“Bushy-browed and big-eyed” Xiaomi betrayed?

![]() 12/03 2024

12/03 2024

![]() 619

619

Written by: Mujiao, Edited by: Xiaoying

In April 2010, Lei Jun and more than 10 others, including Li Wanqiang, posed for a simple group photo in a humble office in Yingu Building.

Ten years later, Lei Jun has become a billionaire. Besides him, four other members in the photo also appeared on the 2024 New Fortune 500 List, with a combined net worth exceeding 160 billion yuan.

Along with the growth in wealth, Xiaomi, which once sold phones for 1,999 yuan, has launched multiple models priced above 10,000 yuan.

Today's Xiaomi and Lei Jun's team are far from their original selves. Can Xiaomi fans who have followed them all the way keep up with Xiaomi's growth pace?

Lei Jun's diligence and frugality, Xiaomi's low-profit and high-volume sales strategy, and its not-very-profitable image have been deeply ingrained in people's minds. It's just that no one expected Xiaomi, which boasts of "winning the world by appealing to the masses," to actually be so profitable.

Xiaomi's third-quarter report for 2024 shows that its cash reserves exceeded 150 billion yuan. Moreover, Xiaomi's net profit in the third quarter reached 6.3 billion yuan.

In a corner unnoticed by many, Xiaomi has quietly "betrayed" its original principles.

01 Xiaomi's Profitability Exceeds Your Imagination

How profitable is Xiaomi? In the third quarter, excluding the 1.5 billion yuan loss from Xiaomi's automotive business, Xiaomi's mobile phone, internet, and IoT businesses collectively earned 7.8 billion yuan, a year-on-year increase of 4.4%, with an overall gross margin of 20.4%. Xiaomi's total gross profit for the first three quarters was 18.9 billion yuan, a year-on-year increase of 32%. Based on this, it is estimated that Xiaomi's gross profit for the entire year will easily exceed 20 billion yuan.

As Xiaomi's new core business, its automotive division, while still incurring losses, has seen a reduction in losses per vehicle from over 60,000 yuan in the second quarter to around 37,000 yuan in the third quarter. Additionally, the gross margin has increased to 17.1%, surpassing that of established players like NIO and XPeng and approaching that of the most profitable new energy vehicle company, Tesla, at 19.8%.

In October this year, Xiaomi launched the Xiaomi SU7 Ultra production version with a pre-sale price of 814,900 yuan. Despite this high pricing, within 10 minutes of opening pre-orders, over 3,680 small orders had been placed. This is still in the initial high-investment stage. As delivery volumes increase and costs are spread out on a larger scale, the costs and losses of Xiaomi's automotive business will further decrease, potentially even turning a profit.

Let's turn to Xiaomi's core business – smartphones. In the third quarter, smartphones remained Xiaomi's primary revenue generator, with global shipments totaling 43.1 million units. According to independent analysis firm Canalys, Xiaomi ranked among the top three in the global smartphone market for 17 consecutive quarters based on shipment volume.

Moreover, Xiaomi's push towards premium smartphones has contributed significantly to its profitability. In the third quarter of 2024, Xiaomi's ASP (Average Selling Price) for smartphones was 1,102.2 yuan, a year-on-year increase of 10.6%. Xiaomi attributes this to the increased share of high-end smartphone shipments. The financial report also shows that Xiaomi has secured a 22.6% market share in the 4,000-5,000 yuan price range and increased its market share to 6.9% in the 5,000-6,000 yuan range.

In fact, Xiaomi has remained profitable every year since its listing in 2018. Excluding the first two years when the overall smartphone market was sluggish, Xiaomi has generally maintained positive profit growth.

Compared to its peers, Xiaomi's profitability stands out even more. When Xiaomi first listed in 2018, its smartphone gross margin was 6.2%. By 2023, Xiaomi's overall gross margin had reached 21.2%, with the smartphone business gross margin increasing to 14.6%. Although Xiaomi's gross margin is lower than that of Samsung, Huawei, and Apple, which range from 30% to 40%, it is higher than that of OPPO and vivo, which hover around 10%.

