Global Mobile Phone Market Reshuffle: Apple Claims Top Spot, Huawei Climbs to Seventh, VIVO Drops Out of Top Five

![]() 01/16 2025

01/16 2025

![]() 582

582

Many contend that the smartphone market is currently at a standstill, with the entire industry seemingly reaching its zenith. Innovation is scarce, and homogeneity is on the rise. Nonetheless, prices continue to escalate, ushering in an era of low innovation and high profitability for the industry.

Concurrently, the market positions of major manufacturers appear largely set, with little anticipated change. As a result, the market remains stagnant, unlikely to witness significant fluctuations.

This stagnation explains why Xiaomi and Huawei have ventured into the automotive sector. With smartphones having peaked, there is little room for further growth in this arena. To achieve expansion, these companies must explore new avenues.

However, IDC's 2024 smartphone data reveals a surprising turn of events. Despite the perception of a stable market landscape, it has actually undergone another round of significant reshuffling.

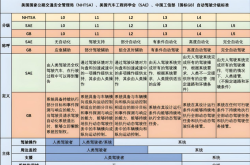

As illustrated in the figure above, annual sales reached 1.2388 billion units, marking a 6.4% year-on-year increase. After years of decline, smartphones appear to be recovering and growing.

Apple, with sales of 232 million units and a market share of 18.7%, has once again secured the top spot globally, albeit with a slight decline of 0.9%. Samsung, with sales of 223 million units and a market share of 18%, ranks second but also experienced a 1.4% drop.

Following closely are Xiaomi, Transsion, and OPPO, with market shares of 13.6%, 8.6%, and 8.5%, respectively, all reporting positive growth. Notably, Xiaomi's growth rate of 15.4% is the highest among the top five brands.

It is speculated that Xiaomi's foray into the automotive industry has positively impacted its mobile phone sales. The data indeed supports this notion, as many believe that Xiaomi's entry into the automotive sector has elevated its brand image and increased consumer recognition. After all, if Xiaomi can manufacture cars, producing mobile phones should present no challenges.

Moreover, Transsion witnessed a 12.7% growth, reclaiming the fourth position and surpassing OPPO and VIVO. OPPO ranks fifth, while VIVO has been squeezed out of the top five, occupying the sixth spot with an 8% market share.

Huawei, despite a 49% increase, ranks seventh and fails to break into the top five. Nonetheless, this represents a significant improvement from its previous ninth-place ranking.

Honor ranks eighth, followed by Lenovo-Motorola in ninth and realme in tenth.

Clearly, the mobile phone market is in a constant state of flux. In 2024, both the top and bottom five rankings have undergone significant changes, contradicting the widespread belief that the market landscape is stable.