E-commerce Spring Festival Clash Unfolds: Taobao vs. WeChat in the Gift-Giving Arena

![]() 01/15 2025

01/15 2025

![]() 696

696

Editor: cc Sun Congying

As the Spring Festival approaches, the inaugural e-commerce battle of 2025 has commenced, with various 'New Year Festival' promotions already live. Amidst this, Taobao unexpectedly unveiled its 'gift-giving' function, widely perceived as a countermeasure to WeChat's own gift-giving feature.

On the eve of Christmas 2024, WeChat Shops introduced the 'gift-giving' function, commonly known as 'blue packets', initially accessible to a select group of users. Amidst rumors that WeChat intended to fully open this feature before the Spring Festival, Tencent clarified that the rollout was gradual, subject to user feedback.

While WeChat's gift-giving function was still in its nascent stages, Taobao launched its version for all users on January 8, a move seen as somewhat confrontational. This inevitably recalls the 2014 Spring Festival when WeChat's red packet feature emerged, disruptively entering the payment realm dominated by Alibaba. Jack Ma later described this as a 'surprise attack on Pearl Harbor'.

Intriguingly, Tencent is cautious about hyping WeChat's gift-giving function. At Tencent's 2024 annual employee conference on January 13, Pony Ma outlined his vision for 'WeChat gift-giving' and WeChat e-commerce. Ma Huateng stressed the desire to avoid over-promotion, aiming for WeChat to evolve into an e-commerce ecosystem connector over five years or more, leveraging social interaction, meticulous craftsmanship, and high-quality products.

So, can the gift-giving function shoulder the significant responsibility of being an 'e-commerce ecosystem connector'?

Taobao vs. WeChat: Which excels in gift-giving?

From a product logic perspective, Taobao's 'gift-giving' function mirrors that of WeChat. In fact, this concept is not unique to WeChat; in January 2024, Douyin introduced the 'Send at Will' feature based on group-buying vouchers, which WeChat adapted into physical gifts.

To determine which gift-giving function is superior, we must analyze both platforms based on shopping experience and social attributes.

