Earning 4.6 Billion Annually! Beijing's National Team Unveils Another Super Unicorn: Ranking Second Globally in Semiconductor Manufacturing Equipment

![]() 07/09 2025

07/09 2025

![]() 567

567

In May 2016, an unexpected corporate merger occurred. A fledgling company, established just six months prior, sought to acquire a 28-year-old American semiconductor equipment company, MTI, for 1.918 billion yuan.

This company is AMEC. Initiated by Beijing E-Town Investment & Development Co., Ltd. (E-Town) in December 2015, AMEC initially focused on the development and manufacturing of semiconductor equipment technology, albeit lacking core technology. E-Town's acquisition strategy aimed to exchange funds for technology.

The key player in this transaction was Lu Hao'an. From a physics Ph.D. to a technical leader at Intel, to heading a prominent domestic equipment company, his career trajectory mirrors the growth of China's semiconductor industry.

In 2016, Lu Hao'an led AMEC's acquisition of MTI, not merely to "buy technology," but to integrate MTI's technology with the Chinese market, achieving a strategic leap.

Nine years later, that leap has materialized.

On July 8, 2025, AMEC listed on the STAR Market with a market value of 77 billion yuan, becoming Beijing's largest IPO of the year in terms of fundraising and the largest technology IPO nurtured by E-Town's state-owned assets.

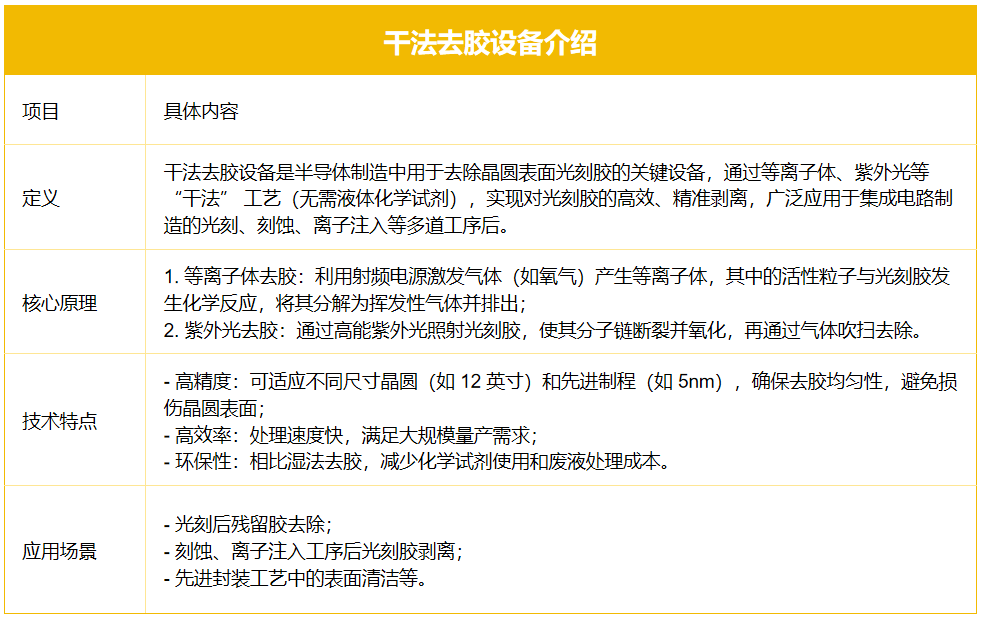

AMEC's primary business is integrated circuit manufacturing equipment. Among its products, dry strip equipment generates the highest revenue share, accounting for 34.60% of the global market in 2023, ranking second globally.

Let's delve into the national-level opportunities this super unicorn showcases behind the scenes:

- 01 -

How did Lu Hao'an become a driving force in China's semiconductor industry? Let's explore his journey.

In 1977, Lu Hao'an enrolled at the University of Science and Technology of China to pursue a bachelor's degree in physics.

After graduating in 1982, he went to the United States through the CUSPEA program to further his studies, obtaining a Ph.D. in solid-state physics from the University of Virginia.

In the 1990s, he served as a scientific researcher at Northwestern University and North Carolina State University, focusing on electronic and optical thin films.

Four years later, he joined Applied Materials, the world's largest semiconductor equipment supplier, rising from senior process engineer to project director. This was his first exposure to the core processes of chip manufacturing, realizing the pivotal role of equipment in technological advancement.

Subsequently, he joined Intel. In 1997, he was transferred to the Silicon Valley Technology Manufacturing Engineering Department, participating in chip mass production research and development. His six years of front-line experience provided him with a comprehensive understanding of the entire process "from the lab to mass production."

