Extreme Cultivation to Build Core Competitive Barriers - Exploring the Password for Lens Technology to Traverse the Cycle

![]() 06/11 2024

06/11 2024

![]() 507

507

Article | Xiangling Says

How can a company, amidst the changing times, not be swayed by temporary gains and losses, achieve long-term stable development, and traverse the cycle? This issue's theme explores the development password of an international enterprise in Hunan.

Companies that traverse the cycle all adhere to a "origin" that drives development.

When counting those companies that have truly traversed the cycle, they often have a seemingly simple "origin" force that enables them to always stand at the starting point of each new cycle. They are all enterprises that deeply cultivate in vertical fields and build an industrial chain ecosystem. For example, Kyocera has deeply cultivated in the field of ceramic materials, providing a wide range of innovative ceramic products to the world through various cutting-edge technologies, from electronic parts, industrial parts, to functional materials, semiconductor processing equipment parts, etc. Kyocera has led the industry development and has always been at the forefront of the world.

Among Chinese listed companies, there are also many such enterprises that continuously cultivate deeply in vertical fields, such as Lens Technology. Like Kyocera, Lens also focuses on the field of brittle materials, using technological research and development as the original driving force to build a core competitive barrier integrating materials, processes, and equipment.

According to the first-quarter report of 2024, Lens Technology's operating revenue was 15.498 billion yuan, an increase of 57.52% year-on-year; net profit was 309 million yuan, an increase of 379.02% year-on-year.

Even in 2022, when the industry was at a "low point of the cycle," Lens Technology's revenue and profits also achieved year-on-year growth. In other words, Lens Technology is also affected by the cycle, but it does not passively follow the cycle, but continuously traverses the cycle and even counteracts the cycle to achieve good performance.

At the end of 2020, when the global economy was volatile and consumer electronics were sluggish, at the 7th Global Shenzhen Business Conference's "Great Power of the Nation, Shaping the Future" forum, Zhou Qunfei, the founder and chairman of Lens Technology Group, said, "I always remember not to do what I'm not familiar with, and I believe that practice makes perfect." "My original intention has never changed in 30 years. I have always adhered to the industry and regarded making good glass as my lifelong pursuit."

Perhaps, this is a simple expression of focusing on strategy and deeply cultivating vertical fields.

And this coincides with the logic of many well-known companies traversing the cycle - "origin," "origin," "origin"!

Adherence to the "origin" supports Lens Technology to traverse cycles

A company that traverses the cycle must adopt different focused strategies at different stages: focusing on categories, focusing on demand, and focusing on the ecological industrial chain.

In 1993, Zhou Qunfei started her entrepreneurial journey with watch glass. Since then, she has always locked in on the core category of "glass" and continuously cultivated in this field for decades.

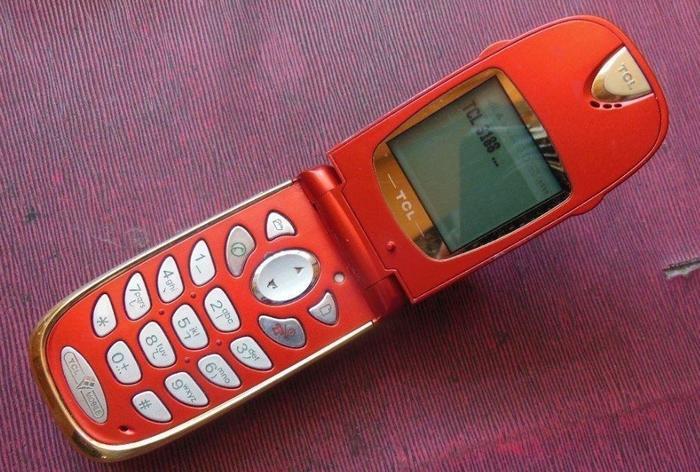

In 2002, the feature phone TCL3188 was released, becoming the world's first mobile phone to use glass as its screen, and it was also the first mobile phone to use Lens Technology's glass screen (mobile phone protective panel).