However, Xiaomi's most profitable business remains its internet services, with a gross margin of 77.5% in the third quarter of 2024. In recent years, Xiaomi's internet services gross margin has remained stable at this high level.

02 Xiaomi's Path to Profitability

Why does Xiaomi's profit data continue to soar, yet many people still believe that Xiaomi doesn't make money? This brings us to Xiaomi's consistent marketing strategy.

"Focusing on cost-effectiveness and being close to users" was Xiaomi's early successful strategy. When Xiaomi's first smartphone was launched in 2011, at a time when the average price of smartphones was 3,000 to 4,000 yuan, Xiaomi quickly captured the hearts of consumers with a price of only 1,999 yuan. For years, Xiaomi's phones with comparable specifications have been priced significantly lower than those of its competitors.

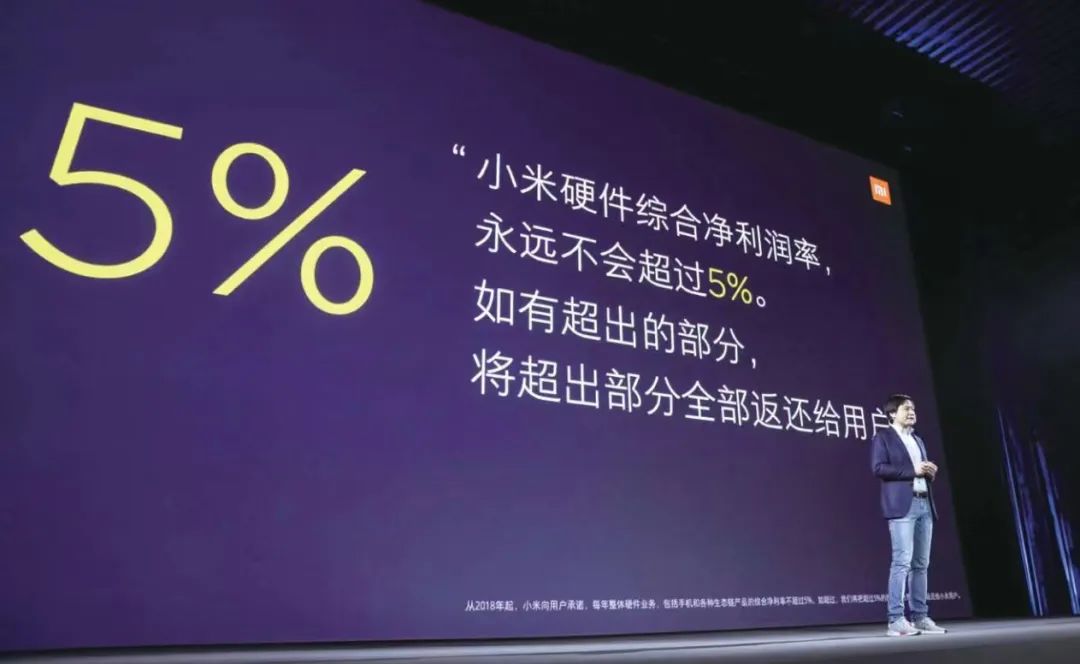

At the launch event for the Xiaomi 6X at Wuhan University, Lei Jun vowed that "Xiaomi's overall hardware net profit margin will never exceed 5%."

At the launch event for the Xiaomi 9 in 2019, Lei Jun even lowered the pricing of the Xiaomi 9 series to below 3,000 yuan by saying, "I convinced the executives to reduce the price overnight." Since then, the phrase "convinced the executives to reduce the price overnight" has become a popular meme among Xiaomi fans.

At this year's Xiaomi automotive launch event, Lei Jun once again pulled off the "convinced the executives to reduce the price overnight" trick. He revealed that the original intended pricing range was 239,000 to 350,000 yuan. However, on the day before the launch, Lei Jun and the executives discussed and decided that being 30,000 yuan cheaper than Tesla would show sincerity. Given the limited production capacity in the first year, they decided to be as sincere as possible and set the final pricing range at 215,900 to 299,900 yuan.

