Pinduoduo Sparks Intense Competition in the E-commerce Industry

![]() 06/11 2024

06/11 2024

![]() 715

715

Is Pinduoduo the endgame of e-commerce? Is the competition never-ending?

All e-commerce giants have begun to emulate Pinduoduo, telling the story of low prices. For merchants, it's another story of meager profits and forced price cuts. Amid this intense competition, how can we find a balance between consumer interests and merchant survival?

According to financial reports, as of March 31, Pinduoduo Group achieved revenue of 86.8 billion yuan in the first quarter of 2024, surpassing the market estimate of 76.86 billion yuan, representing a year-on-year growth of 131%. Adjusted net profit reached 30.6 billion yuan, surpassing the market estimate of 15.53 billion yuan, with a year-on-year increase of 202%.

Pinduoduo's market value has soared to US$215 billion, surpassing Alibaba once again, becoming one of the hottest e-commerce platforms at present.

01 The Rise of Pinduoduo

According to the first-quarter financial report for 2024, in terms of profits, Pinduoduo > Alibaba > JD.com, with JD.com's profits accounting for less than 40% of Alibaba's and 30% of Pinduoduo's. After nine years of operation, Pinduoduo's profitability has surpassed that of 25-year-old Taobao and 21-year-old JD.com, the two former giants of e-commerce.

After the financial report was released, Chen Lei, Chairman and Co-CEO of Pinduoduo Group, said, "We aim to provide a wide range of high-quality products at competitive prices to consumers worldwide." The term "competitive prices" is significant.

In the past, by catering to small and medium-sized merchants abandoned by Alibaba and leveraging Tencent's traffic portal, Pinduoduo successfully leveraged its low-price strategy to disrupt China's online retail industry.

During this process, profound changes have taken place in the Chinese consumer market.

First, there has been a shift in consumer attitudes.

As commodity supply is no longer scarce, and with increasingly diverse product choices and consumption scenarios, public consumption patterns have gradually changed. Getting better services at lower prices has become the consensus of most consumers. Especially after the pandemic, people are more cautious with their money, eagerly seeking more cost-effective alternatives, comparing prices across multiple platforms to find the best deals.

As Chen Lei, Chairman and Co-CEO of Pinduoduo, said in a financial report conference call, from an industry competition perspective, consumers have formed the habit of cross-platform consumption, comparing products across different platforms in terms of categories, prices, service quality, and other dimensions before making a choice.

Second, there have been significant changes in the industrial chain.

In the past, source factories were only responsible for production, and brand companies were needed to aggregate products and reach consumers for sale. However, to cater to consumers' demand for low prices, more manufacturers have come to the forefront, directly selling low-priced white-label products to consumers. Pinduoduo provides these factories with a more direct sales platform.

To maintain its low-price advantage, Pinduoduo recently launched an automatic price-tracking system. Through big data, the system compares registered products with other similar products on the platform and adjusts product prices directly to maintain competitive pricing advantages.

As Pinduoduo pursues a low-price strategy, other e-commerce platforms have been forced to engage in competition. Alibaba's 1688 platform and Douyin Mall, which also pursues a low-price strategy, have also launched similar price comparison systems to find more similar products at lower prices.

In addition, Pinduoduo's "only refund" feature, which favors consumers, introduced in 2021, has attracted more consumers. Subsequently, Taobao and JD.com also introduced this feature at the end of 2023. It can be said that Pinduoduo's rapid rise has brought real pressure and tension to major e-commerce giants, sparking intense competition in the domestic e-commerce industry.

02 Merchants' Profits are Being Squeezed

As the public grows tired of events like 618 and Double 11, "lowest price on the internet" has become a means for platforms to compete for users.

However, frequent price wars have repeatedly squeezed merchants' profits, while the contradiction between platforms and merchants has intensified. At the same time, long-term extreme price competition may lead to declining corporate salaries, deteriorating product quality, and obstacles to the transformation and upgrading of the manufacturing industry. There has been an increasing voice that "low-price competition is destroying the manufacturing industry."

Behind Pinduoduo's soaring market value, more and more merchants have begun to complain about Pinduoduo's extreme price reductions, numerous advertising costs, and the most intolerable "only refund" policy.

Facing relentless competition, Pinduoduo can only further squeeze merchants' profits through various high-price traffic limiting functions and begin to promote a paid traffic model to maintain its low-price advantage, leaving merchants with increasingly slim profits.

From the merchants' perspective, product prices continue to drop, even below cost, and they still have to pay for traffic. Profits are on the verge of collapse. However, in today's market environment that emphasizes price competitiveness, merchants have only two choices: either continue the competition or close down.

