Returning to the Online Market: Honor Re-enters the Mid-range Fray with Fierce Competition

![]() 12/20 2024

12/20 2024

![]() 539

539

To address its lack of presence in the online market, Honor needs a fresh narrative for its IPO. Besides its arch-rival Xiaomi's Redmi, Honor must also keep an eye on OPPO's Realme.

@TechNews original

Four years after going independent, Honor has returned to the battlefield it knows best.

At the launch of its high-end flagship Magic7 series, Honor CEO Zhao Ming announced a new independent product line, the GT series, focusing on online channels. This "preview" has now materialized.

Historically, the internet was Honor's starting point. During the Huawei era, Honor faced users as Huawei's internet sub-brand. Zhao Ming candidly stated, "The path that Honor GT will take is the same as that of past Honor. It will expand its share of the internet mobile phone market through products and experiences."

However, in recent years, as brands have continued to ascend the high-end market and product lines have become increasingly diverse, the mid-range internet performance phone market has also seen rounds of fierce competition. Especially towards the end of each year, the rapid pace of new product launches makes it challenging for ordinary consumers to keep track.

Competing on the most sensitive price point is not easy for any company. So why did Honor choose this moment to return to this race? What situation is the current internet market facing? Can Honor, once the number one internet brand, still perform well?

01 The "Comfort Zone" that is Hard to Return To

When discussing internet brands or the mid-range market, pre-independent Honor is unavoidable. Early on, as a sub-brand of Huawei phones, it helped Huawei expand its territory in the mid-range internet market.

In those years, with its unique strategy and the glow of Huawei, Honor made rapid progress, with sales once surpassing the combined sales of "Xiaomi + Redmi phones," long dominating the throne of internet sales champions.

Frankly speaking, pre-independence Honor was a typical representative of internet brands that followed the cost-effective route. However, after being forcibly separated from Huawei, if Honor wanted to "survive," it had to build a mature brand channel structure and a complete business model focused on "omnichannel" distribution. Relying solely on the internet was clearly not a sustainable path for an independent mobile phone brand.

In recent years, Honor has begun to focus on offline distribution, ultimately transforming the sales ratio between offline and online channels from 3:7 in the past to 7:3 now, successfully navigating through its darkest moments.

However, as the "number one internet phone brand," the launch of the GT series at this time carries significant implications for Honor.

First, Honor does indeed have the ability to return to the internet market.

In fact, Honor hasn't made too many mistakes since its independence. In Zhao Ming's words, "We don't take detours, or at least try to minimize them."

Indeed, Honor hasn't rested on its laurels in recent years but has chosen to reshape the complete system that a mobile phone brand should have. Amidst the industry's rush towards the high-end market, Honor followed the trend, reducing its investment in the mid-range market, where it was most proficient, and shifting towards the high-end market.

For Honor, without the protection of Huawei, this was a gamble of life or death, but fortunately, Honor survived.

After four years, it has completed its system construction, offline channel coverage, as well as strategic layouts in AI, foldable screens, the high-end market, and overseas markets, truly entering a mature stage of development. Its technology, products, channels, and brand system are now sufficient to support "dual-brand" and "dual-channel" operations.

Secondly, the temporary slowdown in the high-end market has fueled a rebound in the mid-range market.

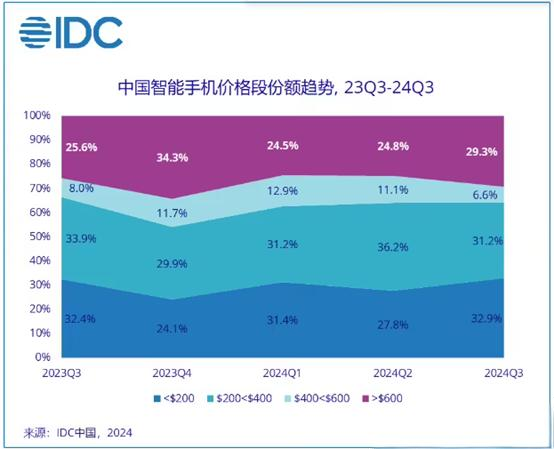

According to IDC data, in the third quarter of 2024, high-end models priced above $600 accounted for 29.3% of the Chinese mobile phone market, while low- and mid-end models priced below $600 accounted for a combined 70.7% share. Compared to the high-end market, the mid-range market is a much larger pie.

