"Dongfang Zhenxuan" Rushes to the Exam of "Low Price and High Quality"

![]() 06/11 2024

06/11 2024

![]() 976

976

Author | Cheng Yu

Statement | The cover image is sourced from the internet.

Original article by Jingzhe Research Institute. If you wish to reprint, please leave a message for authorization.

On June 9, 2022, Dong Yuhui's bilingual live streaming video selling steaks went viral on various platforms. As a flood of traffic poured into Dongfang Zhenxuan's live streaming room, Dong Yuhui blazed a new trail in knowledge-based live streaming, catapulting him into the spotlight as a top live streamer, and simultaneously enabling New Oriental, which was undergoing a difficult transformation, and its teachers to successfully "re-employ" themselves.

However, as Dongfang Zhenxuan is about to celebrate its two-year anniversary of breaking into the mainstream, it has once again been pushed to the forefront due to its "screaming" live streaming style. Recently, Yu Minhong, the founder of New Oriental, evaluated Dongfang Zhenxuan as "chaotic" without hesitation during a live broadcast with Zhang Wenzhong, the founder of Wumart. The related topic quickly trended on social media, and Dongfang Zhenxuan's market value evaporated by approximately HK$2.6 billion in two trading days.

In fact, excluding the unexpected incident caused by Yu Minhong's self-deprecation, the current situation of Dongfang Zhenxuan's live streaming room has seen a significant decline compared to its heyday two years ago. Delving into the reasons behind this, in addition to the issue of "de-Dong Yuhui-ization," it is also related to new changes in the live e-commerce sector.

Dongfang Zhenxuan's Calculation "Went Awry"

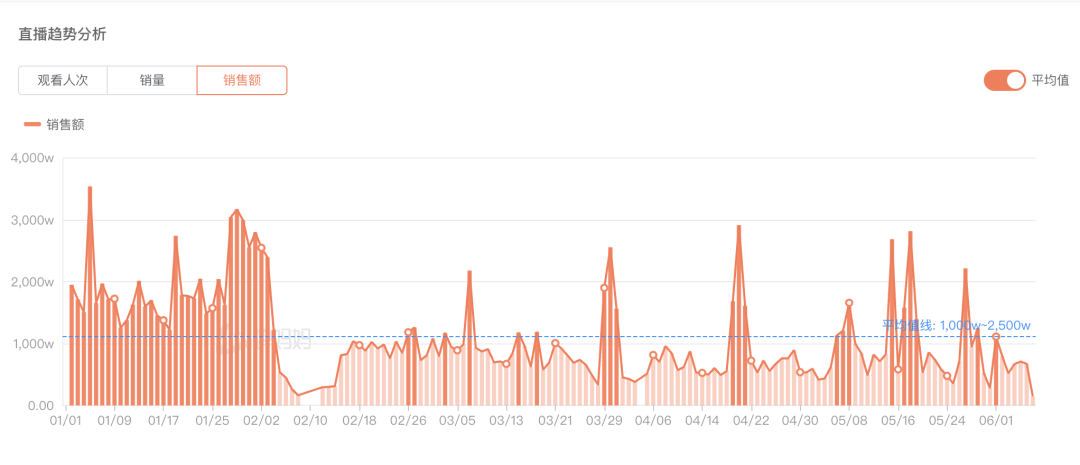

Yu Minhong was willing to disregard the impact and openly criticize "chaos" in Dongfang Zhenxuan's live streaming room in full view. Dongfang Zhenxuan's live streaming room is not without blame. Jingzhe Research Institute learned from the third-party data platform "Chanmama" that since February 4th, the daily sales of Dongfang Zhenxuan's live streaming room have seen a significant decline, and in most cases, it is below its average of 10 million to 25 million yuan this year (January 1, 2024 - June 7, 2024).

In addition, according to Chanmama's monthly list of top influencers, Dongfang Zhenxuan was still in the top spot in December last year, but starting from January this year, it fell from 4th place all the way to 9th place in April. And on the list of top influencers from June 1st to June 6th, Dongfang Zhenxuan has fallen out of the top 10, ranking 12th.

Regarding the signs of decline shown by Dongfang Zhenxuan, a considerable number of netizens believe that this is because after implementing "de-Dong Yuhui-ization," Dongfang Zhenxuan's knowledge-based live streaming brand has lost its effectiveness. It is also for this reason that Yu Minhong gave the evaluation of "chaotic," and on June 1st, the topic "After Dong Yuhui left, Dongfang Zhenxuan's live streaming room's style has changed" trended on social media.

It is certain that the sudden change in the live streaming room's style is the main reason for Dongfang Zhenxuan trending on social media, but Yu Minhong's motivation for evaluating it as "chaotic" is likely not just a matter of live streaming format. After all, as the top manager of a company, Yu Minhong can see problems that many onlookers cannot.