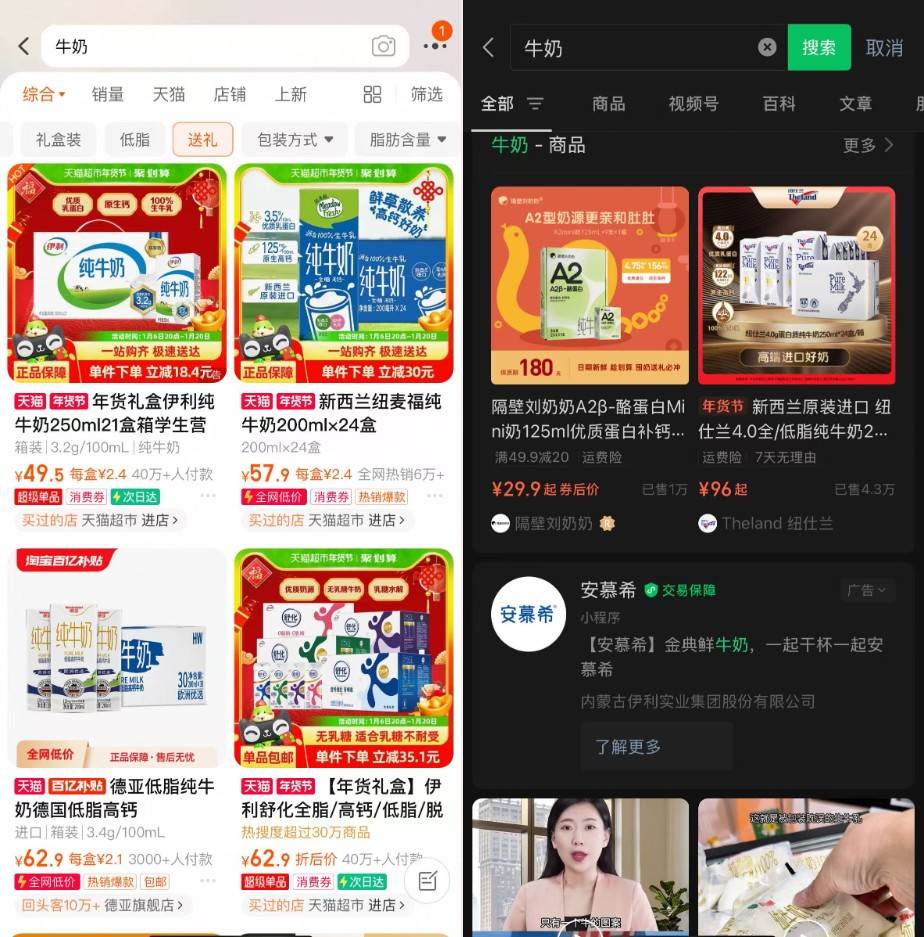

Firstly, considering the comprehensive shopping experience, when you open the Taobao app, you are greeted with a plethora of product recommendations, flash sales, and billions in subsidies. You can also directly access product pages via the search bar. Taobao has also incorporated a 'Gift' option in its secondary navigation bar, simplifying the user experience.

WeChat's shopping entry is more subtle. Upon opening the app, you can search for products via the search bar at the top or the Discover page. However, the search results page defaults to the 'All' category, mixing short videos, encyclopedias, products, and mini-program advertisements, creating a slightly disorganized layout. To reach the product page, you must click the 'Products' category twice in the navigation bar. Integrating the 'gift-giving' function into the chat toolbar, alongside red packets, would streamline access.

