Sales in All Aspects: Is OPPO Preparing for a Counterattack After Falling Behind?

![]() 12/10 2024

12/10 2024

![]() 556

556

Catching Up in the Domestic Market and Steadily Expanding Globally.

Editor: Cola

Fengpin: Chen Chen

Source: Rhodium Finance - Rhodium Finance Research Institute

Global Expansion and Deep Cultivation of the Industry Chain, Both Sides Must Be Strengthened.

On December 6, according to Zol.com, after its domestic launch on October 24, the domestic sales of the OPPO Find X8 series have surpassed one million units, setting a new record for the Find series. Meanwhile, two weeks ago, the series was launched in multiple global markets, with first-day sales in core markets such as Singapore, Thailand, and Indonesia doubling or tripling compared to the previous generation. In the high-end mobile phone markets of 14 countries and regions worldwide, OPPO ranks among the top three in market share. Public opinion believes that this is the result of the company's commitment to technological innovation and brand building.

Separately, according to Red Star News, market sources reported that the construction progress of OPPO's global mobile terminal R&D headquarters project in Hangzhou has stalled. On November 26, the management committee of the Future Science and Technology City (Haichuang Park) in Yuhang District, Hangzhou, confirmed this news, stating, "Upon inquiry, the OPPO project is currently suspended due to scheme adjustments on site."

Public information shows that on October 12, 2020, OPPO acquired Plot 187 in Hangzhou's Future Science and Technology City for 1.184 billion yuan. The company had previously stated that this plot would be developed into OPPO's global mobile terminal R&D headquarters, with construction officially commencing in September 2021 and scheduled for completion in 2027.

After two years of a downturn, the smartphone market experienced a long-awaited rebound in 2024. IDC predicts that smartphone shipments in China will reach approximately 285 million units this year, representing a year-on-year increase of 5.0%. The popularity of the OPPO Find X8 series has clearly benefited from this upturn, but OPPO's overall sales ranking in the latest quarter has still declined.

Before rushing ahead, it is crucial to solidify the foundation. The better the situation, the more important it is to prepare for the future. What are the reasons behind the aforementioned planning adjustments, and what impact will they have in the future? Amidst ups and downs, how can OPPO stage a counterattack and reclaim its former glory as a sales champion?

01

Reflections on Falling Out of the Top Five Among Former Sales Champions

LAOCAI

According to a Canalys report, the Southeast Asian smartphone market grew by 15% year-on-year in the third quarter of 2024, reaching 25 million units. OPPO led the Southeast Asian smartphone market with 5.1 million shipments and a 21% market share, primarily due to the redesign of its entry-level models A3x and A3.

However, Canalys and IDC smartphone sales monitoring reports also show that in the Chinese smartphone market, overall shipments increased by 4% year-on-year to 69.1 million units. vivo rose to the top of the market share rankings, primarily benefiting from the solidification of offline sales through the launch of new mid-range products. Huawei's share also surged, while OPPO (including OnePlus) ranked sixth in market share and shipments, falling out of the top five.

Reviewing the entire year of 2023, according to IDC's report, OPPO's global smartphone shipments decreased by 9.9% year-on-year, with a 16.1% decline in the Chinese market. According to Counterpoint, OPPO accounted for 16.2% of the domestic smartphone market share in 2023, ranking third, while vivo took the top spot among domestic brands with a 16.9% share.

As everyone knows, Shen Wei, the head of vivo, and Chen Mingyong, the head of OPPO, both come from the BBK group and are known as Duan Yongping's two proud "disciples."

In 2001, Duan Yongping stepped back from the spotlight and split BBK into three companies: BBK Communications, BBK Education Electronics, and the newly established OPPO brand, with Shen Wei, Jin Zhijiang, and Chen Mingyong as the respective heads. In 2011, Shen Wei established the vivo brand based on BBK Communications.

Although they share the same roots, the relationship between the two companies can be described as a love-hate one. At vivo's 2024 Developer Conference in October, the company announced that vivo phones have been the top-selling domestic mobile phones for three consecutive years and three quarters. Prior to that, OPPO was once the domestic sales champion.

As shown by Counterpoint data, in 2016, OPPO surpassed Huawei with 78.4 million shipments to become the domestic smartphone sales champion. The growth momentum continued in 2017, with IDC data showing that OPPO's annual shipments reached 111.8 million units, a year-on-year increase of 12%.

In 2023, OPPO was still able to maintain a top-three position in the domestic market share. So why did it slip out of the top tier and start to fall behind in 2024, a year of industry recovery? Analyzing public opinion, intensified market competition, changing consumer demands, and internal strategic adjustments are all factors to consider.

First, in terms of brand competition, based on multiple authoritative monitoring data from IDC, Canalys, and Counterpoint, vivo and Huawei's domestic mobile phone market shares significantly increased in the third quarter of 2024. The strong momentum of these two companies squeezed the survival space of other brands, intensifying internal competition.