This has led to the widespread misconception that Xiaomi doesn't make money. When you think about it, how could a Fortune Global 500 company, a listed company, and a company that can fully fund its own automotive manufacturing not be profitable? After all, Xiaomi's disposable cash reserves of 151.6 billion yuan already exceed the market capitalization of many listed companies.

In essence, Xiaomi's business model is inherently high-margin. Like Apple, Xiaomi's business model is based on the "smiling curve" theory, controlling both ends of the supply chain – research and development and marketing – while outsourcing manufacturing, thereby capturing the high-value segments of branding and technology and relinquishing the low-value segments of manufacturing.

Over the years, Apple has relied on this minimalist supply chain to maintain a 50% share of industry profits despite the low-margin environment in the smartphone industry. Xiaomi follows a similar path, outsourcing the "dirty work" to others while focusing on design and branding, much like Apple.

Not only does Xiaomi have a vast supply chain ecosystem, but it has also created a perfect closed loop for its "people-car-home" ecosystem.

In layman's terms, the so-called "people-car-home" ecosystem aims to attract users to replace all their electronic devices, including phones, home appliances, cars, and various other electronic products in their homes, with Xiaomi products. This was also the goal of Huawei, Honor, OPPO, and other smartphone manufacturers when they collectively entered the home appliance market several years ago.

Today, Xiaomi's various categories within its "people-car-home" ecosystem have demonstrated high gross margins, enhancing Xiaomi's overall profitability. In the third quarter of this year alone, Xiaomi's IoT and consumer products business achieved a gross margin of 20.8%, a record high. Shipments of smart major appliances surged, with record highs in shipments of air conditioners, refrigerators, washing machines, and other products.

03 Becoming Increasingly Unattainable

Once upon a time, you ignored Xiaomi; now, Xiaomi is beyond your reach. From being a "mass-market wonder" to increasingly aiming for premium products, Xiaomi is no longer the same.