Taobao (left) and WeChat (right) gift-giving entries

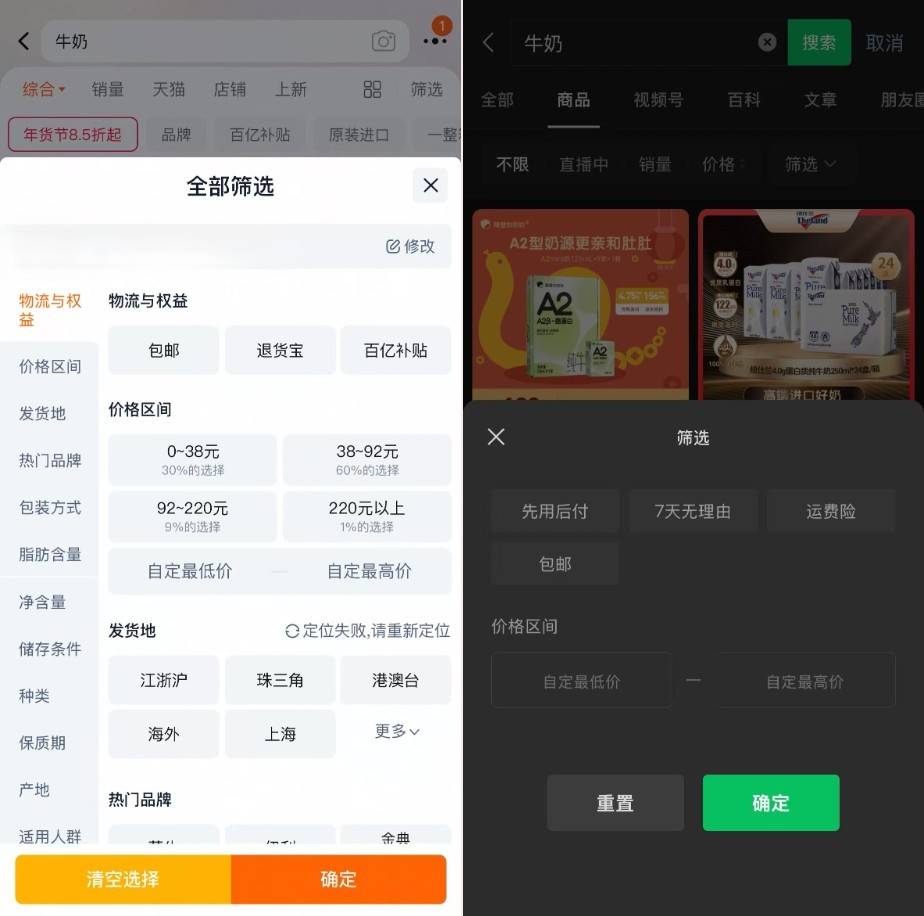

Once you've found the entry, the next step is product selection, hinging on shelf functionality. As a dedicated shelf e-commerce platform, Taobao is undoubtedly superior, offering a comprehensive range of options including price range, shipping location, brand, and specific product parameters (like milk fat content). In contrast, WeChat Shops only provides basic options like pay-after-use, free shipping, and price range, lacking comprehensiveness.

Taobao (left) and WeChat (right) product parameter options

On specific product pages, Taobao and WeChat offer similar presentation. Taobao places 'Support Gift-Giving' below the product name, and clicking 'Send to Friend' on the right leads to the gift settlement page. WeChat places the 'Send to Friend' button on the left, represented by a blue gift icon (the origin of 'blue packets'), also intuitive.

Taobao (left) and WeChat Shops (right) gift-giving product pages

From a product selection standpoint, Taobao outperforms WeChat. The only drawback is that the same product cannot be gifted via the Tmall app, necessitating orders through Taobao. However, both platforms are fully integrated, offering a seamless shopping experience.

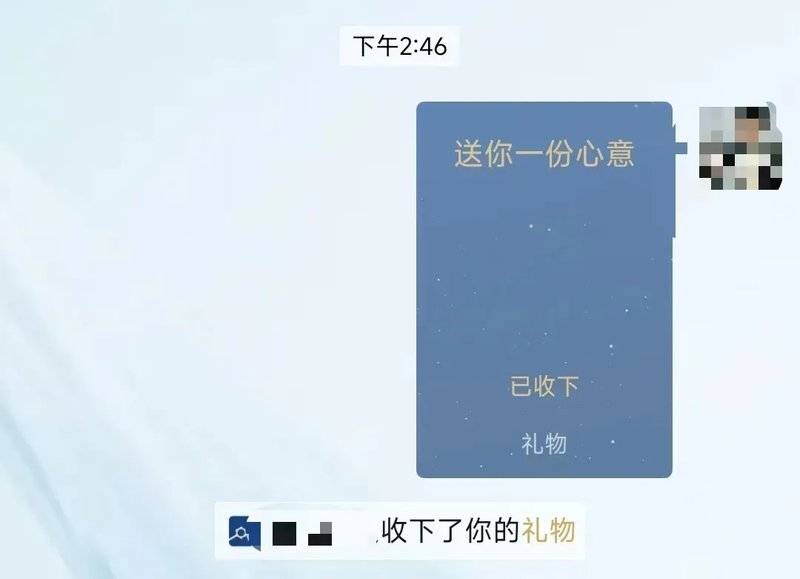

Next, let's examine the gift-sending process, focusing on social attributes. Social interaction is WeChat's strength, naturally excelling in this aspect. Upon successful order placement with a blue packet, it is automatically sent to the recipient with customizable messages, mirroring the WeChat red packet experience. The recipient can open the blue packet, fill in their address, and await delivery.

On Taobao, a security password is generated post-purchase, and the recipient must enter this password and their address to receive the gift. Since Alibaba Group lacks a robust social app akin to WeChat, gift-sending options are numerous, including the in-app messaging function (where you can add friends), WeChat, DingTalk, or scanning a QR code in person, slightly cumbersome.

By comparison, the practical significance of 'gift-giving' on both platforms differs markedly.