Although Dongfang Zhenxuan's breakout into the mainstream began with Dong Yuhui's bilingual live streaming, Dongfang Zhenxuan may never have intended to make Dong Yuhui the core of the live streaming room, but rather pursue a platform-based development strategy. Therefore, after going viral on June 9th, Dongfang Zhenxuan was rumored to be attempting to build its own supply chain and vigorously develop its own products. Moreover, within less than two months, Dongfang Zhenxuan launched an independent app on August 5th.

However, Dongfang Zhenxuan's platform-based development has not been smooth.

In July 2023, Dongfang Zhenxuan's live streaming room was shut down for suspected illegal traffic diversion due to displaying QR codes for its own app and guiding consumers to place orders and purchase on its own app.

Subsequently, Yu Minhong posted on his personal WeChat public account "Laoyu Xianhua" stating that the bustling business model built on external platforms has strong fragility, and there is still a long way to go to consolidate the foundation for long-term development.

Since then, Dongfang Zhenxuan has begun to experiment with multi-platform development and officially announced its entry into Taobao Live in August last year, followed by opening stores on JD.com and Pinduoduo. However, Dongfang Zhenxuan's multi-platform development strategy has not made significant progress. Apart from Taobao's store with 5.82 million followers, Dongfang Zhenxuan's JD.com store only has 468,000 followers, while the Pinduoduo Dongfang Zhenxuan flagship store only has 27,000 followers.

During Dongfang Zhenxuan's platform-based development, Dong Yuhui, as a major contributor, was gradually being separated. Last December, the "small essay incident" erupted, triggering an online confrontation between Dong Yuhui's fans and Dongfang Zhenxuan. Afterwards, Dongfang Zhenxuan's CEO Sun Dongxu was relieved of his duties, and Dong Yuhui separated from Dongfang Zhenxuan's live streaming room, independently launching the account "Yu Hui Tonghang."

But now, it seems that "de-Dong Yuhui-ization" has not brought more help to Dongfang Zhenxuan's live streaming room.

According to media statistics, from January to March this year, Dongfang Zhenxuan's live streaming room sales were 557 million yuan, 228 million yuan, and 286 million yuan, respectively, while "Yu Hui Tonghang's" sales during the same period were 889 million yuan, 450 million yuan, and 626 million yuan, respectively. In addition, on Chanmama's monthly list of top influencers, "Yu Hui Tonghang" has consistently ranked in the top 3 this year.

Therefore, it is not difficult to see that Dongfang Zhenxuan originally intended to leverage Dong Yuhui and the traffic of various platforms to do its own business through a platform-based development strategy, but after two years of折腾 (struggling), it turns out that its calculation "went awry." The reason is that Dongfang Zhenxuan's platform-based strategy was too ambitious at the strategic level, resulting in its deviation from the game rules of live streaming e-commerce. Therefore, despite having a clear goal, it has remained stagnant.

The Awkward Phase of "Top Live Streaming Rooms"

The reason for Dongfang Zhenxuan's stagnation in development is that it overlooked a key issue: To this day, the core of live streaming e-commerce remains the live streaming content and products.

At the live streaming level, without Dong Yuhui, Dongfang Zhenxuan's live streaming room is difficult to replicate "knowledge-based live streaming."

It should be noted that when Dongfang Zhenxuan's live streaming room gained overwhelming traffic due to "knowledge-based live streaming," in addition to Dong Yuhui himself, other broadcasters such as Xiao Qi, Yoyo, Dun Dun, Ming Ming, etc., also gained many fans with their respective charm. However, there is only one Dong Yuhui, and it is difficult for other similar broadcasters to reach Dong Yuhui's level of influence.

*Image source: Dongfang Zhenxuan's official Weibo

As for the product level, Dongfang Zhenxuan has also experienced continuous setbacks. In June 2022, "Dongfang Zhenxuan was complained about moldy and hairy peaches" trended on social media. On the 30th of that month, the China Consumer Association released "618" consumer rights protection information, and Dongfang Zhenxuan was named. In March 2023, Dongfang Zhenxuan's South American white shrimp was mistakenly sold as wild shrimp, sparking heated discussions among netizens. At the same time, Dongfang Zhenxuan also discovered issues such as short weight, insufficient quantity, and mixing of large and small shrimps from the involved suppliers.

And then this year on "315," after media reports revealed that multiple food companies were suspected of violating regulations in the production of preserved pork with preserved vegetables, Dongfang Zhenxuan's self-inspection found that the producer of its "Yu Hui Yuan preserved pork with preserved vegetables" was precisely the company involved. Although Dongfang Zhenxuan proactively apologized and refunded, a series of quality control issues also revealed that the supply chain that Dongfang Zhenxuan had built for its platform-based development was unreliable.

Combined with the significant drop in traffic after "de-Dong Yuhui-ization" and frequent product quality control issues, Dongfang Zhenxuan's "sudden change in live streaming room style" now seems more like a manifestation of "panic." This is because the live streaming e-commerce sector has also undergone significant changes in recent years.

Live streaming e-commerce, as the forefront sales channel in the consumer market, has always been a barometer reflecting consumer market trends. Since the "Li Jiaqi incident," consumer demand for "low price and high quality" has continued to increase.