From a temporal perspective, the launch of Honor's new series is seen as a preparation for the significant opportunity of going public.

Because in terms of market share, when Huawei's domestic market share began to accelerate in the third quarter of 2023, it marked the starting point of Honor's share decline. And this declining trend in market share has yet to show a turning point. As of the third quarter of 2024, Honor's share of the Chinese smartphone market had dropped to 15%, ranking third.

At this critical juncture of going public, fluctuations in market share are obviously not what Honor or its investors want to see. Therefore, complementing the "complete product matrix" for both online and offline channels, telling a new story with a new brand, and contributing more shipments to Honor before the IPO are also reasons for its return to the internet market.

"Clearly, during the time when Huawei phones disappeared, Honor took over some of the market share lost by the former and quickly gained a firm foothold. Now, with Huawei's return, the competitive pressure that Honor needs to bear is increasing, especially in the high-end phone market where there is higher premium. Therefore, focusing on online distribution is a strategic priority, whether at the business level or the capital level," an analyst told TechNews.

For Honor, the emergence of the GT series seems to be a prudent layout, but a fact that cannot be ignored is that the current internet mobile phone market has changed significantly, and it is uncertain whether Honor can still perform well.

02 The Battleground of Mid-range Phones

Currently, in the mid-range online market, the four major domestic phone manufacturers are all making efforts.

Multiple brands such as Honor, Xiaomi and its subsidiary Redmi, OPPO and its subsidiary Realme, vivo and its subsidiary iQOO are all engaged in intense competition. Within just one month, the iQOO Neo10 series, Redmi K80 series, Realme Neo7 series, Honor GT, and the upcoming OnePlus Ace 5 series have all been unveiled.

Due to the lower brand loyalty in the mid-range online market compared to the high-end market, other manufacturers have not been idle during the four years that Honor was absent, stepping in to carve up Honor's original market share, especially Xiaomi, which was previously suppressed by Honor, has returned to center stage.

Recently, Redmi announced the sales results of the K80 series, with sales of over one million units for two models within 10 days of launch, five days faster than the previous generation's three models. Lu Weibing of Xiaomi Group said that as the Xiaomi brand moves towards high-end, it will break through higher price segments in the future, making room for Redmi to gradually take over the position of the K series with the introduction of the Turbo series.

Besides Xiaomi, which is Honor's arch-rival, Honor also needs to be wary of OPPO's rising star, Realme. Xu Qi, Vice President of Realme's Brand, previously announced Realme's product line and future plans for the Neo series. Realme will focus on two flagship series, GT and Neo, with the GT series positioned as high-end performance flagships and the Neo series as mid-range gaming flagships, creating gaming flagships that better understand young people.

Currently, the Chinese market has about 500 million users, about 50% of whom are using phones in this price range. Therefore, for Realme, this price segment is crucial to establishing a foothold in the Chinese market. "The goal of the Neo series is to be number one in the mid-range online market share," said Xu Qi.

It is worth mentioning that the positioning of the Honor GT is as a "new performance technology series that understands young people better." The independent product lines of both brands emphasize their understanding of young consumers' demand for gaming performance, making them direct competitors.

"Both Realme and Honor are strengthening their market positioning through independent series in an attempt to gain a larger market share in the young consumer demand and gaming performance markets. With continuous investments and innovations in products, technology, and market strategies by these two brands, these actions indicate that competition in the mid-range market may intensify," a senior telecom industry analyst told TechNews.

While competition in the mid-range market intensifies, major phone manufacturers must also deal with cost pressures from rising supply chain prices. In fact, due to rising chip and storage component prices, flagship new phones released by domestic phone manufacturers in October this year saw price increases ranging from 200 to 500 yuan.

For high-end models with higher premiums, even with rising component prices, there is still sufficient profit margin to absorb these costs. However, for mid-range models with already slim profit margins, the cost pressure they face is obviously higher.

Tan Ruitao, head of the Realme GT series product line, also said, "In our view, the current increase in SoC chip prices is actually much higher than the degree of price easing for memory chips. From the overall cost perspective, the cost of the entire mid-to-high-end model will remain under pressure next year or the year after."

Even though the industry is already so competitive, Realme's claim that "product hardware gross margin can be 0" puts its peers, especially direct rival Honor, under intense pressure.