For Taobao, 'gift-giving' is more of a formal supplement, enhancing the 'sense of ritual,' such as parents gifting a laptop to a college-bound child or a boyfriend presenting a ring to his girlfriend. Taobao offers a vast array of product categories, brands, and after-sales services, boasting an absolute advantage in the shopping experience itself.

As for WeChat Shops, they grapple with issues like hidden shopping entries, limited product categories and brands, and uncompetitive prices. 'Gift-giving' serves as a functional highlight, attracting users to shop on WeChat Shops, driving traffic. This underscores the current strategic focus of WeChat e-commerce – WeChat Shops.

Zhang Xiaolong personally stepped in to rebuild WeChat Shops

In the e-commerce realm, Tencent has been relatively detached since the failure of PaiPai and Groupon China, focusing mainly on investments, including JD.com, Pinduoduo, and Meituan. It wasn't until the advent of WeChat Video Accounts that Tencent resolved to build a WeChat e-commerce platform.

In 2022, Pony Ma publicly stated: 'The most notable business of WXG (WeChat Business Group) is Video Accounts, essentially the company's beacon of hope.' He added, 'I instructed CDG (Corporate Development Group) Smart Retail to abandon the traditional shelf-based selling model.'

Consequently, Tencent made various adjustments to Video Account e-commerce last year, encompassing organizational structure and business integration. In May 2024, WeChat announced the merger of the Video Account live streaming e-commerce team into the WeChat Open Platform, positioning adjusted live streaming e-commerce on par with Video Accounts. Subsequently, in August, Video Account Shops were upgraded to WeChat Shops, fully integrating store and product information across multiple WeChat scenarios like official accounts (subscription and service), Video Accounts (live streaming and short videos), and Search.

In fact, WeChat launched the WeChat Shop business as early as 2014, but it was then tethered to the official account platform and never gained traction, eventually being discontinued in 2020.

At Tencent's anniversary conference on November 11, 2024, WXG President Zhang Xiaolong unveiled his vision for the future of e-commerce to all Tencent employees: 'Product information should become an atomic transaction component that can freely traverse WeChat.' This was followed by the launch of the 'gift-giving' function.

Reports indicate that since the introduction of WeChat Shops' 'gift-giving' function, it has reached hundreds of millions of users and millions of orders. However, compared to WeChat red packets, the unintuitive entry and relatively complex operation limit universal participation in 'gift-giving.' It's plausible that Tencent might make further adjustments in the future to enhance its prominence within the WeChat interface.

Reviewing WeChat's e-commerce strategy, the short-term goal should be to first fortify the WeChat Shop ecosystem, including attracting more brands, expanding product categories, and laying a solid 'infrastructure' foundation. Then, it should explore models tailored to WeChat through innovative functions and scenarios.

'Social e-commerce' remains unimplemented; will it take five years to hone the sword?

Despite strategically disavowing the traditional shelf e-commerce model and consistently emphasizing the concept of 'social e-commerce,' Tencent has yet to find a solid footing in terms of practical outcomes.

Currently, WeChat Shops still fall within the shelf e-commerce category, plagued by unintuitive entries and mixed information streams. While the 'gift-giving' function embodies social attributes, it heavily relies on shelves. When users seek gifts, they cannot patiently await a specific live stream; ultimately, they will search for and purchase products via the shelf.