Of Pinduoduo's 86.8 billion yuan in revenue in the first quarter, transaction service income (platform commissions from merchants) accounted for 44.4 billion yuan, over half at 51.1%, representing a 327% increase from the same period in 2023.

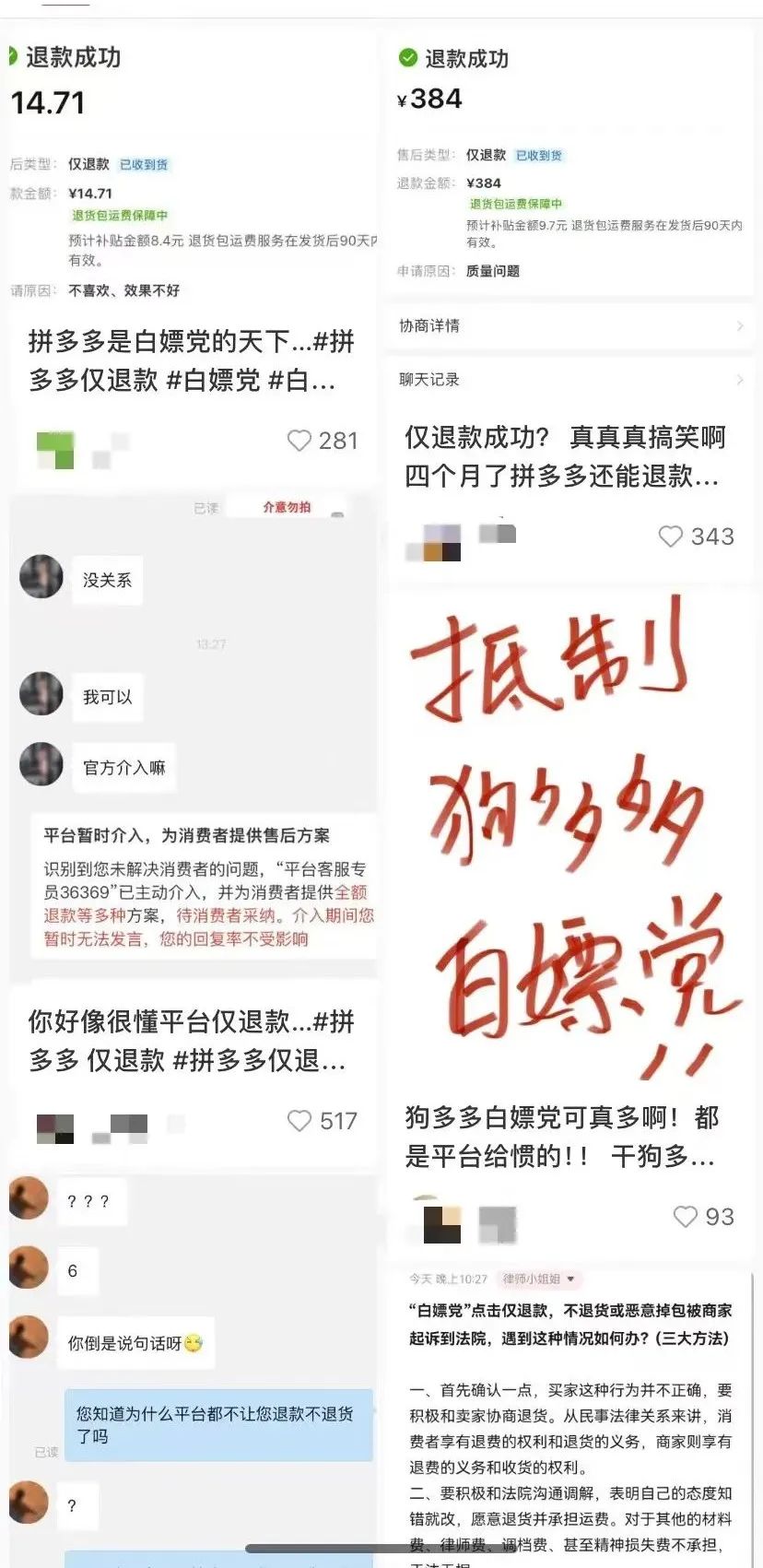

What merchants complain about the most is Pinduoduo's "only refund" feature.

In transactions, customers can easily apply for "only refund," and Pinduoduo tends to support consumers more often. Some "freeloaders" abuse this feature, refunding without returning the goods, causing significant losses to merchants. Therefore, "only refund" is considered a标志性操作 that lowers the bottom line of e-commerce.

