Pinduoduo Seeks New Growth Path Amidst Market Challenges

![]() 06/04 2025

06/04 2025

![]() 632

632

By Leon

Edited by cc Sun Congying

In response to the sharp decline in quarterly net profit, Chen Lei, Chairman and Co-CEO of Pinduoduo Group, emphasized during the Q1 2025 financial report conference call, 'Pinduoduo is not a traditional company, and we do not overly prioritize quarterly financial performance in our investment decisions.'

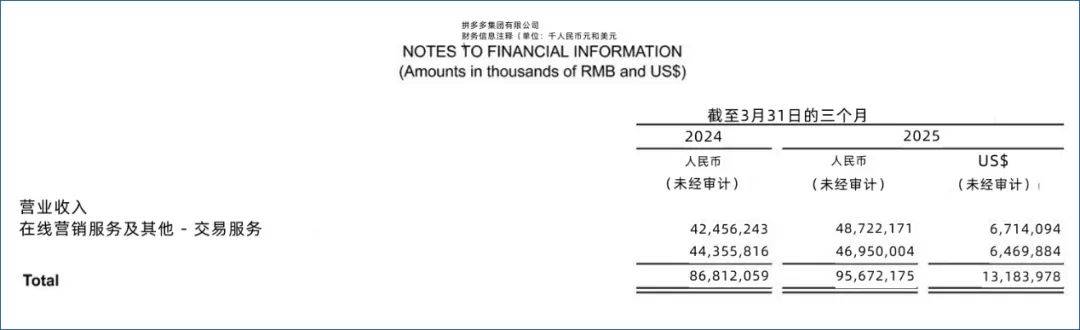

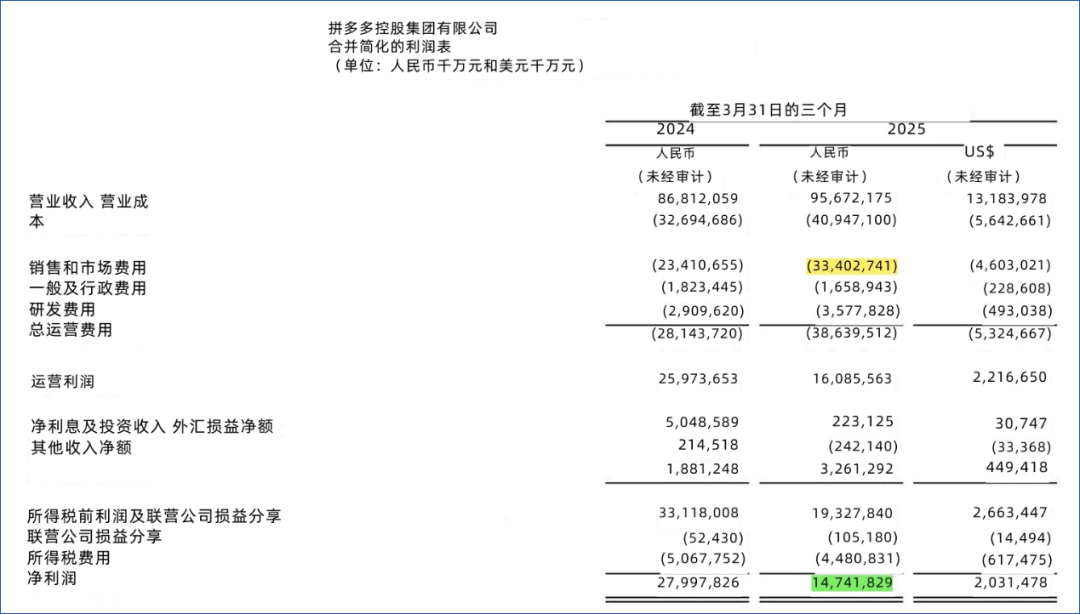

In the first quarter of 2025, Pinduoduo reported revenue of RMB 95.672 billion, marking a 10.21% year-on-year increase. However, net profit attributable to shareholders decreased by 47.35% year-on-year to RMB 14.742 billion, and non-GAAP operating profit margin fell 33% year-on-year to 19.1%, marking the lowest overall growth in three years.