Second, consumers are becoming increasingly rational and mature, with higher expectations for the quality-to-price ratio and cost-effectiveness of high-end phones. While the Find X series has achieved remarkable results, its rapid iterations have also led to increasing product prices, Invisibly raising the threshold for purchasing. At the same time, other brands have intensified their offline channel construction efforts, gradually eroding OPPO's traditional offline advantages.

02

The Pros and Cons of Frequent Launches

When Will the Next Phenomenal Hit Arrive?

LAOCAI

Those who control the channels control the world, and this is especially true in the mobile phone industry.

Focusing on OPPO, its channel advantages are primarily concentrated offline, especially in lower-tier markets. By expanding franchise stores in lower-tier cities, OPPO has established a vast offline sales network. In the early stages of the smartphone boom, this helped the company capitalize on the scale dividends of the lower-tier market by leveraging low prices, successfully overtaking brands like Huawei and Xiaomi.

However, as smart technology has advanced and the first round of market segmentation has been completed, domestic mobile phone brands have started to focus on the high-end market due to enhanced R&D capabilities and consumers' increasing demand for quality. Seeing the potential for higher profit margins, OPPO has also intensified its product line adjustments.

First, OPPO discontinued the once successful R series, which was pivotal in establishing its market position. Counterpoint data shows that the R9 and R9s were the top-selling individual phones in China in 2016 and 2017, respectively, while the R15 regained the top spot in 2018. Thanks to these phenomenal products, OPPO maintained its sales leadership and quickly accumulated a strong reputation and brand presence among consumers.

However, nothing lasts forever. Against the backdrop of domestic brands collectively targeting the high-end market, the Reno series officially replaced the former R series in April 2019, marking OPPO's official entry into the high-end market. Reviewing its high-end strategy, iterative tactics are worth mentioning. According to public data, OPPO has launched 33 phones in the Reno series in the five and a half years since its inception, averaging nearly seven new models per year.

On May 24, 2023, OPPO officially launched the Reno10 series, followed by the Reno11 series on November 23 of the same year. On May 23, 2024, OPPO unveiled the Reno12 series, and on November 18, the design of the Reno13 series garnered significant attention.

Industry analyst Sun Yewen stated that the launch of new models reflects development vitality and confidence in embracing the market and users. However, it is essential to maintain the right pace; too frequent launches can easily lead to consumer fatigue. From a distribution perspective, it can also reduce dealers' enthusiasm for stockpiling inventory, especially under pressure from economic conditions. Dealers may be eager to offload new models at a thin margin upon receipt, preparing for the next model launch just a few months later. In terms of product performance, launching multiple models a year makes it difficult to achieve meaningful technological iterations. With the severe homogenization of smartphones, insufficient innovation and rapid brand iterations can easily lead consumers to question whether the brand is merely seeking to make money. While this may boost short-term sales, it requires vigilance against eroding brand goodwill.

Not being overly demanding. Taking iPhone as an example, the lack of significant innovations across several generations, coupled with the aggressive advancements of domestic brands, has gradually eroded its status among Chinese consumers. Many "Apple fans" have changed their consumer preferences. Even though Apple adopted a price reduction strategy starting in 2023, the sales boost has not been significant.

Even a powerful brand like Apple is facing challenges. To stabilize its declining trend, OPPO must focus on innovation, slow down the pace of new product launches, prioritize quality, and meticulously craft a phenomenal hit or breakthrough that can significantly boost overall sales.

03

From Chips to AI, Compliance is the Red Line

LAOCAI

Objectively speaking, OPPO is not lacking in relevant efforts. However, with competitors constantly striving, OPPO must be precise and avoid detours to stand out in this race for innovation.

In May 2023, according to the Economic Daily News, facing uncertainties in the global economy and mobile phone market, OPPO terminated its self-developed chip project, Zeku (ZEKU).

Industry analysts believe that high R&D costs and technical difficulties were the primary considerations behind OPPO's decision to halt the chip project. As one of the core competitiveness of smartphones, the termination of the chip project reflects not only a strategic choice but also a lack of core innovation worth reflecting on.

Fortunately, with the rise of artificial intelligence, OPPO sees an opportunity for overtaking and has shifted its innovation focus to the AI field. For example, after the launch of the OPPO Find X8 series on October 24, OPPO's Chief Product Officer, Liu Zuohu, stated, "I hold an AI-specific meeting with my colleagues every week to discuss topics mostly related to creating AI experiences that meet users' intuitive needs."

The focus on AI development is also a requirement from OPPO's founder and CEO, Chen Mingyong. He believes that 2024 will be the first year of AI mobile phones. The mobile phone industry has entered its third stage, and OPPO aims to lead and popularize AI mobile phones by establishing an AI center and accelerating resource concentration.

Industry analyst Wang Yanbo stated that compared to enhancing chip hardware performance, AI development represents soft power. OPPO hopes to build an innovative moat through this focus, which could be a strategic breakthrough. However, innovation is also a highly risky and challenging endeavor, with more growth opportunities bringing more competitors, investments, and distinctive breakthroughs, along with higher requirements for quality control and risk management. It remains uncertain how much market surprise OPPO can present, but compliance should be the foundation of all innovations.

