Low Configuration, High Price? Foreign Brand Mobile Phone Sales Decline for Four Consecutive Months! Samsung and Apple Struggle with Arrogance

![]() 01/06 2025

01/06 2025

![]() 564

564

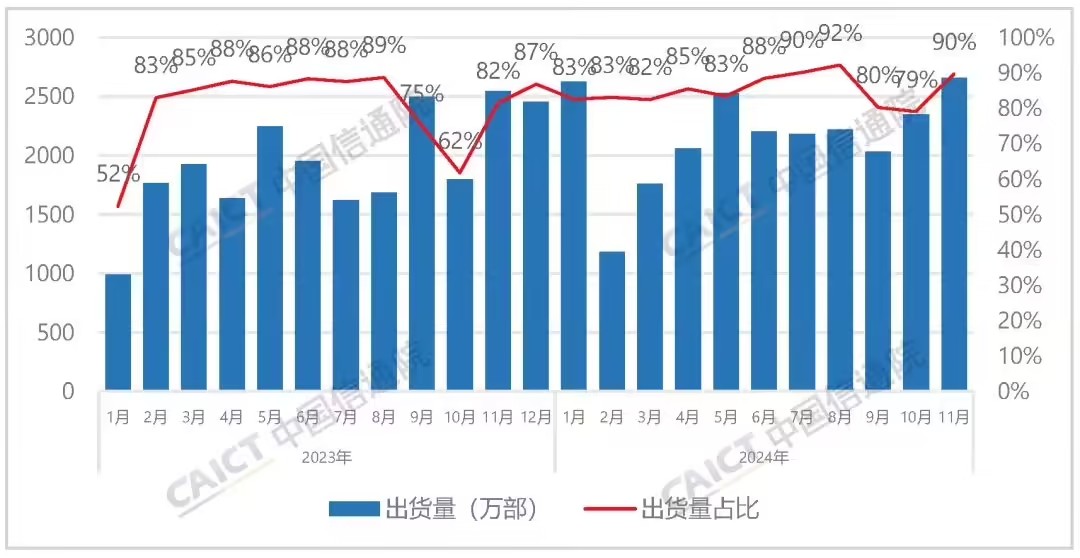

In the Chinese market, sales of "foreign brand" mobile phones have declined year-on-year for four consecutive months.

According to data released by the China Academy of Information and Communications Technology, in November 2024, the shipments of foreign brands in the domestic mobile phone market amounted to only 3.04 million units, marking a year-on-year drop of 47.4% and a month-on-month decline of up to 51%. This represents the fourth consecutive month of year-on-year sales decline. In October 2024, sales of foreign mobile phone brands in China also fell by 44.25%. Since other foreign brands have minimal presence in the Chinese market, this data essentially mirrors changes in Apple's sales in China.

(Source: China Academy of Information and Communications Technology)

Once upon a time, the domestic mobile phone market was dominated by foreign brands, with the song "I Made Money" even boasting, "I bought a Nokia with my left hand and a Motorola with my right hand." Twenty years have passed swiftly, and most foreign mobile phone brands have vanished from the domestic market. Why do domestic consumers no longer favor foreign mobile phone brands?

Foreign brands have faltered in China due to their arrogance.

Starting around 2014, foreign brands gradually lost ground in the domestic market. Korean mobile phone manufacturer LG ceased releasing new phones in China in 2016 and officially announced its withdrawal from the Chinese market in February 2018; in 2024, Japanese manufacturer Sony did not release a Chinese version of its new Xperia 1 VI, and its exit from the Chinese market appears imminent.

The reason these brands withdrew from the Chinese market stems purely from their lack of product strength. In the era of smartphones, product sales hinge on four major factors: hardware configuration, system optimization and adaptation, price, and brand. Sony and LG's mobile phone systems are close to stock Android, which fails to meet the needs of most domestic consumers. They lag behind domestic brands in terms of features while being generally expensive.

Today, only Samsung and Apple remain active foreign mobile phone brands in the domestic market, with Samsung's mobile phone sales relegated to the "others" category, and Apple's sales temporarily ranking among the top five, albeit with an uncertain outlook.