Despite previously issuing warnings about the unsustainability of high revenue growth and emphasizing a focus on long-term intrinsic value, Pinduoduo failed to restore investor and capital market confidence. On May 27, the day the financial report was released, Pinduoduo's share price plummeted by over 20% in pre-market trading, erasing over USD 23 billion in market value in a single day. By May 31, the share price had dropped to USD 96.51 per share, a decline of approximately 27% from the year's high of USD 131.52.

In stark contrast, Alibaba and JD.com delivered robust results with double-digit growth in both revenue and net profit during the same period. The frequent appearances of Jack Ma and Liu Qiangdong not only endorsed their companies' new strategies but also signaled the onset of a fresh round of competition in the e-commerce industry.

Asset-Light Model Hinders State Subsidy Benefits

In 2025, boosting consumption became a top government priority, leading to the implementation of state subsidy policies throughout the year. The policy covered a more diverse range of product categories compared to the previous year, including household appliances, 3C products, mobile phones, and furniture, with subsidies of up to RMB 2,000 per item. Major e-commerce platforms viewed this as an opportunity to drive performance growth. (For details, see: 2025: Will Consumption Be Boosted by State Subsidies or the 'Invisible Hand'?)

Conversely, Pinduoduo achieved a mere 10.21% year-on-year growth in total revenue in the first quarter, with transaction service revenue increasing by just 5.84%, failing to capitalize on state subsidy benefits.

Zhao Jiazhen, Executive Director and Co-CEO of Pinduoduo, acknowledged this issue: 'Pinduoduo's third-party business model has exposed some inherent deficiencies in accommodating certain macroeconomic policies. Compared to platforms that primarily adopt a self-operated model, we have certain disadvantages, which have also affected the price competitiveness of our platform's merchants in some categories.'

Since launching the state subsidy special topic in January, Pinduoduo has covered more than 20 provinces and offers additional discounts on top of state subsidies. However, the results have been unsatisfactory, with issues of high prices and limited product categories failing to attract effective users. For instance, almost none of the mainstream brand models on Pinduoduo participate in state subsidies, in contrast to JD.com's self-operated business, which boasts a rich product range. (For details, see: Trade-in Incentives Intensify, Retail Channels Face Major Showdown in 'New Infrastructure' Capabilities)

In response, Zhao Jiazhen stated that the platform would further upgrade its direct subsidy model, with multi-category subsidies benchmarked against state subsidy price standards. Additionally, the scope of subsidies would be expanded from 3C and household appliances to daily necessities, meaning marketing expenses would remain high in the second quarter.

Suspension of Fully Managed U.S. Business: Temu Faces Ongoing Pressure

Amidst changing global cross-border trade rules, Temu's business has transformed from being Pinduoduo's second growth curve to a potential threat. Future compliance costs and supply chain stability may continue to pressure Pinduoduo's overall profit. (For details, see: Temu Forced Landing, China's Cross-Border E-Commerce 'Free Ride' Blocked)

Although the Trump administration had not yet implemented a new tariff policy in the first quarter, the storm clouds were gathering, and Temu's business was affected. In response to the U.S. tariff policy targeting small parcels valued at less than USD 800, Temu stocked up inventory for approximately three to five months in advance, with Macquarie Securities estimating the scale to be approximately RMB 1.5 billion. (For details, see: Exclusive: Strategic Focus Shifts to South Korea, Temu Accelerates Local Warehouse Layout)

Following the China-U.S. Geneva Economic and Trade Talks Joint Statement, the ad valorem tariff rate for small parcels not exceeding USD 800 was reduced from 120% to 54%, while the specific tariff of USD 100 per small parcel remained unchanged. Under this new policy, Temu suspended its fully managed U.S. business in May and transitioned to semi-managed operations.

