NetEase Games 'Cloud Fly Egg Drop'

![]() 12/05 2024

12/05 2024

![]() 501

501

Author | Wu Kunyan, Wu Xianzhi

Editor | Wang Pan

'I was driven out. When I had differences with Ding Lei on direction, the only outcome was for me to leave.'

Thirteen years ago, when Zhan Zhonghui (nickname: Dingdang), then COO of NetEase Games, led Wu Yunyang, Chen Weian, and others to leave NetEase and found JoyGame, he publicly expressed his grievances. The departure of a president-level figure is extremely rare in NetEase's history, but at that time, NetEase was undergoing a mobile transformation, and with Ding Lei's strong intervention, a top-down will led NetEase through the painful transition period.

As if reliving yesterday, another NetEase president-level figure was recently exposed to be leaving, and the background is also NetEase's critical moment of transformation, with Ding Lei beginning to take over the entire gaming business.

According to multiple sources, the core of this turmoil is the Tianxia Business Unit under NetEase Interactive Entertainment, where the head of the unit and Vice President of NetEase Games, Shao Yun (Shao Yun), will be leaving NetEase. The Tianxia Business Unit will be split into three parts, with the original Eggy Studio (representing the project 'Egg Boy Party') and Wild Studio (representing the project 'Rules of Survival') being upgraded to business units.

As one of the 'Great Dream Sky' series, the Tianxia Business Unit itself is a microcosm of NetEase Games' development history, and NetEase's self-developed engine Messiah also began here. In this context, Shao Yun's departure becomes even more intriguing.

Considering the internal anti-corruption efforts of recent times, NetEase, which has been internally restructuring before the new year, clearly hopes to complete its strategic transformation by 2025. We previously summarized this in the article 'Dream Weaving and NetEase Footing the Bill' as a 'low ARPU, high DAU' approach.

Underneath this are four underlying strategies: minimizing marketing expenses to balance ROI, targeting advantageous genres and concentrating resources to ensure project success rates, relying on agent projects and old games to restore revenue, and cultivating social grounds for user churn.

With Ding Lei's return and full takeover, where will NetEase Games go?

The craftsmanship of middle age is personally smashing the 'small workshop'

In a power-centralized organization, there can be countless 'Empress Xianfei' returning to the palace, but there can only be one 'Emperor Yongzheng'. During times of organizational turmoil, it is Emperor Yongzheng who sits at the center, meticulously allocating everything.

For NetEase, the recent 'Empress Xianfei' returning to the palace is 'Egg Boy Party', which brought a dawn of platform-level games to NetEase and was upgraded to an independent business unit. Emperor Yongzheng, naturally, is Ding Lei, who was reportedly still holding a 45% stake last year.

The practice of studios becoming independent as new business units after undertaking large projects has existed since ancient times. When the revenue and user base of a project reach a certain scale, it is not uncommon for the responsible studio to be upgraded to a business unit within NetEase. Taking the Singularity Business Unit responsible for 'Diablo: Immortal' and 'LifeAfter' as an example, its predecessor was the Black Hole Studio under the Tianxia Business Unit, which is now the Interactive Entertainment Business Group.

Even the entire Interactive Entertainment Business Group is gradually formed after the earliest NetEase Online Games Business Unit continuously spun off new business units. However, the establishment of the overall organizational structure and strategy dates back to Dingdang's departure.

It must be mentioned that at that time, amid the surging wave of mobilization, NetEase was still stuck in the past, developing large projects step by step in the PC gaming era's project initiation strategy. A source close to NetEase said that it was Ding Lei who changed the 'investment strategy', quickly launching dozens of rapidly iterating small projects with investments in the tens of millions, coupled with a unified mid-platform capability, which allowed NetEase to seize the important opportunity of the 2015 shift from PC to mobile gaming.

Since then, NetEase has formed project teams consisting of planners, R&D, and core artists, while different functions such as publishing, art, and user research have been integrated into the mid-platform. The former is responsible for going from 0 to 1, while the latter is responsible for the 'small workshop' manager system from 1 to 100.

Belonging to small-to-medium-sized organizations, project teams can quickly replicate proven gameplay mechanics with agility and supplement them with certain gameplay innovations, thereby enabling rapid trial and error iterations. A typical manifestation is that most of the games launched by NetEase since 2015 did not have high expectations in the initial stages of project initiation, targeting only a small number of players in specific circles, such as 'Onmyoji' and 'Summoners War', 'Rules of Survival' and 'PlayerUnknown's Battlegrounds', and 'Egg Boy Party' and 'Fall Guys'.

