Temu Forced to Cease Operations in Vietnam, Hindering Chinese Cross-border E-commerce Momentum

![]() 12/20 2024

12/20 2024

![]() 714

714

By Leon

Edited by cc Sun Congying

The Chinese cross-border e-commerce industry received distressing news in the final month of 2024.

On December 5, Vietnam's Ministry of Industry and Trade announced that it had requested Temu to halt operations in Vietnam due to the company's failure to fulfill the necessary business registration requirements.

Currently, when accessing Temu's Vietnamese website, a notice appears stating that Temu is in discussions with Vietnam's Ministry of Industry and Trade's Department of E-commerce and Digital Economy to obtain the necessary qualifications for providing e-commerce services in Vietnam.

Temu had only been in the Vietnamese market for just over two months, having entered in early October of this year.

An insider close to Temu revealed that the company is actively communicating with relevant Vietnamese government departments and hopes to find a solution promptly.

Regarding Temu's suspension in Vietnam, Hoang Ninh, Deputy Director of Vietnam's Ministry of Industry and Trade's Department of E-commerce and Digital Economy, stated, "We have received Temu's application and are processing the registration. We have also received supplementary documents and are currently reviewing them. If the requirements are met, we will grant approval." The Ministry of Industry and Trade also mentioned that it is drafting special legislation to strengthen e-commerce management.

Following Indonesia's announcement of policies banning certain e-commerce activities, Vietnam's tightening of cross-border e-commerce regulations signifies a further intensification of international trade barriers. Emerging markets in Southeast Asia, once favored by major e-commerce platforms, are also tightening their regulations, posing additional challenges to Chinese cross-border e-commerce platforms like Temu.

Temu's Vietnamese venture halted after just two months

In October 2024, Temu officially entered the Vietnamese market. Prior to this, Temu had already operated in over 80 countries and regions worldwide, including Southeast Asian markets like the Philippines, Malaysia, Thailand, and Brunei, but had yet to enter Singapore and Indonesia.

However, the Southeast Asian market differs from the US market, with fiercer competition in lower-tier markets where low-price promotions are common, but there is still room for growth. According to local Vietnamese Chinese residents interviewed by Wall Street Tech Eye, Temu has become a shopping channel for many Chinese, while China's TikTok e-commerce platform holds a first-mover advantage.

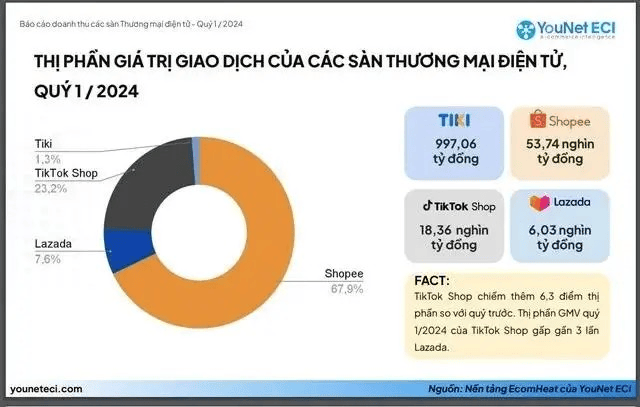

Data indicates that Vietnam's e-commerce market totaled 79 trillion Vietnamese dong (approximately RMB 22.6 billion) in sales in Q1 2024, dominated by the top three players: Shopee, TikTok Shop, and Lazada, with Shopee holding a remarkable 67.9% market share.

Shopee, a cross-border e-commerce company founded in Singapore by Li Xiaodong, a native of Tianjin who later acquired Singaporean citizenship, leverages Singapore's geographical location and China's supply chain advantages to maintain a leading market share in Southeast Asia. In 2023, Shopee generated annual revenue of $9 billion (approximately RMB 65.5 billion), a 23.5% year-on-year increase.

In contrast, Temu's progress in the Southeast Asian market has been slower. According to publicly available information, since its launch in the Philippines in August 2023, Temu's average traffic over three months accounted for only 0.3% of its global traffic, a far cry from the over 17% traffic share in the US and Japan markets.

Given this situation, Temu saw potential in Vietnam's rapidly growing economy and chose to enter the market urgently. However, the Vietnamese government did not welcome this move.

In mid-November, Vietnamese authorities required Temu to complete the registration process by the end of November or face the risk of suspension. According to Vietnam's Decree No. 52/2013/ND-CP on E-commerce (amended and supplemented by Decree No. 85/2021/ND-CP), e-commerce platforms with Vietnamese-language domain names, Vietnamese-language display pages, or over 100,000 transactions from Vietnam within a year must register with Vietnam's Ministry of Industry and Trade before officially entering the Vietnamese market and must establish a representative office or designate an authorized representative in Vietnam in accordance with the law. Additionally, e-commerce platform managers are responsible for registering through the General Department of Taxation's electronic information portal to calculate, declare, and pay taxes independently.