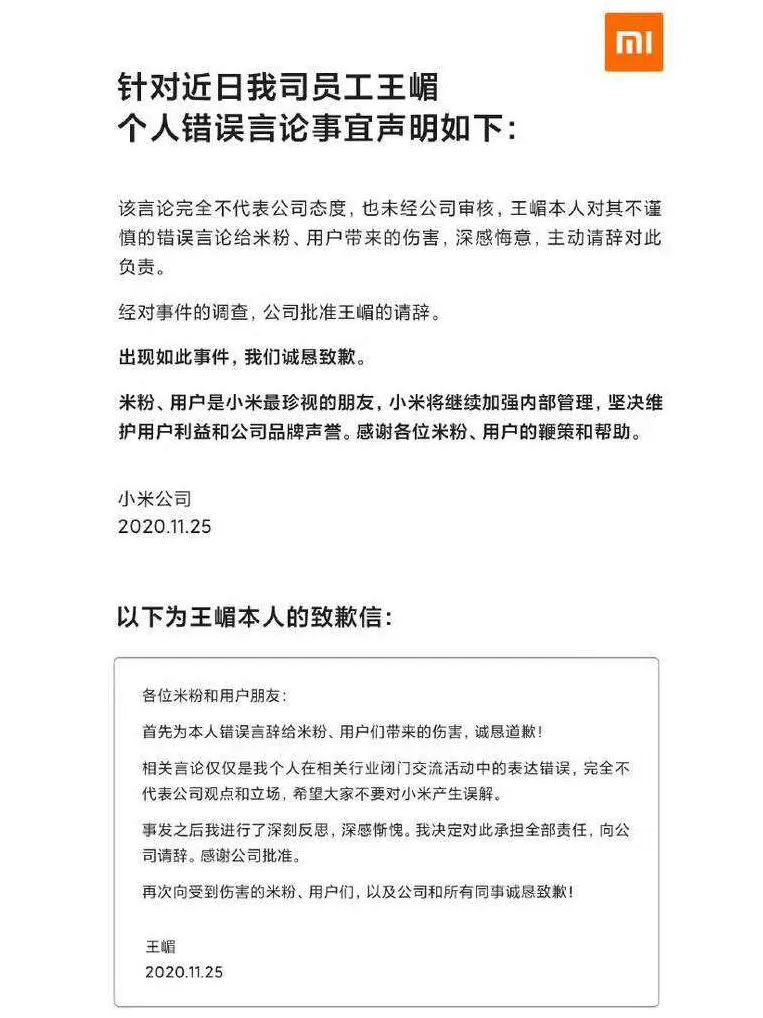

At a China Human Resources Management Annual Conference in 2020, Wang Mei, former vice president of Xiaomi's Qinghe University, said, "I don't know if any of you use Xiaomi phones. There are quite a few young people who do. Why? First, Xiaomi believes that in the future, whoever wins the masses wins the world. It will definitely be the world of young people. Of course, young people won't be considered 'masses' in the future because we're making premium phones now."

Her remarks caused an uproar, drawing the attention of Xiaomi fans, critics, and onlookers alike. Her statement seemed to insult multiple groups: 1) Insulting young people by calling them "masses." 2) Insulting Xiaomi users by implying they are "masses." 3) Insulting Xiaomi's current phones by suggesting they are low-end. 4) Suggesting that future Xiaomi phone users will no longer be considered "masses" and that Xiaomi aims to make money through premium phones.

Many netizens expressed sadness, saying, "I always thought I was a Xiaomi fan, but apparently, I was just considered a 'mass' in their eyes." "So I bought a Xiaomi phone and ended up being labeled a 'mass'?"

In fact, in an interview ten years ago, Lei Jun also mentioned, "Winning the masses wins the world. I rely on the 'Redmi phone' to win the masses." He stated that he didn't mind being the leader of the masses but I hate others slandering my qualities the most 。

However, this is not the same as ten years ago. Times have changed, and the meaning of "masses" has also evolved. Originally, "masses" was a self-deprecating neutral term, but when used by a third party, it can be considered insulting. Therefore, these remarks by Xiaomi executives were seen by many netizens as "eating with one hand and biting with the other" or "turning on the cook after eating a full meal."

In the eyes of many consumers, Xiaomi is aiming for premium products and starting to look down on the "masses." Although this incident ultimately ended with Wang Mei issuing an apology and resigning, it left an indelible impression on consumers.