The flipside of a large workshop composed of many small workshops is that the functional mid-platform can achieve a certain degree of 'rain or shine' stability. The success of a game largely depends on the planning and promotion efforts of the project team. Looking back, 'Onmyoji' frequently collaborated with numerous anime influencers around its launch, and more recently, 'Justice' has been criticized internally and externally for its 'crazy marketing'.

With Ding Lei's secondary intervention, such an organizational form may become a thing of the past.

A strong piece of evidence is that since the beginning of this year, NetEase has already shut down several games, including 'Marvel Super War', 'Operation Genesis', and 'Mobile Legends: Bang Bang'. This has already gone beyond the scope of rapid iteration, indicating that small-to-medium-sized projects are quickly being marginalized or even cut by NetEase, with resources increasingly focused on head projects with the potential for large DAU.

At the same time, older games with poor performance also have to face the dilemma of shrinking resources and restoring revenue, making 'user churn' a necessary path.

Unlike many internet companies, Ding Lei has always been the 'patriarch' of NetEase, with a management style more akin to traditional entrepreneurs like Zhong Shanshan. Moreover, NetEase is not a platform company.

Ding Lei, who touts 'craftsmanship' and sees himself as a product manager, presents a people-oriented management style. The advantage is high governance efficiency, but the disadvantage is that business investments and directions are determined by personal preferences, which even trickles down to game projects and beyond.

The 'Great Dream Sky' self-verification battle is underway

'Brother Lei can control Interactive Entertainment, but he can't control Thunderfire. Once the financial statements are submitted, there's nothing that can stop Thunderfire from going crazy.'

The Thunderfire Business Group, which is only about one-fifth the size of Interactive Entertainment, has been on the rise in recent years. Besides 'Egg Boy Party', other successful new products such as 'Justice', 'Naraka: Bladepoint', and the heavily emphasized 'Infinity' mentioned in a recent earnings call all originated from the Thunderfire Business Group.

The 'Great Dream Sky', which once helped NetEase conquer the world, has also become a hard-hit area for NetEase's internal restructuring. It should be noted that 'Mobile Legends: Bang Bang' and 'Pokémon Quest', which announced shutdowns this year, as well as the previously troubled 'The Legend of the Condor Heroes', belong to the Dahua Business Unit, Tianxia Business Unit, and Huanyou Business Unit, respectively. Especially for the Tianxia Business Unit, where older games have failed to shoulder the burden of revenue restoration.

At the product level, the Tianxia Business Unit operates games such as the 'Tianxia' IP, 'Tears of Themis', 'Pokémon Quest', 'Green Field', 'Rules of Survival', and 'Egg Boy Party'. Among them, 'Pokémon Quest' is about to be shut down, and with the independence of the two flagship products 'Rules of Survival' and 'Egg Boy Party', the Tianxia Business Unit's discourse power will inevitably plummet, which may be the core reason why Shao Yun 'had to' leave.

In terms of revenue volume, 'Rules of Survival' and 'Egg Boy Party' have long been qualified to become independent business units. The reason for the delay until now may be due to the decline in their operational performance over the past year.

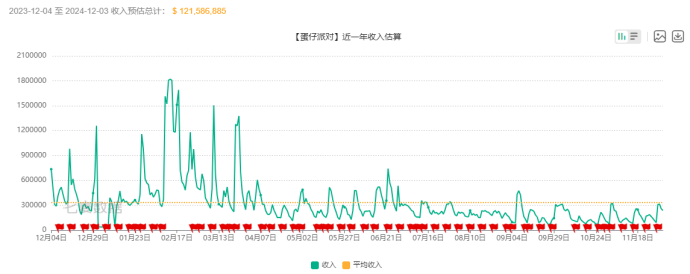

When the 'Egg War' at the beginning of the year ended with 'Egg Boy Party' enjoying a resounding victory, the team was high-spirited and did not anticipate the dual decline in revenue and activity over the following year. According to a 2024 Q2 research report by CICC, the total gameplay duration of 'Egg Boy Party' plummeted by 56%. Data from Qimai shows that its revenue also showed fluctuating declines.