In December last year, an article titled "Depth: The Rise of Cost-Effective Consumption, High-Quality Supply Promotes Demand" released by CITIC Securities mentioned that cost-effectiveness has become an important new consumption trend. Domestic consumers are becoming more rational and paying more attention to product quality and utility, with a huge demand for high-quality supply.

However, in the field of live streaming e-commerce, top live streaming rooms find it difficult to balance low prices and high quality.

As an open sales channel, live streaming e-commerce itself does not add too much sales cost for merchants. However, top live streaming rooms participate in it as intermediaries and share a piece of the pie, whether in the form of slot fees or commissions. In addition, when top broadcasters' live streaming rooms participate in live streaming e-commerce, they often excessively pursue low prices, ignoring the rationality of commodity prices, which has a negative impact on merchants.

Nowadays, on various live streaming e-commerce platforms, popular tags such as "lowest price on the internet," "exclusive price in the live streaming room," and "price protection" have become standard for top live streaming rooms. Due to the "siphon effect" brought by huge traffic, top live streaming rooms often have more bargaining power when selecting products, and by leveraging the low-price advantage obtained through negotiations with merchants, these top live streaming rooms can continuously attract traffic and consolidate their positions.

However, top live streaming rooms' strong demand for low prices is ultimately unbearable for some merchants. According to media reports, last October, live streaming host Xinba sold a mattress originally priced at 20,000 yuan for 4,980 yuan in his live streaming room, while also giving away gifts such as a five-zone black gold mattress and a Jinsaozi wok. The ultra-low price brought Xinba's live streaming room a surge in orders, but it also sparked protests from offline distributors, ultimately leading the relevant company to withdraw the online products under pressure from public opinion.

As top live streaming rooms find it increasingly difficult to obtain low-price advantages, reducing the frequency of live streaming e-commerce and gradually fading out of the scene has become the choice of most people.

In February this year, Xiaoyangge's personal account fell out of the top 20 in the live streaming sales ranking. Subsequently, "Xiaoyangge" announced during a live broadcast that he would reduce the number of live streaming e-commerce sessions this year. Kuaishou's top broadcaster Xinba also revealed in mid-March that he would suspend live streaming for two years to沉淀 (consolidate). In addition, some celebrity broadcasters have also reduced the frequency of live streaming e-commerce, and the trend of de-emphasis on top broadcasters in the entire live streaming e-commerce sector is evident.

Live Streaming E-commerce Faces the Exam of "Low Price and High Quality"

Against the backdrop of the rise of cost-effective consumption, "low price and high quality" is the main theme of the current e-commerce industry. When both users and platforms demand "low price and high quality," top live streaming rooms, as intermediaries, have become a source of premium pricing, thus facing pressure to be eliminated from the ecosystem. Dongfang Zhenxuan's fall from grace is reasonable.

In fact, the main supply of "low price and high quality" comes from small and medium-sized merchants, as only by stripping away brand premiums can listed products offer sufficiently low prices. And as a necessary scene for live streaming, the live streaming room still needs the role of broadcasters to connect consumers and products. Therefore, e-commerce platforms are increasingly encouraging new merchants to broadcast themselves and supporting mid-tier broadcasters.

For example, in the second half of last year, Taobao Live launched supportive policies such as "Merchant Super Broadcast," "New Joint Broadcast Plan," and "Eco-Star Entry Plan," helping merchant broadcasters grow rapidly during promotional periods in terms of cash, traffic, and off-platform advertising. In February this year, Taobao Live also launched a full-service center, providing "nanny-style" operational services ranging from account cold start, official inventory support, to marketing planning.

TikTok launched the "Douyin New Merchant Plan" in August last year, providing comprehensive support policies to newly registered merchants, including zero-threshold entry, refund of product card order commissions, 7-day 100% premium subsidy for shipping insurance, and permanent free use of official data tools. In February this year, the "Douyin New Merchant Plan" added two new benefits: "Exclusive Support for New Merchant Sales" and "Limited-Time Subsidy for New Merchant Promotion Traffic." For qualified merchants, the Douyin platform will bear the shipping insurance order premium within 30 days and provide up to 1,000 yuan in traffic coupons. Merchants who complete specified cash consumption tasks can receive up to 5,000 yuan in Qianchuan consumption return red envelope incentives.

Little Red Book is also making efforts in store broadcasting this 618 season, introducing new gameplays such as "Store Broadcasting Ranking Competition," "Store Broadcasting New Star Plan," "Super Store Broadcasting Day," and "Store Broadcasting Consumption Return Coupons," covering top merchants, small and medium-sized merchants, and new merchants. It is reported that during the 618 period, Little Red Book will also rank based on factors such as the transaction amount in the live streaming room, the number of transactions, and the audience's dwell time, releasing the Little Red Book 618 Brand List and Store List.

It is worth mentioning that while reducing the cost of live streaming e-commerce and maintaining platform pricing power, major platforms are also vigorously governing inferior products.

In February this year, Douyin E-