The boss of Roborock, who cashed out 900 million yuan, advises 12,500 shareholders who lost money to be patient

![]() 12/05 2024

12/05 2024

![]() 492

492

As the company's share price continues to decline, founder Chang Jing engages in 'desert off-roading', leading investors to question his 'neglect of duty'. This is understandable, as 12,500 investors are now underwater at the end of the third quarter. At this critical juncture, Chang Jing advises investors to be patient, but who can accept that?

Recently, a video of Chang Jing, the founder and CEO of Roborock, engaging in 'desert off-roading' on social media platforms has raised questions from investors about his 'neglect of duty'.

When Chang Jing shared which was more challenging, snow off-roading or desert off-roading, the most liked comment was, 'Mr. Chang, don't just play with cars, take care of your Roborock. Investors have been crying for a month.'

When Chang Jing conveyed to the outside world that 'Roborock's fundamentals are good,' there was also a comment in the comments section, 'Mr. Chang, conveying information can't just rely on words. You reduced your holdings at a high price this year, but the company's share price fell against the trend. Shouldn't you repurchase?' When Chang Jing shared 'how to get rid of anxiety through exercise,' a comment that read, 'Buying Roborock shares has made me depressed...' received likes.

In response to investor questions, Chang Jing released a video on November 29, saying, 'I hope investors holding Roborock shares can be patient. This is a painful period of strategic transformation, and the current changes are for longer-term development in the future.'

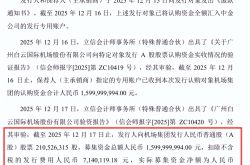

However, investors are not buying Chang Jing's explanation and point out that 'Chang Jing cashed out 900 million yuan but advises investors to be patient.' According to 'Digital Intelligence Research Club,' from March 2023 to June 2024, Chang Jing reduced his holdings twice, cashing out 888 million yuan. Soon, the hashtag '#Chairman Cashes Out 900 Million but Advises Investors to Be Patient' trended on social media, sparking wider controversy.

From a capital market perspective, Roborock has indeed been in a volatile downtrend recently. The share price has fallen from a high of 333.50 yuan per share on October 18 to 217.80 yuan per share at the close on December 4, a decline of nearly 35%. If calculated from mid-May this year, the share price has fallen by more than 50% in the past six months. As the first stock to exceed 1,000 yuan on the STAR Market, Roborock reached an all-time high of 1,494.99 yuan per share in June 2021. Over the past three years, Roborock's share price has plummeted.

As the company's share price continues to decline, founder Chang Jing engages in 'desert off-roading,' leading investors to question his 'neglect of duty.' This is understandable, as 12,500 investors are now underwater at the end of the third quarter. At this critical juncture, Chang Jing advises investors to be patient, but who can accept that?

The robotic vacuum cleaner industry is Deeply immersed growth dilemma

In the just-concluded third quarter, Roborock's performance can be described as a 'thunderclap.' For the first three quarters, Roborock achieved revenue of 7.007 billion yuan, a year-on-year increase of 23.17%; net profit attributable to shareholders was 1.472 billion yuan, a year-on-year increase of 8.22%.

For the third quarter alone, Roborock's net profit attributable to shareholders fell sharply by 43.40% to 351 million yuan, a decrease of 51.32% from the second quarter. Non-deductible net profit also fell by 45.25% year-on-year to 325 million yuan, a decrease of 37.42% from the second quarter, marking the largest quarterly decline since 2021.

Regarding the change in performance, Roborock attributed it to 'further strengthening market expansion at home and abroad and launching multiple new products, resulting in increased sales and research and development expenses.'

'Digital Intelligence Research Club' found in Roborock's financial statements that research and development expenses were not the primary reason for the decline in Roborock's performance growth rate. In the third quarter, Roborock invested 231 million yuan in research and development, a year-on-year increase of about 43%. However, as this accounted for less than 9% of revenue, the impact of research and development investment on performance was limited.

In contrast, Roborock's operating costs in the first three quarters increased by nearly 600 million yuan compared to the previous year, reaching 3.233 billion yuan, and selling expenses increased by nearly 500 million yuan to 1.564 billion yuan. From the perspective of total expenditure, the increase in operating costs and sales investments is the fundamental reason for diluting profit margins and causing a significant decline in net profit growth. In the third quarter of 2024, Roborock's net profit margin fell by 13 percentage points year-on-year to 13.57%.

Therefore, the capital market immediately responded with a sharp decline of 11.02% in the financial statements, ranking first in declines in both the Shanghai and Shenzhen stock exchanges.