Whether from a revenue or activity perspective, the UGC moat emphasized by 'Egg Boy Party' during the 'Egg War' does not seem as solid as initially envisioned. UGC is content spontaneously or actively produced by players within the game ecology, with retention and activity as the foundation. However, lacking Tencent's social grounds for user retention, player churn significantly affects the barrier effect of UGC.

As for 'Rules of Survival', as one of NetEase's most successful overseas releases, its performance also to some extent mirrors NetEase's overseas expansion process. According to data.ai, 'Rules of Survival' ranked 15th in Chinese game overseas revenue in 2023, a significant drop from its ranking in 2018. In contrast, in the latest quarterly financial report, NetEase did not disclose the proportion of overseas game revenue.

After the huge success of 'Rules of Survival' in Japan, its successful experience failed to be smoothly replicated in broader markets such as Europe and the United States, possibly due to the immaturity of overseas distribution mechanisms – stagnation on the mobile side and reliance on Steam for 'luck' on the PC side, such as the globally released 'Seven Days' earlier this year.

With one being a platform-level project in the domestic market and the other being a top brand in the overseas market, NetEase's decision to split the Tianxia Business Unit into three sends a clear signal that Ding Lei, who strives for hands-on management, will focus on the subsequent progress of these two projects. And with this turmoil, the heads of the Eggy Business Unit, Kwan (Cheng Kuan), and the Wild Business Unit, Ding Chao, are likely to bypass the business group and report dotted-line to Ding Lei.

Following the aforementioned two products, the self-verification battle for the 'Great Dream Sky' and even the entire Interactive Entertainment Business Group has begun. Signs of this are already evident in the latest quarterly report – NetEase's PC game revenue increased by 29% year-on-year and 30% quarter-on-quarter.

Furthermore, as the nurturing ground for NetEase's MMO genes, Interactive Entertainment also has two heavily anticipated upcoming works: 'Yan Yun Sixteen Sounds' and 'Tian Xia 4', which are facing strong competition from peer companies. Perfect World's next-generation MMO 'Zhu Xian World' is at the forefront. It is reported that the two works reserved by NetEase lag behind their competitors in player community reputation.

Is it better to cut internally than to spend externally?

For a gaming company, it is obviously not good if the boss doesn't play games. But it's also not good if the boss loves games too much.

Regardless of the situation, we can find corresponding companies in the gaming industry. Ding Lei, who claims to be a game enthusiast, is obviously the latter. This is a hallmark of NetEase Games' development. Every few years during periods of change, he personally takes charge on the front lines, placing big bets on promising directions.

Returning to the underlying strategies mentioned at the beginning, Ding Lei has unknowingly led NetEase to complete three shifts: reducing marketing costs, concentrating resources, and restoring revenue. The only unclear aspect is how to build a user reservoir for NetEase.

As early as 2018, NetEase launched the strategic social product 'NetEase Netease', with Ding Lei posting a 10-day consecutive draw to attract new users. However, its community content is limited to its own system, making it difficult to avoid content narrowing and difficulties in attracting new users, turning this product into a tool for NetEase to distinguish between core and non-core users.

While players can indeed be retained on 'NetEase Netease', core players circulating within different gaming circles seem to have little use for increasing the DAU of a single product. In fact, the later live streaming platform 'CC Live' also fell into the same trap, encompassing NetEase's gaming products while simultaneously capping its growth potential.

In comparison, starting anew undoubtedly offers more imagination, as evidenced by NetEase's recent launch of 'Little Bee'. As a 'Little Yellow Book' highly similar to Xiaohongshu in product attributes, it introduces identity verification and tipping mechanisms to introduce social vitality. The active community atmosphere and grass-roots marketing effect also have the potential to extend to gaming – the low-frequency social relationships within games can complete high-frequency scenario conversions on this new ground.

However, considering the long cold start cycle of the product, this is not the preferred option for NetEase, which is currently short on ammunition. On the contrary, with over 120 billion in cash reserves, investing and acquiring to secure a piece of land for itself is the better choice.

For example, Heartbeat Games, which has been continuously deepening its channel cooperation with NetEase in recent years, is a good target. Although its gaming community TapTap is also a low-frequency interaction community, it allows NetEase to expand the scope of mutual traffic guidance between games beyond its own backyard.

If Ding Lei really needs to place a big bet, instead of cutting internally, it might be better to open his wallet and look outward.