Amazon Clones Temu to Compete on Low Prices, But Pinduoduo Faces an Uphill Battle in the US

![]() 12/12 2024

12/12 2024

![]() 630

630

By Leon / Edited by Hou Yu

This Black Friday, global e-commerce giant Amazon went all in. Surprisingly, the most popular deals didn't come from Prime members but from Haul, the low-priced mall.

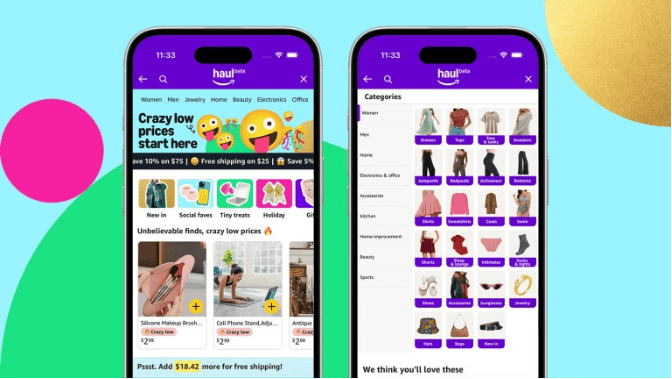

Amazon launched Haul in mid-November, focusing on low prices and currently targeting the US market. Haul offers 35 categories, including fashion, home goods, electronics, etc., all priced at $20 and below. It offers free shipping on orders over $25 with a delivery time of one to two weeks.

During Black Friday (November 29th - December 2nd), Haul offered 50% off sitewide and prominently displayed banner ads on the Amazon App, leading to a rapid shopping spree due to the significant discounts.

According to Marketplace Pulse data, on the second day of Black Friday, Amazon Haul had 2,700 best-selling items, most of which were sold out. The report also noted that nearly all the hundreds of third-party sellers on Amazon Haul were from China.

Obviously, Haul's popularity exceeded Amazon and sellers' expectations. Subsequently, internal Amazon sources revealed that the company was discussing opening Haul to third-party sellers without an invitation system. This news quickly spread in the domestic cross-border e-commerce circle, with many sellers eager to seize this new opportunity.

In June this year, Amazon held a closed-door seller recruitment meeting in Shenzhen to recruit sellers for its upcoming project, 'Low-Priced Store.' The first batch of invited sellers numbered around 200. This move was widely interpreted as Amazon's response to Chinese cross-border e-commerce platforms like Pinduoduo's Temu and Shein. Now that Haul's initial launch has been successful, it is significant for Amazon.

Amazon is in a hurry to compete with Temu

Founded in 1994, Amazon is a pioneer in global e-commerce. Initially selling paper books, Amazon later expanded into electronic books and the Kindle e-reader, eventually becoming the world's largest integrated e-commerce company with 24 sites globally.

In the early stages of China's e-commerce development, Amazon also wanted a piece of the pie, acquiring Joyo.com for $75 million in 2004 to establish Amazon China. Unfortunately, Amazon China struggled to adapt to the local market and eventually withdrew, leaving only its overseas shopping service, 'Amazon Global Store.'

As a side note, Lei Jun was one of the founders of Joyo.com. In an interview, he mentioned that when he later met Amazon founder Jeff Bezos, the first thing Bezos said was, 'I'm sorry I didn't take good care of Joyo.com.'

Returning to the topic, amidst a global economic downturn, the consumer market is experiencing 'consumption stratification,' where ordinary consumers are no longer buying luxury goods but instead purchasing white-label products or more cost-effective mid-range products more frequently. The decline in revenue for luxury groups like LVMH and Kering in the first three quarters of this year illustrates this point.

In this context, Amazon, known for its Prime membership service, faces a similar problem as Alibaba: neglecting the low-price market and lacking competitiveness in the white-label sector. Meanwhile, Chinese cross-border e-commerce platforms led by Temu are continuously eroding the low-price market share in the US, evident in various data. Amazon is clearly restless.

According to Stocklytics research data, the global e-commerce market is expected to reach $4.11 trillion in 2024, a year-on-year increase of 15%. Amazon's third-quarter financial report showed that online store net sales were $61.41 billion, a year-on-year increase of 7.2%, lagging behind the overall market growth rate.

Meanwhile, Temu is showing rapid growth in the US market, with MAU (Monthly Active Users) reaching 51 million in 2023, closely trailing Amazon's 67 million. In 2024, Temu's GMV in the US market is expected to reach $20 billion to $25 billion, surpassing Walmart in revenue scale.