Of course, whether it's competing for online users, strengthening the mid-range market, or focusing on performance, these are all changes that Honor, Realme, and other manufacturers have made to increase sales. However, in the current environment and with changing user needs, price reductions and concessions cannot fully solve the problem. For consumer electronics products like mobile phones, which are purchased infrequently, used frequently, and have increasingly longer replacement cycles, marketing and comprehensive product capabilities are still the primary factors influencing user decisions.

Therefore, even though Honor has had successful experiences in the past, the current mid-range online market, which is highly competitive, is not optimistic.

According to the latest IDC report, by 2025, the market share of smartphones priced above $600 in the Chinese market is expected to reach 30.9%, with a year-on-year increase of 2.1%; while the market share of smartphones priced below $200 will also increase by 2.1% year-on-year, reaching 31.5%.

It is worth noting that among the three different price segments, the market share of the $200-400 segment will decrease to 28.0%, a decrease of 4.2 percentage points. This data indicates that the current mid-range phone is not yet the first choice for most consumers.

03 A New Moat is Needed

Honor began building its brand at the end of 2013 and quickly rose to become the "number one internet phone brand," which exceeded the expectations of most industry insiders.

There are two main reasons for this: one is that the entire online mobile phone market was in an explosive growth phase, transitioning from 0 to 1, and the establishment of the Honor brand was "timely"; the other is the "technology spillover" resulting from Huawei's deep technological accumulation, as well as precise product definition and leading "light model" business logic.

But as mentioned above, although the industry is in a rebound phase, the rapid competition among various players has already carved up the market space. Therefore, the Honor GT series can hardly be considered timely; it could even be said to have been born at the wrong time.

On the positive side, Honor's current product system has completed its high-end and global layout. As an online mid-range branch, the Honor GT series can quickly receive technology from Honor's flagship models. The problem is that Honor no longer has its past advantages.

During the Huawei era, the most crucial technology spillover that Honor received was Huawei's Kirin chips. At that time, for most domestic brands, there were not many options for platform choices; it was either Qualcomm Snapdragon or MediaTek Dimensity, leading to the homogenization of product platforms in the market. Only Honor could stand out. Being able to use a Kirin flagship chip for just 1999 yuan was indeed attractive enough for users.

But now, without Kirin chips, Honor is no different from others in terms of main performance. Several new models at the same price point as the Honor GT series use either the Snapdragon 8 GEN 3 or MediaTek Dimensity 9300+, with the Pro version offering a choice between the Snapdragon 8 Gen 2 and MediaTek Dimensity 9400.

Tracing back a year ago, new products equipped with these platforms were all high-end flagship models with higher prices at launch. However, due to the rapid iteration of the market, flagship platforms are often downgraded to the 2000 yuan price segment within less than a year to ensure sufficient competitiveness.

This is also true for Honor without Kirin chips. Without a platform advantage, it can only follow the trend and become another player in platform homogeneity.

To provide users with a more distinctive experience, companies have invested significant efforts in various areas. iQOO has integrated self-developed gaming chips into its phones and collaborated with game developers to fine-tune the system. Redmi boasts the Turbo Engine 4.0, Realme the GT performance engine, OnePlus the industry's pioneering chip-level gaming technology, and Honor the Phantom Engine. Despite their alluring names and promises, these technologies primarily focus on system tuning for enhanced gaming smoothness, which necessitates gradual validation through real-world user experiences.

In terms of products, companies share a coherent direction for mid-range performance smartphones. Notably, when competitors offer batteries starting at 6000mAh and even reaching 7000mAh, the 5300mAh battery of the Honor GT appears less impressive.

Marketing plays a pivotal role in capturing the online mid-range market. Honor can draw from past experiences but must recognize the current marketing landscape's divergence from the past. All companies are actively cultivating younger executive teams, engaging with universities, and sponsoring e-sports events to connect with young users. Employing younger executives who better understand youth culture facilitates the creation of more youthful products.

In the future, Honor's ability to conduct operations that resonate with netizens and young people will be crucial to its success. Despite having truly separated from the Huawei system and established a robust financial foundation, the Honor GT series still faces a challenging path to surpass the achievements and industry standing of "original Honor" prior to its independence, given the fiercely competitive market and surrounding competitors.