(Source: Samsung)

In 2012 and 2013, Samsung mobile phones topped domestic sales, but due to insufficient localization and adaptation and excessively high prices, sales in China plummeted in 2014 as OPPO, vivo, Xiaomi, and other brands emerged and competition intensified. The 2016 Samsung Galaxy Note 7 explosion incident further angered domestic consumers with Samsung's handling, leading to a collapse in reputation and brand image, a rapid decline in sales, and eventual fall into the "others" category.

In fact, mobile phone hardware malfunctions are not uncommon, and other manufacturers have also faced issues like omitted oil-repellent layers, camera glare, Wi-Fi burnout, etc. Mixing screens and flash memory also frequently occurs. As long as these issues are handled properly, they do not cause overly serious consequences. However, Samsung first denied issues with the Chinese version of the Galaxy Note 7 and then forced Chinese employees to apologize to dealers, displaying an arrogant attitude that Chinese consumers could not accept.

Samsung's arrogance targets Chinese consumers, whereas Apple's arrogance extends to all global consumers. While Android manufacturers typically roll out advanced hardware configurations, equipping flagship models with 1.5K/2K 120Hz screens, 1-inch large-aperture main cameras, ultrasonic fingerprints, super-fast charging, and other hardware, Apple still refuses to equip the iPhone 16 with a high-refresh-rate screen, forcibly distinguishing its products. Memory and flash memory are frequently ridiculed by netizens as being more expensive than gold.

(Source: Leitech production)

During the Steve Jobs era, the iPhone was an industry leader and standard setter. After Tim Cook took over Apple, the iPhone began to show signs of resting on its laurels. Each new generation's hardware configuration became a routine upgrade, and the software level ceased to be ahead of the Android system. Every year after the WWDC conference or the launch of a new system, netizens would ridicule Apple for copying Android again. For example, iOS 18 boasts over a dozen features, such as free icon arrangement on the home screen, game mode, application locking, etc., all bearing traces of "homage" to Android.

There are generally three main factors driving the purchase of iPhones today. The first is brand influence; Apple remains the dominant player in the global high-end mobile phone market. The second is the need for Apple's ecosystem, with the interoperability of devices like iPhones, Macs, and iPads, which only Huawei, with its developed super terminals, can match. The third is simplicity and reassurance, eliminating the need to adjust numerous personal habits, privacy protection, ad tracking, and other settings upon receiving the phone, making it suitable for novice users or elders.

Since new iPhone models are typically released in the third quarter of each year, sales usually peak from September of that year to the first quarter of the next year. During the same period this year, iPhone sales fell short of expectations, with repeated price reductions and promotions to trade volume for sales. Besides the decline in iPhone competitiveness amidst fierce competition from Android manufacturers, other reasons include the recovery of Huawei, which once shared the domestic high-end mobile phone market with Apple, and the delayed launch of Apple Intelligence, the main feature of the iPhone 16 series.

Arrogance often means a lack of progress. Industry competition is akin to sailing against the current. While foreign mobile phone brands have slowed down, domestic brands are scrambling to speed up. In the era of feature phones and the early stages of smartphones, domestic brands struggled to compete with foreign brands. However, today, three of the top five global mobile phone brands are domestic manufacturers, and domestic manufacturers dominate the top ten sales rankings.

Even Apple and Samsung, which still perform well in sales despite leaving the Chinese market, must consider how to restore their dominance in the domestic market amidst this situation.

To turn the tide, Samsung and Apple can no longer afford to offer "low configuration at high prices".

Whenever I discuss the declining sales of Samsung and Apple brands with netizens, some argue that Samsung remains the global leader in mobile phone sales even after leaving the Chinese market, denying the importance of the Chinese market. Is this really the case? The answer is obviously no. According to statistics from agencies like IDC, Counterpoint, and Canalys, domestic smartphone sales account for about a quarter of the global total. Such a vast and high-quality market is highly sought after by foreign companies.

Samsung, which has not performed well in domestic sales, has not given up on the Chinese market and continues to launch the Pioneers Program and W series phones for Chinese consumers every year. Apple CEO Tim Cook has also visited China multiple times, three times in 2024 alone. Besides meeting with Minister of Commerce Wang Wentao to promote Apple Intelligence, he also emphasized deepening cooperation with Chinese supply chain companies to win over Chinese consumers.

(Source: Apple)

However, Samsung and Apple's actions have failed to win the recognition of Chinese consumers. The reason remains insufficient product strength, making it difficult to attract a large number of consumers by relying solely on brand value. The key to changing this situation lies in enhancing product capabilities.

