihu," he said.

At the same time, Zhihu also announced the spin-off and independent operation of its vocational education brand app, "Zhihu Zhixuetang." However, according to the financial report, Zhihu's vocational training business is still in its infancy and seems far from meeting Zhihu's high expectations. In the third quarter of 2024, Zhihu's vocational training business revenue was 105 million yuan, accounting for approximately 12.4% of total revenue.

In Zhang Shule's view, the vocational training sector is a promising direction, but Zhihu seems somewhat "out of place" in this field. On the one hand, vocational education is a systematic form of education with diploma and examination systems. The most basic evaluation criterion lies in the pass rate after completing vocational education. How Zhihu addresses this issue is crucial.

On the other hand, most vocational education consumption activities tend to occur offline because the learning environment is crucial for learning outcomes, and many professional fields require offline practice for deeper understanding. However, Zhihu's vocational education efforts are more focused online. If it cannot effectively address the issue of the learning atmosphere, relying solely on the online model will be difficult to fully support the development of this business.

"If Zhihu wants to achieve profitability, it still needs to address the issue of marketing scenarios and find a direction that aligns with its user base and platform tone," Zhang Shule said.

Yang Huaiyu holds a different view. He analyzed for "TechNews" that as Zhihu continuously optimizes its cost structure, improves operational efficiency, and increases the proportion of high-margin businesses, its profitability is gradually improving.

"Although it will take some time to achieve comprehensive profitability in the short term, considering Zhihu's continuous efforts in content ecosystem construction and business model innovation, in the long run, Zhihu is expected to achieve stable profitability in the fourth quarter of next year."