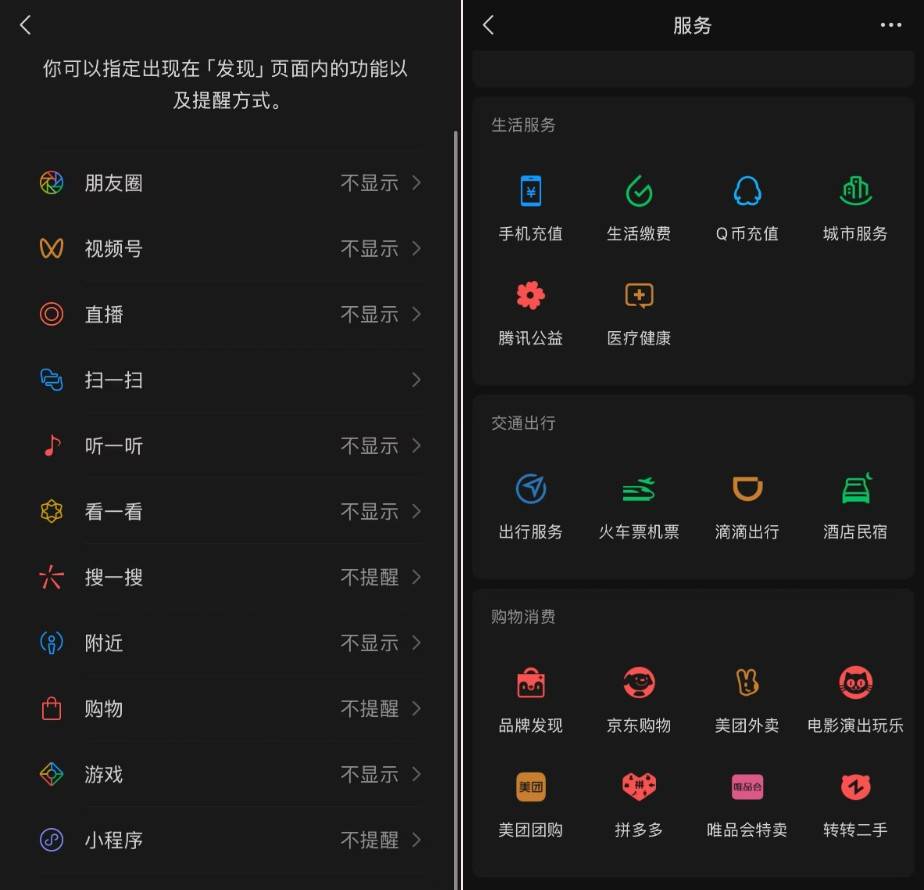

Moreover, WeChat is still cluttered with various entries and third-party platforms, including the 'Shopping' entry on the Discover page (JD.com), entries for JD.com, VIPS.com, Meituan Waimai, etc., on the Service page, and brand direct stores in mini-programs (independent of WeChat Shops). These operate independently, lacking a unified transaction experience.

Performance-wise, Tencent's Q3 2024 financial report only mentioned the stimulation of Video Accounts, mini-programs, and WeChat Search on marketing service revenue, without disclosing specific GMV for WeChat e-commerce. Research institutions estimate that WeChat Shops' transaction scale in 2024 reached tens of billions of yuan, an increase but still less than one-tenth of Douyin e-commerce. This indirectly indicates that while WeChat Shops' revenue is growing, only a small fraction of WeChat's over 1.3 billion monthly active users shop on the platform, and the conversion rate from social interaction to shopping is low.

So, where lies the landing point for WeChat e-commerce? Shelves are undoubtedly the simplest and most intuitive approach, akin to Douyin and Kuaishou, with primary entries like 'Shopping' or 'Mall' in the navigation bar. Essentially, social interaction is WeChat's core function, while shelves or live streaming are merely tools to convert users into consumers; they are not mutually exclusive. Zhang Xiaolong's vision of an 'atomic transaction component' necessitates a more intuitive and accessible carrier. However, the likelihood of WeChat adopting this design logic is currently extremely low.

In recent years, China's e-commerce market has become saturated, with Taobao, JD.com, and Pinduoduo firmly entrenched in the top tier, and Douyin, Kuaishou, and others dividing the live streaming e-commerce pie. The question looms: WeChat e-commerce has been developing for several years yet holds minimal market share; if it still requires five years or more to create high-quality products, how much market space will remain for WeChat by then?