As we all know, Roborock built its business on the first-mover advantage of robotic vacuum cleaners. By 2023, nearly 94% of Roborock's revenue still came from robotic vacuum cleaners and related accessories. However, the market has changed significantly. The robotic vacuum cleaner market has become a red ocean. With many new entrants, the entire market became saturated within a few years. In 2022, domestic sales of robotic vacuum cleaners declined by about 24% year-on-year, and the decline continued in the following two years.

With declining sales, players also need to survive, and 'price wars' are the most direct strategy. Players such as Ecovacs, Xiaomi, Narwal Robotics, and Dreame Technology have all reduced prices, forcing high-end focused Roborock to respond reluctantly. In 2024, Roborock not only launched multiple products in the 2,000 yuan price range but also expanded its product categories. 'Digital Intelligence Research Club' learned that in the first three quarters of 2024, Roborock launched eight robotic vacuum cleaners, roughly one per month. Frequent launches increased Roborock's market share but also increased inventory and turnover days.

Data shows that Roborock's inventory reached 1.719 billion yuan in the third quarter. For comparison, from 2020 to the first three quarters of 2023, Roborock's inventories were 381 million yuan, 596 million yuan, 694 million yuan, and 928 million yuan, respectively. With high inventory levels, turnover days have also slowed significantly. In 2020, Roborock's turnover days were less than 60 days, but they surged to 110.55 days in the first three quarters of 2024.

On the other hand, along with Roborock's frequent new product launches come constant complaints and after-sales issues. According to Heimao Complaints, as of December 4, there were up to 1,557 complaints related to Roborock, mostly involving quality issues, false advertising, and poor customer service.

As the robotic vacuum cleaner industry continues to intensify competition and engage in price wars, Chang Jing, the chairman and CEO of Roborock, reduced his holdings twice between March 2023 and June 2024, cashing out a total of 888 million yuan.

Jishi Automobile has little presence

As an independent company established in January 2021, Shanghai Luoke Intelligent Technology Co., Ltd., jointly founded by Chang Jing and Yan Feng, the former CTO of WM Motor, quickly secured funding from investors such as Sequoia Capital and Tencent. After signing a cooperation production agreement with Weiqiao Entrepreneurial Group, Jishi Automobile's first model, the Jishi 01, was officially launched in August 2023, priced between 349,900 and 359,900 yuan.

By August 2024, Jishi Automobile launched another version of the Jishi 01 with standard range, reducing the price to 299,900 yuan after some features were removed.

Launching a car within two years of its establishment and another new model the following year is a significant breakthrough and achievement for a lesser-known new brand.

However, judging from the situation of various shareholders, it is difficult for them to provide much support to Jishi Automobile. On the one hand, although Roborock and Jishi Technology are both startups founded by Chang Jing, there is no direct connection between the two companies. Chang Jing's two reductions totaling 888 million yuan have also raised market suspicions that the funds were used to 'infuse blood' into Jishi Automobile. Meanwhile, Yan Feng's former company, WM Motor, has long been in financial trouble and has since gone bankrupt. The contract manufacturer, Beijing Automotive Manufacturing Plant, has also faced counterfeiting accusations from BAIC Group.

As for sales, there has been no significant breakthrough since the delivery of the Jishi 01. Early in 2024, there were even rumors that 'Jishi Automobile sold zero units in January,' although these were later debunked as false. However, according to 'Digital Intelligence Research Club,' cumulative sales of Jishi Automobile in the first three quarters were only 2,909 units, giving it little presence in the market. Amidst rounds of shuffling among new-energy vehicle startups, the number of players has dwindled from hundreds at its peak to just a dozen, forming distinct tiers. The first tier consists of NIO, Xpeng, Li Auto, and Xiaomi, among others. Neta, struggling to survive, is in the second tier, while players in the third tier, such as HiPhi, Jishi, and Hozon Auto, may exit the market at any time.

Amidst fierce competition, Jishi Automobile is already planning to expand overseas before it has firmly established itself in the domestic market. To promote its products, Chang Jing has been actively posting videos and has even placed his title as the founder of Jishi Automobile before that of Roborock's chairman in his personal profile.

The harder Chang Jing promotes Jishi Automobile, the more it highlights the fierce competition in the automotive industry and the precarious position of Jishi Automobile. A car brand with monthly sales of only a few hundred units is unlikely to be the final winner. The time left for China's new-energy vehicle startups is running out.