In 2003, he was transferred to China to lead two crucial tasks:

Dalian Chip Factory Construction: Responsible for equipment supply chain management for Asia's first 12-inch factory (Fab 68), promoting localized procurement.

Government Affairs Development: Served as Director of Intel China Public Affairs for four years, coordinating government relations and education projects, laying the groundwork for understanding industrial policies.

In 2009, he became President of SEMI China (Semiconductor Equipment and Materials International).

His journey with AMEC began seven years later, in 2015.

In December of that year, Beijing E-Town Investment & Development Co., Ltd. established "AMEC," initially focused on the development and manufacturing of semiconductor equipment technology but lacking core technology.

The following year, E-Town acquired Mattson Technology from the United States, and Lu Hao'an was appointed CEO amidst the crisis. MTI, founded in 1989, possesses core technologies such as dry stripping and rapid thermal processing, with customers including giants like TSMC and Samsung.

This perfectly addressed AMEC's weakness.

Dry stripping and rapid thermal processing are key process equipment technologies in semiconductor chip manufacturing.

The former, akin to "washing glass," removes photoresist residue during chip manufacturing. The latter, like "microwave heating," can heat wafers to over 1000°C in seconds, used for activating doped atoms or repairing lattice damage.

In 2018, AMEC's Beijing E-Town factory commenced production, and the first domestically produced dry strip equipment rolled off the production line. It upgraded MTI's equipment process capability from 65nm to 5nm, and rapid thermal processing equipment achieved a 13.05% global market share (ranking second). Simultaneously, its products entered TSMC's 5nm production line, Samsung's DRAM production line, and domestic 12-inch wafer factory coverage jumped from 15% to 60%.

In 2018, AMEC's revenue exceeded US$252 million, turning losses into profits. In 2020, AMEC received three rounds of financing, introducing institutions such as Sequoia China, IDG Capital, and Shenzhen Capital Group, with its valuation soaring to 20 billion yuan, solidifying its status as a super unicorn.

In the past three years, AMEC's performance has exhibited a "V-shaped" recovery: revenue in 2022 was 4.76 billion yuan and net profit was 380 million yuan, marking a steady start. However, in 2023, revenue declined by 17% to 3.93 billion yuan due to industry cycles. With the acceleration of domestic substitution, the company rebounded in 2024, with revenue increasing by 18% to 4.63 billion yuan, and net profit soaring by 75% year-on-year to 540 million yuan.

- 02 -

From the above narrative, it's evident that AMEC is a quintessential national team player. The actual controller is the Beijing Economic-Technological Development Area Management Committee, with E-Town holding a 45.05% stake.

This indirectly illustrates that AMEC aims to tackle the challenge of domestic substitution.

Etching equipment is one of the core equipment in chip manufacturing, and its precision directly determines the nanometer-level forming quality of transistor structures.

Currently, AMEC's dry etch equipment has entered the supply chains of Samsung and Yangtze Memory Technologies, and its equipment can be used for the manufacturing of logic chips from 65nm to 5nm.

In comparison, Lam Research's plasma etchers have full coverage of 3-nanometer processes, and its extreme ultraviolet (EUV) compatible etch technology is even more advanced.

More concerningly, international giants are consolidating their monopoly positions through "technological iteration + ecosystem binding."

The "atomic layer etch" solution jointly launched by Applied Materials (AMAT) and Lam Research can control errors within 0.1 nanometers, while AMEC's millisecond-level temperature control technology cannot yet achieve the same level of uniformity.

Leading wafer fabs like TSMC prefer to adopt a "full suite of equipment" approach – etch, deposition, and inspection equipment from the same supplier to ensure compatibility, making it challenging for companies like AMEC with a single product line to penetrate advanced process production lines.

Faced with a wide gap, AMEC's R&D strategy is not to compete head-on but to rely on the technological heritage of MTI acquired in 2016, embarking on a path of "grafting innovation."

For example, drawing on MTI's dual-wafer transfer technology in rapid thermal processing equipment, AMEC has developed an etch chamber that can simultaneously process two wafers, increasing production efficiency by 40% and reducing costs by 30%.

This differentiated approach has enabled some products to achieve a strategic leap. In the field of 3D NAND flash memory, AMEC's high-aspect-ratio etch equipment, with its sidewall protection technology, boasts a 5% higher yield than similar Lam Research products, entering Micron Technology's 128-layer stacking production line.