Stacking configurations is not difficult, but not every mobile phone manufacturer is willing to do it, as it often equates to compressing profit margins in most cases. Of course, there are no junk products, only junk prices. As long as the price is right, there will still be consumers willing to buy. Ultimately, the simplest way to enhance product competitiveness is to stack configurations, reduce prices, and add some localization and adaptation.

As global giants, Samsung and Apple have sufficient confidence in their brand influence and are unlikely to want to increase sales by reducing profit margins and giving benefits to consumers. Therefore, their products lack sincerity in configuration while being excessively priced. Apple, in particular, boasts a starting price of 5999 yuan for its standard version, towering over the competition.

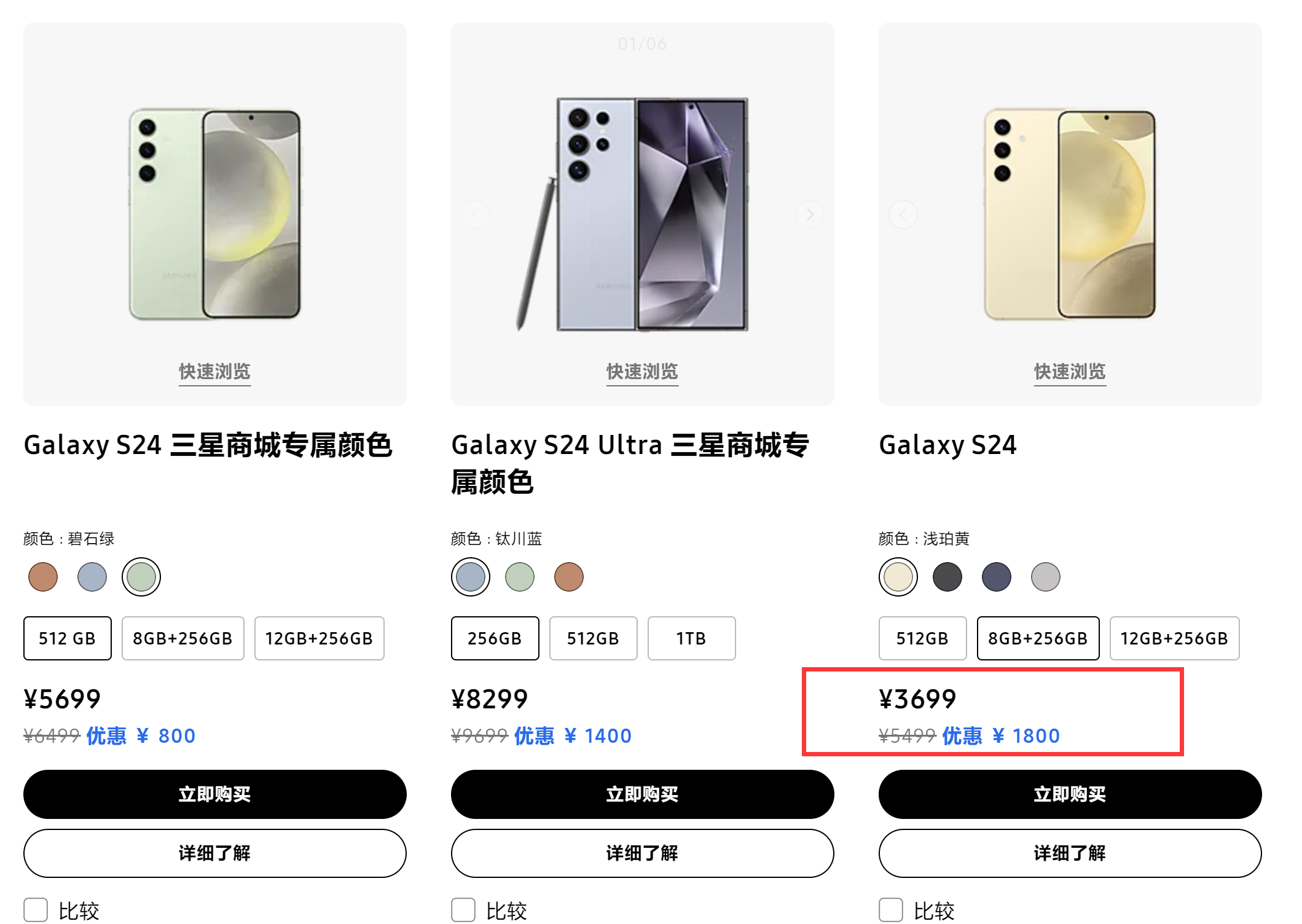

The original price of the Samsung Galaxy S24 8GB+256GB version was as high as 5499 yuan, which can be described as extremely bold. Domestic brands like OPPO, vivo, and Xiaomi usually start with 12GB+256GB storage combinations for their standard flagship models, with starting prices ranging from 4000 to 4500 yuan, about 1000 yuan lower than Samsung's. Currently, the official website price of the Galaxy S24 series has dropped by up to 1800 yuan, but it is unlikely to significantly boost sales. The new generation of domestic flagship phones may even be cheaper than the Galaxy S24 with the same storage specifications after discounts.

(Source: Samsung)

After the iPhone 16 series failed to meet sales expectations, Apple quickly responded by offering discounts of up to 800 yuan on its official website. Starting from January 4, during the New Year festival, the maximum direct discount on iPhones on Apple's Tmall flagship store was 1000 yuan, even more significant than the Double 11 promotion. However, in my opinion, this price reduction is unlikely to significantly boost Apple's sales. With Apple Intelligence temporarily unavailable in China and limited upgrades to other configurations in the iPhone 16 series, there is little incentive for consumers to upgrade their phones.

Moreover, the Huawei Mate 70 series and a new batch of flagship phones equipped with Dimensity 9400 and Snapdragon 8 Ultimate Edition have arrived, offering more competitive prices and configurations. They have also introduced forced compatibility with Apple to actively integrate into the Apple ecosystem, facilitating the use of Macs and iPads. Although Apple and Samsung are reluctant, they may need to further reduce prices and improve the cost-effectiveness of their products to some extent.

China's mobile phone industrial chain is the backbone supporting domestic brands.