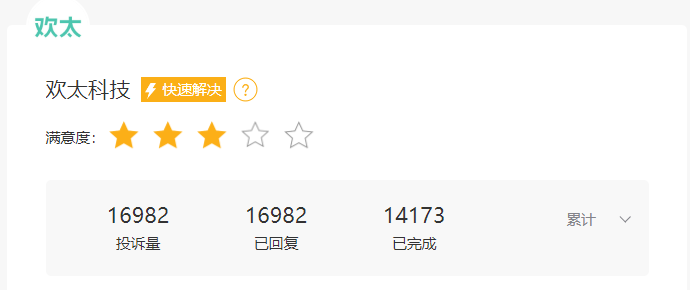

Browsing complaints on HeiMao Complaints and searching for OPPO reveals complaints against a company named HuanTai Technology. Currently, the OPPO software store is a third-party software download platform primarily for OPPO brand phones, providing daily application software and game APP products for the Android system. HuanTai Technology operates the game center of the OPPO software store and is a subsidiary of OPPO.

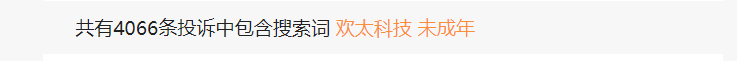

On August 2, 2023, the Cyberspace Administration of China published the "Guidelines for the Construction of a Minor Mode for Mobile Internet (Draft for Comment)," proposing to upgrade the "Youth Mode" to the "Minor Mode" and expand its scope from apps to mobile intelligent terminals and app stores, realizing a three-way linkage between software, hardware, and the operating system to facilitate users' one-click access to the mode, creating a safe and healthy online environment for minors.

As the operator of OPPO's software and game center, as of December 9, 2024, there have been a total of 16,982 complaints related to HuanTai Technology on HeiMao Complaints. Among them, over 4,000 complaints contain the word "minor," primarily involving disputes over recharge, refunds, and induced consumption.

(All complaints above have been reviewed by the platform.)

Although it is unrealistic to satisfy everyone, the aforementioned complaints may be biased or one-sided. HuanTai Technology is deeply involved in the mobile phone and IoT industries and is actively working on improvements. It has also formed partnerships with other mobile phone manufacturers and automakers. The complaints do not solely point to OPPO. However, as a subsidiary, any oversight on red-line issues is sensitive. While it is important to provide a better software innovation experience, it is more urgent to plug loopholes in minor gaming consumption. It is always beneficial to identify and address deficiencies and prioritize risk management.

The market is evolving rapidly, and there are no permanent champions. The key is to learn from setbacks, accumulate energy through gradual self-improvement, and eventually stage a counterattack.

Industry analyst Wang Tingyan believes that although success or failure should not be judged solely by short-term results, the decline in sales and the stalled construction progress of the global mobile terminal R&D headquarters project should serve as a wake-up call for OPPO and the smartphone industry as a whole. In a high-stakes game, the winner is determined by who makes fewer mistakes and takes the lead. Re-evaluating market positioning and strategies, and reducing misjudgments, should be OPPO and Chen Mingyong's critical focus to regain past glory and truly capitalize on AI advancements.

04

Acquisitions on One Hand, Going Global on the Other

Winning Through Comprehensive Competition

LAOCAI

Facing challenges and crises, OPPO is adjusting its strategies to find a way out.

On November 22, Daqian Ecology announced that the company had received a notice from its controlling shareholder, Daqian Investment, informing it that Daqian Investment would transfer 24.5489 million shares, representing 18.09% of the issued shares, to Suzhou BBK for a transfer price of 15 yuan per share, totaling 368 million yuan. This made Suzhou BBK the controlling shareholder of Daqian Ecology.

This successful acquisition means that OPPO is leveraging capital market forces to explore diversified development paths. It remains to be seen whether OPPO can integrate various resources in the future to break the inherent business model, inject new vitality into its transformation or innovation, and tell new growth stories.

Separately, OPPO has achieved impressive results in overseas markets. For example, in the third quarter of 2024, OPPO shipped 5.1 million smartphones in the Southeast Asian market, accounting for a 21% market share and surpassing Samsung to lead the Southeast Asian market. On November 18, Canalys released a list of smartphone shipments in Latin America for the third quarter, showing that OPPO regained its position in the top five with a 62% year-on-year growth rate.

In the view of Rhodium Finance, as the domestic smartphone market becomes increasingly competitive, going global has shifted from being an option to a necessity. As a pioneer in going global, OPPO's achievements demonstrate its first-mover advantage and reflect its strength and development potential.

However, this is merely the first step on a long journey. OPPO should be aware that the speed and scale of globalization are merely superficial indicators. What truly matters are strategic endurance, product uniqueness, core technological innovation, and comprehensive competition across the entire industry chain. So, is the stalled construction of the global mobile terminal R&D headquarters project a plus?

Catching up in the domestic market, pursuing stable and far-reaching globalization. Whether OPPO can achieve success both domestically and internationally, and achieve a counterattack in sales, it is still on the way.

This article is original content from Rhodium Finance

Please leave a message if you need to reprint it