Here, Lens used the glass technology accumulated since the watch glass era to enter the consumer electronics field of mobile phones and successfully stood at the starting point of the "color screen feature phone" sub-cycle under the "feature phone" big cycle, and to a certain extent, promoted the development of the cycle.

Subsequently, domestic feature phone brands such as ZTE and Konka began to adopt glass screens, and Lens Technology also gained the trust and orders of major customers such as Motorola.

As for the understanding of "focusing on demand," Zhou Qunfei has a very clear and firm understanding, which is "customer demand." The essence of a company's existence is to meet the needs of society. In today's era where everything is customer-centric and customers are king, satisfying consumer demand is the foundation of business development. This can be seen from the corporate mission she personally formulated: "Strive to provide customers with satisfactory products and services." Even though many people and institutions have suggested optimizing this sentence, she still chose to stick to this simple but direct expression of the essence.

To achieve this "demand," Lens Technology takes research and development as the most important solution.

Zhou Qunfei believes that, "A company must have technological accumulation and provide the latest technology on each customer's product every year to help them enhance their product and brand value."

Lens Technology's scientific research and innovation, with a focus on the strategy of "new technology, new processes, new materials, and new fields," continuously improves in multiple dimensions such as materials, technology, processes, and equipment, and overall builds the company's comprehensive competitiveness.

Most people who know Zhou Qunfei know that she is very obsessed with technological innovation and research and development. "Lens Technology has patents for all materials and processes. Technological accumulation and pre-research storage continuously empower our products and customers," Zhou Qunfei once said.

In 2004, the Motorola V3 was released, becoming the world's first mobile phone with sales exceeding 100 million units, and it used Lens Technology's developed window protective glass. The entire phone used three pieces of glass, which were used for the main screen, sub-screen, and camera protection cover.

At this point, glass began to fully replace acrylic on mobile phones.

And the subsequent story continues on the "origin".

With the arrival of the new cycle of smartphones, Lens Technology successfully entered Apple's industrial chain in 2006 with high-quality glass panels that meet touchscreen requirements.

At this point, Lens Technology successfully established itself at the starting point of the huge cycle of smartphones and began to develop rapidly alongside the mobile phone industry, participating in the design and production of every subsequent generation of Apple products.

In 2015, Lens Technology went public, and from 2015 to 2022, Lens Technology accumulated profits of up to 17.314 billion yuan.

Looking back at the big stage of mobile phone development, with fierce brand competition and rotation of giants, Lens Technology has always stood with the giant brands, whether it is European and American, Korean, or Chinese Taiwanese companies represented by Motorola, Nokia, Ericsson, Samsung, HTC, Apple, or Chinese brands such as Huawei, Xiaomi, OPPO, vivo, and Honor, traversing the fierce competition in the global mobile phone brand industry cycle.

To this end, Lens Technology's investment in research and development is significant. From its listing to 2023, Lens Technology has invested more than 15 billion yuan in technological research and development, and has over 2,200 patents, ranking among the industry's forefront.

In October 2023, Lens Technology established the Lens Innovation Research Institute, which will directly gather more than 300 global high-level scientific research talents and over 3,000 R&D engineers to further promote Lens Technology's research and development innovation capabilities.

At the end of the "origin" is the focus on the ecological industrial chain

When a company develops to a certain scale, the competition it faces will shift from competition on a single value point to competition on the value chain, and industrial integration will become the ultimate trend for the development of many industries. When Lens has become the industry leader, to break through the development bottleneck, it must face the issue of "focusing on the ecological industrial chain".

Looking at Lens's development history, we can see that Lens Technology is already answering this question, and its performance is quite good. Its main development directions are: vertical integration and horizontal expansion into different tracks.