In recent years, domestic mobile phone brands have ventured overseas, expanding their territory in Europe, Southeast Asia, South Asia, and other regions to compete with Samsung and Apple. If the market were completely open and global mobile phone manufacturers were allowed to compete freely, it is unlikely that any manufacturer could compete with domestic brands like Huawei, Xiaomi, OPPO, vivo, and Honor.

Considering supply chain issues and total costs, I believe that even if Apple and Samsung were to engage in a price war with Chinese brands, they might not necessarily win. The key to domestic mobile phone brands' ability to minimize mobile phone costs lies in China's mature industrial and supply chain system. However, Samsung relies very little on China's supply chain. According to Fomalhaut Techno Solutions statistics, the hardware supplied by mainland China for iPhone components has dropped to 2%.

(Source: Apple)

Future competition in the mobile phone industry is essentially a battle among suppliers, integration capabilities, system optimization and adaptation, and intelligent ecosystems. Without low-cost hardware provided by suppliers in mainland China, the production costs of Samsung and Apple mobile phones will be higher than those of domestic mobile phones. Additionally, as Apple gradually moves its assembly plants away from China, mobile phone costs become even more uncontrollable. To maintain profit margins, Samsung and Apple cannot engage in price wars like domestic manufacturers.

On the other hand, the rise of domestic brands in the high-end market has also had a significant impact on Samsung and Apple. Domestic flagship phones that integrate AI functions and are equipped with MediaTek Dimensity 9000 series and Qualcomm Snapdragon 8 series SoCs offer an experience on par with the iPhone but at a starting price that is 1500 to 2000 yuan lower, making them a potentially better choice.

Samsung's retreat from the Chinese market is a foregone conclusion, while Apple still has hope for recovery. However, judging from Apple's attitude, its market share is likely to be continuously eroded by domestic brands in the future. The good news for Apple is that its heritage and brand influence are still strong, unmatched by other mobile phone manufacturers. If it can change its strategic direction in a timely manner, it still has room for maneuver.

In the past, the two giants of the mobile phone industry, Nokia and Motorola, were eliminated by consumers for failing to keep up with the times. Samsung and Apple are both global mobile phone giants that rely on brand influence and relevant policies to maintain high sales in European and American markets. However, in the freely competitive Chinese market, the competitiveness of Samsung and Apple mobile phones is declining. Only by proactively embracing China's supply chain can they significantly enhance their mobile phone competitiveness in the short term and compete with domestic brands in a price war.

Source: Leitech