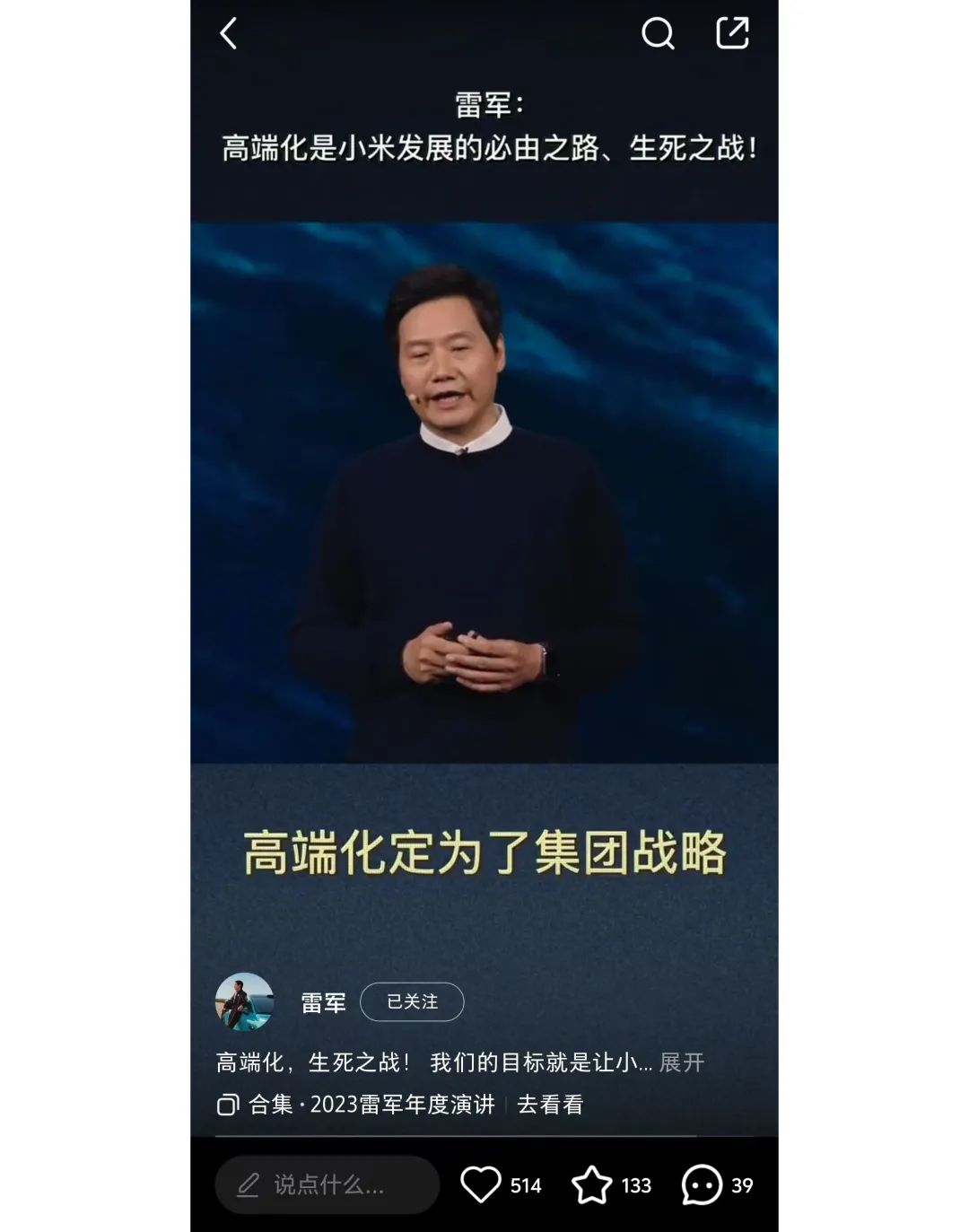

And in the past two years, Xiaomi has indeed "lived up to expectations" by moving further and further towards premium products. On the one hand, Xiaomi has started to heavily invest in self-developed chips and systems. On the other hand, one can see signs from Xiaomi's phones released in recent years. From the Xiaomi 15 and Xiaomi MIX Flip to the Xiaomi MIX Fold 4, their starting prices range from 4,499 yuan, 5,999 yuan, to 8,997 yuan, with none falling below 4,000 yuan, and even trending towards prices exceeding 10,000 yuan.

This has led many consumers to comment, "Who would spend tens of thousands of yuan on a Xiaomi phone when they can buy Huawei or Apple for the same price?" "I couldn't afford Xiaomi when I was poor, and now I still can't afford Xiaomi."

Turning to automobiles, initially, netizens speculated about prices of "99,000 yuan" or "199,000 yuan." However, when the Xiaomi SU7 went on sale, its starting price was 215,900 yuan. While a car priced under 300,000 yuan might be within reach for the "masses," the Xiaomi SU7 Ultra is priced at 814,900 yuan, clearly targeting the premium market.

Moreover, Xiaomi's once-stated commitment that "the overall hardware net profit margin will never exceed 5%" has gone unmentioned. Instead, phrases like "removing the shackles of cost-effectiveness" and "premiumization" are often on Lei Jun's lips. Xiaomi has ultimately grown into a form that is "unattainable" for many of us.

Conclusion

Going public means a surge of capital but also brings additional pressures. Therefore, when Xiaomi first went public, Lei Jun was concerned that the power of capital would change Xiaomi's original intentions and cause the company, which is guided by the core philosophy of "moving people and being reasonably priced," to lose its way under the temptation of profit and become a market sacrifice.

Seven years later, it appears that Xiaomi may have ultimately taken the path Lei Jun once feared.

Images sourced from the official website. Infringement will be deleted upon request.