In fact, before the emergence of low-price e-commerce, Amazon itself lacked strategic experience in price wars. Traditionally, Amazon's main site encourages price competition among third-party sellers through the exposure mechanism of the 'Buy Box.' According to a ten-month monitoring by Feedvisor, only 2% of products on Amazon experience price wars, which are random and short-lived, failing to meet consumer demand.

Launching Haul is a necessary move for Amazon to respond to market changes, and its operating model also pixel-level mimics Temu.

Can US e-commerce compete with China's 'king of volume'?

Essentially, Amazon Haul adopts a semi-managed model similar to Temu. In a semi-managed model, sellers retain the right to list and price their products while outsourcing warehousing, distribution, and logistics to the platform. This model is more flexible and offers a wider range of products compared to a fully managed model where the platform handles procurement centrally.

Since both platforms use a semi-managed model, the competition lies in suppliers, pricing, and customer experience (including logistics and service).

Starting with suppliers, as mentioned earlier, most Haul suppliers are from China and ship products via small package direct mail, with Amazon subsidizing shipping costs.

Since last year, Amazon has increased its focus on Chinese suppliers, delving into various industrial clusters. A notable strategy is the 'Ten Initiatives for Industrial Cluster Takeoff' support plan announced in August 2023, using various preferential policies to attract sellers from the supply chain.

However, Amazon's 'dark history' still gives Chinese sellers pause. In 2021, Amazon banned a large number of Chinese sellers, involving 600 brands and about 3,000 accounts, citing repeated abuse of reviews. Similarly, Pinduoduo's approach to Temu sellers is controversial, with sellers protesting opaque fines and frozen payments multiple times.

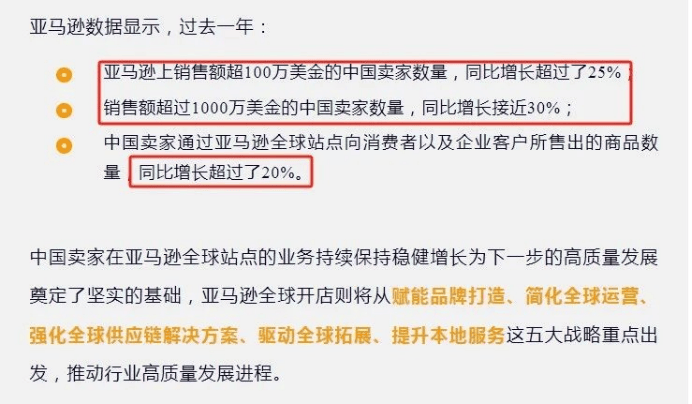

Adhering to the principle of 'not putting all eggs in one basket,' Chinese cross-border sellers remain optimistic about Amazon. Official data from Amazon's Global Selling Cross-Border Summit held at the end of last year showed that in 2023, the number of Chinese sellers on Amazon with sales exceeding $1 million increased by over 25% year-on-year, while those with sales exceeding $10 million grew by nearly 30%, and the number of products sold increased by over 20%. It is foreseeable that if Amazon subsequently opens more Haul substations in different countries and regions and fully opens up to sellers, it will not lose to Temu in terms of suppliers and product categories.

So, do US consumers recognize Haul? Overall, the reception is mixed.