In recent years, with the development of the Southeast Asian e-commerce market, countries have continuously improved laws and regulations governing the e-commerce market, with stricter regulatory trends encompassing transparency in information reporting, maintenance of market competition order, and protection of consumer rights. From the perspective of maintaining local business order, the Vietnamese government's suspension of Temu is understandable.

In fact, during Pinduoduo's third-quarter earnings call, the parent company of Temu anticipated potential risks associated with compliance. Pinduoduo's Chairman and Co-CEO Chen Lei mentioned "compliance," "long-term investment, and optimization" and warned of future profit declines.

Perhaps there was a delay in implementing strategic policies from the top-down, or perhaps Temu's middle management felt compelled under performance pressure. Temu hastily entered the Vietnamese market and continued to use Pinduoduo's aggressive marketing tactics, inevitably drawing the attention of Vietnamese regulators.

Viral Marketing Continues, but Price Competitiveness is Waning

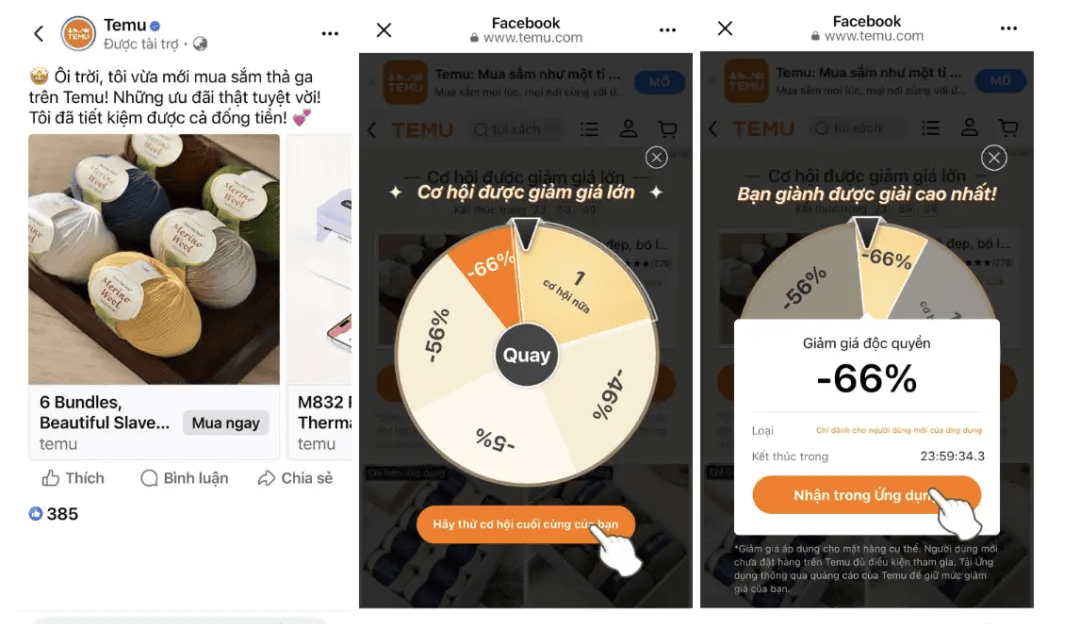

"Shop Like a Billionaire" is Temu's advertising slogan in Vietnam. Undoubtedly, this advertisement is highly infectious and persuasive, quickly capturing the attention of Vietnamese consumers.

After launching in Vietnam, Temu quickly sparked discussions on social media, achieving over 100,000 downloads by the end of October. However, as consumers began using the platform, complaints and doubts gradually emerged. For example, the "Lucky Wheel" offers up to 66% off limited-time discounts, which is very attractive. This gamified, FOMO (Fear of Missing Out) marketing tactic is a hallmark of Pinduoduo and should be familiar to domestic users.

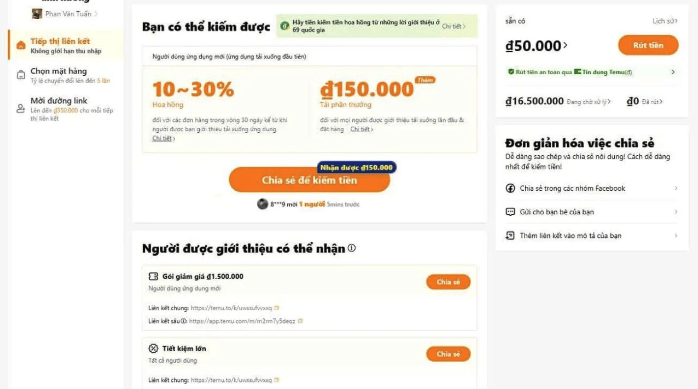

Unsurprisingly, the "one-click discount" social model has also been introduced to Vietnam, even more directly. Temu's "Affiliate Marketing" program in Vietnam encourages ordinary consumers to invite new users to install the Temu App via a link, receiving a bonus of 50,000 Vietnamese dong (approximately RMB 14.3 yuan) for each successful invitation, and 150,000 dong if a purchase is made. Users can even earn commissions by sharing products, with a maximum of 30%.