On a social media platform, searching for "only refund" will reveal multiple negative contents related to this feature.

In 2023, the "only refund" policy triggered a wave of protests from Pinduoduo merchants, leading to a series of "shop bombings." The number of lawsuits related to "only refund" is also increasing. After being squeezed excessively, many merchants choose to leave the platform.

03 Putting the Brakes on Low Prices

As the competition in the domestic e-commerce industry continues, the blind pursuit of low prices has created more and more conflicts and controversies among platforms, merchants, and consumers.

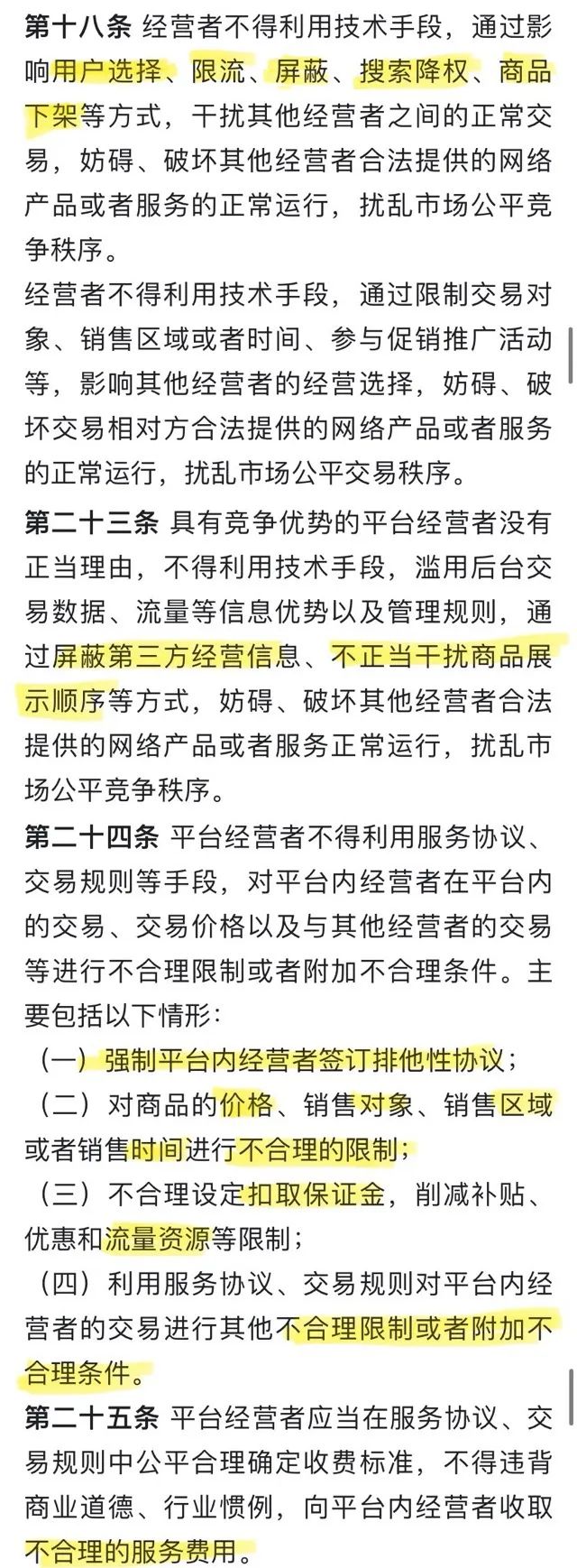

Recently, the State Administration for Market Regulation officially issued the "Interim Provisions on Anti-Unfair Competition in the Internet Industry" (hereinafter referred to as the "Provisions"), which will come into effect on September 1. Articles 18, 23, 24, and 25 of the "Provisions" aim to regulate platform operators reasonably, effectively putting the brakes on the current chaos of low prices in the e-commerce market.

Article 18 of the "Provisions" clearly states that operators must not use technical means to interfere with normal transactions between other operators, hinder or disrupt the normal operation of network products or services provided by other operators legally, or disrupt the order of fair competition in the market, through methods such as influencing user choices, limiting traffic, blocking, reducing search rankings, or下架商品.

The "Provisions" aim to regulate a series of "霸王条款" such as platform high-price traffic limiting, automatic price changes, logistics refunds, and unreasonable deductions of deposits. Although the "only refund" policy that merchants are most concerned about is not mentioned in the "Provisions," many merchants believe that the end of the "only refund era" is not far off.