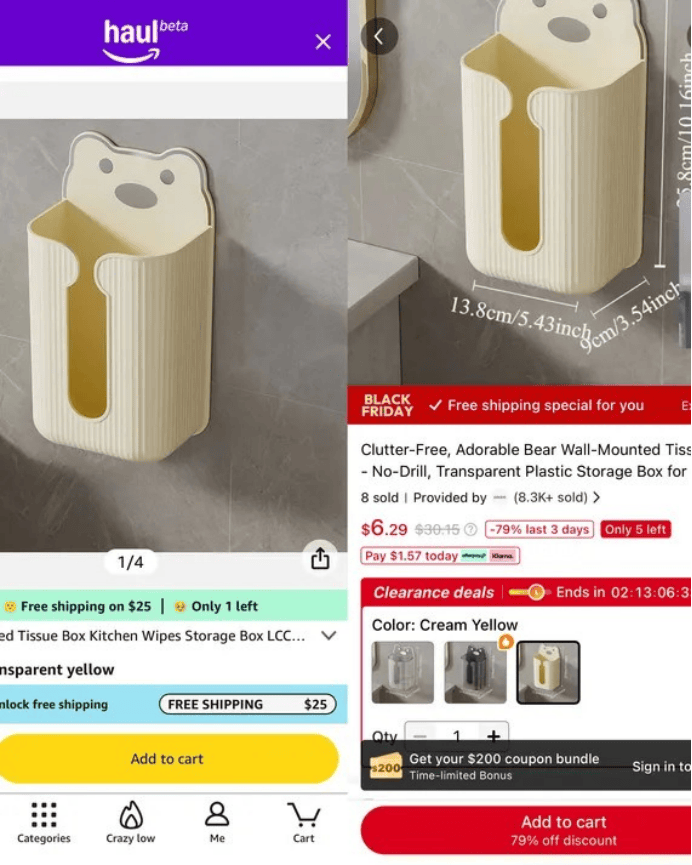

After an in-depth experience with Haul, NY Mag described it as a 'boring clone' of Temu. White-label product images and descriptions are almost identical, with prices differing by only a few cents. For example, a hanging tissue box costs $6.99 on Haul and $6.29 on Temu; another phone case costs $3 on Haul and $3.60 on Temu.

In terms of service, Amazon Haul requires a minimum order of $25 for free shipping, with a delivery time of one to two weeks. Temu's shipping policies vary by product, with some items eligible for free shipping and most requiring a minimum order of $30 for free shipping, usually delivered within 12 days. Additionally, Haul supports Amazon's refund guarantee, while Temu's refund mechanism is also lenient, even offering full refunds.

Left: Haul, Right: Temu

NY Mag points out that Haul's main disadvantage currently lies in its recommendation mechanism and algorithms. The Haul homepage is cluttered with disorganized recommendations, providing a poor user experience that needs continuous optimization. Overall, Haul has initially met Amazon's expectations: it can somewhat contain Temu and perhaps convert some price-sensitive users into Prime members.

Interestingly, as the low-price e-commerce battle intensifies, US consumers are becoming smarter. Many US netizens place orders for the same product on platforms like Haul, Temu, and TikTok Shop, keeping the one that arrives first and requesting refunds for the others.

Ultimately, the US e-commerce market is also experiencing its own 'Pinduoduo moment,' indicating a fierce competition in the cross-border e-commerce market in 2025.

How long can cross-border e-commerce, built on 'de minimis value,' last?

With Amazon's entry, global competition in low-priced cross-border e-commerce has intensified further, accompanied by uncertainties.

Firstly, there's the US 'de minimis value' policy. Originating in the 1930s, this policy exempts imports valued at less than $200 from customs duties, originally intended to facilitate tourists carrying gifts across borders. In 2016, then-President Obama signed the Trade Facilitation and Trade Enforcement Act of 2015 to increase the duty-free allowance for imported goods to $800 to boost domestic consumption.

In other words, platforms like Temu, known as the 'Four Little Dragons of Going Abroad,' have gained a foothold in the US market largely due to the $800 duty-free policy. Leveraging China's manufacturing cost advantages, they ship low-priced goods directly or store them in US forward warehouses via cost-effective shipping methods, further shortening delivery times.

However, the US has become aware of this 'loophole.' On September 13th this year, the US government announced plans to tighten the duty-free import policy for small parcels. A White House report noted a surge in the number of de minimis duty-free shipments entering the US, from 140 million pieces annually to over 1 billion pieces. Most of these parcels originate from e-commerce platforms founded in China, undermining the competitiveness and interests of US local enterprises. Considering that Trump will officially take office in January next year, mainstream opinion believes he will take action regarding this policy.

An interesting point is the timing of Amazon's launch of its low-priced mall. By introducing a low-priced mall heavily reliant on the Chinese supply chain just as the new policy looms, Amazon is either making a bold move or is confident in its strategy. For a giant like Amazon, the latter is more likely.

Recent comments by Amazon founder Jeff Bezos also sent a positive signal. On December 4th local time, Bezos said at a conference, 'This time, I'm really optimistic. He (Trump) seems to be putting a lot of effort into reducing regulations. If I can help, I will.'

Unlike platforms like Temu, Amazon is an American company. Even if the US implements new policies restricting the import of small packages, Amazon can still transfer costs by subsidizing local enterprises. It is certain that both Amazon's main site and Haul will rely on the Chinese supply chain for a long time.

In contrast, Chinese cross-border e-commerce platforms face a less optimistic situation. They must not only contend with competition from Amazon but also prepare for potential restrictions. Recently, Temu's announcement of establishing forward warehouses in the US could be a viable strategy. Essentially an investment, forward warehouses align with the US goal of creating jobs, potentially increasing bargaining power in negotiations.

Additionally, with TikTok's legal defeat in the US, the future of its e-commerce business is uncertain. If it completely exits the US market, the resulting market gap will undoubtedly become a target for competition among Amazon, Temu, AliExpress, and others. It is certain that the US market remains attractive, and no cross-border e-commerce platform is willing to cede it easily.