Temu's semi-managed model targets merchants with overseas warehouse resources, with the platform no longer handling warehousing and logistics, thereby reducing the impact of tariffs. However, as the platform reduces direct services, related revenue will decrease. Additionally, the increased management difficulty of the semi-managed model raises sales and marketing expenses. According to a Citibank report, the transition to semi-managed operations has led to a 'mismatch between investment and return cycles' for Pinduoduo, resulting in a surge in short-term costs that have not yet translated into revenue. Coupled with Pinduoduo's ecosystem investments, sales and marketing expenses in this financial report surged by 42.7% year-on-year to RMB 33.402 billion.

With decelerating growth on the main platform and challenges in its cross-border e-commerce business, Pinduoduo seeks a new growth narrative. During the conference call, Chen Lei repeatedly mentioned 'increasing support and subsidies for the vast number of small and medium-sized merchants,' focusing on the 'hundred billion subsidy + hundred billion support' plan to build a long-term ecosystem. However, this comes at the cost of sacrificing short-term profits.

Previous Methodologies Become Shackles for Growth

The hundred billion support plan invests RMB 100 billion over three years, focusing on supporting high-quality agricultural production areas and industrial belt merchants by reducing merchant fees and providing marketing support. This also includes supporting capable merchants to enter the black label store system (brand).

Chen Lei continued to emphasize the impact of high investment on future performance, stating, 'Given the mismatch between the return and business investment cycle, our profitability may face challenges in the short term, and such challenges may persist for a longer period.'

The hundred billion support plan is essentially a defensive investment against the backdrop of consumption stratification.

McKinsey's latest report, 'China's Consumption in the New Normal,' notes that China's consumer market in 2025 did not shrink as pessimistically predicted but instead exhibited a coexistence of 'rational adaptation' and 'structural growth.' Consumer confidence has stabilized, and consumers are increasingly purchasing goods or services that enhance their quality of life and personal achievements, rather than solely pursuing low prices. This signifies the end of the era of pure consumption downgrading and the emergence of consumption stratification as a new trend.

Pinduoduo, an e-commerce platform that grew during the 'consumption downgrading' era, relies on small and medium-sized merchants and white-label products. However, with the advent of the consumption stratification era, Pinduoduo has recognized the importance of brand customers and introduced brand flagship stores, building a black label store system. Nonetheless, it still cannot rival JD.com and Taobao in scale, particularly in areas like branded clothing, 3C home appliances, and beauty and personal care products. As Taobao opts to 'return to the internet' and JD.com shifts to an 'affordable yet high-quality' strategy, Taobao Factories and JD.com POP stores compete for Pinduoduo's white-label users, leaving Pinduoduo under siege from all sides. (For details, see: Temu Headquarters Under Siege Again, White-Label Merchants Seeking to Sever Ties with Pinduoduo?)

Furthermore, Pinduoduo's shortsightedness in AI limits growth potential. Huang Zheng, the founder of Pinduoduo, has repeatedly emphasized that Pinduoduo is not a traditional company, and this 'non-traditional' aspect is evident in its deliberate neglect of AI empowerment. Instead of building large models, Pinduoduo expanded its traditional algorithm team, focusing on individual-level consumer demand research. However, Huang Zheng and the Pinduoduo management team overlooked the risks of long-term technological iteration and AI's role in cost reduction and efficiency enhancement in e-commerce. In the first quarter, Pinduoduo's R&D expenses were only RMB 3.577 billion, significantly lower than its competitors.

For example, Taobao Group's customer management revenue increased by 12% year-on-year in Q1, primarily due to basic software service fees and increased omnichannel promotion penetration, with AI playing a pivotal role. Jiang Fan, CEO of Alibaba's e-commerce business group, stated, 'The application space for AI in the e-commerce sector is enormous. We are currently focused on improving the user experience through AI, which has the potential to reconstruct traditional algorithm systems like search, recommendation, and advertising. We have already seen positive results.' (For details, see: Wu Yongming Assists Jiang Fan in Taking Charge, Alibaba Quietly Plans Succession?)

Given that Pinduoduo's current growth hinges on building a merchant ecosystem, investment institutions have adopted a cautious attitude towards its future performance. China Merchants Bank believes that the inflection point for profit growth will not emerge until at least the fourth quarter of 2025. Currently, Citibank has downgraded its target price from USD 165 to USD 152, while Macquarie has reduced its target price from USD 153 to USD 126.