- 03 -

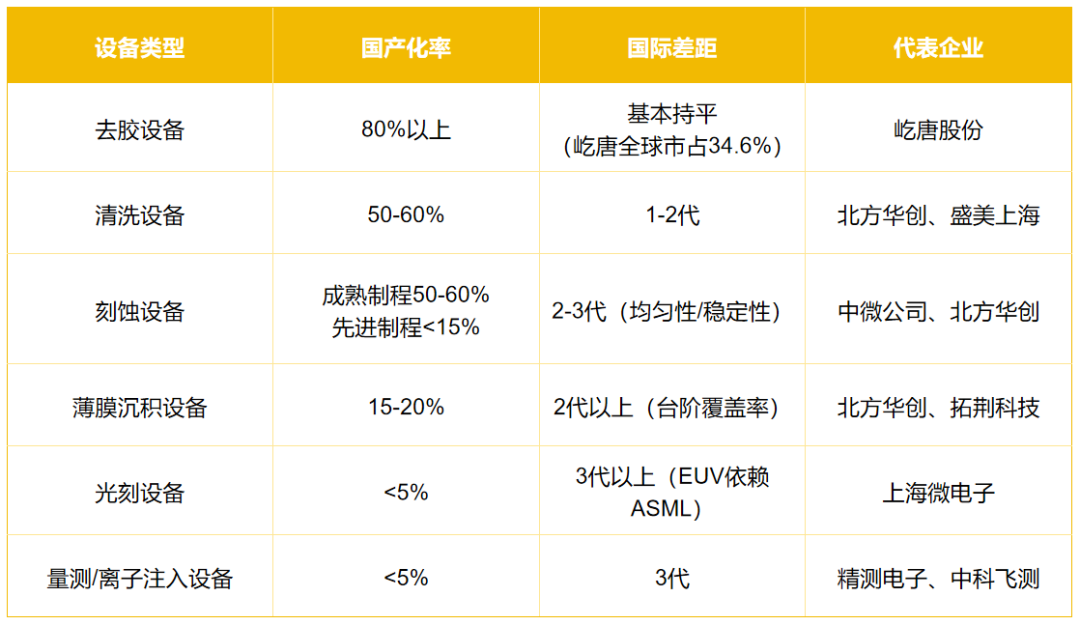

AMEC also reveals structural opportunities for the localization of semiconductors.

According to Gartner data, the size of the semiconductor equipment market in mainland China will exceed US$50 billion in 2025, but the localization rate for some segments is less than 20%, especially in key areas such as etching and thin film deposition, which still rely heavily on imports.

Statistics on the localization degree of various stages of chip manufacturing

A key underlying reason is that etchers and thin film deposition equipment need to achieve atomic-level precision control.

For example, the plasma energy fluctuation of a 5nm etcher needs to be controlled within 0.1%, while domestic equipment still lags behind international giants by 2-3 generations in uniformity and stability.

In thin film deposition equipment, atomic layer deposition (ALD) technology requires film thickness control to reach 0.1nm (equivalent to 1 atomic layer), while domestic equipment has a step coverage rate of less than 90% for nodes below 7nm, far below Applied Materials' (AMAT) 99.5%.

Moreover, domestic manufacturers heavily rely on imports for core components.

The radio frequency power supply for etchers is dominated by MKS in the United States, vacuum pumps by Pfeiffer Vacuum in Germany, and the gas distribution system for thin film deposition equipment by Horiba in Japan. The localization rate for some key components is less than 10%.

Against these backdrops, several opportunities arise for domestic enterprises.

The first is the "domestic substitution window" for core components. In 2024, after some domestic enterprises were included on the Entity List, more than 50% of the imported components for etchers faced supply disruptions, such as radio frequency power supplies and vacuum pumps.

U.S. export controls will compel China to accelerate the autonomy of its supply chain.

The second is "lane-changing overtaking" through differentiated technological routes.

Unlike international giants that compete head-on in silicon-based advanced processes, Chinese enterprises are achieving technological overtaking in niche areas.

For example, in third-generation semiconductor equipment, Zhongwei Semiconductor, in collaboration with Contemporary Amperex Technology Co. Limited (CATL), has developed automotive-grade silicon carbide etchers with a yield exceeding 92%.

In advanced packaging equipment, AMEC has combined MTI's annealing technology with etch processes to launch an integrated "etch-anneal" equipment, securing small-batch orders from JCET.

In summary, the competition in China's semiconductor equipment industry is a marathon, not a sprint. This marathon presents not a challenge but an opportunity for Chinese enterprises.

The content of this article is for reference only and does not constitute any investment advice. The cover image was created by AI.