However, Vietnamese consumers soon discovered the catch. Some Vietnamese netizens complained, "You get 50,000 dong for inviting one person, but you can only withdraw it if their order amount exceeds 250,000 dong." Additionally, the in-app prompt "XX has invited XX people" creates an intangible sense of competition, causing anxiety among some Vietnamese consumers.

However, the prices on Temu are not necessarily cheaper. "I advise my friends that even if they like Temu, they should still compare prices. I compared prices recently and found that almost everything is double the price on Shopee," said a Vietnamese netizen on a Facebook discussion group.

Moreover, this suspension incident has negatively impacted Temu's brand image. According to some Temu users in Vietnam, refunds were not credited back to users' bank accounts but instead to e-commerce wallets, which were then "suspended." Additionally, some November orders showed items as lost or not cleared by customs.

Considering Shopee and TikTok Shop's strong market dominance in Vietnam, Temu had planned to capture a share of the market through aggressive marketing after entering Vietnam but was forced to pause, incurring incalculable losses.

In the Era of Deglobalization, Cross-border E-commerce Must "Embrace Change"

Geopolitical tensions and increased international trade barriers indicate that Chinese e-commerce's overseas expansion has entered a new phase. The first phase of aggressive expansion is a thing of the past, and compliance and long-termism are the current development directions.

In terms of compliance, cross-border e-commerce companies must first address changes in taxation. Currently, countries like the US and Vietnam are accelerating the implementation of the cancellation of the "small package tax exemption" policy, with thresholds set at $800 (approximately RMB 5,828) in the US and 1 million Vietnamese dong (approximately RMB 286) in Vietnam. If this new policy is implemented, it will undoubtedly impact the export of white-label Chinese products.

Secondly, there are issues related to marketing logic, app design, and security. On November 8, the European Commission stated in a press release that it would urge the European Commission and consumer protection departments of 29 countries to jointly request Temu to cease "problematic practices" that may mislead consumers and violate EU product safety rules. These "problematic practices" include false discounts, pressure sales (such as false inventory or limited-time offers), forced gamification (lucky wheels), fake reviews, etc. This means that Temu cannot directly replicate Pinduoduo's operating model and must adapt for the European market.

Finally, competition is intensifying. Take Amazon's low-priced mall Haul as an example; its operating logic is very similar to Temu's. Although Amazon is a latecomer to the low-priced white-label market, its status as an American company provides it with policy advantages that may impact Chinese cross-border e-commerce platforms like Temu. The good news is that Amazon relies heavily on China's commodity supply chain, which is optimistic from the perspective of China's overall export volume. (For details, see: Amazon "Clones" Temu, Competing on Low Prices, Making it Difficult for Pinduoduo to Win in the US)

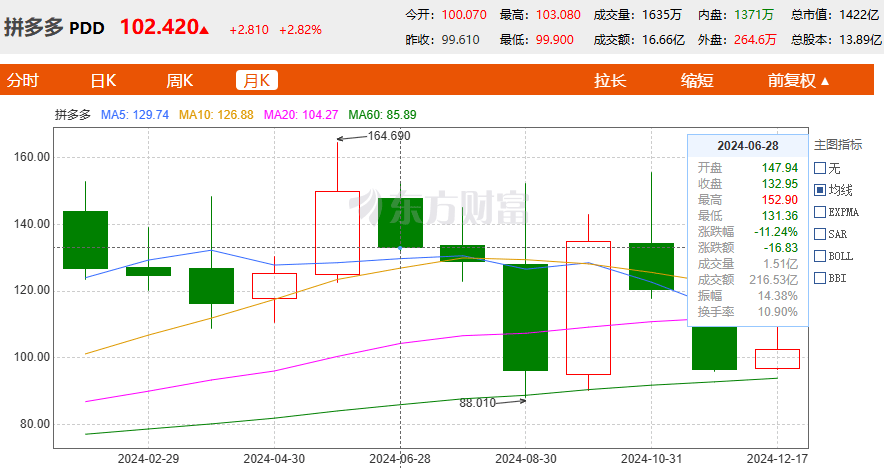

In terms of share price, Pinduoduo has fallen from a high of $164.69 per share in May of this year to $102.42 per share on December 18, a drop of 62.2%. Its total market capitalization has shrunk from over $200 billion to $142.2 billion, currently trailing Alibaba by over $60 billion.

It is evident that Temu is just a microcosm of Chinese cross-border e-commerce. Companies like Alibaba, ByteDance, and Shein also face a less-than-friendly international environment. With stricter regulations and more restrictions, "lightning-fast" rapid expansion is no longer feasible, and strategic adjustments are necessary.