On the vertical side, taking "making good glass" as the origin, Lens Technology is also continuously making efforts in new materials, structural components, modules, and assembly businesses. These are considered Lens Technology's "stepping out of glass," but in reality, it is undeniable that they are still built on Lens Technology's full understanding of glass materials and products - glass is still the "origin".

According to the 2023 financial report, Lens Technology's smartphone and computer business segments achieved revenue of 44.901 billion yuan, an increase of 17.50% year-on-year, continuing to maintain a leading market share position and gaining increasing voice in the entire industrial chain.

Of course, with a 30-year span, if Lens Technology can go from watches to mobile phones, naturally, it can also go from mobile phones to other products. As long as they require "glass," Lens Technology has the ability to stand at the starting point of the cycle.

On the horizontal track, in addition to traditional consumer electronics fields such as smartphones, computers, and smartwatches, Lens Technology has also expanded into fields such as VR and smart home appliances. Under the cycle of the Internet of Everything, the boundaries of consumer electronics continue to expand. In the first-quarter report of 2024, Lens Technology's smart headset and smart wearable business brought in revenue of 3.104 billion yuan, expecting further growth.

And even more noteworthy is Lens's efforts in the smart car track.

According to data from the China Association of Automobile Manufacturers, in 2023, China's domestic new energy vehicle sales reached 9.495 million units, an increase of 37.87% year-on-year, and it is expected that sales will reach 11.5 million units in 2024. Undoubtedly, this is another huge cycle.

Since 2020, Lens Technology has already expanded into the new energy vehicle track and entered the supply chain of smart cars such as Tesla.

Currently, Lens Technology's customers include major automotive manufacturers such as BMW, Mercedes-Benz, Volkswagen, Ideal, NIO, and BYD, with over 30 automotive customers (mainly involving new products such as center console modules, instrument panels, smart B-pillars, and C-pillars).

According to the annual report, in 2022, Lens Technology's new energy vehicle business achieved revenue of 3.584 billion yuan, an increase of 59.41% year-on-year, accounting for 7.67% of total revenue; in 2023, its new energy vehicles and smart cockpit businesses achieved revenue of 4.998 billion yuan, an increase of 39.47% year-on-year.

Looking at these data alone, there may not be much concept.

Horizontally speaking, in the "Top 100 Revenue Rankings of Listed Companies in China's Auto Parts Industry in 2023" compiled by the China Business Industry Research Institute, 4.998 billion yuan can be ranked around the 50th position, and this list is a combined ranking of all types of automobiles and all types of parts and components supply chain companies after several, ten, or even decades of development. Lens Technology has occupied a mid-range position in just a few years with its glass products, demonstrating its development momentum and market scale.

In a report by Puyin International, Lens Technology's automotive electronics revenue in 2025 is expected to exceed 10 billion yuan - if this prediction is correct, Lens Technology will enter the top ranks of the automotive parts industry with its glass and other products.

New Opportunities for Lens's "Origin" in the AI Era

Cycles are endless, and for companies to thrive, they need to continuously traverse new cycles.

With the arrival of the era of large models, from mobile phones to laptops, from smart wearables to smart cars, AI+terminals will revolutionize various terminal products. In addition to the increased demand for components such as chips and memory, the new round of AI wave will also have increasingly higher requirements for screens.

AI-enabled and AI-supported terminal devices (cars are also a type of "terminal") will have their own higher requirements for thin profiles, foldable/deformable designs, lower power consumption, higher resolutions, aspect ratios that can automatically adapt to special operations, richer colors and superior contrast ratios, and higher driving frequencies.

Counterpoint predicts that the global AI mobile phone penetration rate will be about 40% in 2027, with shipments expected to reach 522 million units; Canalys predicts that 60% of computers shipped in 2027 will be equipped with AI functions.

This creates another huge market opportunity for glass and related materials and processes.

Under such circumstances, the value and significance of the origin of "making good glass" for Lens Technology is self-evident. In the future, Lens Technology is expected to continue to soar on this track.

*All images in this article are sourced from the internet.